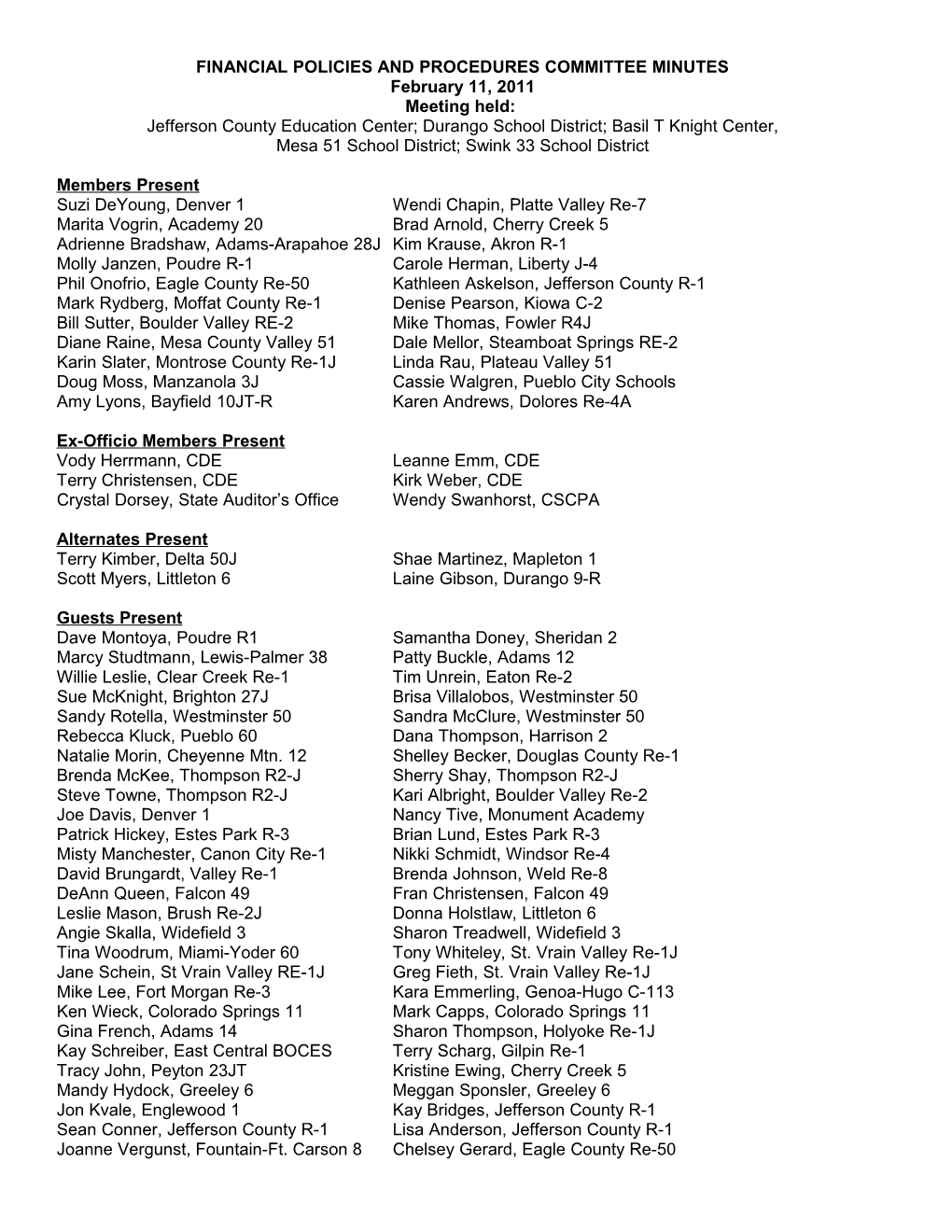

FINANCIAL POLICIES AND PROCEDURES COMMITTEE MINUTES February 11, 2011 Meeting held: Jefferson County Education Center; Durango School District; Basil T Knight Center, Mesa 51 School District; Swink 33 School District

