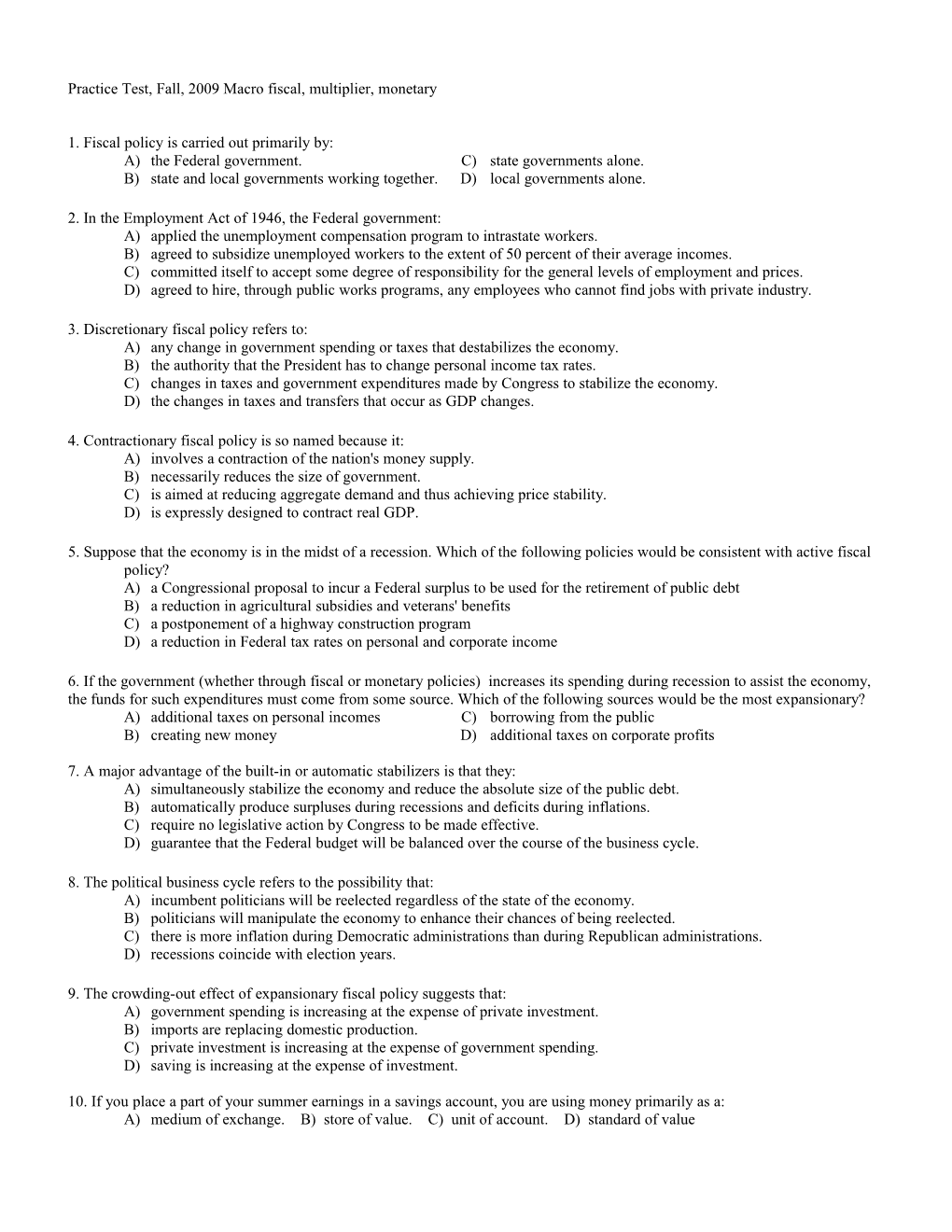

Practice Test, Fall, 2009 Macro fiscal, multiplier, monetary

1. Fiscal policy is carried out primarily by: A) the Federal government. C) state governments alone. B) state and local governments working together. D) local governments alone.

2. In the Employment Act of 1946, the Federal government: A) applied the unemployment compensation program to intrastate workers. B) agreed to subsidize unemployed workers to the extent of 50 percent of their average incomes. C) committed itself to accept some degree of responsibility for the general levels of employment and prices. D) agreed to hire, through public works programs, any employees who cannot find jobs with private industry.

