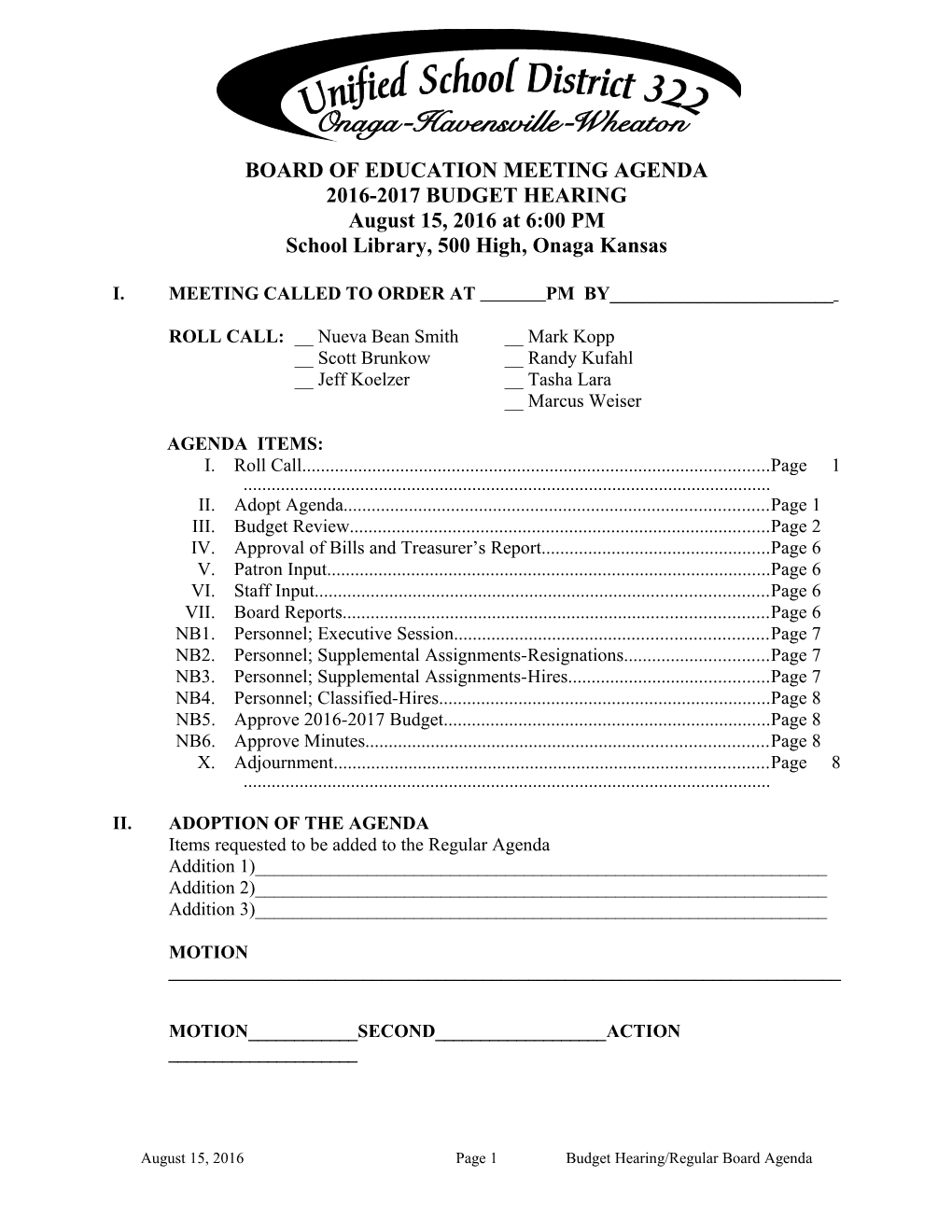

BOARD OF EDUCATION MEETING AGENDA 2016-2017 BUDGET HEARING August 15, 2016 at 6:00 PM School Library, 500 High, Onaga Kansas

I. MEETING CALLED TO ORDER AT PM BY______

ROLL CALL: __ Nueva Bean Smith __ Mark Kopp __ Scott Brunkow __ Randy Kufahl __ Jeff Koelzer __ Tasha Lara __ Marcus Weiser

AGENDA ITEMS: I. Roll Call...... Page 1 ...... II. Adopt Agenda...... Page 1 III. Budget Review...... Page 2 IV. Approval of Bills and Treasurer’s Report...... Page 6 V. Patron Input...... Page 6 VI. Staff Input...... Page 6 VII. Board Reports...... Page 6 NB1. Personnel; Executive Session...... Page 7 NB2. Personnel; Supplemental Assignments-Resignations...... Page 7 NB3. Personnel; Supplemental Assignments-Hires...... Page 7 NB4. Personnel; Classified-Hires...... Page 8 NB5. Approve 2016-2017 Budget...... Page 8 NB6. Approve Minutes...... Page 8 X. Adjournment...... Page 8 ......

