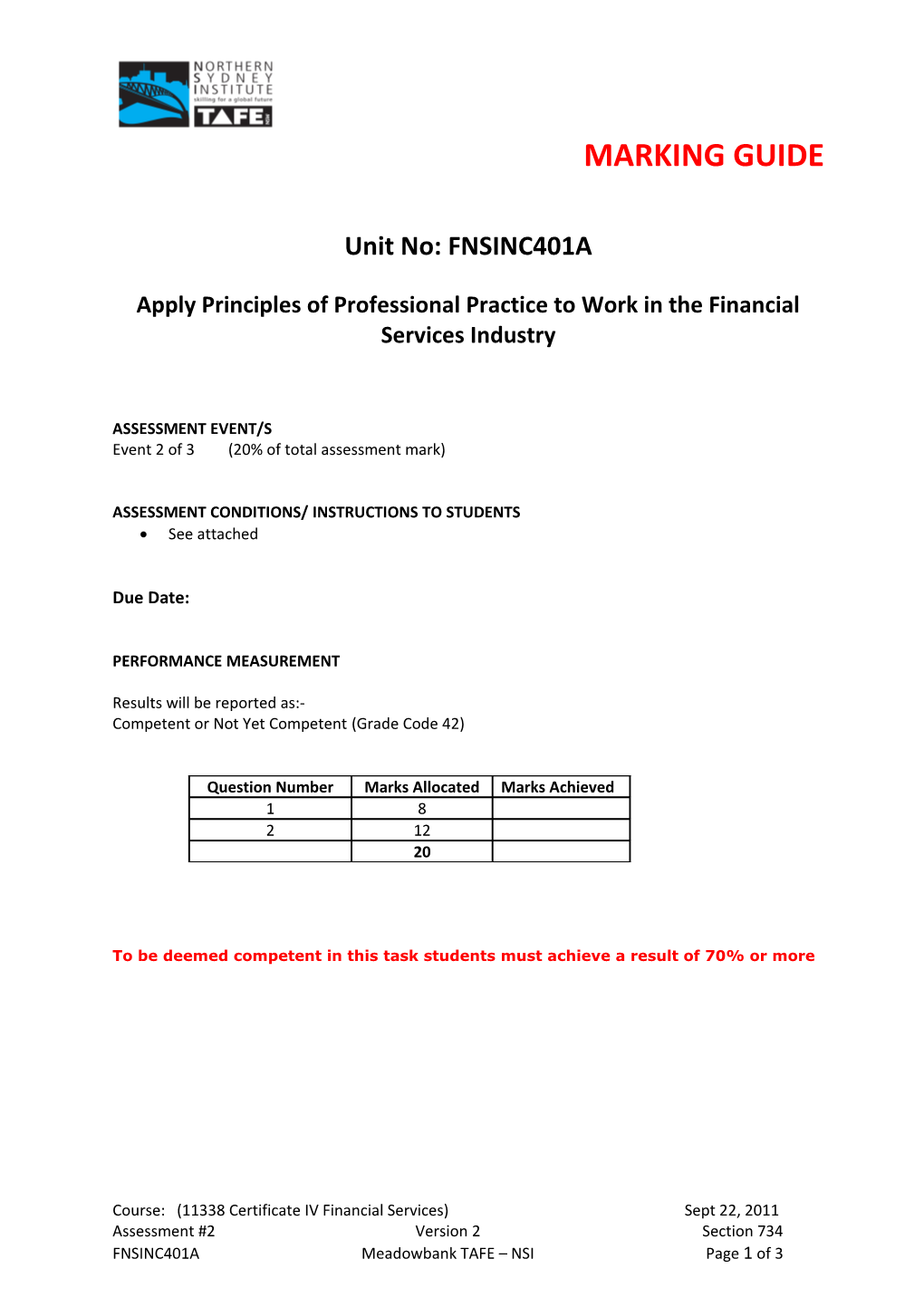

MARKING GUIDE

Unit No: FNSINC401A

Apply Principles of Professional Practice to Work in the Financial Services Industry

ASSESSMENT EVENT/S Event 2 of 3 (20% of total assessment mark)

ASSESSMENT CONDITIONS/ INSTRUCTIONS TO STUDENTS See attached

Due Date:

PERFORMANCE MEASUREMENT

Results will be reported as:- Competent or Not Yet Competent (Grade Code 42)

Question Number Marks Allocated Marks Achieved 1 8 2 12 20

To be deemed competent in this task students must achieve a result of 70% or more

Course: (11338 Certificate IV Financial Services) Sept 22, 2011 Assessment #2 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 1 of 3 Instructions: All questions must be completed There is no set length to the answers required as long as adequate information is provided to answer the question (ie answers may be presented in point form, as long as it answers the question given). Submit your completed task to your facilitator by uploading your answers (in a word document) to the Sakai website Students must be deemed competent in all elements of this task to be deemed competent in this unit. Include a list of references at the end of your task if necessary

Task 1: Case Study Money Business Pty Limited is a small financial services company providing accounting, taxation and financial planning services to the public. Their clients are mainly individuals and small businesses. The accounting services provided include bookkeeping services, preparation and audit of accounts, preparation of financial reports, assistance with company set ups and administration. Taxation services provided are tax advice and preparation of tax returns. Financial planning services offered are provision of financial products advice, investment advice, dealing in financial products.