Members Present Suzi DeYoung, Denver 1 Wendi Chapin, Platte Valley Re-7 Marita Vogrin, Academy 20 Brad Arnold, Cherry Creek 5 Adrienne Bradshaw, Adams-Arapahoe 28J Kim Krause, Akron R-1 Molly Janzen, Poudre R-1 Carole Herman, Liberty J-4 Phil Onofrio, Eagle County Re-50 Kathleen Askelson, Jefferson County R-1 Mark Rydberg, Moffat County Re-1 Denise Pearson, Kiowa C-2 Bill Sutter, Boulder Valley RE-2 Mike Thomas, Fowler R4J Diane Raine, Mesa County Valley 51 Dale Mellor, Steamboat Springs RE-2 Karin Slater, Montrose County Re-1J Linda Rau, Plateau Valley 51 Doug Moss, Manzanola 3J Cassie Walgren, Pueblo City Schools Amy Lyons, Bayfield 10JT-R Karen Andrews, Dolores Re-4A

Ex-Officio Members Present Vody Herrmann, CDE Leanne Emm, CDE Terry Christensen, CDE Kirk Weber, CDE Crystal Dorsey, State Auditor’s Office Wendy Swanhorst, CSCPA

Alternates Present Terry Kimber, Delta 50J Shae Martinez, Mapleton 1 Scott Myers, Littleton 6 Laine Gibson, Durango 9-R

Guests Present Dave Montoya, Poudre R1 Samantha Doney, Sheridan 2 Marcy Studtmann, Lewis-Palmer 38 Patty Buckle, Adams 12 Willie Leslie, Clear Creek Re-1 Tim Unrein, Eaton Re-2 Sue McKnight, Brighton 27J Brisa Villalobos, Westminster 50 Sandy Rotella, Westminster 50 Sandra McClure, Westminster 50 Rebecca Kluck, Pueblo 60 Dana Thompson, Harrison 2 Natalie Morin, Cheyenne Mtn. 12 Shelley Becker, Douglas County Re-1 Brenda McKee, Thompson R2-J Sherry Shay, Thompson R2-J Steve Towne, Thompson R2-J Kari Albright, Boulder Valley Re-2 Joe Davis, Denver 1 Nancy Tive, Monument Academy Patrick Hickey, Estes Park R-3 Brian Lund, Estes Park R-3 Misty Manchester, Canon City Re-1 Nikki Schmidt, Windsor Re-4 David Brungardt, Valley Re-1 Brenda Johnson, Weld Re-8 DeAnn Queen, Falcon 49 Fran Christensen, Falcon 49 Leslie Mason, Brush Re-2J Donna Holstlaw, Littleton 6 Angie Skalla, Widefield 3 Sharon Treadwell, Widefield 3 Tina Woodrum, Miami-Yoder 60 Tony Whiteley, St. Vrain Valley Re-1J Jane Schein, St Vrain Valley RE-1J Greg Fieth, St. Vrain Valley Re-1J Mike Lee, Fort Morgan Re-3 Kara Emmerling, Genoa-Hugo C-113 Ken Wieck, Colorado Springs 11 Mark Capps, Colorado Springs 11 Gina French, Adams 14 Sharon Thompson, Holyoke Re-1J Kay Schreiber, East Central BOCES Terry Scharg, Gilpin Re-1 Tracy John, Peyton 23JT Kristine Ewing, Cherry Creek 5 Mandy Hydock, Greeley 6 Meggan Sponsler, Greeley 6 Jon Kvale, Englewood 1 Kay Bridges, Jefferson County R-1 Sean Conner, Jefferson County R-1 Lisa Anderson, Jefferson County R-1 Joanne Vergunst, Fountain-Ft. Carson 8 Chelsey Gerard, Eagle County Re-50 Kurt Shugars, Telluride R-1 Teri Arnett, DeBeque 49JT Wendy Winfrey, Ouray R-1 Vi Crawford, Mesa County Valley 51 Susan Schoon, Garfield Re-2 Christy Hamrick, Garfield Re-2 Barb Hazelton, Mesa County Valley 51 Nancy Paregien, Mesa County Valley 51 Cheryl Gomez, Ridgway R-2 Colleen Love, Ridgway R-2 Velva Addington, Swink 33 Don Trujillo, Pueblo 70 Sherry Herman, Cheraw 31 Dianna Baker, Karval Re-23 Dottie Burnett, Santa Fe Trail BOCES Melissa Brunner, Montezuma-Cortez Re-1 Steve Cole, Dolores Re-2 Janell Wood, Archuleta 50JT JoAnna Valdez, Archuleta 50JT Susan Doudy, Mancos Re-6 Anne Gundersen, Ignacio 11JT Jerene Wilkinson, Monte Vista C-8 Rhoda Getz, Alamosa Re-11J Steve Dazzio, Dazzio & Plutt, LLC CPA’s David Lyon, CDE Elizabeth Conway, CDE Steve Clawson, Clifton Gunderson CPA Jean Bushong, Clifton Gunderson CPA Wendy Saathoff, Poysti & Adams CPA