3. Discretionary fiscal policy refers to: A) any change in government spending or taxes that destabilizes the economy. B) the authority that the President has to change personal income tax rates. C) changes in taxes and government expenditures made by Congress to stabilize the economy. D) the changes in taxes and transfers that occur as GDP changes.

4. Contractionary fiscal policy is so named because it: A) involves a contraction of the nation's money supply. B) necessarily reduces the size of government. C) is aimed at reducing aggregate demand and thus achieving price stability. D) is expressly designed to contract real GDP.

5. Suppose that the economy is in the midst of a recession. Which of the following policies would be consistent with active fiscal policy? A) a Congressional proposal to incur a Federal surplus to be used for the retirement of public debt B) a reduction in agricultural subsidies and veterans' benefits C) a postponement of a highway construction program D) a reduction in Federal tax rates on personal and corporate income

6. If the government (whether through fiscal or monetary policies) increases its spending during recession to assist the economy, the funds for such expenditures must come from some source. Which of the following sources would be the most expansionary? A) additional taxes on personal incomes C) borrowing from the public B) creating new money D) additional taxes on corporate profits

7. A major advantage of the built-in or automatic stabilizers is that they: A) simultaneously stabilize the economy and reduce the absolute size of the public debt. B) automatically produce surpluses during recessions and deficits during inflations. C) require no legislative action by Congress to be made effective. D) guarantee that the Federal budget will be balanced over the course of the business cycle.

8. The political business cycle refers to the possibility that: A) incumbent politicians will be reelected regardless of the state of the economy. B) politicians will manipulate the economy to enhance their chances of being reelected. C) there is more inflation during Democratic administrations than during Republican administrations. D) recessions coincide with election years.

9. The crowding-out effect of expansionary fiscal policy suggests that: A) government spending is increasing at the expense of private investment. B) imports are replacing domestic production. C) private investment is increasing at the expense of government spending. D) saving is increasing at the expense of investment.

10. If you place a part of your summer earnings in a savings account, you are using money primarily as a: A) medium of exchange. B) store of value. C) unit of account. D) standard of value

11. Which of the following is not part of the M2 money supply? A) money market mutual fund balances C) currency B) money market deposit accounts D) large ($100,000 or more) time deposits

12. A $20 bill is a: A) gold certificate. B) Treasury note. C) Treasury bill. D) Federal Reserve Note.

13. In which of the following situations is it certain that the quantity of money demanded by the public will decrease? A) nominal GDP decreases and the interest rate decreases B) nominal GDP increases and the interest rate decreases C) nominal GDP decreases and the interest rate increases D) nominal GDP increases and the interest rate increases Answer: C

14. The reserves of a commercial bank consist of: A) the amount of money market funds it holds. B) deposits at the Federal Reserve Bank and vault cash. C) government securities that the bank holds. D) the bank's net worth.

15. The primary purpose of the legal reserve requirement is to: A) prevent banks from hoarding too much vault cash. B) provide a means by which the monetary authorities can influence the lending ability of commercial banks. C) prevent commercial banks from earning excess profits. D) provide a dependable source of interest income for commercial banks.

16. Money is destroyed when: A) loans are made. B) checks written on one bank are deposited in another bank. C) loans are repaid. D) the net worth of the banking system declines.

17. When a commercial bank has excess reserves: A) it is in a position to make additional loans. B) its actual reserves are less than its required reserves. C) it is charging too high an interest rate on its loans. D) its reserves exceed its assets.

18. Overnight loans from one bank to another for reserve purposes entail an interest rate called the: A) prime rate. B) discount rate. C) Federal funds rate. D) treasury bill rate.

19. If the monetary authorities want to reduce the monetary multiplier, they should: A) lower the legal reserve ratio. C) increase bank reserves. B) raise the legal reserve ratio. D) lower interest rates.

20. Reserves must be deposited in the Federal Reserve Banks by: A) only commercial banks which are members of the Federal Reserve System. B) all depository institutions, that is, all commercial banks and thrift institutions. C) state chartered commercial banks only. D) federally chartered commercial banks only.

