Price Discrimination: Monopolist S Charging More Than One Price

Total Page:16

File Type:pdf, Size:1020Kb

Price Discrimination: Monopolist’s Charging More than One Price

- Single-price monopoly: monopolist is constrained to charge the same price to all buyers.

- Price discrimination usually allows the monopolist to do better.

(turn some consumer surplus into profit)

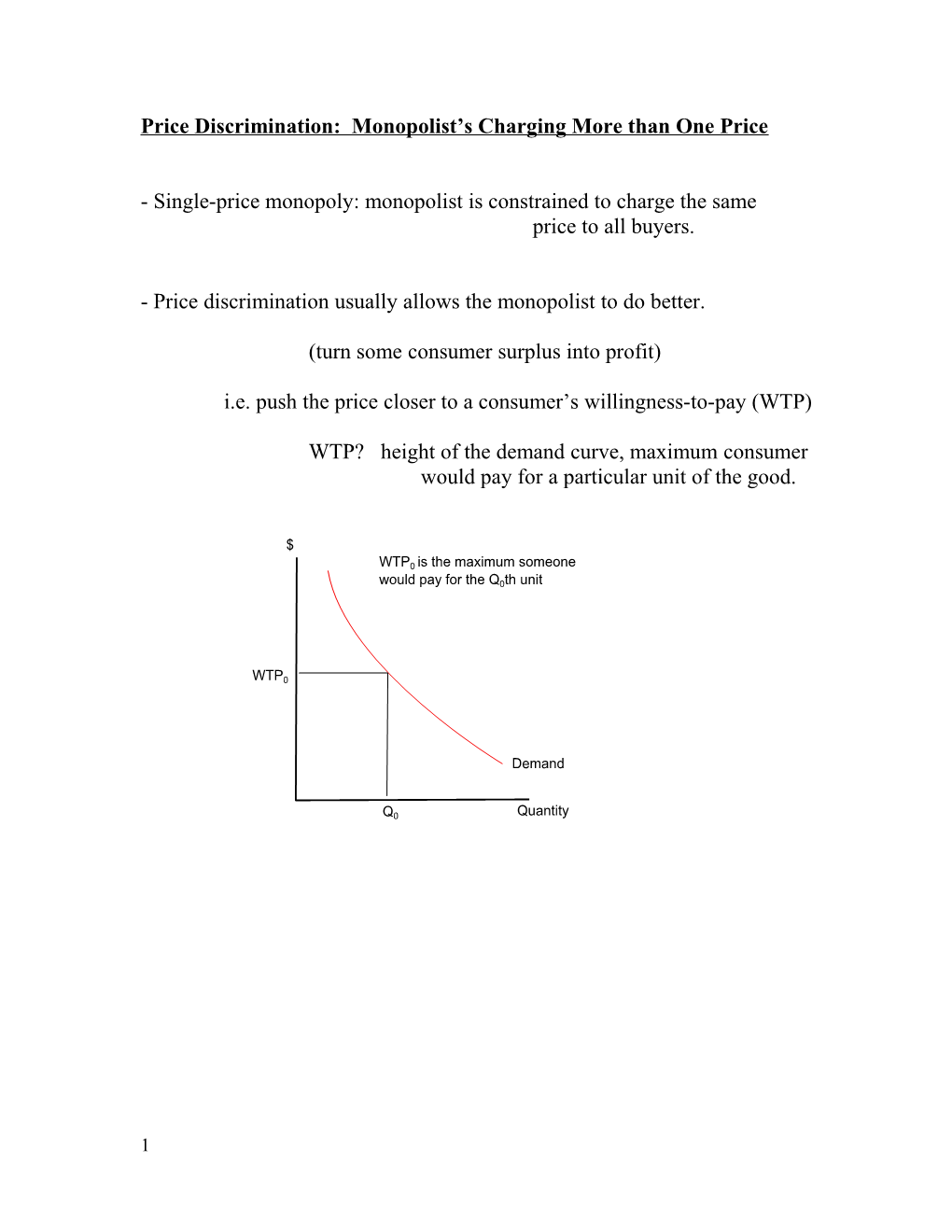

i.e. push the price closer to a consumer’s willingness-to-pay (WTP)

WTP? height of the demand curve, maximum consumer would pay for a particular unit of the good.

