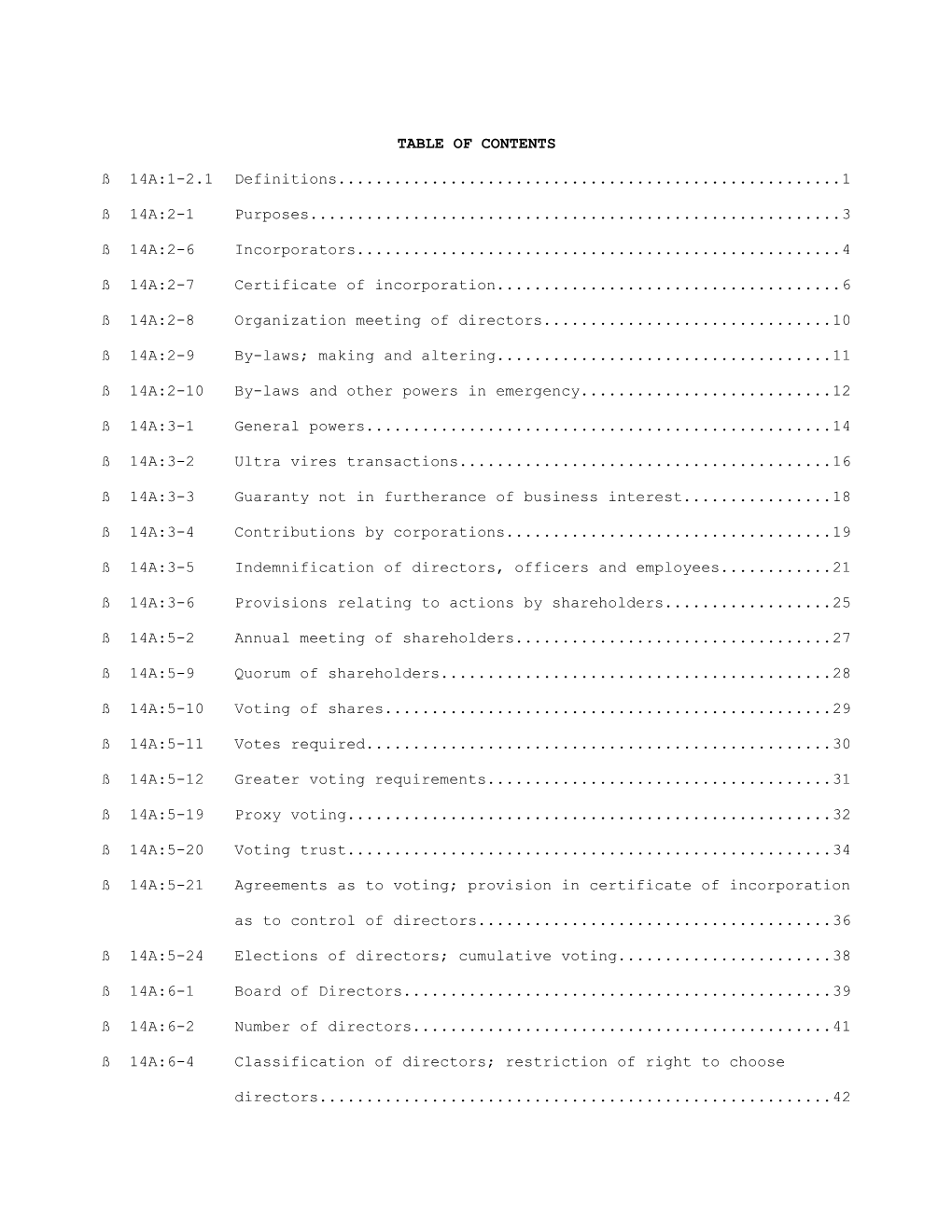

TABLE OF CONTENTS

ß 14A:1-2.1 Definitions...... 1

ß 14A:2-1 Purposes...... 3

ß 14A:2-6 Incorporators...... 4

ß 14A:2-7 Certificate of incorporation...... 6

ß 14A:2-8 Organization meeting of directors...... 10

ß 14A:2-9 By-laws; making and altering...... 11

ß 14A:2-10 By-laws and other powers in emergency...... 12

ß 14A:3-1 General powers...... 14

ß 14A:3-2 Ultra vires transactions...... 16

ß 14A:3-3 Guaranty not in furtherance of business interest...... 18

ß 14A:3-4 Contributions by corporations...... 19

ß 14A:3-5 Indemnification of directors, officers and employees...... 21

ß 14A:3-6 Provisions relating to actions by shareholders...... 25

ß 14A:5-2 Annual meeting of shareholders...... 27

ß 14A:5-9 Quorum of shareholders...... 28

ß 14A:5-10 Voting of shares...... 29

ß 14A:5-11 Votes required...... 30

ß 14A:5-12 Greater voting requirements...... 31

ß 14A:5-19 Proxy voting...... 32

ß 14A:5-20 Voting trust...... 34

ß 14A:5-21 Agreements as to voting; provision in certificate of incorporation

as to control of directors...... 36

ß 14A:5-24 Elections of directors; cumulative voting...... 38

ß 14A:6-1 Board of Directors...... 39

ß 14A:6-2 Number of directors...... 41

ß 14A:6-4 Classification of directors; restriction of right to choose

directors...... 42 ß 14A:6-5 Vacancies and newly created directorships...... 43

ß 14A:6-6 Removal of directors...... 44

ß 14A:6-7.1 Directors' voting; quorum of board of directors and committees;

action of board and committees; action of directors without a

meeting...... 46

ß 14A:6-8 Director conflicts of interest...... 48

ß 14A:6-12 Liability of directors in certain cases...... 49

ß 14A:6-14 Liability of directors; reliance on records and reports...... 51

ß 14A:7-1 Authorized shares...... 53

ß 14A:7-2 Issuance of shares in classes and series; board action...... 55

ß 14A:7-3 Subscription for shares...... 57

ß 14A:7-4 Consideration for shares...... 59

ß 14A:7-5 Payment for shares; nonassessability...... 60

ß 14A:7-6 Redeemable shares...... 61

ß 14A:7-8.1 Par value of shares and stated capital...... 63

ß 14A:7-14.1 Limitations on distributions to shareholders...... 64

ß 14A:7-15 Authority to pay dividends...... 65

ß 14A:7-15.1 Share dividends, share divisions and combinations...... 67

ß 14A:7-16 Acquisitions of a corporation's own shares...... 69

ß 14A:11-1 Right of shareholders to dissent...... 70

ß 14A:11-5 Rights of dissenting shareholder...... 73

ß 14A:12-4 Dissolution pursuant to action of board and shareholders...... 74

