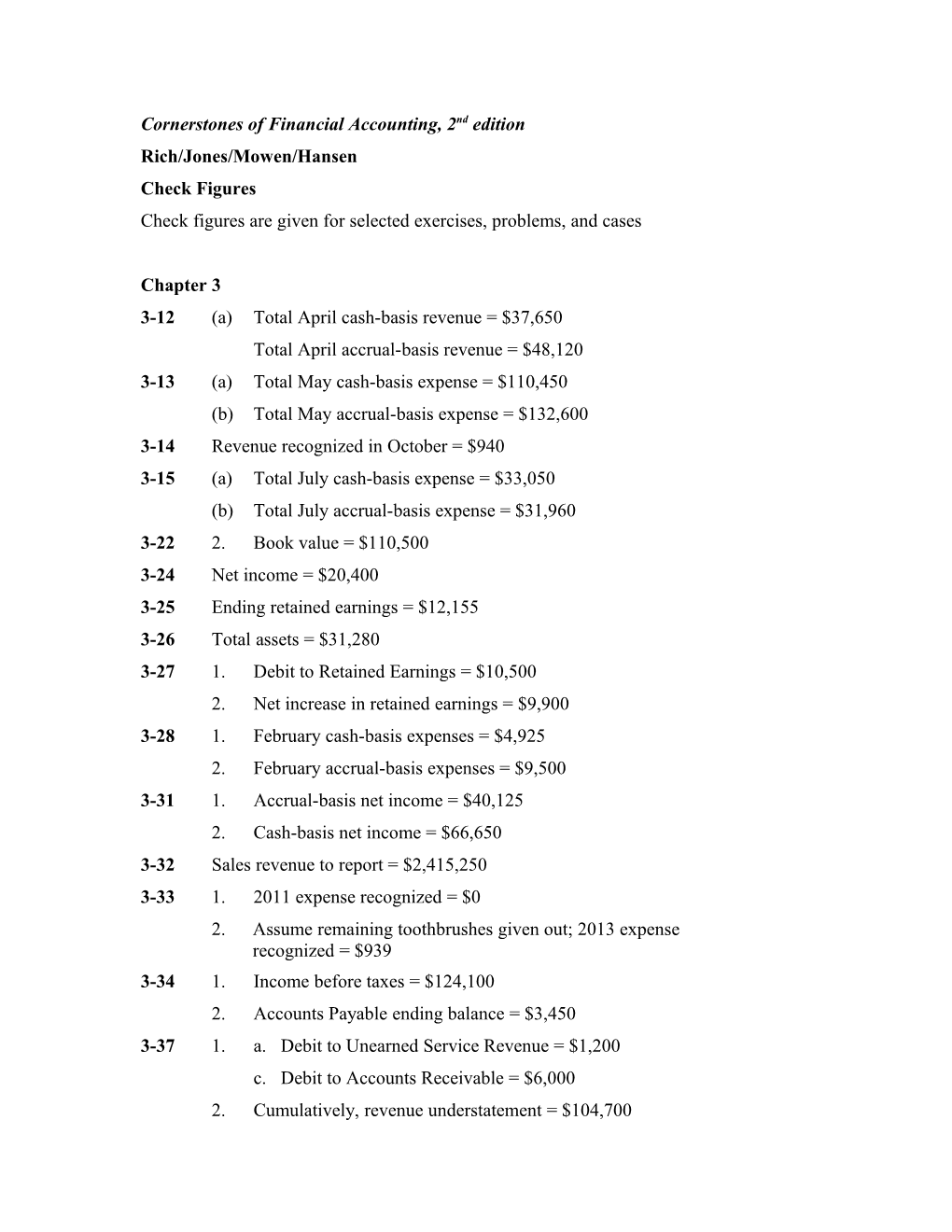

Cornerstones of Financial Accounting, 2nd edition Rich/Jones/Mowen/Hansen Check Figures Check figures are given for selected exercises, problems, and cases

Chapter 3 3-12 (a) Total April cash-basis revenue = $37,650 Total April accrual-basis revenue = $48,120 3-13 (a) Total May cash-basis expense = $110,450 (b) Total May accrual-basis expense = $132,600 3-14 Revenue recognized in October = $940 3-15 (a) Total July cash-basis expense = $33,050 (b) Total July accrual-basis expense = $31,960 3-22 2. Book value = $110,500 3-24 Net income = $20,400 3-25 Ending retained earnings = $12,155 3-26 Total assets = $31,280 3-27 1. Debit to Retained Earnings = $10,500 2. Net increase in retained earnings = $9,900 3-28 1. February cash-basis expenses = $4,925 2. February accrual-basis expenses = $9,500 3-31 1. Accrual-basis net income = $40,125 2. Cash-basis net income = $66,650 3-32 Sales revenue to report = $2,415,250 3-33 1. 2011 expense recognized = $0 2. Assume remaining toothbrushes given out; 2013 expense recognized = $939 3-34 1. Income before taxes = $124,100 2. Accounts Payable ending balance = $3,450 3-37 1. a. Debit to Unearned Service Revenue = $1,200 c. Debit to Accounts Receivable = $6,000 2. Cumulatively, revenue understatement = $104,700 3-38 1. a. Credit to Prepaid Insurance = $1,620 d. Credit to Prepaid Advertising = $2,900 2. Cumulatively, expenses understatement = $7,480 3-39 2. a. Debit to Insurance Expense = $8,750 c. Debit to Unearned Rent Revenue = $200,000 3-40 2. b. Credit to Prepaid Insurance = $1,050 d. Credit to Prepaid Repairs & Maintenance = $100 3-41 1. Supplies used = $11,620 3-42 1. a. Debit to Interest Expense = $3,200 c. Supplies used = 6,730 3-43 1. b. Credit to Prepaid Insurance = $2,040 d. Credit to Rent Payable = $390 3-44 May 31 credit to Prepaid Insurance = $3,050 May 31 credit to Sales Revenue = $7,250 3-46 1 and 2. Net income = $33,347 3-47 2. Credit to Retained Earnings = $26,100 3-48 Adjusted Trial Balance columns totals = 509,493 Net Income = 12,747 Ending Retained Earnings = 23,747 3-49A 1. Cash-basis March loss = $(315) 2. Accrual-basis March income = $585 3-50A 1 and 2. 