1 - Why not price discriminate all the time?

(a) resale problem: those who buy low might resell to those who are charged a high price (arbitrage)

- resale undercuts monopolist: can re-establish a single price.

(consider: airline ticket restrictions, services vs. goods)

(see handout from McAfee: lists factors affecting resale)

(b) information problem: can the monopolist identify those willing to pay a high price?

- those willing to pay most have no incentive to reveal this.

- can a monopolist find some way to identify them? if so price discrimination becomes more likely.

Types of price discrimination:

Perfect price discrimination: charge a different price for each (first-degree price discrim.) unit sold.

Second degree price discrimination: different price for different units bought by the same customer.

Third-degree price discrimination: different price for different groups of customers.

(we will model each of these and give examples below)

------

2 Perfect Price Discrimination: (First-degree price discrimination)

- Monopolist knows the maximum that each buyer is willing-to-pay (WTP) for each unit of the good.

i.e., knows the height of the demand curve at each quantity.

- assume there is no resale problem.

- Perfect price discrimination: different prices for each unit sold.

- charge each consumer the maximum they are willing to pay for each unit of the good bought.

- As before the monopolist will maximize profits by producing up to the point where MR=MC.

- but the MR curve is now the same as the demand curve!

- a different price is charged for each unit sold.

- so: MR = Price

- the perfectly price discriminating monopolist need not cut the price charged to “infra-marginal” buyers to sell more output.

(infra-marginal buyers : buyers not at the margin)

3 - What will the monopolist do?

- produce up to the point where:

MR = MC

Price of the last unit sold = MC (QPPD in diagram)

- charge each consumer the maximum that they will pay.

- this allows the monopolist to expropriate all of the consumer surplus. (all surplus is producer surplus!)

- profit is as large as it can possibly be in this market.

- output is higher than in the single-price case:

- no reason to restrict output

- selling more does not require price cuts for infra-marginal buyers.

4 - Outcome is efficient! -- achieves maximum surplus

- same output level of perfect competition.

- But all surplus goes to the monopolist as producer surplus.

- Hard to perfectly price discriminate in practice:

- monopolist needs a lot of information.

- Any possibilities?

- One-to-one bargaining: bargain over price, can a skilled seller extract the maximum possible price?

- maybe sometimes for : used cars, street vendors, flea markets.

- Top US universities? individualized tuition: price as tuition minus individualized assistance.

- how close can they get?

5 - Is information technology pushing us in this direction?

- Internet retailers: gather information on past purchasing behaviour and tailor the price offered to past behaviour.

- Grocery store discount cards: collect information on buying patterns (tailor prices to customers via coupons sent out).

- Google ad auctions -- is it close to this?

- Consumer reaction: unfair! (early Amazon case).

6 A Monopolist with Multiple Markets: (Third-degree Price Discrimination)

- Monopolist price discriminates between consumers but not between units of a good bought by a particular consumer.

- Say the monopolist can separate customers into two markets with different demand curves, i.e. groups with differences in WTP:

- so: has partly overcome the information problem;

- assume that customers cannot resell between the two markets.

- The firm faces two demand curves (D1 and D2) and two marginal revenue curves (MR1 and MR2).

- As before one set of cost curves: it is the same firm producing output for both markets.

- Firm decides how much to sell and what price to charge in each market.

- Consider first unit of output the firm might produce:

- Profitable to produce it as long as MR > MC in at least one market.

- Sell it in the market with the highest MR.

- Similar decision for all subsequent units:

- Produce more as long as MR >MC and sell each unit in the market with the highest MR.

- This creates a tendency to keep MR1 = MR2 if selling in both markets.

- Consequence? MR curve for the combined market is the horizontal

sum (over quantities) of MR1 and MR2.

7 - Produce total output at the point where the horizontal sum of MR1 and MR2 equals MC.

- output in market 1 is where:

MR1 = MC (MC determined where the combined MR curve =MC)

- output in market 2 is where:

MR2 = MC (MC determined where the combined MR curve =MC) e.g.

8 (Combined MR = MC at Q1*+Q2* prices will be P1* and P2*)

(see another version: text Fig. 12-13)

- Notice that if MC intersected MR1+MR2 on its first segment (so output below Q11) -- the monopolist would only sell in market 1.

