ALLOCATION OF SERVICE DEPARTMENT COSTS TO PROFIT AND INVESTMENT CENTERS

A potential source of disharmony among responsibility centers in decentralized firms is the allocation of service department costs. Most businesses have departments that do not produce goods but rather service other departments. Examples are data processing, accounting, planning, personnel, and cafeteria and medical facilities. Service departments carry out essential auxiliary services for an organization. There are several reasons for allocating service department costs.

1. Other departments receive benefits from service departments and should be charged for the benefits received. 2. Allocation helps other departments realize the cost of the services received and decide how much service to request. 3. Allocation usually results in a more effective distribution of services among departments. 4. Allocation helps in costing the company’s products, because service department costs should be viewed as part of a product’s cost.

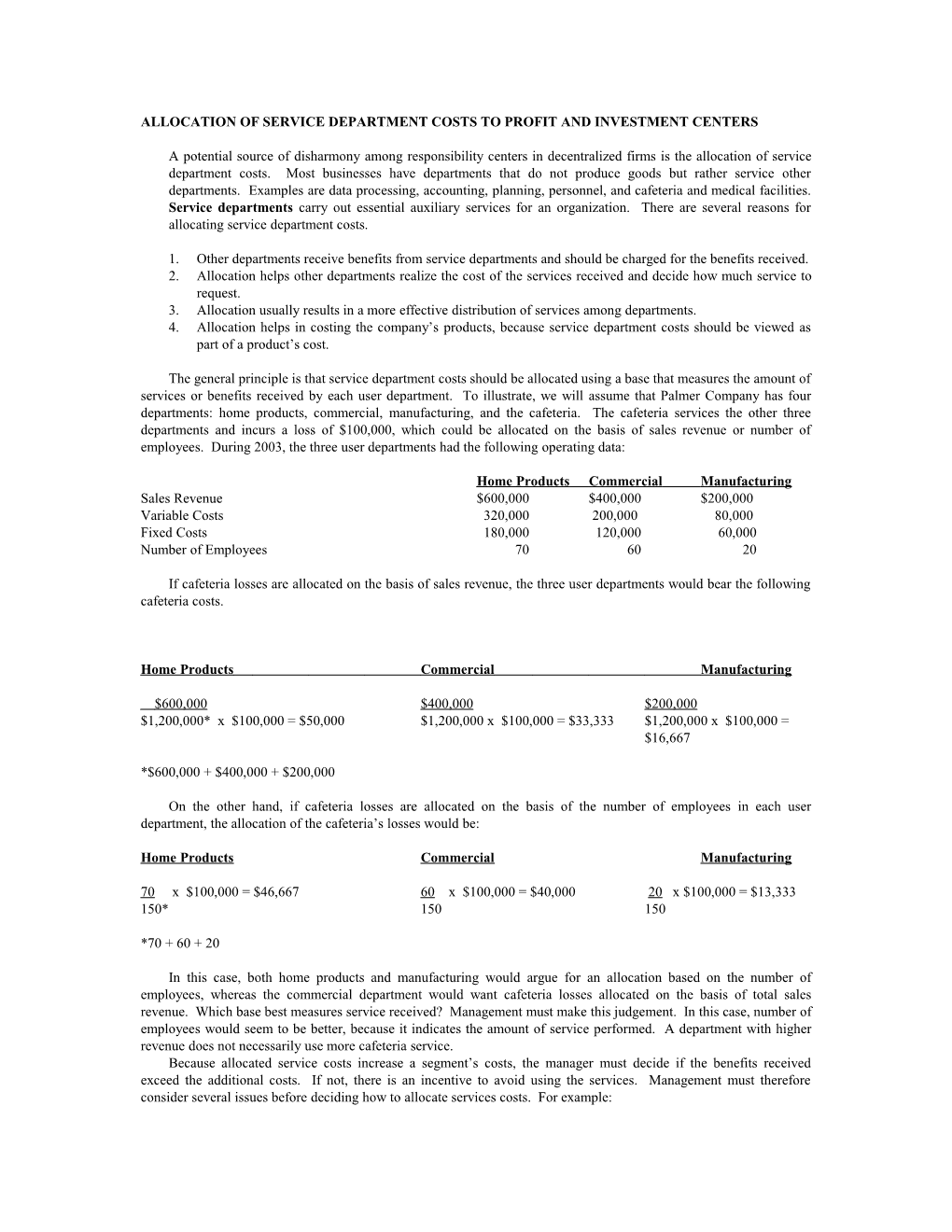

The general principle is that service department costs should be allocated using a base that measures the amount of services or benefits received by each user department. To illustrate, we will assume that Palmer Company has four departments: home products, commercial, manufacturing, and the cafeteria. The cafeteria services the other three departments and incurs a loss of $100,000, which could be allocated on the basis of sales revenue or number of employees. During 2003, the three user departments had the following operating data:

Home Products Commercial Manufacturing Sales Revenue $600,000 $400,000 $200,000 Variable Costs 320,000 200,000 80,000 Fixed Costs 180,000 120,000 60,000 Number of Employees 70 60 20

If cafeteria losses are allocated on the basis of sales revenue, the three user departments would bear the following cafeteria costs.

Home Products Commercial Manufacturing

$600,000 $400,000 $200,000 $1,200,000* x $100,000 = $50,000 $1,200,000 x $100,000 = $33,333 $1,200,000 x $100,000 = $16,667

*$600,000 + $400,000 + $200,000

On the other hand, if cafeteria losses are allocated on the basis of the number of employees in each user department, the allocation of the cafeteria’s losses would be:

Home Products Commercial Manufacturing

70 x $100,000 = $46,667 60 x $100,000 = $40,000 20 x $100,000 = $13,333 150* 150 150

*70 + 60 + 20

In this case, both home products and manufacturing would argue for an allocation based on the number of employees, whereas the commercial department would want cafeteria losses allocated on the basis of total sales revenue. Which base best measures service received? Management must make this judgement. In this case, number of employees would seem to be better, because it indicates the amount of service performed. A department with higher