ß 14A:12-7 Involuntary dissolution; other remedies...... 76

ß 14A:12-8 Effective time of dissolution...... 84 3 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 1. GENERAL PROVISIONS AND DEFINITIONS

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:1-2.1 (2006)

ß 14A:1-2.1. Definitions

As used in this act, unless the context otherwise requires, the term: (a) "Act" or "this act" means the "New Jersey Business Corporation Act" and includes all amendments and supple- ments thereto. (b) "Attorney General" means the Attorney General of New Jersey. (c) "Authorized shares" means the shares of all classes and series which the corporation is authorized to issue. (d) "Board" means board of directors. "Entire board" means the total number of directors which the corporation would have if there were no vacancies. (e) "Bonds" includes secured and unsecured bonds, debentures, notes and other written obligations for the payment of money. (f) "Certificate of incorporation" includes: (i) the original certificate of incorporation or any other instrument filed or issued under any statute to form a do- mestic or foreign corporation, as amended, supplemented or restated by certificates of amendment, merger or consolida- tion or by other certificates or instruments filed or issued under any statute; and (ii) a special act or charter creating a domestic or foreign corporation, as amended, supplemented or restated. (g) "Corporation" or "domestic corporation" means a corporation for profit organized under this act, or existing on its effective date and theretofore organized under any other law of this State for a purpose or purposes for which a cor- poration may be organized under this act. (h) "Director" means any member of the governing board of a corporation, whether designated as director, trustee, manager, governor, or by any other title. (i) "Foreign corporation" means a corporation for profit organized under laws of a jurisdiction other than this State for a purpose or purposes for which a corporation may be organized under this act. (j) "Resolution" means any action taken or authority granted by the shareholders, the board, or a committee of the board, regardless of whether evidenced by a formal resolution. (k) "Secretary of State" means the Secretary of State of New Jersey. (l) "Shareholder" means one who is a holder of record of shares in a corporation. (m) "Shares" means the units into which the proprietary interests in a corporation are divided. (n) "Subscriber" means one who subscribes for shares in a corporation, whether before or after incorporation.