- Market 2 would never generate revenues sufficient to cover MC.

(Calculus version for those interested:

Profit = P1∙ Q1 + P2 ∙Q2 – TC(Q1+Q2) with P1=P1(Q1), P2=P2(Q2)

where: P1 and P2 are prices in markets 1 and 2 and these depend on Q1 and Q2 (quantities sold in each market) respectively, TC() is the level of total cost which depends on total output produced: Q1 +Q2.

First order conditions for a profit maximum are then:

∂ Profit/∂Q1 = P1 + Q1∙∂ P1/∂Q1 - ∂TC/∂Q1 = 0 i.e. MR1 – MC = 0

∂ Profit/∂Q2 = P2 + Q2∙∂ P2/∂Q2 - ∂TC/∂Q2 = 0 i.e. MR2 – MC = 0

so: MR1 = MR2 = MC when profits are maximized)

9 Example: Two Markets with Different Demand Curves

Market 1 demand: P1= 27.5-2.5Q1 so MR1=27.5 - 5Q1 Market 2 demand: P2= 40- 5Q2so MR2=40 - 10Q2

Marginal cost: MC = 1∙ (Q1+Q2) note: it depends on total output.

Algebraic solution?

Assuming it is worthwhile to produce in both markets the discussion

above tells you that: MR1 = MR2 = MC when the monopolist is maximizing profits.

So you could set: MR1= MR2 : 27.5 - 5Q1 =40 - 10Q2 (or 4Q2-2Q1 = 5)

Then use either MR1=MC or MR2=MC, lets use the latter: 40 - 10Q2 = (Q1 +Q2) (or 40-11Q2 = Q1)

Now you have 2 linear eqns in two unknowns Q1 and Q2. Solve!

e.g. use the last condition to replace Q1 in: 4Q2-2Q1 = 5 then solve for Q2. (Q2=3.27)

now find Q1 by substituting Q2=3.27 into: 27.5 - 5Q1 =40 - 10Q2 you get Q1=4.04

Now that you have Q1 and Q2 you can find P1 and P2 (just substitute the solutions to the quantities into the demand curves).

This gives: P1 = 27.5-2.5 (4.04) = 17.4 P2 = 40 -2.5 (3.27) = 23.65

10 - An alternative solution? solve for the combined MR curve in the above example then set combined MR=MC – you can then solve for Q1+Q2, once this is know you can calculate MR1 and MR2 and then Q1, Q2 then P1, P2.

- Combined MR is discontinuous: as long as MR>27.5 sells only in Market 2. - initially combined MR = 40-10Q

- When selling in both markets must sum MR1 and MR2 over quantities to get the combined MR curve.

How? Solve MR1 = 27.5 -5Q1 for Q1= (27.5-MR1)/5

Solve MR2 = 40-10Q2 for Q2= (40-MR2)/10

Now: MR1=MR2=MR along this segment. So add Q1+Q2:

Q1+Q2= ( 95-3 MR) /10

Solve for MR to get combined MR:

MR = [95-10 (Q1+Q2)]/3

(combined D-curve can be found the same way: sum across quantities at a given P)

then when maximizing profit: MR=MC

[95-10 (Q1+Q2)]/3 = Q1+Q2 so Q1+Q2=7.31 (as above)

- Possible outcomes in the two market model:

- Produce in both markets (as in the example)

- Produce only for one market (possible if MC is always above MR in one of the markets)

- Don’t produce at all (e.g. always have MC>40 in the example above).

11 - Note that the price charged will be higher in the market with least elastic demand.

define: P1 as price in market 1 and P2 as price in market 2

1 as the price elasticity of demand in market 1

2 as the price elasticity of demand in market 2.

when producing for both markets:

MR1 = MR2

P1 ( 1 + 1/ 1 ) = P2 ( 1 + 1/ 2 )

P1 = ( 1 + 1/ 2 )

P2 ( 1 + 1/ 1 )

e.g. if 2 =-2 and 1 =-3 then

P1/P2 = .5 / .67 < 1 so P1 < P2

- Profit maximization: two-price monopolist does better charging different prices in the two markets unless price elasticities of demand are the same.

