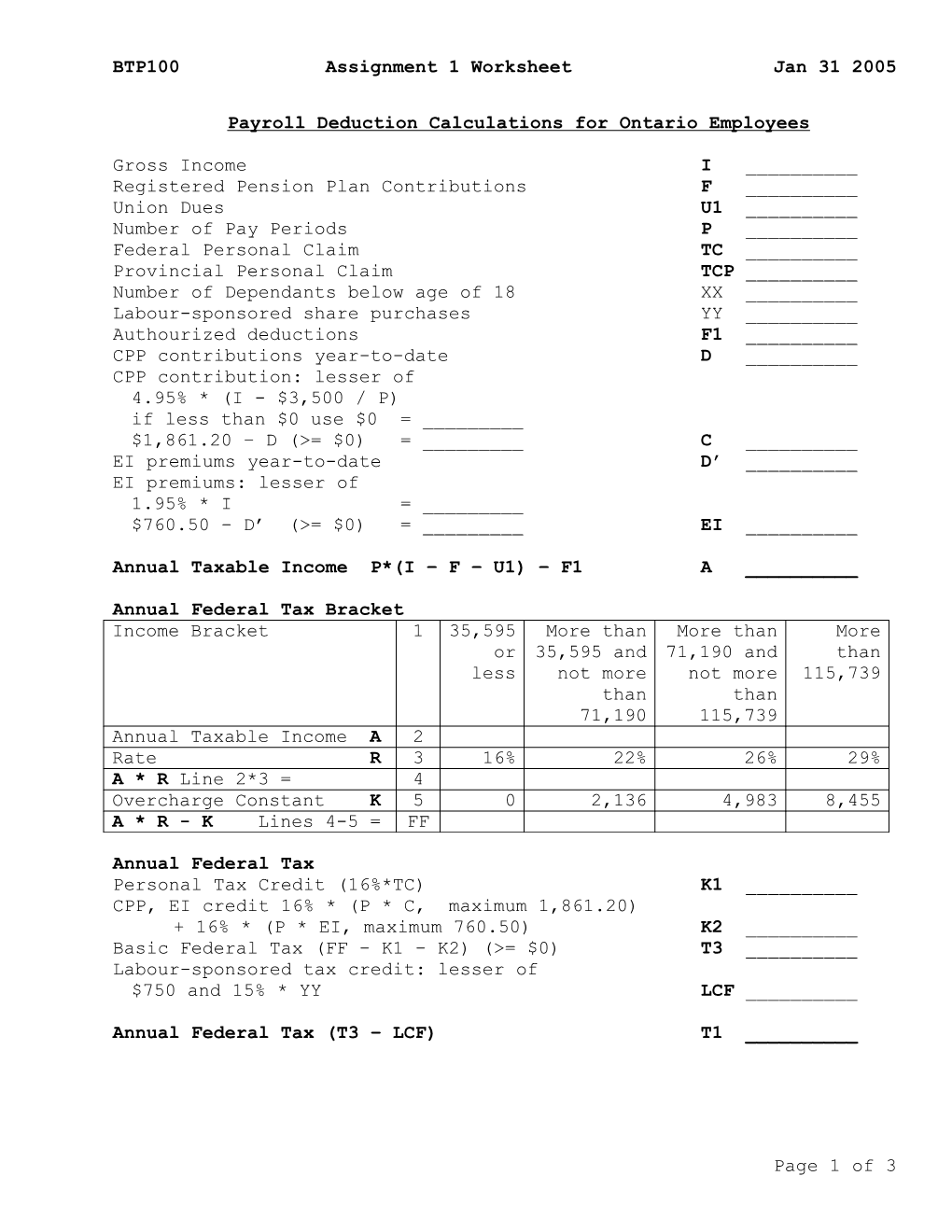

BTP100 Assignment 1 Worksheet Jan 31 2005

Payroll Deduction Calculations for Ontario Employees

Gross Income I ______Registered Pension Plan Contributions F ______Union Dues U1 ______Number of Pay Periods P ______Federal Personal Claim TC ______Provincial Personal Claim TCP ______Number of Dependants below age of 18 XX ______Labour-sponsored share purchases YY ______Authourized deductions F1 ______CPP contributions year-to-date D ______CPP contribution: lesser of 4.95% * (I - $3,500 / P) if less than $0 use $0 = ______$1,861.20 – D (>= $0) = ______C ______EI premiums year-to-date D’ ______EI premiums: lesser of 1.95% * I = ______$760.50 – D’ (>= $0) = ______EI ______

Annual Taxable Income P*(I – F – U1) – F1 A ______

Annual Federal Tax Bracket Income Bracket 1 35,595 More than More than More or 35,595 and 71,190 and than less not more not more 115,739 than than 71,190 115,739 Annual Taxable Income A 2 Rate R 3 16% 22% 26% 29% A * R Line 2*3 = 4 Overcharge Constant K 5 0 2,136 4,983 8,455 A * R - K Lines 4-5 = FF

Annual Federal Tax Personal Tax Credit (16%*TC) K1 ______CPP, EI credit 16% * (P * C, maximum 1,861.20) + 16% * (P * EI, maximum 760.50) K2 ______Basic Federal Tax (FF – K1 – K2) (>= $0) T3 ______Labour-sponsored tax credit: lesser of $750 and 15% * YY LCF ______

Annual Federal Tax (T3 – LCF) T1 ______

Page 1 of 3 BTP100 Assignment 1 Worksheet Jan 31 2005

Annual Ontario Tax Bracket Income Bracket 6 34,010 More than 34,010 More than or and not more than 68,020 less 68,020 Annual Taxable Income A 7 Rate V 8 6.05% 9.15% 11.16% A * V Line 7*8 = 9 Overcharge Constant KP 10 0 1,054 2,422 A * V – KP Lines 9-10 = PP