1 (o) "Subsidiary" means a domestic or foreign corporation whose outstanding shares are owned directly or indirectly by another domestic or foreign corporation in such number as to entitle the holder at the time to elect a majority of its directors without regard to voting power which may thereafter exist upon a default, failure or other contingency. (p) "Treasury shares" means shares of a corporation which have been issued, and have been subsequently acquired by the corporation under circumstances which do not result in cancellation. Treasury shares are issued shares, but not outstanding shares. (q) "Other business entity" means a partnership or limited liability company, whether organized under the laws of this State or under the laws of any other state or foreign jurisdiction. (r) "Votes cast" means all votes cast in favor of and against a particular proposition, but shall not include absten- tions.

HISTORY: L. 1988, c. 94, ß 1; Amended 1995, c. 279, ß 1.

LexisNexis (R) Notes:

LAW REVIEWS

1. 25 Rutgers L. J. 151, NOTE: New Jersey and the Limited Liability Company--Perfect Together?, Autumn, 1993.

2 13 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 2. PURPOSE AND FORMATION

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:2-1 (2006)

ß 14A:2-1. Purposes

A corporation may be organized under this act for any lawful business purpose or purposes except to do in this State any business for which organization is permitted under any other statute of this State unless such statute permits organi- zation under this act.

HISTORY: L. 1968, c. 350.

LexisNexis (R) Notes:

CASE NOTES

1. Whether or not licensed medical professionals or entities could practice as a limited liability company, be they do- mestic or foreign, was a matter that could only be determined through discovery; in order to lawfully incorporate as a general business corporation, the entity could not be permitted to incorporate under an alternative statute unless the al- ternative statute permitted the entity to also incorporate as a general business corporation. Selective Ins. Co. of Am. v. Med. Alliances, LLC, 362 N.J. Super. 392, 827 A.2d 1188, 2003 N.J. Super. LEXIS 267 (Law Div. 2003).

2. Where the oil corporation guaranteed rental payments to the landlord on a lease entered into between the landlord and a service station operator, which lease had been negotiated by the corporation, it was liable to the landlord as a guaran- tor on such lease when the tenant defaulted on the rent; former N.J. Rev. Stat. ß 14:3-4 (now N.J. Stat. Ann. ß 14A:2-1) was not pertinent as there was no evidence to suggest that the corporation carried on the business of insurance or as a guaranty company, and adequate consideration supported the agreement to guarantee the rent. Hall v. Pauser, 128 N.J.L. 211, 24 A.2d 575, 1942 N.J. Super. LEXIS 398 (N.J. Super. Ct. 1942).

3. In an action seeking an injunctive relief, the lower court properly dismissed the bill and its claims of insolvency be- cause a de facto corporation did not exist where the failure to file a certificate of incorporation with the secretary of state, as required by former N.J. Rev. Stat. ß ß 14:2-1 and 14:2-4 (now N.J. Stat. Ann. ß ß 14A:2-1 and 14A:2-7), and because there was an attempt to avoid fees and franchise taxes, under former N.J. Rev. Stat. ß 14:16-1 (now N.J. Stat. Ann. ß 14A:15-2), and the opening of a bank account was the only exercise of corporate powers. Culkin v. Hillside Restaurant, Inc., 126 N.J. Eq. 97, 8 A.2d 173, 1939 N.J. Super. LEXIS 871 (N.J. Super. Ct. 1939).

3 4 23 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 2. PURPOSE AND FORMATION

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:2-6 (2006)

ß 14A:2-6. Incorporators

(1) One or more individuals or domestic or foreign corporations may act as incorporator or incorporators of a corpora- tion by signing and filing in the office of the Secretary of State a certificate of incorporation for such corporation. Indi- viduals acting as incorporators shall be at least 18 years of age. Incorporators need not be United States citizens or resi- dents of this State or subscribers to shares in the corporation. (2) Except as otherwise provided in the certificate of incorporation, any action required or permitted by this act to be taken by incorporators may be taken without a meeting. (3) When there are two or more incorporators, if any dies or is for any reason unable to act, the other or others may act. If there is no incorporator able to act, any person for whom an incorporator was acting as agent may act in his stead, or if such other person also dies or is for any reason unable to act, his legal representative may act.

