Dr. John F. Clayburg Presents CYCLONE '98 A Proprietary Trading Program Designed Specifically For Day Trading the S&P 500 Stock Futures Index

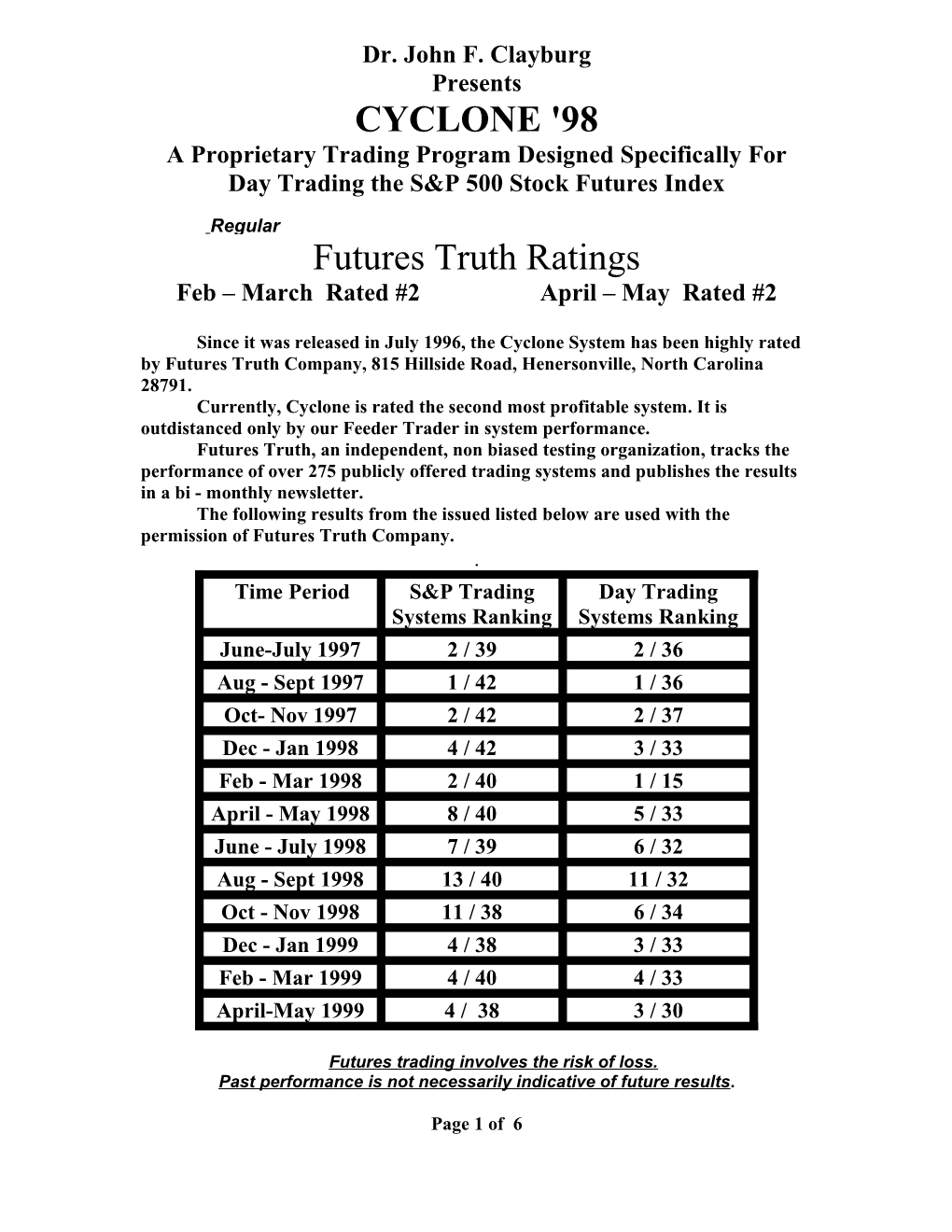

Regular Futures Truth Ratings Feb – March Rated #2 April – May Rated #2

Since it was released in July 1996, the Cyclone System has been highly rated by Futures Truth Company, 815 Hillside Road, Henersonville, North Carolina 28791. Currently, Cyclone is rated the second most profitable system. It is outdistanced only by our Feeder Trader in system performance. Futures Truth, an independent, non biased testing organization, tracks the performance of over 275 publicly offered trading systems and publishes the results in a bi - monthly newsletter. The following results from the issued listed below are used with the permission of Futures Truth Company. . Time Period S&P Trading Day Trading Systems Ranking Systems Ranking June-July 1997 2 / 39 2 / 36 Aug - Sept 1997 1 / 42 1 / 36 Oct- Nov 1997 2 / 42 2 / 37 Dec - Jan 1998 4 / 42 3 / 33 Feb - Mar 1998 2 / 40 1 / 15 April - May 1998 8 / 40 5 / 33 June - July 1998 7 / 39 6 / 32 Aug - Sept 1998 13 / 40 11 / 32 Oct - Nov 1998 11 / 38 6 / 34 Dec - Jan 1999 4 / 38 3 / 33 Feb - Mar 1999 4 / 40 4 / 33 April-May 1999 4 / 38 3 / 30

Futures trading involves the risk of loss. Past performance is not necessarily indicative of future results.

Page 1 of 6 System Design and Operating Principles

The Cyclone System operates as a longer-term day trading system. Each day proprietary support and resistance points are calculated using data inputs from the last several trading sessions. These are the pivot points from which the entries for the day are calculated.

The calculation of these pivot points is done by a series of self adaptive functions that actually test the system against past market data and adjust the parameters of the pivot point calculation accordingly. The use of these techniques is one of the reasons that this system has continued to work through many different ranges of market volatility.

When the market trades through one of these two pivot points the system will place a sell stop a calculated distance below the pivot point and a buy stop a calculated distance above the pivot point. The system enters the market when it trades through one of these stops.

The system can reverse its initial position only one time during each trading day. The reversal point factor is calculated daily as a part of the self-adaptive technology which is basic to the operation of the system.

For instance, if the system is long from 951.00 and the reversal factor was 2.70 the system would exit the long position and take a new short position at the 948.30 level.

All reversal positions carry a protective stop equal to the value of the reversal factor. In the example above, the short position, which resulted from the reversal entry at 948.30, would carry a 2.70 point protective stop and would exit the market at that level should we trade higher.

Should this trade be stopped out all trading for the day will cease. There will be no more than two trades per day from the system. Also, the system will not trade every day. Historically the system usually trades only 2 - 3 days per week so you should expect no more that 6 trades per week on the average.

