Homework-Chapter 16

Problem 1

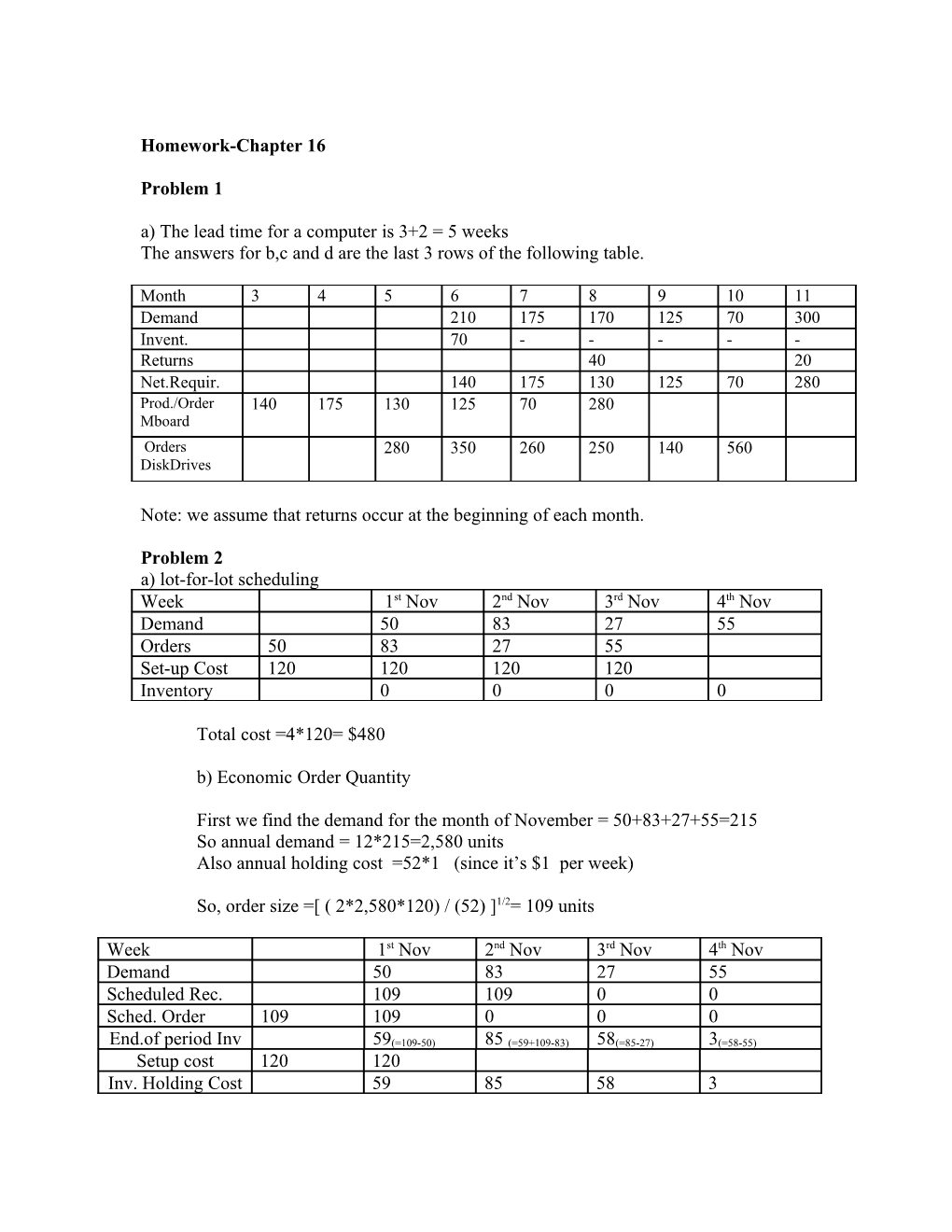

a) The lead time for a computer is 3+2 = 5 weeks The answers for b,c and d are the last 3 rows of the following table.

Month 3 4 5 6 7 8 9 10 11 Demand 210 175 170 125 70 300 Invent. 70 - - - - - Returns 40 20 Net.Requir. 140 175 130 125 70 280 Prod./Order 140 175 130 125 70 280 Mboard Orders 280 350 260 250 140 560 DiskDrives

Note: we assume that returns occur at the beginning of each month.

Problem 2 a) lot-for-lot scheduling Week 1st Nov 2nd Nov 3rd Nov 4th Nov Demand 50 83 27 55 Orders 50 83 27 55 Set-up Cost 120 120 120 120 Inventory 0 0 0 0

Total cost =4*120= $480

b) Economic Order Quantity

First we find the demand for the month of November = 50+83+27+55=215 So annual demand = 12*215=2,580 units Also annual holding cost =52*1 (since it’s $1 per week)

So, order size =[ ( 2*2,580*120) / (52) ]1/2= 109 units

Week 1st Nov 2nd Nov 3rd Nov 4th Nov Demand 50 83 27 55 Scheduled Rec. 109 109 0 0 Sched. Order 109 109 0 0 0

End.of period Inv 59(=109-50) 85 (=59+109-83) 58(=85-27) 3(=58-55) Setup cost 120 120 Inv. Holding Cost 59 85 58 3 Total cost = 2*120 + 59+85+58+3 = $ 445 c) Least Unit Cost heuristic

Cover week 1 : Order 50 units setup cost= 120 and inv. cost= 0 => cost/unit = 120/50=2.4

Cover weeks 1&2 : Order 133 units Setup cost= 120 Inventory cost = (133-50)* 1 = 83 so cost/unit= 203/133= 1. 526 < 2.4 so continue

Cover weeks 1&2&3 : Order 160 units Setup cost= 120 Inventory cost = (160-50)* 1 + (110-83)*1 = 137 so cost/unit= 257/160= 1. 61 >1.526 so stop.

So we should only cover periods 1 and 2.

We start over from week 3. Cover week 3 : Order 27 units Setup cost= 120 Inventory cost = 0 so cost/unit= 120/27= 4.44

Cover weeks 3&4 : Order 82 units Setup cost= 120 Inventory cost = 55 so cost/unit= 175/82= 2.134 < 4.44 so order this quantity.

So our total cost will be the cost of ordering at the beginning of week 1 and 3. That is, (120 + 83) + (120 +55) = $378 which is the lowest among options a,b, and c.