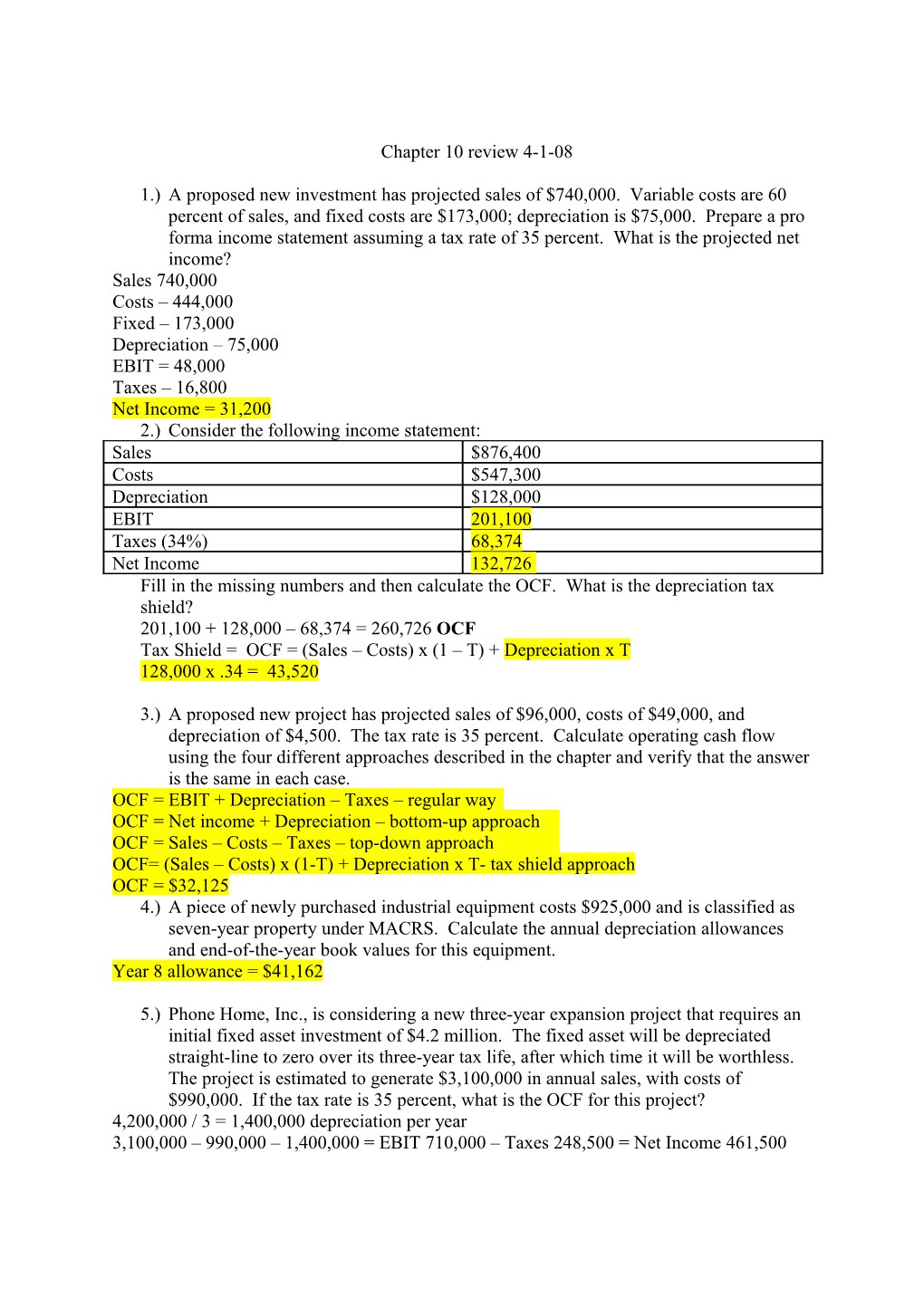

Chapter 10 review 4-1-08

1.) A proposed new investment has projected sales of $740,000. Variable costs are 60 percent of sales, and fixed costs are $173,000; depreciation is $75,000. Prepare a pro forma income statement assuming a tax rate of 35 percent. What is the projected net income? Sales 740,000 Costs – 444,000 Fixed – 173,000 Depreciation – 75,000 EBIT = 48,000 Taxes – 16,800 Net Income = 31,200 2.) Consider the following income statement: Sales $876,400 Costs $547,300 Depreciation $128,000 EBIT 201,100 Taxes (34%) 68,374 Net Income 132,726 Fill in the missing numbers and then calculate the OCF. What is the depreciation tax shield? 201,100 + 128,000 – 68,374 = 260,726 OCF Tax Shield = OCF = (Sales – Costs) x (1 – T) + Depreciation x T 128,000 x .34 = 43,520

3.) A proposed new project has projected sales of $96,000, costs of $49,000, and depreciation of $4,500. The tax rate is 35 percent. Calculate operating cash flow using the four different approaches described in the chapter and verify that the answer is the same in each case. OCF = EBIT + Depreciation – Taxes – regular way OCF = Net income + Depreciation – bottom-up approach OCF = Sales – Costs – Taxes – top-down approach OCF= (Sales – Costs) x (1-T) + Depreciation x T- tax shield approach OCF = $32,125 4.) A piece of newly purchased industrial equipment costs $925,000 and is classified as seven-year property under MACRS. Calculate the annual depreciation allowances and end-of-the-year book values for this equipment. Year 8 allowance = $41,162

5.) Phone Home, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $4.2 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $3,100,000 in annual sales, with costs of $990,000. If the tax rate is 35 percent, what is the OCF for this project? 4,200,000 / 3 = 1,400,000 depreciation per year 3,100,000 – 990,000 – 1,400,000 = EBIT 710,000 – Taxes 248,500 = Net Income 461,500 OCF = 710,000 + 1,400,000 – 248,500 = 1,861,500

6.) In the previous problem, suppose the required return on the project is 12 percent. What is the project’s NPV?

Year 0 Year 1 Year 2 Year 3 Operating cash flow 1,861,500 1,861,500 1,861,500 Change in NWC Capital spending -4,200,000 0 Total cash flow -4,200,000 1,861,500 1,861,500 1,861,500

NPV = 271,008.91