II. ADOPTION OF THE AGENDA Items requested to be added to the Regular Agenda Addition 1)______Addition 2)______Addition 3)______

MOTION ______

MOTION______SECOND______ACTION ______

August 15, 2016 Page 1 Budget Hearing/Regular Board Agenda 2015-2016 USD 322 BUDGET HEARING

III. BUDGET REVIEW The budget is presented for the Board’s final review. The District’s proposed budget for the 2016-2017 school year was published in The Onaga Herald on August 4, 2016. At this hearing, the Board may adjust the budget limits lower but cannot raise the limits above what was published. A. General Fund (Form 151, Code 06) In the past, this fund covered the District’s general operational expenditures. With declining enrollment, reduced funding at the state level, and increasing costs; payroll/benefits account for the majority of general fund expenditures. The remaining expenditures are for general transportation and fund transfers. For the 2016-2017 fiscal year districts are to deposit the following state aid into the general fund and immediately transfer it back out to the appropriate fund: Special Education ($317,071) and KPERS ($229,935). The flow-through of state aid artificially inflates the General Fund; however, it does not provide any new money. In prior years this aid would have been deposited directly to its fund bypassing general. The prior method of funding was based on actual full-time equivalent (FTE) enrollment multiplied by base state aid per pupil (BSAPP). The prior method used weightings which provided additional aid for low enrollment and programs such as At-Risk, Special Education, Vocational Education and Transportation. Under the Block Grant, no additional state aid will be provided for increased base enrollment or increased participation in the special programs. The general fund budget is established by the State. The established general fund levy is 20.00 mills, which is the same in every district. New from the 14-15 legislative process was the Legislature’s requirement that counties send the taxes generated locally by the 20 mills directly to the State who then redistributes the funds to the school districts. The 2016-2017 General Fund budget is set at $2,699,665. B. Federal Funds (Code 07) The Federal Funds budget of $58,106 includes the following federal grants: Title I $45,219 (Increase of $33) Title II $13,330 (Decrease of $443) REAP $TBA Title I grant funds the district reading specialist’s salary and benefits. Title II grant will fund 36% of the additional 2nd grade teacher salary for class-sized reduction. The Small, Rural School Achievement Program (REAP) grant award has not been announced for FY17. This grant can be spent on anything that meets the spending guidelines of any of the Title programs. In the past, the district has spent it to update technology.

August 15, 2016 Page 2 Budget Hearing/Regular Board Agenda C. Supplemental General Fund/Local Option Budget (LOB) (Form 155, Code 08) The Local Option Budget of $840,540 will require a levy of 21.761 mills. FY15 closed with a cash carryover of $32,780. Fund transfers to other funds account for 44% of the LOB budget. In addition to fund transfers, the LOB fund will be used to maintain the existing school facilities and equipment and to purchase new equipment and supplies for use in the district. Operational expenditures such as custodial supplies, facility maintenance, utilities, insurance, supplies and equipment are budgeted in the LOB. The State support of the LOB is 38% of the budget ($322,095). The Statewide LOB maximum allowed authority without an election is 30% (33% with an election) of the computed General Fund. The FY16 computed General Fund uses last year’s actual FTE and weightings multiplied by a BSAPP of $4,490. Under the Block Grant funding, no additional funding will be provided for increased enrollment in 2016- 2017. LOB state aid changed from an equalized 81.2% funding to a quintiles calculation. The computed General Fund for FY17 (same as 14-15) is $2,801,799. The maximum allowed LOB for FY17 is $840,540. D. At-Risk K-12 (Code 13) Under the prior school funding formula, At-Risk state aid was computed by using the estimated number of students who qualify for free lunch and the BSAPP. This weighting no longer exists under the Block Grant. FY16 At-Risk closed with a cash carryover of $114,999. The At Risk fund is funded through transfers from General and LOB. Any student who is identified in need of At-Risk services is eligible to receive those services. Salaries to be funded with at-risk funds in USD322 are Kindergarten teacher (.5), Grade 1-3 teachers (.5), and elementary para-professionals. These salaries, along with summer/extended day school, after-school tutoring, school improvement teams, and credit recovery will be funded from the At-Risk fund. The At-Risk budget is set at $240,000. E. Capital Outlay Fund (Code 16) The capital outlay levy limit is 8.00 mills on the local assessed valuation. The current continuous and permanent capital outlay resolution was adopted June 9, 2014. The fund’s FY16 carryover cash balance is $236,311. The primary use of the Capital Outlay fund is the purchase and repair of equipment, facility operations including custodial/maintenance salaries, maintenance and repair and purchase of district buses/vehicles. The Capital Outlay budget is set at $450,000. F. Driver Training Fund (Form-195A, Code 18) Revenue is obtained through a State reimbursement of $90 ($33 increase from prior year) for each student successfully completing the driving course, fund transfers and any student fees that are assessed locally. Fees of $200 per in-district students and $300 per out-of-district students will be assessed. There is a carryover of $10,000 from FY16. All driver training related expenditures are paid from this fund. The Driver Training budget is set at $8,750. G. Food Service Fund (Form-162, Code 24) Revenue for the Food Service Fund is obtained from Federal, State and Local revenue from the sale of student and adult meals and fund transfers. The food service program is expected to be self sufficient. A carryover of $26,999 from FY16 is provided. Food service related expenditures are paid from this fund. The Food Service budget is set at $219,068.