During the last 45 minutes of the trading day all open positions will exit either by the reversal stop, market on close or on a trailing stop which is activated only during this time frame. An indicator supplied as a part of the system package will alert the trader to the position and movements of this protective feature. As most have probably noticed the market will usually maintain its trend during the last hour of trade. However, when this last hour trend is broken it can be extremely violent. Thus the need for additional protection during this critical last hour.

Futures trading involves the risk of loss. Past performance is not necessarily indicative of future results. Page 2 of 6 MOST IMPORTANT PAGE

The System relies on the big trade to be successful.

When traders are not successful with the Cyclone System it is usually for the following reason. The system relies on the big winning trade to achieve most of its profits. To participate in this big trade the trader must take every trade generated by the system. The system makes nearly all its profits during a contract on usually less than 20% of the trades. Therefore, there are more losing trades than winning trades. It is quite unusual for the winning percentage to exceed 45% in any contract. The system also will take several consecutive losses prior to catching the big trade. People are unsuccessful when trading this system because, after a series of losses, they decide to stop trading the system for a while "until it starts working again". Invariably these traders are out of the market when the huge winner hits. They then decide the system is now working again and jump back in just in time for the next series of losses. Needless to say, being in for the series of losses and skipping the big winning trade soon leads to an unsuccessful experience with the system. Traders also seriously deplete their accounts by trying to beat the system by not only picking and choosing which trades to take (see above) but by trying to enter and / or exit earlier / later than the system suggests. The self-adaptive routines within the programming of the system are set for a specific pattern recognition routine. Trying to beat this routine just doesn't work. Granted, it is very tempting to take a significant profit from the system, especially when one has endured a series of losses. Occasionally this will be a sound strategy. However, remember that the system needs the big trade to be profitable over the long haul. I can recall many, many instances where traders have taken $2,000 - $3,000 profits during the day and felt real good about it until the system itself exits market on close with a $6,000 profit. It simply comes down to this. If you are impressed with the system and its results then by all means trade the system. If you don't like the looks of the system or if the "roller coaster ride" of a few big profits and many smaller losses aggravates your insomnia then this system is not for you. If you think you can obtain the system and then do a better job of trading it that the way in which it is written don't bother. Many before you have tried and failed and called to complain that the system is no good. The bottom line is that the system sells itself. I don't have to. I do feel an obligation, however, to clearly emphasize how those who have failed with the system in the past have done so in the fervent expectation that you will not follow in their tracks.