21. The discount rate is the interest: A) rate at which the central banks lend to the U.S. Treasury. B) rate at which the Federal Reserve Banks lend to commercial banks. C) yield on long-term government bonds. D) rate at which commercial banks lend to the public. 22. If the Federal Reserve authorities were attempting to reduce demand-pull inflation, the proper policies would be to: A) sell government securities, raise reserve requirements, and raise the discount rate. B) buy government securities, raise reserve requirements, and raise the discount rate. C) sell government securities, lower reserve requirements, and lower the discount rate. D) sell government securities, raise reserve requirements, and lower the discount rate. . ____ 23. Which of the following is an example of crowding out? a. A decrease in the rate of growth of the money supply decreases GDP. b. A budget deficit increase causes an increase in interest rates, which causes a decrease in investment spending. c. An increase in tariffs causes a decrease in imports. d. A decrease in government borrowing causes a decrease in decrease in interest rates.

____ 24. Fiscal policy is a. the money supply policy that the Fed pursues to achieve particular economic goals. b. the spending and tax policy that the government pursues to achieve particular macroeconomic goals. c. the investment policy that businesses pursue to achieve particular macroeconomic goals. d. the spending and saving policy that consumers pursue to achieve particular macroeconomic goals. e. none of the above

____ 25. When the money supply increases: a. The interest rate rises; this in turn cuts back investment spending, which in turn raises total expenditures and shifts the AD curve rightward. b. The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve leftward. c. The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve rightward. d. The interest rate falls; this in turn stimulates investment spending, which in turn lowers total expenditures and shifts the AD curve leftward.

____ 26. Monetary policy is a. the policy concerning changes in the money supply that is pursued to achieve particular macroeconomic goals. b. the expenditures and taxation policy that the government pursues to achieve particular macroeconomic goals. c. the investment policy that businesses pursue to achieve particular macroeconomic goals. d. the spending and saving policy that consumers pursue to achieve particular macroeconomic goals. e. the spending policy that the Treasury pursues to achieve particular macroeconomic goals.

____ 27. Theoretically, to eliminate a recessionary gap, the Fed could ____ the money supply, and to eliminate an inflationary gap, the Fed could ____ the money supply. a. increase; decrease b. increase; increase c. decrease; increase d. decrease; decrease e. not change; not change Expans28. Expansionary fiscal policy actions include ____ government spending and/or ____ taxes, while contractionary fiscal policy actions include ____ government spending and/or ____ taxes. a. increasing; increasing; decreasing; decreasing b. decreasing; decreasing; increasing; increasing c. increasing; decreasing; increasing; decreasing d. decreasing; increasing; increasing; decreasing e. increasing; decreasing; decreasing; increasing

29. When government spending exceeds government revenues during a given period of time, A) a budget deficit exists. B) a budget surplus exists. C) the national debt must be decreasing. D) Congress is obliged to raise taxes.

30. ) When you purchase Nautica clothing and tickets to see the Eminem concert A) you are buying consumption goods. B) you are buying capital goods. C) you are consuming intermediate goods. D) you are buying physical capital.

31. The consumption function shows the relationship A) between households' disposable income and their consumption spending. B) between investment and rate of return. C) between consumption spending and capital gains. D) between government spending and tax collection.

32. If the average propensity to consume is 0.8, then the average propensity to save is A) 0. B) 0.2. C) 0.8. D) 1.

33. If the multiplier in the economy is 3, the marginal propensity to save (MPS) must be A) 0.33. B) 0.67. C) 1. D) 3.

34. The multiplier equals A) consumption/real disposable income. B) change in consumption/change in real disposable income. C) 1/MPC. D) 1/(1 - MPC).

Answers: 1.A 2.C 3.C 4.C 5.D 6.B7.C 8.B9.A 10.B 11.D 12.D 13.C 14.B 15.B 16.C 17.A 18.C 19.B 20.B 21.B 22.A 23.B 24.B 25.C 26.A 27.A 28.E 29.A 30.A 31.A 32.B 33.A 34.D

When the reserve requirement is increased: A) required reserves are changed into excess reserves. B) the excess reserves of member banks are increased. C) a single commercial bank can no longer lend dollar-for-dollar with its excess reserves. D) the excess reserves of member banks are reduced. Answer: D