HISTORY: L. 1968, c. 350; Amended by L. 1973, c. 366, ß 5.

LexisNexis (R) Notes:

CASE NOTES

1. The temptation to disregard the corporate form and to "pierce the corporate veil" has become much greater since the General Corporation Act, N.J. Stat. Ann. ß 14A:2-6 was amended to permit the sole ownership of all the capital stock of the corporation by one person; the statute now permits one person to function as a corporation sole places upon the court the duty to realize that this procedure is lawful and that the corporate form may not be disregarded except in the case of actual fraud. Mingin v. Continental Can Co., 171 N.J. Super. 148, 408 A.2d 146, 1979 N.J. Super. LEXIS 938 (N.J. Super. Ct. 1979).

2. Trade name user was not entitled to seek an injunction to enjoin another corporation from using the same name be- cause mere incorporation in the style and title did not, in and of itself, grant any exclusive right to the trade name user of the trade name and prior preemption of a certain name and prior use were essential to an injunction against the use of an identical or similar name; the trade name user failed to prove the elements requisite for unfair competition or that any

5 secondary meaning had become appended to use of the name. B. Di Medio & Sons v. Camden Lumber & Millwork Co., 23 N.J. Super. 365, 93 A.2d 45, 1952 N.J. Super. LEXIS 662 (N.J. Super. Ct. 1952).

3. The temptation to disregard the corporate form and to "pierce the corporate veil" has become much greater since the General Corporation Act, N.J. Stat. Ann. ß 14A:2-6 was amended to permit the sole ownership of all the capital stock of the corporation by one person; the statute now permits one person to function as a corporation sole places upon the court the duty to realize that this procedure is lawful and that the corporate form may not be disregarded except in the case of actual fraud. Mingin v. Continental Can Co., 171 N.J. Super. 148, 408 A.2d 146, 1979 N.J. Super. LEXIS 938 (N.J. Super. Ct. 1979).

6 24 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 2. PURPOSE AND FORMATION

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:2-7 (2006)

ß 14A:2-7. Certificate of incorporation

(1) The certificate of incorporation shall set forth: (a) The name of the corporation; (b) The purpose or purposes for which the corporation is organized. It shall be a sufficient compliance with this paragraph to state, alone or with specifically enumerated purposes, that the corporation may engage in any activity with- in the purposes for which corporations may be organized under this act, and all such activities shall by such statement be deemed within the purposes of the corporation, subject to express limitations, if any; (c) The aggregate number of shares which the corporation shall have authority to issue; (d) If the shares are, or are to be, divided into classes, or into classes and series, the designation of each class and series, the number of shares in each class and series, and a statement of the relative rights, preferences and limitations of the shares of each class and series, to the extent that such designations, numbers, relative rights, preferences and limita- tions have been determined; (e) If the shares are, or are to be, divided into classes, or into classes and series, a statement of any authority vested in the board to divide the shares into classes or series or both, and to determine or change for any class or series its des- ignation, number of shares, relative rights, preferences and limitations; (f) Any provision not inconsistent with this act or any other statute of this State, which the incorporators elect to set forth for the management of the business and the conduct of the affairs of the corporation, or creating, defining, limiting or regulating the powers of the corporation, its directors and shareholders or any class of shareholders, including any provision which under this act is required or permitted to be set forth in the bylaws; (g) The address of the corporation's initial registered office, and the name of the corporation's initial registered agent at such address. On or after the effective date of this 1989 amendatory and supplementary act, the address of the registered office as shown on the certificate of incorporation shall be a complete address, including the number and street location of the registered office and, if applicable, the post office box number; (h) The number of directors constituting the first board and the names and addresses of the persons who are to serve as such directors; (i) The names and addresses of the incorporators; (j) The duration of the corporation if other than perpetual; and (k) If, pursuant to subsection 14A:2-7(2), the certificate of incorporation is to be effective on a date subsequent to the date of filing, the effective date of the certificate.