August 15, 2016 Page 3 Budget Hearing/Regular Board Agenda H. Professional Development Fund (Form 195, Code 26) Revenue for this fund is provided through fund transfers. A carryover of $30,001 from FY15 is provided. Expenditures for staff professional development and Professional Development Council activities are paid from this fund. The Professional Development Fund is set at $30,001.

I. Special Education Fund (Form-118, Code 30) Revenue for the Special Education Fund is received from the State and transfers from the General and Supplemental General Funds. Expenditures for all Special Education programs are paid from this fund. The 2002 Legislature passed into law that special education state aid for cooperatives be run through the participating school districts’ general fund. An additional $233,531 of budget authority will be run through our general fund on behalf of the Holton Special Education Cooperative. In addition $83,540 of estimated state aid for special education transportation services and staffing categorical aid will be included in the general fund. Our largest expenditure in the special education budget is the assessment paid to the Holton Special Education Co-op that sponsors the special education programs offered in the District. The next largest expenditure is for transporting special education students, of which eighty percent is reimbursed by the State. The Special Education budget is set at $504,999. J. Vocational Education Fund (Code 34) Vocational state aid received in the past was based on fall semester enrollment/clock hours in advanced vocational classes and was deposited into the General Fund. This weighting no longer exists under the Block Grant therefore there will be no additional state aid received for any increase in vocational program enrollment. The Vocational Fund revenue is provided only through transfers from the General Fund & LOB. All vocational education related expenditures are paid from this fund. The Vocational Education budget is set at $183,800. K. Gifts and Grants Fund (Code 35) Examples of expenditures that can be paid from this fund are grants from cities or counties (not Federal), and gifts from booster clubs, individuals, foundations, organizations and businesses. The FY15 actual revenue/expenditures reflect grant activities for Kansas Reading Roadmap, FSB Cash4Teachers, and local memorials and donations. The Kansas Reading Roadmap grant accounted for $175,529 of the fund’s activity in FY15. The Gifts and Grants budget is set at $189,101.

L. KPERS Special Retirement Fund (Form-195C, Code 51). This fund was established by Legislative action in 2004. This is a “flow- through” fund. State aid, that used to be directly deposited into the KPERS accounts of USD #322 employees who are eligible for the KPERS Retirement Program, must now be deposited into the district’s bank account and immediately disbursed back to KPERS. New under the Block Grant is the requirement that the money flow through the general fund and be transferred out to the KPERS fund thus inflating the general fund. This is not new money. This fund does not in any way effect the operating budget and/or tax rate of the school district. It does represent the state aid amount projected to fund our current employees’ KPERS payments and could result in republishing the budget if wages are underestimated. The KPERS Special Retirement Fund budget is set at $229,935.