The MB employees are: Two partners – owners/directors of the business One full time & one casual receptionist One full time & one casual office assistant Two part time book keepers One full time financial planner Three full time accountants Two part time accountants

You have been employed by Money Business Pty Limited as a consultant to provide information to be used in a training package for new employees so that they understand their legal obligations when working in the company and offering advice to clients.

You are required to complete the following matrix showing which of the following legislation / regulations relate to each of the employees and how much knowledge they need to have: a. Corporations law b. Financial services licence requirements c. Financial adviser’s legal responsibilities d. Common law e. Tax law f. Trade Practice Act g. Privacy Act

The grading scale to be used: 1. requires no knowledge of 2. requires a little knowledge of 3. requires a good knowledge of 4. requires to have full knowledge of Course: (11338 Certificate IV Financial Services) Sept 22, 2011 Assessment #2 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 2 of 3 MATRIX

Fin Corp FSL Advisor Comm Tax Law TPA Privacy law Legal Law

B C D E F G A Partners 4 3 3 4 4 4 4

Receptionist 1 1 1 1 1 2 3

Office Assistant 2 1 1 1 1 2 3

Bookkeeper 2 2 2 3 3 3 3

Financial Planner 2 4 4 3 4 3 3

Accountant 4 2 2 3 4 3 4

Marking Guide: 8 marks Marking is based on teacher’s professional experience - ie if a student notes that a Bookkeeper should have full knowledge of privacy (4) though the marking guide says 3, are they actually incorrect? Deduct ½ mark per each answer that is totally off the mark ie Partners need to have little or no knowledge of the TPA.

Task 2:

You are required to investigate the professional bodies relevant to the Accounting industry. For two of these bodies you are required to advise: CPA – ICA - IPA

i) What are the joining requirements of each? To become a member of the Certified Public Accountant: Candidate’s entry point into CPA Program will be determined by an individual assessment of prior education and experience. Candidate must hold an accredited degree or a postgraduate award, recognised by CPA Australia Candidate needs to demonstrate competence in CPA’s prescribed foundation level knowledge, usually an accounting degree that is recognized by CPA, will often meet all the requirements of the Foundation level and allow candidates to commence at the professional level. Within a six-year period, candidates must have successfully completed CPA Australia’s professional level examinations and the Practical Experience Requirement. To become a member of the Institute of Chartered Accountant: Need to meet requirements of both components of the Chartered Accountants Program a. Practical Experience component . Three-year period of on-the-job training which, together with previous undergraduate study and enrolment in the Chartered Accountants Program

Course: (11338 Certificate IV Financial Services) Sept 22, 2011 Assessment #2 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 3 of 3 . Candidate needs to develop and track the attainment of key workplace competencies throughout the three years of qualifying service, under the guidance of an approved internal mentor b. The Graduate Diploma of Chartered Accounting . An Institute accredited Australian accounting Bachelor or Masters degree with passes in subjects covering the core knowledge areas required by the Institute . Completed any Australian non-accounting degree and Institute accredited conversion course. Or Completed any Australian non-accounting degree, have accounting work experience and have passed the Chartered Accountants Program entrance exam . Overseas qualifications that have been assessed and recognised by the Institute and demonstrated the required level of knowledge of the pre-requisite core knowledge areas required by the Institute.

To become a member of the IPA: The IPA has several levels of membership:[4] Associate (AIPA) Member (MIPA) Fellow (FIPA) Students studying towards an accounting qualification can join the IPA Student Register. – AIPA membership requires: Advanced Diploma in Accounting or University degree in Accounting MIPA membership requires: Advanced Diploma in Accounting IPA Program Stage 1 and Stage 2 (confers a Master of Commerce in Professional Accounting) Mentored Experience Program or University degree in Accounting IPA Program Core (4 units) (confers a Graduate Certificate in Professional Accounting) Mentored Experience Program Members with a University qualification may elect to complete a further 4 units and obtain a Master of Commerce (Professional Accounting) from the University of New England FIPA membership requires: MIPA status 10 years experience in accounting (5 of which are at a senior level) 7 years membership of IPA

ii) Why would you join each (or any) of these bodies? - Continual development of skills - Enhances job prospects as employers are aware of the standards required by these associations - CPD allows members to keep up to date with accounting and other legislation - Work with peers to enhance knowledge - Monthly or bi monthly magazine allowing members to keep abreast of current and future changes within the industry - Gain recognition from employers by being more equipped with the skills - Reach my professional goals for a long, rewarding and successful career - Gain international recognition , reciprocal international benefits and international career opportunities - Give me an opportunity to attend training events, products and support services in specialist accounting areas - Affect my profession and all aspects of starting and managing an accounting practice

iii) What advantages and disadvantages are there of being a member of these bodies? Advantages: Special rates on products and services like credit cards, home loans, health insurance, life insurance and publications Discounts on professional development courses