Members and Alternates Absent Terry Buswell, Centennial BOCES Paula Sublett, San Juan BOCES

MINUTES FINANCIAL POLICIES AND PROCEDURES COMMITTEE February 11, 2011

I. Call to Order and Introductions Vody Herrmann called the meeting to order at 9:30 am. Those in attendance were asked to introduce themselves and their district.

II. Approval of Agenda Kim Krause made a motion to approve the agenda as presented. Carole Herman 2nd the motion. Motion carried.

III. Approval of Minutes Carole Herman made a motion to approve the minutes from the September 24, 2010 meeting. Denise Pearson 2nd the motion. Motion carried.

IV. Legislative Updates Vody stated that there were not a lot of updates to present today. The few items that districts need to be aware of are: 1) SB11-156 FY10-11 General Fund Reserve Reduction – Will reduce the required amount to be kept in reserve at the state level from 4% to 2.3%. This should free up approximately $118M. 2) SB11-157 Modifications to School Finance Act – This is the supplemental bill for School Finance. Incorporated in the bill is the additional $22.9M that is required to fund Total Program at the $5.438B level currently in statute. The Joint Budget Committee approved the supplemental request and has put it in the form of a bill to go forward to the General Assembly. If it passes there will be no further rescissions to school districts for FY10-11. The bill further reduces Total Program funding by $216M and adds two line items in the State budget that shows the federal dollars that are available for school districts to use, $156M of federal funds for Ed Jobs and $60M of State Fiscal Stabilization Funding ARRA funds. The bill also adds the additional $124,000 to fund the Start Smart Breakfast program. 3) SB11-164 Cash Fund Transfers for FY10-11 – This bill will take $2.853M from the Department’s contingency funds. This will leave approximately $1M for emergency assistance to school districts. 4) SB11-074 Option to Change PERA Contribution Rate – This bill allows employers in the school or local government division of PERA and the Denver public schools division of PERA only to decrease the employer contribution rate and increase the member contribution rate by an amount to be determined by the employer but not greater than 2.5%. 5) HB11-1115 Public Entity Construction Retainage – Currently, a public entity is allowed to withhold payment for up to 10% of the value of completed work on the first half of a construction project to ensure that the work meets specification. This bill changes that amount to 5% of the value of the entire project. 6) HB11-1077 Education of Gifted Children - This bill separates the "Exceptional Children's Educational Act", article 20 of title 22, Colorado Revised Statutes, into two parts: One concerning children with disabilities and another concerning gifted children. Language related only to gifted children is relocated to the second part.

V. Funding of Total Program A spreadsheet was distributed that shows how funding for Total Program has regressed beginning with FY2008-09 year through FY2011-12 projections. For FY2010-11, including the supplemental amount in SB11-157, the rescission amount is projected to be $381M through the State Budget Stabilization Factor in the funding calculation. For FY2011-12 the current projected rescission of 11.26% is optimistic and could realistically be 3% higher. The State is projecting a $142M reduction in property taxes over projections. K-12 Education is 45% of the State’s budget and the $1.1B budget reductions cannot come from all other State agencies. The Governor will present the budget reduction numbers to the Joint Budget Committee next week. There is a spreadsheet on the website that incorporates all the new projections for pupil count and inflation for FY2011-12 Fiscal Year 2011-12 Funding Calculation . There is also a spreadsheet posted on the website that shows FY2010-11 Total Program Funding incorporating the $22.9M supplemental requested in SB11-157. Fiscal Year 2010-11 Total Program Funding pursuant to SB11- 157 Supplemental Request - SFSF ARRA & EdJobs The amounts in the spreadsheet have changed slightly from the information presented at the December webinar due to the supplemental request shifting ARRA allocations between K-12 and higher education. There are several districts identified with gray highlighting. These are the districts that are high property tax districts and fall into categorical buyout within the school finance funding formula.