revenue does not necessarily use more cafeteria service. Because allocated service costs increase a segment’s costs, the manager must decide if the benefits received exceed the additional costs. If not, there is an incentive to avoid using the services. Management must therefore consider several issues before deciding how to allocate services costs. For example: 1. Which cost-allocation methods will encourage managers to make the most goal-congruent decisions? A method based on the measurement of usage by each segment is usually best. Segment managers can control usage and can evaluate the resulting benefits in relation to the costs. Following are some examples of service-cost allocation usage bases.

Service Department Basis for Service-Cost Allocation Cafeteria Number of employees in each division Custodial and Utility Costs Square footage of each division Data Processing Usage by each division Personnel Number of employees in each division

2. Should all service costs be allocated? Perhaps the costs of services that top management requires of all departments to use (services that segment managers may not choose to use voluntarily) should not be allocated at all. Examples are internal auditing and personnel training. Since charging on the basis of usage often discourages use, some other arrangement, such as a flat fee, should be established if allocation is considered necessary.

3. Should actual or standard service costs be allocated? If actual costs are allocated, user departments may be burdened with the inefficiences of the service departments. Because of this potential inequity, standard rates, multiplied by the actual level of activity, are usually used. Any remaining costs created by inefficiences are the responsibility of the service departments. Applying a standard rate that is tied to usage allows the user departments to concerntrate on controlling usage and the service departments to concentrate on controlling costs. This leads to goal congruenct decisions within a company.

To Summarize: Most businesses have departments that do not produce goods but rather service other departments. Service departments carry out essential auxiliary services for an organization. They are usually allocated to profit and investment enters because: Other departments receive benefits from service departments and should be charged for the benefits received. Allocation helps other departments realize the cost of the services received and decide how much service to request. Allocation usually results in a more effective distribution of services among departments. Allocation helps in costing the company’s products, because service department costs should be viewed as part of a product’s cost.

Service department costs should be allocated to user departments using a basis that measures the services or benefits received.