Course: (11338 Certificate IV Financial Services) Sept 22, 2011 Assessment #2 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 4 of 3 Access to tools and resources to help in day-to-day work like auditing and reporting templates, taxation checklists Role opportunities for combination of technical accounting, strategy, leadership and business skills to any business concern Internationally recognized and highly regarded An on-going free subscription to the Institute's magazine, Charter Access to the Institute's Online Knowledge Centre catalogue books and journals, supported by professional research staff. Access to Institute community and special interest groups Disadvantages: - Cost of membership - CPD requirements (can also be costly)

iv) What, if any, continuing professional education (CPE) requirements do these bodies impose on their members? CPA - Certified Public Accountant Members with CPA qualification need to maintain their high standards of knowledge and technical expertise through ongoing certification. All members have a professional obligation to themselves, their employers and the community to plan and participate in a continuing education program, tailored to meet their own needs. Holders with status of Associate (ASA), CPA, Fellow (FCPA) or if retired and provide public accounting services (whether or not for reward), must complete 120 CPD hours each triennium. Members must do at least 20 hours of CPD each year and may be required to submit records and a diary of CPD activities. ICA – Institute of Chartered Accountant Members are required to undertake at least the ICA prescribed level of Training & Development activities each year. It is the responsibility of each member to interpret an activity and to judge whether the activity resulted in personal and professional development Members are required to allocate 40% of the total minimum Training & Development hours to their specialisation. Members are required to undertake a minimum of 120 hours of Training and Development over a three year period (triennium). Of these, a maximum of 30 hours may comprise technical reading Training and Development is regarded as an ongoing commitment. Must also complete a minimum of 20 hours per year. IPA -Continuing Professional Education (CPE) All members of the IPA (except retired members) must complete a minimum of 80 hours structured CPE activity per 2 years. The IPA recommends for members to meet this requirement that they complete 40 structured hours CPE activity per year. However a minimum of 10 hours per annum is possible with 70 hours being completed in the second year.

v) What sort of rules and regulations (or requirements) do these bodies impose on or require the members to adhere to? CPA - Certified Public Accountant and ICA – Institute of Chartered Accountant Professional Standards: CPA and ICA members undertaking a review of a STCLG (Second Tier Companies Limited by Guarantee) as required by the Corporations Act must : . Hold a practicing certificate issued CPA or ICA . Have appropriate Professional Indemnity Cover . Have continuing Professional Development . Have appropriate knowledge and experience and are properly supervised in the conduct of the review. Minimum Continuing Professional Development Standard: CPA and ICA members who are not registered Company Auditors must complete training course which includes reviews of financial statements prior to commencing STCLG reviews

Course: (11338 Certificate IV Financial Services) Sept 22, 2011 Assessment #2 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 5 of 3 Must complete at least 30 hours of relevant 3 year period comprising any combination of courses on reviewing or auditing financial statements and financial accounting training Accounting Professional and Ethical Standards: CPA and ICA members who are Assurance Practitioners of STCLGs need to comply with the relevant standards issued by the Accounting Professional and Ethical Standards Board Knowledge Requirements: CPA and ICA Assurance Practitioners must meet some key knowledge requirements: . Financial Statements – Accounting and Assurance An understanding of the Australian Accounting Standards issued by Australian Accounting Standards Board . An understanding of the applicable audit and assurance standards

Your answer should be presented by listing the organisation, and noting the information to be provided underneath. Example: ABC Organisation i) to join, prospective members must have completed the HSC ii) it is important to join this organisation to be able to advance in the industry

Marking Guide: 12 marks Students do not need to provide fully detailed answers (that is, they do not need as much information as supplied in this marking guide).

Suggested mark allocation i. What are the joining requirements of each? 1 mark per accounting body (total 2) ii. Why would you join each (or any) of these bodies? 1 mark per accounting body (total 2) iii. What advantages and disadvantages are there of being a member of these bodies? 1 mark per accounting body (total 2) iv. What, if any, continuing professional education (CPE) requirements do these bodies impose on their members? 1 mark per accounting body (total 2) v. What sort of rules and regulations (or requirements) do these bodies impose on or require the members to adhere to? 2 marks per accounting body (total 4)

Course: (11338 Certificate IV Financial Services) Sept 22, 2011 Assessment #2 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 6 of 3