VI. SFSF-ARRA & Ed Jobs Funding a. Grant Tracker – Funds Draw-down David Lyon and Elizabeth Conway from the Grant Fiscal Management Unit (GFMU) at CDE were present to discuss the process for districts to access the SFSF-ARRA and Ed Jobs funds associated with total program funding. GFMU has set up a process using an online tracker system to upload data to the Department. After reviewing the process it appears to be more cumbersome than they would like so they have created an alternative method to request funds along with the assurance documents that must be collected. Since these are ARRA funds there is an FTE calculation required by OMB to report back to the feds. The recommendation is to use the funds to pay for items other than salaries, i.e. benefits for the Ed Jobs funds or utilities for the SFSF-ARRA funds. This will eliminate the FTE calculation. If a district needs to report FTE’s they should contact the GFMU for guidance.

David reviewed the “Request for Funds” form that may be used instead of the online tracker system. It is a spreadsheet form similar to one used for many of the reimbursement grants. The form can be submitted to the [email protected] email address. Those that have already submitted requests through the online tracker system can continue to do so.

Assurance forms will need to be collected for the SFSF-ARRA funds similar to the assurance form collected for the Ed Jobs funds. The SFSF-ARRA assurance form and “Request for Funds” form will be sent out as soon as SB11-157 has passed. The Ed Jobs funds are available for draw- down now. The SFSF-ARRA funds must be spent by Sept. 2011 and the Ed Jobs funds by Sept. 2012. The Department is recommending that the funds be used before the end of the fiscal year. There has been discussion that any unused funds could possibly be drawn back at the Federal level.

It is recommended that a local BOE have a resolution describing the use of these federal funds. A supplemental appropriation can also be used, which is a resolution in itself.

A question was asked regarding the flowing of these federal funds through to charters. Vody stated that as long as the charters were receiving their full PPR, districts are not required to shift federal dollars to the charters if it is easier for reporting purposes. If districts choose not to flow the federal funds to their charters, she recommends having the charters sign off that they understand they are receiving an amount equal to the federal portion. She also warned against reclassifying any expenditure from programs that receive other reimbursement, i.e. special education, transportation, etc.

b. Grant Cash-flow – 60 Day Rule An issue occurred this year in the ADE transmission in that the Department had to modify the “grants revenue must equal grant expenditures” for some school districts. This was due to how their auditor was treating grants accounts receivables revenues receipted beyond its “period of availability” as deferred revenue. The booking of the deferred revenue caused recognized revenues to be less than the allowable expenditures for such grants. This in turn led to a negative fund balance for that grant and, in several instances, for the Grants Fund as well, which is a violation of statute. Kirk Weber had a PowerPoint presentation that analyzed the issue and presented research he conducted in GASB codifications and the FPP handbook to hopefully find some clarification to this problem. He also reviewed several districts’ revenue recognition policies and noted that some had changed their policy between last year and this year. He used Adams 14 as an example, for FY09 the policy considered revenue to be available if collected within 60 days after the end of the fiscal year, except grant revenue, which were recorded when eligible expenditures were incurred. For FY10 the policy was changed to consider revenues to be available when they are collected within the current period or soon enough thereafter to pay liabilities with 60 days after the end of the fiscal year, except grant revenues, which are considered to be available when they are collected within 90 days. Jefferson County’s policy has a 60 day rule for property taxes and 120 days for all other revenue. There appears to be some flexibility in the definition of “period of availability” as long as it is noted in the district’s significant accounting policies. Districts may want to look at their policies and extend the time limit for grants to alleviate this problem. Districts also need to demonstrate due diligence in requesting grant funds in a timely manner.

David Brungardt stated that he is currently having a problem getting grant reimbursements from the Grants Fiscal Management Unit at the Department. He has one grant that they requested funds prior to June 30th that he has still not receive the funds, so even changing their policy to 120 days would not cover this. Kirk Weber stated that there has been discussion with the GFMU and the timely reimbursements to districts and he will continue to keep on them regarding this as it gets closer to the end of the year.

Vody stated that her biggest concern with this issue is that the different treatment by auditors is causing statutory violations for a small group of districts. Somehow she felt the committee needs to determine if this is allowable or not so districts know how to access funds and do not end up being in violation of statute. The rules need to be clear so the Department is not forced to waive edits for individual districts when not everyone is allowed the same accommodations. She asked what needed to take place through the Financial Policies and Procedures committee at a policy making level for the recognition of federal revenues and expenditures so everyone is treated the same.

Crystal Dorsey from the Office of the State Auditor stated that they place a lot of reliance on what the CPA does since their office does not have the resources to conduct individual audits. There can be differences of opinions between CPA’s, but ultimately they are putting their license and reputation on the line. They know their individual clients better than anyone.

