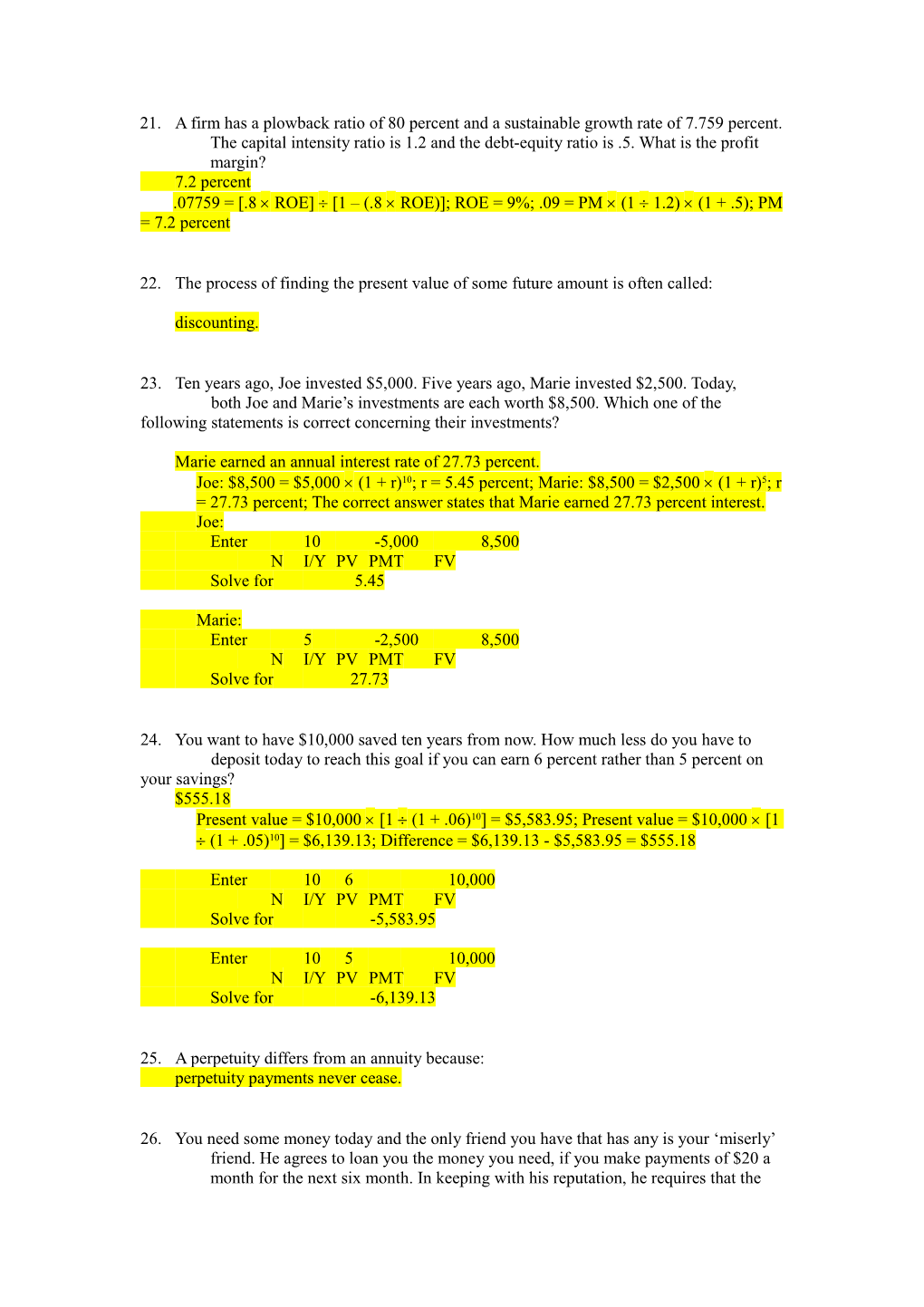

21. A firm has a plowback ratio of 80 percent and a sustainable growth rate of 7.759 percent. The capital intensity ratio is 1.2 and the debt-equity ratio is .5. What is the profit margin? 7.2 percent .07759 = [.8 ROE] [1 – (.8 ROE)]; ROE = 9%; .09 = PM (1 1.2) (1 + .5); PM = 7.2 percent

22. The process of finding the present value of some future amount is often called:

discounting.

23. Ten years ago, Joe invested $5,000. Five years ago, Marie invested $2,500. Today, both Joe and Marie’s investments are each worth $8,500. Which one of the following statements is correct concerning their investments?

Marie earned an annual interest rate of 27.73 percent. Joe: $8,500 = $5,000 (1 + r)10; r = 5.45 percent; Marie: $8,500 = $2,500 (1 + r)5; r = 27.73 percent; The correct answer states that Marie earned 27.73 percent interest. Joe: Enter 10 -5,000 8,500 N I/Y PV PMT FV Solve for 5.45

Marie: Enter 5 -2,500 8,500 N I/Y PV PMT FV Solve for 27.73

24. You want to have $10,000 saved ten years from now. How much less do you have to deposit today to reach this goal if you can earn 6 percent rather than 5 percent on your savings? $555.18 Present value = $10,000 [1 (1 + .06)10] = $5,583.95; Present value = $10,000 [1 (1 + .05)10] = $6,139.13; Difference = $6,139.13 - $5,583.95 = $555.18

Enter 10 6 10,000 N I/Y PV PMT FV Solve for -5,583.95

Enter 10 5 10,000 N I/Y PV PMT FV Solve for -6,139.13

25. A perpetuity differs from an annuity because: perpetuity payments never cease.

26. You need some money today and the only friend you have that has any is your ‘miserly’ friend. He agrees to loan you the money you need, if you make payments of $20 a month for the next six month. In keeping with his reputation, he requires that the first payment be paid today. He also charges you 1.5 percent interest per month. How much money are you borrowing? $115.65 = $20 5.697187165 1.015 = $115.65

Enter 6 1.5 -20BGN N I/Y PV PMT FV Solve for 115.65

27. You estimate that you will have $24,500 in student loans by the time you graduate. The interest rate is 6.5 percent. If you want to have this debt paid in full within five years, how much must you pay each month?

$479.37 ; $24,500 = C 51.10864813; C = $479.37

Enter 512 6.5/12 24,500 N I/Y PV PMT FV Solve for -479.37

28. Your insurance agent is trying to sell you an annuity that costs $100,000 today. By buying this annuity, your agent promises that you will receive payments of $384.40 a month for the next 40 years. What is the rate of return on this investment? 3.45 percent ; This can not be solved directly, so it’s easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that you answer is correct.

Enter 4012 /12 -100,000 384.40 N I/Y PV PMT FV Solve for 3.45

29. One year ago, the Jenkins Family Fun Center deposited $3,600 in an investment account for the purpose of buying new equipment four years from today. Today, they are adding another $5,000 to this account. They plan on making a final deposit of $7,500 to the account next year. How much will be available when they are ready to buy the equipment, assuming they earn a 7 percent rate of return?

$20,790.99 ; FV = $20,790.99

Enter 5 7 -3,600 N I/Y PV PMT FV Solve for 5,049.19

Enter 4 7 -5, 000 N I/Y PV PMT FV Solve for 6,553.98

Enter 3 7 -7,500 N I/Y PV PMT FV Solve for 9,187.82

Future value = $5,049.19 + $6,553.98 + $9,187.82 = $20,790.99

30. Your credit card company charges you 1.5 percent per month. What is the annual percentage rate on your account?

18.00 percent APR = .015 12 = .18 = 18 percent