Futures trading involves the risk of loss. Past performance is not necessarily indicative of future results.

Page 3 of 6 Performance Data

The following pages contain a sample of the performance data for the Cyclone System.

Please keep in mind that the data for 1998 forward is calculated with the S&P point value of 250. All data prior to 1998 is calculated with a point value of 500. The contract value was cut in half by the CME during the trading of the December 97 contract. I changed the point values for the system when the contract rolled over to the March 98 contract.

You have probably noticed thus far a lack of some of the "hype" normally associated with most system promotional material. You haven't seen fancy four color charts and eye catching graphics touting this system as the greatest thing since sliced raisin bread. No "quotes" from Super Trader from West Undershirt USA claiming he made a million bucks a week with this system while on vacation.

On the contrary, I've made an honest effort to point out the trading approach the system uses and have tried to explain the downside to this approach.

There's a reason for this.

The system doesn't need the hype, etc.

It sells itself.

Please read and understand the following paragraphs before proceeding

The CFTC requires that we state that - NOTICE: Hypothetical performance results have many different by any particular trading program benefit of hindsight. In addition, hypothetical Fortrading example, does notthe abilityinvolve to financial withstand risk lossesand no or adhere to a whichparticular cannot trading be fully program in spite of andaccounted all of which for in can the adverselypreparation affect of actual Page 4 of 6 CYCLONE SYSTEM EQUITY CURVE

Jan 1, 1990 thru March 10, 1999 Hypothetical Trades Contract Trades Wins Losses Largest Largest Max Net Contract Cumulative Win Loss Drawdown Profit

Mar '90 25 12 13 $4,175 ($1,025) ($2,850) $12,650 Mar '90 $12,650 June '90 40 23 17 $3,200 ($1,025) ($2,500) $10,950 June '90 $23,600 Sep '90 28 12 15 $3,400 ($1,025) ($4,600) $4,325 Sep '90 $27,925 Dec '90 34 17 17 $4,250 ($1,025) ($4,900) $8,075 Dec '90 $36,000 Mar '91 35 16 19 $3,450 ($1,025) ($5,625) $3,850 Mar '91 $39,850 June '91 38 25 13 $3,975 ($1,025) ($2,025) $10,970 June '91 $50,820 Sep '91 41 28 13 $3,200 ($1,025) ($1,550) $18,225 Sep '91 $69,045 Dec '91 37 24 13 $5,400 ($1,025) ($4,575) $17,950 Dec '91 $86,995 Mar '92 39 23 16 $3,875 ($1,025) ($2,150) $14,750 Mar '92 $101,745 June '92 41 24 17 $2,725 ($1,025) ($4,700) $9,125 June '92 $110,870 Sep '92 45 23 22 $3,275 ($1,025) ($2,500) $6,675 Sep '92 $117,545 Dec '92 42 16 26 $2,275 ($1,025) ($3,425) $2,800 Dec '92 $120,345 Mar '93 39 23 16 $3,600 ($1,025) ($2,300) $14,475 Mar '93 $134,820 June '93 50 25 25 $4,900 ($1,025) ($4,775) $9,275 June '93 $144,095 Sep '93 46 20 26 $1,275 ($1,025) ($4,650) ($1,625) Sep '93 $142,470 Dec '93 51 23 28 $2,225 ($1,025) ($6,750) ($300) Dec '93 $142,170 Mar '94 44 19 25 $1,950 ($1,025) ($4,575) ($1,625) Mar '94 $140,545 June '94 43 21 22 $2,075 ($1,025) ($5,875) $2,200 June '94 $142,745 Sep '94 44 25 19 $2,025 ($1,025) ($2,800) $5,650 Sep '94 $148,395 Dec '94 45 26 19 $3,100 ($1,025) ($3,525) $17,975 Dec '94 $166,370 Mar '95 54 21 33 $1,750 ($1,025) ($4,250) ($1,725) Mar '95 $164,645 June '95 47 26 21 $3,125 ($1,025) ($3,200) $17,625 June '95 $182,270 Sep '95 55 27 28 $2,675 ($1,025) ($5,375) $4,050 Sep '95 $186,320 Dec '95 43 18 25 $2,175 ($1,025) ($7,650) $600 Dec '95 $186,920 Mar '96 33 17 16 $3,900 ($1,025) ($7,075) $12,025 Mar '96 $198,945 June '96 51 25 26 $6,225 ($1,025) ($8,325) $22,000 June '96 $220,945 Sep '96 49 16 33 $9,450 ($1,025) ($6,250) $14,750 Sep '96 $235,695 Dec '96 88 34 54 $7,575 ($1,125) ($8,950) $15,025 Dec '96 $250,720 Mar '97 91 32 59 $7,225 ($1,550) ($16,650) $15,125 Mar '97 $265,845 June '97 108 34 74 $9,625 ($1,825) ($14,200) $31,775 June '97 $297,620 Sep-97 102 33 69 $10,775 ($2,175) ($14,800) $12,700 Sep-97 $310,320 Dec-97 62 27 35 $24,875 ($4,600) ($9,400) $51,950 Dec-97 $362,270 Mar-98 31 28 14 $5,150 ($1,100) ($2,387) $11,087 Mar-98 $373,357 Jun-98 64 26 38 $4,725 ($1,000) ($8,200) $10,925 Jun-98 $384,282 Sep-98 62 21 41 $10,050 ($2,500) ($10,150) $8,325 Sep-98 $392,607 Dec-98 65 32 33 $7,975 ($1,975) ($9,350) $51,175 Dec-98 $443,782 Mar '99 71 20 51 $7,000 ($1,600) ($23,000) $200 Mar-99 $443,982

