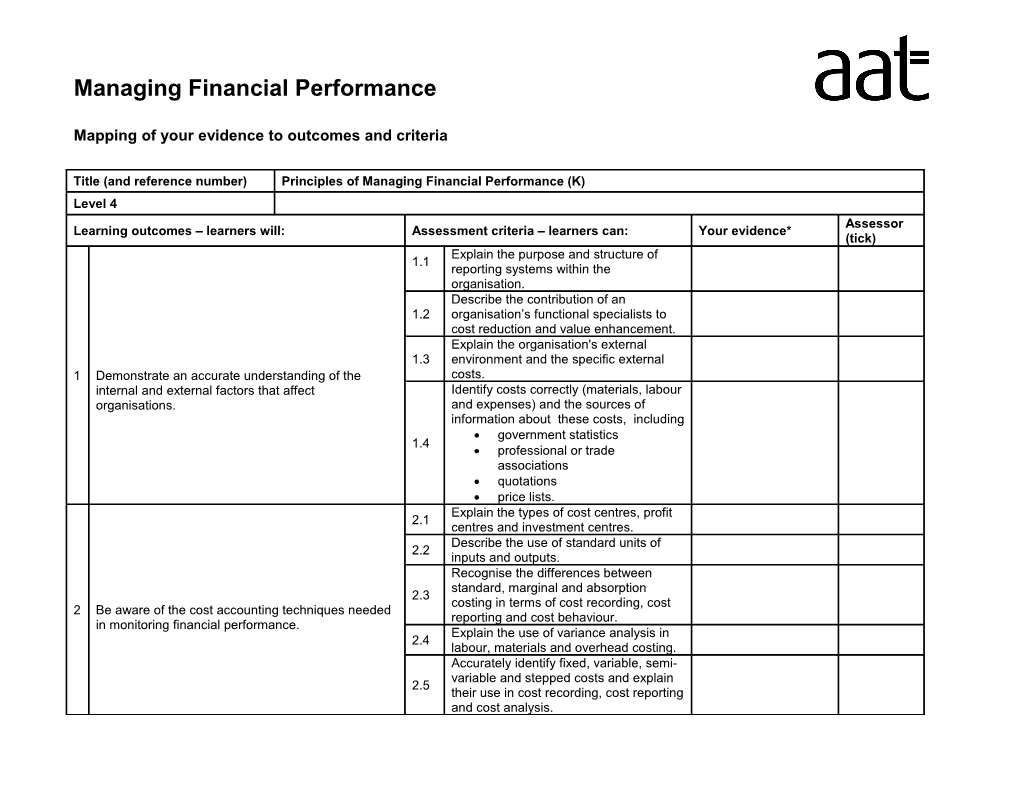

Managing Financial Performance

Mapping of your evidence to outcomes and criteria

Title (and reference number) Principles of Managing Financial Performance (K) Level 4 Assessor Learning outcomes – learners will: Assessment criteria – learners can: Your evidence* (tick) Explain the purpose and structure of 1.1 reporting systems within the organisation. Describe the contribution of an 1.2 organisation’s functional specialists to cost reduction and value enhancement. Explain the organisation's external 1.3 environment and the specific external 1 Demonstrate an accurate understanding of the costs. internal and external factors that affect Identify costs correctly (materials, labour organisations. and expenses) and the sources of information about these costs, including government statistics 1.4 professional or trade associations quotations price lists. Explain the types of cost centres, profit 2.1 centres and investment centres. Describe the use of standard units of 2.2 inputs and outputs. Recognise the differences between standard, marginal and absorption 2.3 costing in terms of cost recording, cost 2 Be aware of the cost accounting techniques needed reporting and cost behaviour. in monitoring financial performance. Explain the use of variance analysis in 2.4 labour, materials and overhead costing. Accurately identify fixed, variable, semi- variable and stepped costs and explain 2.5 their use in cost recording, cost reporting and cost analysis. Identify the relevant performance and 3.1 quality measures to use to monitor financial performance. Explain the principles of discounted cash 3.2 flow. Identify appropriate performance indicators to use for efficiency effectiveness productivity cost per unit 3.3 balanced scorecard benchmarking control ratios (efficiency, capacity and activity) scenario planning (‘what-if’ 3 Understand the techniques necessary for measuring analysis). performance and managing costs. Explain the use and purpose of techniques: indexing 3.4 sampling time series (e.g. moving averages, linear regression and seasonal trends). Identify the correct ratios used to monitor 3.5 financial performance. Describe a range of cost management techniques and recognise when these should be used 3.6 life cycle costing target costing (including value engineering) activity-based costing.

*You can use a number of different types of evidence to demonstrate your competence, for example a letter, excel spreadsheet, report or witness testimony. Your training provider will be able to give you guidance so it is important that you discuss it with them. As you may be referring to an individual piece of evidence more than once in your evidence summary you will need to cross reference all pieces of evidence by giving each a unique number and refer to page number, paragraph number etc. This number should be included in the evidence document name when you submit it. Financial Performance

Mapping of your evidence to outcomes and criteria

Title (and reference number) Measuring Financial Performance (S) Level 4 Assessor Learning outcomes – learners will: Assessment criteria – learners can: Your evidence* (tick) Obtain income and expenditure 1.1 information from different units within the organisation and consolidate in an appropriate form. Reconcile income and expenditure information collected from various 1.2 departments or information systems within the organisation. Account for transactions between the separate units of the organisation, in 1.3 accordance with the organisation’s 1 Collate information from various sources and procedures. prepare routine cost reports. Identify other valid relevant information 1.4 from internal and external sources. 1.5 Prepare routine cost reports. Analyse routine cost reports and compare with budget and standard costs 1.6 to accurately identify any differences and the implications of these. Correctly identify variances and prepare 1.7 relevant reports for management. 2 Compare results over time using 2.1 methods that allow for changing price Make suggestions for improving financial levels. performance by monitoring and analysing Monitor and analyse current and information. 2.2 forecast trends in prices and market conditions on a regular basis. 2.3 Compare trends with previous data and identify potential implications. Consult relevant staff in the organisation 2.4 about the analysis of trends and variances. Calculate ratios, performance indicators and measures of value added in 2.5 accordance with the organisation’s procedures. 2.6 Prepare relevant performance indicators. Interpret the results of relevant performance indicators, identify potential 2.7 improvements and estimate the value of such improvements. Identify ways to reduce costs and enhance values, consulting specialists 2.8 as necessary.

Prepare estimates of capital investment 2.9 projects using discounted cash flow techniques. Prepare reports in the most appropriate 3.1 format and present them to management within the required timescales. Prepare exception reports to identify 3 Prepare performance reports for management 3.2 matters which require further investigation. Make specific recommendations to 3.3 management in a clear and appropriate form.

*You can use a number of different types of evidence to demonstrate your competence, for example a letter, excel spreadsheet, report or witness testimony. Your training provider will be able to give you guidance so it is important that you discuss it with them. As you may be referring to an individual piece of evidence more than once in your evidence summary you will need to cross reference all pieces of evidence by giving each a unique number and refer to page number, paragraph number etc. This number should be included in the evidence document name when you submit it.