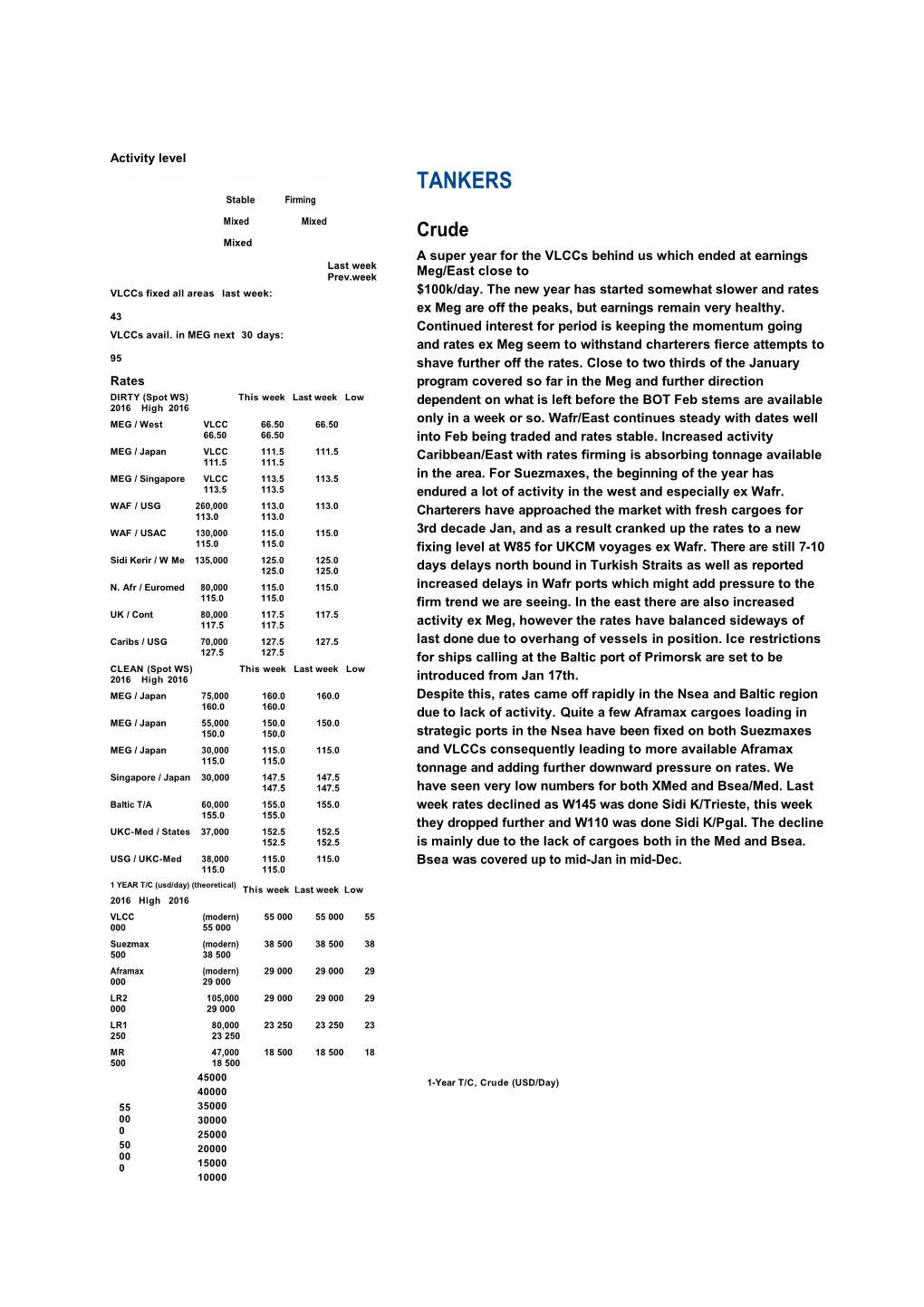

Activity level VLCC Suezmax Aframax P.E. of Suez TANKERS P.W. of Suez Stable Firming Mixed Mixed Crude Mixed A super year for the VLCCs behind us which ended at earnings Last week Prev.week Meg/East close to VLCCs fixed all areas last week: $100k/day. The new year has started somewhat slower and rates ex Meg are off the peaks, but earnings remain very healthy. 43 Continued interest for period is keeping the momentum going VLCCs avail. in MEG next 30 days: and rates ex Meg seem to withstand charterers fierce attempts to 95 shave further off the rates. Close to two thirds of the January Rates program covered so far in the Meg and further direction DIRTY (Spot WS) This week Last week Low dependent on what is left before the BOT Feb stems are available 2016 High 2016 MEG / West VLCC 66.50 66.50 only in a week or so. Wafr/East continues steady with dates well 66.50 66.50 into Feb being traded and rates stable. Increased activity MEG / Japan VLCC 111.5 111.5 Caribbean/East with rates firming is absorbing tonnage available 111.5 111.5 MEG / Singapore VLCC 113.5 113.5 in the area. For Suezmaxes, the beginning of the year has 113.5 113.5 endured a lot of activity in the west and especially ex Wafr. WAF / USG 260,000 113.0 113.0 113.0 113.0 Charterers have approached the market with fresh cargoes for WAF / USAC 130,000 115.0 115.0 3rd decade Jan, and as a result cranked up the rates to a new 115.0 115.0 fixing level at W85 for UKCM voyages ex Wafr. There are still 7-10 Sidi Kerir / W Me 135,000 125.0 125.0 125.0 125.0 days delays north bound in Turkish Straits as well as reported N. Afr / Euromed 80,000 115.0 115.0 increased delays in Wafr ports which might add pressure to the 115.0 115.0 firm trend we are seeing. In the east there are also increased UK / Cont 80,000 117.5 117.5 117.5 117.5 activity ex Meg, however the rates have balanced sideways of Caribs / USG 70,000 127.5 127.5 last done due to overhang of vessels in position. Ice restrictions 127.5 127.5 for ships calling at the Baltic port of Primorsk are set to be CLEAN (Spot WS) This week Last week Low 2016 High 2016 introduced from Jan 17th. MEG / Japan 75,000 160.0 160.0 Despite this, rates came off rapidly in the Nsea and Baltic region 160.0 160.0 due to lack of activity. Quite a few Aframax cargoes loading in MEG / Japan 55,000 150.0 150.0 150.0 150.0 strategic ports in the Nsea have been fixed on both Suezmaxes MEG / Japan 30,000 115.0 115.0 and VLCCs consequently leading to more available Aframax 115.0 115.0 tonnage and adding further downward pressure on rates. We Singapore / Japan 30,000 147.5 147.5 147.5 147.5 have