Annual Ontario Tax Personal Tax Credit (6.05% * TCP) K1P ______CPP, EI credit 6.05% * (P * C, maximum 1,861.20) + 6.05% * (P * EI, maximum 760.50) K2P ______Basic Provincial Tax (PP – K1P – K2P) (>= $0) T4 ______Surtax a (T4 – 3,929) * 20% >=0 ______Surtax b (T4 – 4,957) * 36% >=0 ______Total Surtax ______= V1 ______

Provincial Tax Reduction: lesser of T4 + V1 ______and 2 * ($190 + $350 * XX) – (T4 + V1) if less than $0 use $0 ______= S ______

Labour-sponsored tax credit: lesser of $750 and 15% * YY LCP ______

Ontario Health Premium Income Bracket 11 20,000 More More More More More or than than than than than less 20,000 36,000 48,000 72,000 200,000 and not and not and not and not more more more more than than than than 36,000 48,000 72,000 200,000 Annual Taxable 12 Income A Base Amount 13 0 20,000 36,000 48,000 72,000 200,000 Line 12 - 13 = 14 Rate 15 0% 6% 6% 25% 25% 25% Line 14 * 15 = 16 0 Base Premium 17 0 0 300 450 600 750 Line 16 + 17 = 18 0 Premium Limit 19 0 300 450 600 750 900 Lesser of 18,19 V2 0

Annual Ontario Tax (T4 + V1 + V2 – S - LCP) T2 ______

Page 2 of 3 BTP100 Assignment 1 Worksheet Jan 31 2005

Annual Federal Tax per Pay Period (T1 / P) TP1 ______

Annual Ontario Tax per Pay Period (T2 / P) TP2 ______

Total Tax Deduction per Pay Period (TP1 + TP2) T ______

CPP contribution C ______

EI premium EI ______

Total Deductions (T + C + EI + F + U1) TD ______

Net Income (I – TD) ______

The item symbols shown in boldface are those used by the Canada Customs and Revenue Agency

Page 3 of 3