After further discussion it was decided that Department staff will contact GASB for an official opinion regarding the situation and bring the information back at the next meeting.

Nicki Schmidt asked if there could be a process developed to expedite distribution of the SpEd. funding similar to the Title distribution. Vody asked that a letter be drafted to the Commissioner of Education from a group; i.e. districts CFO’s, CASBO, CASE-DBO; that addresses the current distribution processes and ask that they be cleaned up. It is her opinion that this may raise more awareness to possibly get this dealt with. Representatives from CASBO and CASE-DBO both had upcoming meetings and said they would address the issue.

VII. SWAP Vody introduced Leanne Emm as the new Interim Director of Public School Finance. Leanne reviewed the School to Work Program (SWAP) and recommended accounting updates. The Department met with the Division of Vocation Rehabilitation (DVR) to review the revenue and expenditure accounting process at the district level after DVR received a federal grant onsite review finding. They were unable to account for the full expenditures related to the grant. Districts must be able to show expenditures for the total amount of the program, which is currently the federal and district match amount. It is also proposed that districts would begin requesting funds from DVR rather than to receive a monthly payment form DVR. At an undetermined time DVR could request backup expenditure information for the funds request. A handout will be posted on the FPP meeting website that shows the proposed accounting process. VIII. Chart of Accounts Change a. Review balance sheet code definition for “committed” to “other restricted” Kirk Weber stated that this relates to the GASB 54 treatment that changes fund equity classification. Currently the COA has specific restricted codes for each of the statutory required reserves. There has been a request from districts for an “other restricted” reserve account code that is not tied to any statutory requirement for use of other reservations specific to the district. After discussion, Phil Onofrio made a motion to add account code 6769 – Other Restricted Reserve Fund Balance to the FPP Chart of Accounts. Marita Vogrin 2nd the motion. Motion carried. The code will be available for the FY10-11 year.

b. Proposed Expansion of Capital Project Funds Several districts have multiple capital projects funds and requested some changes in the use of funds 44-49. Kirk Weber presented a proposal to change the way these funds roll in the ADE Financial December data collection. Currently these funds roll to Fund 41 – Building Fund. The proposal is to have Funds 44, 45 and 46 roll to Fund 41 – Building Fund and Funds 47, 48 and 49 roll to Fund 43 – Capital Reserve/Capital Projects Fund. With the elimination of the Fund 21 – Capital Reserve Special Revenue Fund this will allow for more flexibility for capital projects. After discussion it was decided to tabled the item to the next meeting for action.

IX. Financial Policies and Procedures Issues - Discussion a. Capital Reserve Restricted Reserve – Use of Fund 21 vs. Fund 43 Terry Christensen reported that there are still several districts that reported transfers of funds from their General Fund to Fund 21 – Capital Reserve Special Revenue Fund in their Financial December ADE transmission. With the elimination in statute of the required per pupil amount for capital/risk management, Fund 21 is no longer appropriate as a special revenue fund. Any fund balance at the end of FY09 is restricted for use as prescribed in statute prior to its repeal. There will be a spreadsheet posted that shows the amount of restricted reserve for districts in Fund 21. For the FY2010-11 ADE submission there will be an edit warning that will address those districts that have continued to transfer funds into Fund 21.