seen very low numbers for both XMed and Bsea/Med. Last Baltic T/A 60,000 155.0 155.0 week rates declined as W145 was done Sidi K/Trieste, this week 155.0 155.0 they dropped further and W110 was done Sidi K/Pgal. The decline UKC-Med / States 37,000 152.5 152.5 152.5 152.5 is mainly due to the lack of cargoes both in the Med and Bsea. USG / UKC-Med 38,000 115.0 115.0 Bsea was covered up to mid-Jan in mid-Dec. 115.0 115.0 1 YEAR T/C (usd/day) (theoretical) This week Last week Low 2016 High 2016 VLCC (modern) 55 000 55 000 55 000 55 000 Suezmax (modern) 38 500 38 500 38 500 38 500 Aframax (modern) 29 000 29 000 29 000 29 000 LR2 105,000 29 000 29 000 29 000 29 000 LR1 80,000 23 250 23 250 23 250 23 250 MR 47,000 18 500 18 500 18 500 18 500 45000 1-Year T/C, Crude (USD/Day) 40000 55 35000 00 30000 0 25000 50 20000 00 0 15000 10000 P – EAST OF during the week. A mixture of delays, good activity and a r SUEZ – tightening position list has driven rates for MEG/UKC upto The LR2 USD 2.45mill and MEG/JPN at WS115 based on 2015 o market has worldscale rates. So far we have not seen any fixtures basis d seen a 2016 rates, but with a radical drop in bunker prices year-on- u busy start year the flat rates have decreased by as much as 30% and to the new effectively owners are looking at WS160 based on 2016 rates. c year and The LR1 market has been relatively quiet this week, and rates t rates have have suffered as a consequence with a ship on subs for firmed up MEG/JPN at WS150 (2016 rates) 01.2012 12.2012 12.2013 12.2014 12.2015 12.2016 – i.e. some 10 points lower than LR2. The MR market has had an VLCC Suezmax Aframax even quieter start to the year with almost no action at all, with soft rates. – WEST OF SUEZ – Since our last report before the 1-Year T/C, Clean (USD/Day) Holidays there has been limited change to the LR2 market in the 30000 West, as we see rates still around USD 3.4mill for UKC/JPN and 28000 a supertight position list. After a few quiet weeks the LR1 26000 24000 market has so far had a busy week stepping in for the tight LR2 22000 market, with several eastbound cargoes in play from both Med and 20000 UKC. The MR market has started off the year on a firming note, 18000 16000 with firming rates being done on the UKC/USAC Gasoline trade. 14000 Here too there has been a lot of discussion concerning the 2015 12000 versus 2016 worldscale rates but after a few days of fixing, 01.2012 12.2012 12.2013 12.2014 things are starting to fall into place. For the Handies the week 12.2015 12.2016 has not been too crazy and rates are going somewhat sideways LR2 LR1 MR at around WS162.5 for x-UKC and WS175 for x-MED. DRY BULK