The CFTC requires that we state that - NOTICE: Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed the results may have under or over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Futures trading involves the risk of loss. Past performance is not necessarily indicative of future results.

Page 6 of 6 Dr. John F. Clayburg Omega Research Solution Provider Omega Research Easy Language Expert 29568 Hwy 141 Coon Rapids, Iowa USA 50058-7178 (712)684-5239 Voice and Fax e mail: [email protected] www.clayburg.com

LEASE / PURCHASE AGREEMENT CYCLONE SYSTEM

The undersigned agrees to lease / purchase the Cyclone System from Dr. John F. Clayburg subject to the following terms and conditions. The purchaser understands that the data used to represent the performance of the system is hypothetical in nature. Purchaser has read and understands the disclaimers associated with the promotional material. Purchaser is aware that the system has less than 50% profitable trades and is subject to substantial drawdown and several consecutive losing trades as documented in the above-mentioned testing and descriptive literature. Dr. Clayburg agrees to furnish, free of charge, system updates and upgrades, as and if they become available, for a period of one calendar year from the date of purchase. After one year has passed such upgrades will be available for a charge of $200.00 per year. The purchase is non - refundable. A fully functional 30-day demo version will be provided for a fee of $100.00. If an individual feels he/she requires further time to evaluate the system, extensions of the trial period may be requested by calling the developer. The system has been developed in total by Dr. Clayburg. Neither this agreement nor any representations contained herein are not binding on his heirs. The system computer code, being proprietary in nature, will not be disclosed. However, the operating theory will be revealed. The system, while profitable in the past, is not in any way guaranteed to be profitable in the future. Past results are not indicative of future performance. There are no implied warranties of any nature associated with this product. Payment is by credit card only. In the instance of a lease agreement, purchaser/lessee agrees that his/her credit card will be charged the first of each month to renew the lease unless developer is notified of cancellation in writing at least 5 business days prior to the end of the month. If a demo copy is ordered, purchaser/lessee agrees that the full monthly lease will be charged to his/her credit card at the end of the demo period unless developer is notified of cancellation in writing at least 5 business days prior to the end of the demonstration expiration. By signing below purchaser/lessee acknowledges that he/she has read and understands the disclaimers included with the testing data and understands the concept of hypothetical testing and real time trading. Purchaser/lessee understands that past performance is not necessarily indicative of future results. By signing below and ordering this product, purchaser/lessee agrees to all of the terms and conditions and expressly acknowledges all of the disclaimers herein above set forth.

PURCHASE PRICE: $2,900.00. US Funds only. LEASE PRICE: $200.00 per month US Funds only. Please Indicate: Full Purchase __ ($2,900.00) 1 Month Lease __ $(200.00) Demo __($100.00) CREDIT CARD INFORMATION

Card: ______

Card Number: ______EXPIRATION ____ / ____

Purchaser: (Please Print) ______Signature: ______Date: ______