August 15, 2016 Page 4 Budget Hearing/Regular Board Agenda M. Contingency Reserve (Code 53) This fund was first established by a general fund transfer during the close of the 2001-2002 fiscal year. The legislature used to restrict the unencumbered cash balance that could be held in contingency reserve however the 2013 legislature removed that cap. The only source of revenue for this fund is a transfer from the general fund. A carryover of $246,270 from FY16 is provided. The fund shall be maintained for payment of expenses of the district attributable to financial contingencies as determined by the Board. (K.S.A. Supp. 72-6426 as amended by 2002 Senate Substitute for House Bill 2094). The Contingency Reserve budget is set at $246,270. N. Bond and Interest Fund (Form-242, Code 62) This fund was established to pay the principal and interest for the general obligation bond for the building program that was originally financed in 1993 and paid off early in October 2012. Delinquent B&I taxes are still trickling in. The Board passed a resolution last year declaring it has no intent to issue another bond and that the funds are no longer needed for their intended purpose. Any future taxes received will be transferred to Capital Outlay. We may receive a small amount of delinquent taxes in the 16-17 budget year, but no budget is set for them. Therefore, we will transfer and seek budget authority in the 17-18 budget year if this occurs.

BUDGET SUMMARY

FUND BUDGET TAX RATE General...... $2,699,665 20.000 Supplemental General (LOB)...... $840,540 21.110 Capital Outlay...... $450,000 8.000 Driver Training...... $8,750 Food Service...... $219,068 Professional Development...... $30,001 Special Education...... $504,999 Vocational Education...... $183,800 Federal Funds...... $58,106 Gifts and Grants...... $189,101 At-Risk K-12...... $240,000 KPERS Special Retirement...... $229,935 Bond and Interest...... $0 0.000 ...... Totals $5,653,965 49.110

August 15, 2016 Page 5 Budget Hearing/Regular Board Agenda IV. REVIEW AND APPROVAL OF BILLS AND TREASURER’S REPORT

Recommended ACTION: I recommend approval of the July 2016 bills and Treasurer’s Report.

MOTION ______

MOTION______SECOND______ACTION ______

V. PATRON INPUT

1.

2.

VI. STAFF INPUT

1.

2.

VII. BOARD REPORTS

1. SUPERINTENDENT/OHS PRINCIPAL REPORT; ADAM MCDANIEL Enrollment Update Beginning School In-Service Update Starting of School Items Elementary School Middle School High School Final Facility Items

2. TECHNOLOGY REPORT; DARRIN REITH -WRITTEN

3. MAINTENANCE/CUSTODIAL REPORT; GREG SCHMELZLE -WRITTEN

August 15, 2016 Page 6 Budget Hearing/Regular Board Agenda VIII. ACTION ON OLD BUSINESS

IX. ACTION ON NEW BUSINESS

1. PERSONNEL; EXECUTIVE SESSION

Recommended ACTION: Move into executive session to discuss nonelected personnel matters to protect the privacy interests of the individual(s) to be discussed.

MOTION______

MOTION______SECOND______ACTION ______

2. PERSONNEL; SUPPLEMENTAL ASSIGNMENTS-Resignations Jordan Boswell- OHS Volleyball Asst Abbie Nider- Spirit Squad Sponsor

Recommended ACTION: I recommend the 2 resignations be accepted as presented and to thank each staff member for their service to the district.

MOTION______

MOTION______SECOND______ACTION ______

3. PERSONNEL; SUPPLEMENTAL ASSIGNMENTS-Hires Kaitlin Dallman- OHS VB Asst (20% of combined Head and Asst. Salary) Nikki Boswell- OHS VB Asst (20% of combined Head and Asst. Salary) Ramon Fisher- OGS Head Boys Basketball

Recommended ACTION: I recommend the hires for supplemental contracts as presented.

MOTION______

MOTION______SECOND______ACTION ______

August 15, 2016 Page 7 Budget Hearing/Regular Board Agenda 4. PERSONNEL; Classified-Hire (Clerk of the Board) Administration has conducted interviews for the Clerk of the Board position. Brooke Callaway has been offered the position, pending board approval.

Recommended ACTION: I recommend Brooke Callaway be hired and appointed to the position of U.S.D. 322 Clerk of the Board, and to be appointed as the U.S.D. 322 determining official for all USDA Lunch Applications.

MOTION______

MOTION______SECOND______ACTION ______

5. APPROVE 2016-2017 BUDGET

Recommended ACTION: I recommend adoption of the budget for FY2017 as presented. The Board may adjust the budget limits lower but cannot raise the limits above what was published.

MOTION

MOTION______SECOND______ACTION ______

6. APPROVE MINUTES

Recommended ACTION: I recommend approval of the minutes of the regular July 11th board meeting and the July 18th special meeting of the Board of Education.

MOTION

MOTION______SECOND______ACTION ______

X. ADJOURNMENT

August 15, 2016 Page 8 Budget Hearing/Regular Board Agenda