- consider charging a single price instead of two different prices:

- lower the price in the high price market: means selling output

for which MR2 - raising the price in the low price market means not selling some output for which MR1 > MC. - profits must be lower when a single price is charged ! - a monopolist will typically want to separate its markets. 12 - The approach used to look at a monopolist in two markets generalizes to monopolists operating in more than two markets. - Examples of this type of price discrimination: - Student discounts (students have lower income and lower WTP on average). - Senior discounts (more time on average to shop for bargains? Maybe lower income on average: lower WTP) - Airfares “Saturday-night stayover” rates and business travellers. - Price differences by location: could reflect costs but in some cases may largely be price discrimination. - Price of same pharmaceuticals in poor and rich countries. (see also Harford chapter on the Assignment 2 for examples) 13 Hurdle Models and 3 rd Degree Price Discrimination: - A “hurdle” is placed in the buyers way in order to try and separate those with a higher willingness to pay from those with a lower willingness to pay. Those who overcome the hurdle pay a lower price. Those who do not overcome the hurdle pay a higher price. - Hurdle is a “trick” to overcomes information problem: gets customers to reveal if they have higher or lower WTP. - Key idea: - those most sensitive to price (most elastic demand) will overcome the hurdle and pay a lower price; - those least sensitive to price will not overcome the hurdle and will pay a higher price. - typical price discrimination result. - the hurdle is an example of “screening”: uncovers info about buyer’s WTP. 14 - Hurdle examples: coupons and rebates (cost of time and who uses them); hardcover vs. paperback books (who is willing to wait for the paperback?), video game prices (on release vs. later); sale pricing (who will wait for bargains?). quality differences: have “high quality- high price” and “lower quality – low price version” of the good. - This could raise profits if those with high WTP are also more likely to prefer high quality. e.g. Intel 486 vs. 486SX processors (SX a “damaged” version of 486) IBM laser printer example (added chip to slow down inferior model) - Practical difficulty? How to identify true price discrimination from price differences due to real quality differences? 15 Direct and Indirect 3 rd degree Price Discrimination - Direct price discrimination: different pricing on the basis of observable characteristics of the buyer e.g. age of buyer, location. - Indirect price discrimination: - price based on behaviour or choices of buyers that allow sellers to infer something about WTP. - sellers might be able to induce buyers reveal that they have high or low WTP. - Hurdle model is an example of indirect price discrimination: those willing to jump the hurdle reveal info on their WTP. - Variation in product attributes: - can you add characteristics that appeal to higher WTP people? e.g. fancy coffee, “luxury” versions of everyday goods; are green or fair-trade goods examples of this? i.e. appeal to people who are less price sensitive due to high income or due to concern about other attributes of the good. 16 Second-Degree Price Discrimination: - The monopolist charges a schedule of prices with the price on extra units declining as the consumer buys more. e.g. charge $5 for each of the first two units bought, $3 for each of the next two and $1 for any purchases over five units. - price discrimination on the units bought by a given consumer but not across consumers. - This can allow the monopolist to take advantage of differences in willingness to pay for various units of the good, i.e., take advantage of demand curves for individual buyers being downward sloping. - Allows the monopolist to capture more consumer surplus than the single price case but not as much as the perfectly discriminating monopolist. - Example in diagrams: - Start with demand curve for one buyer (one of many identical buyers?) - Single-price monopoly solution: MR=MC say gives P1, Q1. - Would the monopolist be willing to sell more units (given it has charged P1 and sold Q1)? - Treat like a single-price monopoly problem with new demand curve equal to old minus Q1. Set MR2=MC. - Generally can raise profits by selling additional units at a lower price (P2): see diagram. 17 - Can do even better than this if recognize interdependence of first stage and second stage. i.e. set P1 recognizing that it affects size of left-over market at the second stage. - Could imagine extending this: charge a third, fourth, fifth etc. price for still more units. - how many prices in the schedule? if complex pricing is costless to administer then move toward perfect price discrimination! 