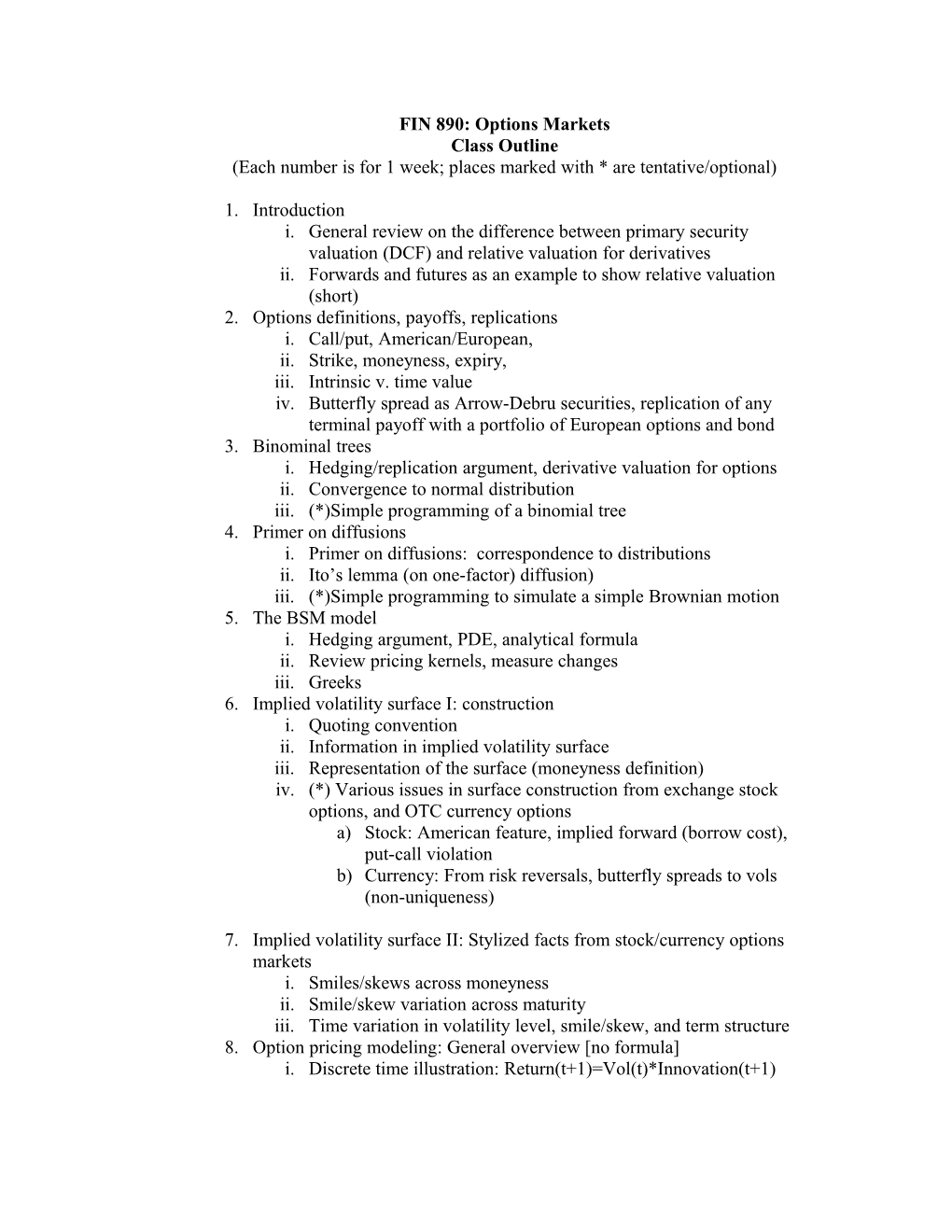

FIN 890: Options Markets Class Outline (Each number is for 1 week; places marked with * are tentative/optional)