2011 total expenses = $609,925 3-51A 2. b. Credit to Service Revenue = $40,685 e. Credit to Prepaid Insurance = $2,000 g. Credit to Interest Payable = $450 i. Debit to Supplies Expense = $3,510 3-52A 1. b. Debit to Accounts Receivable = $1,125 c. Debit to Rent Expense = $9,375 f. Debit to Supplies Expense = $17,900 2. Net overstatement of income would be $2,320 3-54A 2. Total operating expenses = $476,489 Ending retained earnings = $166,591 Total current liabilities = $493,459 3-55A 1. (a) Adjusted Accumulated Depreciation = $168,500 (c) Adjusted Insurance Expense = $17,120 (e) Adjusted Wages Expense = $50,950 2. (b) Debit to Unearned Service Revenue = $7,380 (d) Debit to Rent Expense = $1,500 3-56A 1. Credit to Retained Earnings = $71,950 2. Net income = $71,950 3-57A 1. b. Credit to Accounts Receivable = $2,332,028 e. Debit to Accounts Payable = $39,200 h. Debit to Interest Expense = $30,000 2. Ending Cash balance = $2,012,324 Ending Interest Payable balance = $30,000 3. Net income = $1,125,948 4. Ending retained earnings = $1,563,323 5. Total current liabilities = $578,707 3-58A 1. Adjusted Trial Balance columns totals = 5,581,688 Net Income = 32,512 Ending Retained Earnings = 71,712 2. Total current liabilities = $159,438 3-49B 1. Cash-basis March income = $1,950 2. Accrual-basis March income = $1,560 3-50B 1 and 2. 2011 total expenses = $51,670 3-51B 2. b. Credit to Service Revenue = $2,825 d. Credit to Prepaid Insurance = $750 g. Debit to Supplies Expense = $175 3-52B 1. b. Debit to Accounts Receivable = $17,640 e. Debit to Supplies Expense = $661 2. Net understatement of income would be $32,734 3-54B 2. Total operating expenses = $923,890 Ending retained earnings = $67,730 Total current liabilities = $69,130 3-55B 1. (a) Adjusted Prepaid Insurance = $4,144 (d) Adjusted Service Revenue = $132,130 (e) Adjusted Depreciation Expense = $10,500 2. (b) Credit to Interest Payable = $4,175 (c) Credit to Wages Payable = $17,600 3-56B 1. Credit to Retained Earnings = $49,250 2. Net income = $49,250 3-57B 1. b. Credit to Accounts Receivable = $199,100 g. Debit to Accounts Payable = $73,000 h. Debit to Interest Expense = $2,700 2. Ending Cash balance = $12,300 Ending Interest Payable balance = $2,700 3. Net income = $38,500 4. Ending retained earnings = $86,500 5. Total current liabilities = $36,800 3-58B 1. Adjusted Trial Balance columns totals = 2,204,300 Net Income = 148,900 Ending Retained Earnings = 135,600 2. Total current liabilities = $88,600 3-66 3. Expenses = 365,550 3-67 4. Credit to Retained Earnings = $98,000,000 3-68 3. Abercrombie & Fitch debit to Income Summary (to close expenses) = $2,943,503,000 3-69 2. Ending Cash balance $7,380 Ending Sales Revenue balance = $9,500 3. Trial balance totals = 93,300 5. Net income understatement would be $23,830 6. Net income = $1,210 Total current liabilities = $11,860