18 Two-Part Tariff or Two-Part Pricing: - “Disneyland Dilemma”! W. Oi Quarterly Journal of Economics 1971. - Text discussion of this type of scheme: pp. 135-136. - Key aspect: two-part pricing (1) Fixed charge; and (2) marginal charge. - Imagine an amusement park operator facing a typical downward sloping demand curve for rides. - like the usual monopolist sets price and output of rides so that MR = MC (call the price P*) - Say that at the single-price monopoly outcome a typical consumer has a typical demand curve for rides (downward-sloping). - indicate consumer surplus when price is P* as area “A+B”. - The operator can do still better by also charging an admission fee in addition to its per ride price. i.e., this is “two-part pricing” or a “two-part tariff”. - How much would the admission fee be? - given the price per ride of P* the maximum entrance fee is area A+B. - notice that the monopolist gets all the surplus: fee turns consumer surplus into producer surplus. 19 - Model above assumed that P* was set as if a single-price monopolist. - If the firm knows that it will also charge an entry fee at what level will it set the price P*? - The firm will want the efficient outcome (P**=MC) as this maximizes total surplus (the fee allows it to take all surplus). - Disneyland? P**=0 (roughly the MC of a ride), entry fee only. - Other examples of this type of arrangement? - Cell phone packages: often a fixed fee plus charges based on usage. - Electricity pricing: often a fixed fee plus charges per KwH. - Club pricing. 20 Efficiency and Monopoly: - Single-price Monopolist (see above): - at profit maximizing outcome: Price > MC - what someone will pay for one more unit of the good is greater than the extra resource cost: some extra consumer and producer surplus could be created by raising output. - the monopoly outcome is inefficient. - size of efficiency loss (deadweight loss, excess burden): - area between height of demand curve and MC curve from output where MR=MC to where MC intersects demand curve. - from an efficiency sense price is too high and output too low. 21 - Efficiency loss gives a justification for policies limiting monopoly power (anti-trust legislation: Canada: The Competition Act ). - the political reason for regulation likely has more to do with the distributional consequences of monopoly. i.e., high price and the transfer of consumer surplus to producers. - Perfect price discrimination: - no efficiency loss: monopolist produces up to where P = MC . - distributional issue: all the surplus goes to the monopolist. - Imperfect price discrimination: - typically between the two extremes: smaller efficiency loss than single-price monopoly, larger than perfect discrimination case. - Efficiency vs. equity: - price discrimination enhances efficiency but seems inequitable. i.e. different prices for different people. - hurdle model: buyer pays a different price as they do not find it worthwhile to jump the hurdle (pays more by choice?) 22 Policy Response to Monopoly: - A standard policy response to monopoly is to break it up or prevent it. - Canada: Competition Bureau. e.g. see Dec. 2010 waste services firm merger for example. (http://www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/03324.html) - What if it is a natural monopoly? - with large economies of scale the market will always tend toward monopoly. - the monopolist will produce where MR=MC - there will be an efficiency loss. - but given cost structure a competitive market cannot be created. - Efficiency requires setting Price = MC. - with a natural monopoly this will often involve making a loss. e.g. consider cost structure: Fixed cost and constant marginal cost: TC = F + m Q F = fixed cost Q= output m = marginal cost P = m then P < AC = (F/Q) + m (loss) - with flat or falling MC setting price = MC (efficient outcome) will result in the firm making a loss. 23 - Some possible Policy Solutions? - Public enterprise: - government run monopolist. - efficiency requires making a loss. - how to cover this (taxes will create their own efficiency losses). - incentive issues: will public enterprises be more badly run than private firms? e.g. cost curves may be higher for public enterprises if they are less well run (another source of efficiency loss) - see text discussion: pp. 421-423. 24 - Regulation: - government regulates the private monopolist. e.g., could control price: price ceiling could give efficiency could regulate rates of return (incentives here to inflate costs of investment) - Contracting out: - government specifies in detail what it wants provided and accepts bids from private firms to provide the good or service. - Could avoid some of the problems of the public enterprise. - “Detail” Monopoly and Innovation: Some Considerations - Does lack of competitive pressure discourage innovation? (model of firm behaviour and this: if above is true the firm is not a profit maximizer) - Does the existence of monopoly profits provide finance for innovation? (role of financial markets: statement may be true if financial markets are inefficient and firm’s must finance expansion with own profits) - Do monopoly profits provide other firms with an incentive to create alternatives to the monopoly good/service? 25 Should we care about monopoly? - Concerns: - Distribution and efficiency issues. - Equity (fairness) issues and price discrimination. - Possible innovation problems. - Question of whether the government can do better? - regulation, public enterprise: better or not? 26