b. Agency Fund Treatment for Federal Grant Activity Vody addressed two cases where the independent auditors have proposed the use of the agency fund treatment for the Federal grant activities between entities. In particular, Ft. Lupton and Keenesburg had entered into a consortium agreement to operate as an Administrative Unit for IDEA (Special Education) grant funding with Ft. Lupton acting as the oversight district for the AU. The independent auditor identified the net portion of the funding that was “flow-thru” to the other district as being purely a conduit arrangement between the two districts. Ft. Lupton claimed no responsibility or compliance requirement related to the activities of the other district. The auditor therefore recognized all of the flow-thru monies to Keenesburg in an agency fund as custodial item only. Neither of the districts reported the monies for single audit purposes. This is a possible non-compliance issue with the oversight district where funds could be pulled back or we have a situation where the two participating districts are truly not an AU. Wendy Swanhorst stated that she felt the issue in this particular case is that the district that received the funds cannot get a clean opinion on a single audit because they do not have oversight for the expenditure of the funds at the second district. The only why that could happen would be if both districts were audited by the same auditor. Vody stated that this is truly a unique situation and there has been discussion with the Special Education Unit and she did learn that there has been a change to the AU requirements that may allow the two districts to become individual AU’s. Kirk Weber acknowledged that there is a concern with BOCES because their AU agreement uses the same concept. The Department is meeting with the Special Education Unit to review the actual documentation for the consortium agreement between Ft. Lupton and Keenesburg and it will be up to them to make the determination on any future funding process. Vody stressed again that she wants treatment for all districts to be uniform and consistent. The other case involved child nutrition programs being supported by a Charter School Food Authority (SFA). The Charter SFA claimed no responsibility or compliance requirements related to the activities of the other schools under the Charter SFA. Adrienne Bradshaw asked if the district has charter schools under their SFA that they flow-thru federal dollars to would they need to have an agency fund to account for these funds. Vody stated as long as the district is the SFA for a district charter school that school is a part of the district’s food service program and thus the district is responsible for reporting all food service activity. This issue was related more to charter schools that have asked to be released from their district’s SFA and entered into a SFA agreement amongst the charter schools. One charter school had taken on the responsibility of being the Charter SFA and they did not account for all of the Federal funding and related activities of the nutrition program. Vody asked if anyone has ideas or suggestions to please provide them.

c. Charter Schools and Single Audits Kirk Weber reported on the opinion that the Department received from Brustein & Masasevit, Attorneys at Law, a Washington, DC firm that specializes in Federal program compliance. Their opinion is that charter schools do not have to conduct a single audit because the charter schools are not considered recipients or sub-recipients under the Single Audit Act. However, the single audit of the school district (LEA) must include the charter schools within the LEA. In the case of the Charter School Food Authority, if the Charter SFA is receiving a grant or subgrant, then the Charter SFA must conduct a single audit (assuming it spends at least $500,000 in Federal funds per year).

d. Non-Voter Approved Debt Service Fund The Department has had a request to identify a non-voter approved debt service fund in the Chart of Accounts. Statute specifically requires a voter approved debt service fund but there are many incidences of debt other than voter approved, i.e. COP’s, charter school debt service. After discussion it was decided to table the item and bring back recommendations at the next meeting.

X. Committee Memberships a. Charter School Ex-Officio Liaison – To replace Lee Barratt Lee Barratt the Charter School Ex-Officio Liaison member is no longer with the Charter School Institute creating a vacancy. Eileen Johnston has volunteered to fill the vacancy. Karin Slater made a motion to appoint Eileen Johnston to fill the vacancy. Carole Herman 2nd the motion. Motion carried.

b. Special Education Advisory Committee – to replace Leanne Emm Charm Paulmeno from the Exception Student Leadership Unit at the Department has requested the committee recommend a member for the Special Education Fiscal Advisory Committee to replace Leanne Emm. Shelley Becker volunteered to serve on the committee. The information will be provided to ESLU.

XI. Other Topics of Interest a. Audit & ADE submission Update Terry Christensen gave a report on the current status of the Financial December ADE submission. For the FY09-10 data, there are 19 districts that have not completed their submission, compared to 23 last year. For current year the Department has approve 110 districts compared to 57 last year. She stated that this is due largely to the quality of the data and audits submitted and commended the districts for their efforts. She also stated that the Department is checking the district websites for compliance with the “Financial Transparency Act”.

b. Average Daily Membership Study Report The report is completed and there is a link on the PSFU website to the study report. Average Daily Membership Study Their recommendation is that there is more than one count in a year. They do recommend that the Department try to use existing collections, i.e. Safety collection, End of Year Report, etc. and look at some type of average daily membership. Vody encourage everyone to read the report. The report will be presented to the Joint Education Committee on February 23rd at 7:30AM. c. Alternative School Financial Models Pilot Program Leanne Emm reminded districts can still participate in an Alternative School Financial Models Pilot Program. There were no districts present that indicated they were interested in participating in the program. d. Financial Self-study Training Sessions Kirk Weber reviewed a new self-study training session for new business managers available on the PSFU website. e. Recognition Adrienne Bradshaw requested the floor and asked those in attendance to join her in thanking Vody Herrmann for her years of service to CDE School Finance. Vody received a standing ovation and large round of applause from the audience. Vody thanked the group for all of their hard work and dedication to the students of the State.

There being no further business to come before the Committee, the meeting was adjourned.