Capesize CAPESIZE (usd/day, usd/tonne) TCT Cont/Far East (180' dwt) 12 200 12 200 12 200 12 200 As expected rates have been under pressure the first week of the new year. West Tubarao / R.dam (Iron ore) 3.70 3.70 3.70 3.70 Australia / China rates are up from sub 3 pmt levels during Christmas to approx Richards Bay/R.dam 3.20 3.20 3.20 3.20 3,30USD with a slightly further improvement expected. Fronthaul cargoes remain scarce. PANAMAX (usd/day, usd/tonne) Some period activity with short period fixtures beeing concluded around the USD Transatlantic RV 4 350 4 350 4 350 4 350 4,500 a day for 175,000 dwts. TCT Cont / F. East 8 000 8 000 8 000 8 000 TCT F. East / Cont 480.0 480.0 480.0 480.0 Panamax Activity in the Atlantic seems to increase a bit after X-mas and new year, especially grain from USG and ECSA to far east absorbing tonnage. Transatlantic roundvoyages paying arnd 4000 USD depending delivery, duration and redelivery. Cold weather and more ice can make Baltic and North Atlantic tight, if iceclassed tonnage needed. Sofar rates steady. Rates moving up for fronthaul and 10.000 + 150 bb reported fixed from USG to feast. ECSA to feast paying mid 7 k + 220 k bb. Grain from ECSA to continent paying mid 6k for a good Kamsarmax. Nopac rounds paying 4000 USD + 100 k bb. Pacific rounds hovering around low/mid USD 3000. Period market slow but

Handy After a quiet holiday period, the market has slowly awakened from its slumber. Rates are not running away but the market looks like it is finding a bottom. Averages for a Surpa are now around mid USD 4000’s and only marginally down from pre Christmas levels. 2016 has started with a couple of period fixtures reported at low USD 6000’s for Ultramaxes. Thus by default Supras will only be worth something in the USD 5’s for a 12 month deal.

GAS

Chartering The inevitable drop in the VLGC spot freight market more or less coincided with the turn of the year, and the Baltic VLGC index has come off nearly 20% from the end of 2015 to the beginning of 2016. It is way too early to say whether this softening will carry on in the weeks ahead or whether it is temporarily influenced by the weak crude oil and the subsequent soft sentiment in all CFR markets lately on top of a steep fleet growth (not less than 36 VLGC newbuildings were delivered in 2015). Daily returns has come off to USD 45,000/day on modern VLGCs, many seasoned LPG shipping players will say this is a very healthy number while others feel this is a poor return. 2016 brings (many) more VLGC newbuildings and more LPG export capacity as well, and the fleet balance ahead will be decided by trading pattern, in particular the frequency of 100 days+ roundvoyages. At the start of 2016 we have made some logical changes to vessel descriptions/segments in our rate tables. The benchmark VLGC used for calculations has been altered as well in line with new designs and more favourable performance figures. In essence the speed has been increased as evidenced in actual vessel tracking while the consumption has been kept more or less unaltered. The change is, however, not very visible in a falling freight market and continued modest HFO prices. NEWBUILDING

Only six days into the new year, most of the contracts in the below table were reported in the latter part of December. On the tanker side aframaxes were in focus as Tsuneishi secured an order for 8 vessels of which four went to their "in- house" owners Kambara Kisen. Ship Finance went to Daehan (Korea) for two option two LR2 type product carriers to be delivered in the second part of 2017. The contract was done in combination with a 7+2 years charter to US based Energy Company. At the doorstep of a new year we expect yards to compete strongly for new contractcs in a market with diminishing demand and prices under continous pressure.

NEWBUILDING CONTRACTS

MT 4 112000 dwt Tsuneishi Kambara Kisen MT 4 112000 dwt Tsuneishi Meiji Shipping PC 2 114000 dwt Daehan Ship Finance 2017 opt 2 LPG 1 84000 cbm Hyundai KSS 2q17 Chem 2 26300 dwt Ningbo Xinle Prime Shipping 2017 opt 2

SALE AND PURCHASE TRANSACTIONS

Type Vessel Size Built Buyer Price Comm.

MT Hemsedal Spirit 320 000 2010 Bahri 77,50 Enbloc MT Voss Spirit 320 000 2010

USD/JPY 118.6 118.6 118.6 USD/KRW 1 201 1 201 1 201 USD/NOK 8.96 8.96 8.96 EUR/USD 1.07 1.07 1.07

Interest rate LIBOR USD 6 mnths

0.85

0.85

0.85 NIBOR NOK 6 mnths 1.15 1.15 1.15 Commodity prices Brent spot (USD)

34.90

34.90

34.90

Bunker prices Singapore 380 CST

177.0

177.0

177.0 180 CST 200.0 200.0 200.0 Gasoil 330.0 330.0 330.0 Rotterdam 380 HSFO 129.0 129.0 129.0 180 CST 150.0 150.0 150.0 Diesel 296.0 296.0 296.0