FDIC Deposit Insurance Premia

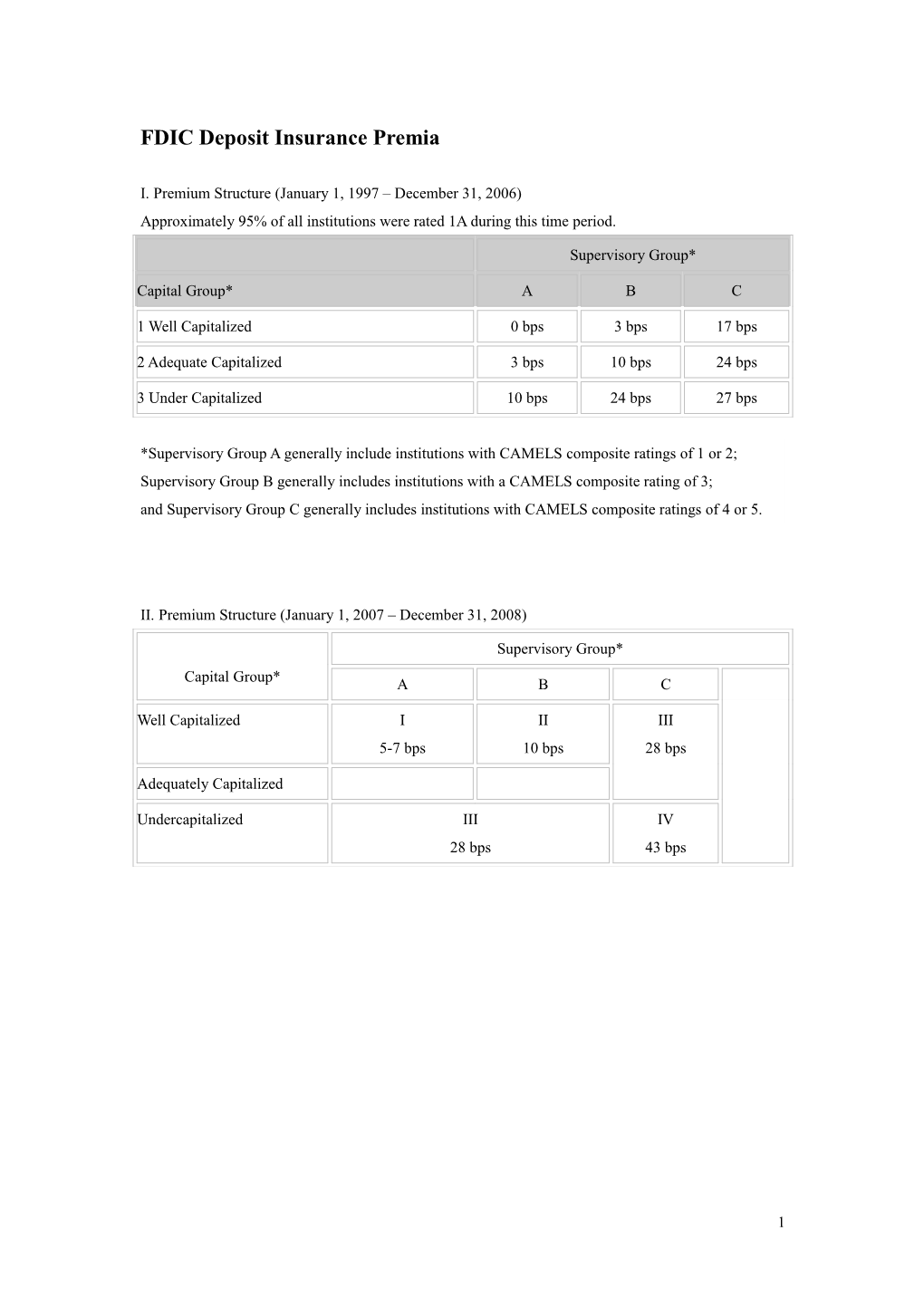

I. Premium Structure (January 1, 1997 – December 31, 2006) Approximately 95% of all institutions were rated 1A during this time period.

Supervisory Group*

Capital Group* A B C

1 Well Capitalized 0 bps 3 bps 17 bps

2 Adequate Capitalized 3 bps 10 bps 24 bps

3 Under Capitalized 10 bps 24 bps 27 bps

*Supervisory Group A generally include institutions with CAMELS composite ratings of 1 or 2; Supervisory Group B generally includes institutions with a CAMELS composite rating of 3; and Supervisory Group C generally includes institutions with CAMELS composite ratings of 4 or 5.

II. Premium Structure (January 1, 2007 – December 31, 2008)

Supervisory Group*

Capital Group* A B C

Well Capitalized I II III 5-7 bps 10 bps 28 bps

Adequately Capitalized

Undercapitalized III IV 28 bps 43 bps

1 III. Premium Structure (Effective April 1 2011)

Total Base Assessment Rates for established institutions (insured 5 or more years)

Risk Risk Risk Risk Large & Category Category Category Category Highly I* II III IV Complex Institutions**

Initial Base Assessment Rate 5 – 9 14 23 35 5 - 35

Unsecured Debt Adjustment (added) *** -4.5 to 0 -5 to 0 -5 to 0 -5 to 0 -5 to 0

Brokered Deposit Adjustment (added) N/A 0 to 10 0 to 10 0 to 10 0 to 10

Total Base Assessment Rate 2.5 to 9 9 to 24 18 to 33 30 to 45 2.5 to 45

* The risk categories are based on CAMELS. ** See §327.8(f) and §327.8(g) for the definition of large and highly complex institutions. *** The unsecured debt adjustment cannot exceed the lesser of 5 basis points or 50 percent of an insured depository institution’s initial base assessment rate. (1) a decrease of up to five basis points (or 50% of the initial base assessment rate) for long-term unsecured debt, including senior unsecured debt (other than debt guaranteed under the Temporary Liquidity Guarantee Program) and subordinated debt; (2) an increase for holding long-term unsecured or subordinated debt issued by other insured depository institutions known as the Depository Institution Debt Adjustment ("DIDA"); and (3) for institutions not well rated and well capitalized, an increase not to exceed 10 basis points for brokered deposits in excess of 10 percent of domestic deposits.

Total Base Assessment Rates for newly insured small institutions (those insured less than 5 years) *

Risk Risk Risk Risk Category Category Category Category I II III IV

Initial Base Assessment Rate 9 14 23 35

Brokered Deposit Adjustment (added) N/A 0 to 10 0 to 10 0 to 10

Total Base Assessment Rate 9 14 to 24 23 to 33 35 to 45

Total base assessment rates do not include the depository institution debt adjustment. http://www.fdic.gov/deposit/insurance/historical.html

2