1. Introduction i. General review on the difference between primary security valuation (DCF) and relative valuation for derivatives ii. Forwards and futures as an example to show relative valuation (short) 2. Options definitions, payoffs, replications i. Call/put, American/European, ii. Strike, moneyness, expiry, iii. Intrinsic v. time value iv. Butterfly spread as Arrow-Debru securities, replication of any terminal payoff with a portfolio of European options and bond 3. Binominal trees i. Hedging/replication argument, derivative valuation for options ii. Convergence to normal distribution iii. (*)Simple programming of a binomial tree 4. Primer on diffusions i. Primer on diffusions: correspondence to distributions ii. Ito’s lemma (on one-factor) diffusion) iii. (*)Simple programming to simulate a simple Brownian motion 5. The BSM model i. Hedging argument, PDE, analytical formula ii. Review pricing kernels, measure changes iii. Greeks 6. Implied volatility surface I: construction i. Quoting convention ii. Information in implied volatility surface iii. Representation of the surface (moneyness definition) iv. (*) Various issues in surface construction from exchange stock options, and OTC currency options a) Stock: American feature, implied forward (borrow cost), put-call violation b) Currency: From risk reversals, butterfly spreads to vols (non-uniqueness)

7. Implied volatility surface II: Stylized facts from stock/currency options markets i. Smiles/skews across moneyness ii. Smile/skew variation across maturity iii. Time variation in volatility level, smile/skew, and term structure 8. Option pricing modeling: General overview [no formula] i. Discrete time illustration: Return(t+1)=Vol(t)*Innovation(t+1) ii. All models fall into different combinations of innovation distribution (process) specifications and volatility dynamics specifications iii. Multiple factors: Each innovation is one economic source of shock. a) CAPM (systematic innovation + idiosyncratic) b) Market (small) risk + credit (crash) risk c) currency (dollar yen): dollar risk – yen risk iv. Determine how many sources of risks to model first, model their volatility dynamics later. 9. Heston model I: Volatility modeling example i. Comment: Probably the only operational way of modeling volatility dynamics so far ii. Specification (discrete time meaning: simple AR(1)) iii. (*) Simulation progamming: euler approximation (and a long list of literatures to improve its performance) 10. Heston model II: characteristic function i. Characteristic function: definition, solution, derivatiton (?) ii. (*) General knowledge: Characteristic function, cumulant- generating function, moment-generating function (Kendall: Chapter 4). 11. Heston model III: option pricing i. Numerical inversion of characteristic function to get density ii. Numerical inversions to get option price. iii. (*) proof iv. (*) Coding. v. (*) Various numerical improvements. 12. Merton model I: a classic example for static innovation specification i. Review of diffusion normal distribution ii. Introduction of jumps non-normal distributions. iii. (*) Ito’s lemma on jumps 13. Merton model II: i. (*) Simulation programming ii. (*) Get the details right for stock pricing modeling (compensation) iii. Characteristic function 14. Put Heston and Merton together to create your own model. i. Use diffusion (BS) or jump (Merton or something else) or both to model different innovations ii. Use Heston to model the volatility of each innovation iii. Characteristic functions are simple combinations of the above (with some details) 15. (*)Literature review (if time permits): How things work in the literature Read papers and show how the models are cooked as in 14. i. Bates (1996), Bakshi, Cao, Chen (1997): Heston + Merton jump (direct addition, nothing extra) ii. Bates (2000): Try to model return as sum of two Bates (1996), but cannot identify the model. iii. Huang & Wu (2004, JF): Show how to mix and match to generate a wide variety of models a) SV1: diffusion with Heston + jump Bates (1996) b) SV2: BS model (diffusion with constant vol) + jump with Heston vol c) SV3: (Diffusion+jump) with one Heston vol d) SV4: Diffusion + jump, each with its own Heston vol. iv. Carr and Wu (2007, JFE): a) (jump+diffusion)_Heston model – (jump+diffusion)_Heston model to generate stochastic skew in currency b) The two (jump+diffusion) are identical for identification v. Carr and Wu (2008, JFE) vi. Carr and Wu (2010, working paper)