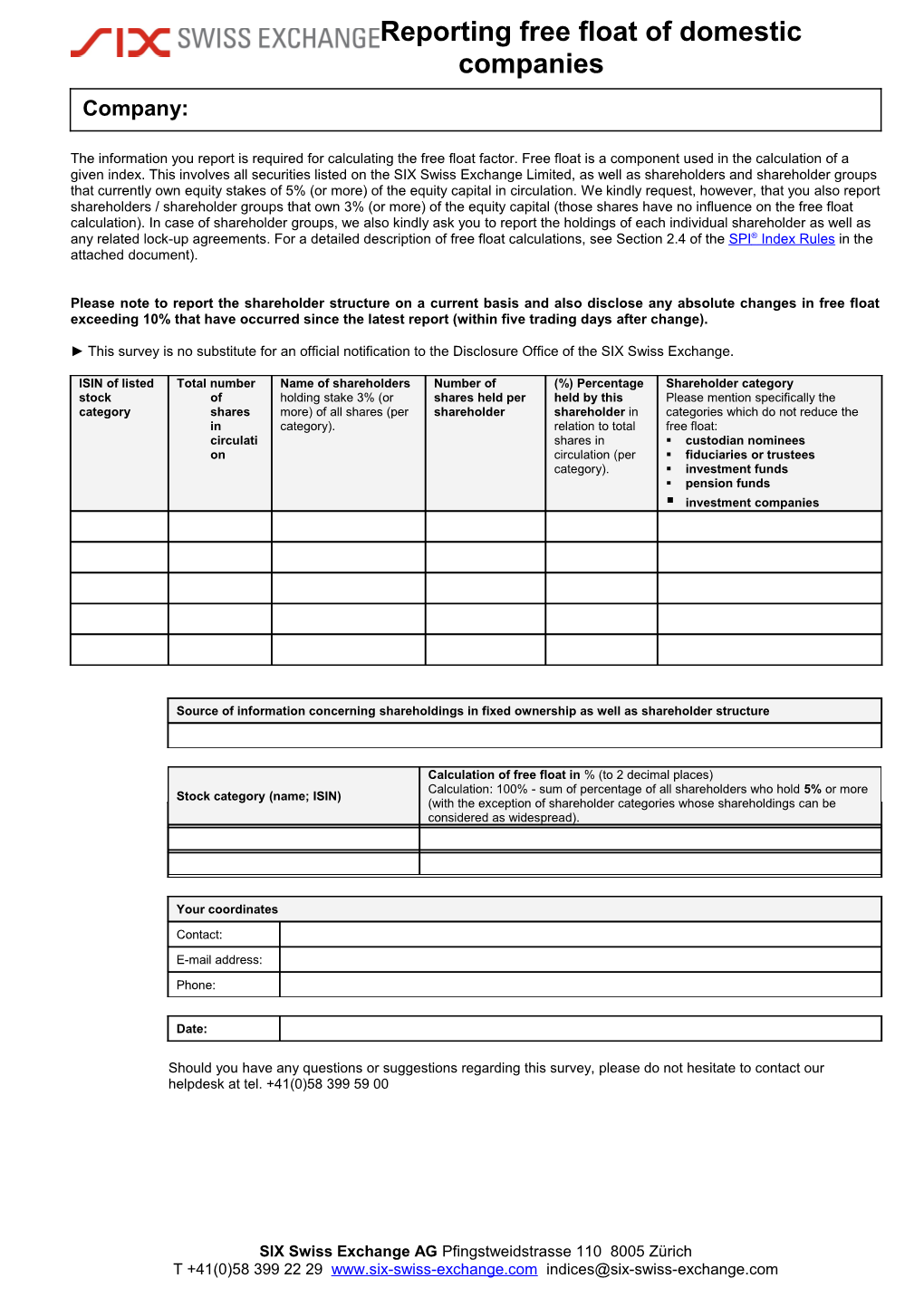

Reporting free float of domestic companies Company:

The information you report is required for calculating the free float factor. Free float is a component used in the calculation of a given index. This involves all securities listed on the SIX Swiss Exchange Limited, as well as shareholders and shareholder groups that currently own equity stakes of 5% (or more) of the equity capital in circulation. We kindly request, however, that you also report shareholders / shareholder groups that own 3% (or more) of the equity capital (those shares have no influence on the free float calculation). In case of shareholder groups, we also kindly ask you to report the holdings of each individual shareholder as well as any related lock-up agreements. For a detailed description of free float calculations, see Section 2.4 of the SPI ® Index Rules in the attached document).

Please note to report the shareholder structure on a current basis and also disclose any absolute changes in free float exceeding 10% that have occurred since the latest report (within five trading days after change).

► This survey is no substitute for an official notification to the Disclosure Office of the SIX Swiss Exchange.

ISIN of listed Total number Name of shareholders Number of (%) Percentage Shareholder category stock of holding stake 3% (or shares held per held by this Please mention specifically the category shares more) of all shares (per shareholder shareholder in categories which do not reduce the in category). relation to total free float: circulati shares in . custodian nominees on circulation (per . fiduciaries or trustees category). . investment funds . pension funds . investment companies

Source of information concerning shareholdings in fixed ownership as well as shareholder structure

Calculation of free float in % (to 2 decimal places) Calculation: 100% - sum of percentage of all shareholders who hold 5% or more Stock category (name; ISIN) (with the exception of shareholder categories whose shareholdings can be Remarks considered as widespread).

Your coordinates

Contact:

E-mail address:

Phone:

Date:

Should you have any questions or suggestions regarding this survey, please do not hesitate to contact our helpdesk at tel. +41(0)58 399 59 00

SIX Swiss Exchange AG Pfingstweidstrasse 110 8005 Zürich T +41(0)58 399 22 29 www.six-swiss-exchange.com [email protected]