7 (2) The certificate of incorporation shall be filed in the office of the Secretary of State. The corporate existence shall begin upon the effective date of the certificate, which shall be the date of the filing or such later time, not to exceed 90 days from the date of filing, as may be set forth in the certificate. Such filing shall be conclusive evidence that all conditions precedent required to be performed by the incorporators have been complied with and, after the corporate ex- istence has begun, that the corporation has been incorporated under this act, except as against this State in a proceeding to cancel or revoke the certificate of incorporation or for involuntary dissolution of the corporation. (3) The certificate of incorporation may provide that a director or officer shall not be personally liable, or shall be liable only to the extent therein provided, to the corporation or its shareholders for damages for breach of any duty owed to the corporation or its shareholders, except that such provision shall not relieve a director or officer from liability for any breach of duty based upon an act or omission (a) in breach of such person's duty of loyalty to the corporation or its shareholders, (b) not in good faith or involving a knowing violation of law or (c) resulting in receipt by such person of an improper personal benefit. As used in this subsection, an act or omission in breach of a person's duty of loyalty means an act or omission which that person knows or believes to be contrary to the best interests of the corporation or its shareholders in connection with a matter in which he has a material conflict of interest.

HISTORY: L. 1968, c. 350; Amended 1987, c. 35, ß 1; 1988, c. 94, ß 10; 1989, c. 17, ß 1; 1989, c. 175, ß 1.

LexisNexis (R) Notes:

CASE NOTES

1. On motion of the Official Committee of Administrative Claimants ("ACC") for an order authorizing it to commence and prosecute certain causes of action against certain directors and officers of the debtor in bankruptcy, a Delaware cor- poration, on behalf of the bankruptcy estate, exculpation language in 8 Del. C. ß 102(b)(7) did not apply to officers of Delaware corporations and, to the extent that the ACC complained of the conduct of debtor's officers, the exculpation clause allegedly contained in the corporate charter did not bar potential liability; likewise, New Jersey's equivalent statute did not allow exculpation of officers for duty of due care violations, N.J. Stat. Ann. ß 14A: 2-7(3), though it was subject to the same exceptions found in Delaware's statute. In re LTV Steel Co., 333 B.R. 397, 2005 Bankr. LEXIS 1983 (Bankr. N.D. Ohio 2005).

2. On motion of the Official Committee of Administrative Claimants ("ACC") for an order authorizing it to commence and prosecute certain causes of action against certain directors and officers of the debtor in bankruptcy, a Delaware cor- poration, on behalf of the bankruptcy estate, exculpation language in 8 Del. C. ß 102(b)(7) did not apply to officers of Delaware corporations and, to the extent that the ACC complained of the conduct of debtor's officers, the exculpation clause allegedly contained in the corporate charter did not bar potential liability; likewise, New Jersey's equivalent statute did not allow exculpation of officers for duty of due care violations, N.J. Stat. Ann. ß 14A: 2-7(3), though it was subject to the same exceptions found in Delaware's statute. In re LTV Steel Co., 333 B.R. 397, 2005 Bankr. LEXIS 1983 (Bankr. N.D. Ohio 2005).

3. On motion of the Official Committee of Administrative Claimants ("ACC") for an order authorizing it to commence and prosecute certain causes of action against certain directors and officers of the debtor in bankruptcy, a Delaware cor- poration, on behalf of the bankruptcy estate, exculpation language in 8 Del. C. ß 102(b)(7) did not apply to officers of Delaware corporations and, to the extent that the ACC complained of the conduct of debtor's officers, the exculpation clause allegedly contained in the corporate charter did not bar potential liability; likewise, New Jersey's equivalent

8 statute did not allow exculpation of officers for duty of due care violations, N.J. Stat. Ann. ß 14A: 2-7(3), though it was subject to the same exceptions found in Delaware's statute. In re LTV Steel Co., 333 B.R. 397, 2005 Bankr. LEXIS 1983 (Bankr. N.D. Ohio 2005).

4. Where the boards of a public utility company and its holding company hired a law firm to investigate the basis for shareholders' allegations of mismanagement by board members, and where the law firm relied on the straightforward language of N.J. Stat. Ann. ß 14A:2-7(3) in advising the boards that a clause in the relevant certificate of incorporation applied to limit the directors' and officers' personal liability to the corporation or its shareholders, the boards acted rea- sonably in relying on the law firm's advice in evaluating the shareholders' demands to sue members of the boards. Fink v. Codey (In re PSE&G S'holder Litig.), 173 N.J. 258, 801 A.2d 295, 2002 N.J. LEXIS 1082 (2002).

5. Trial court properly granted summary judgment dismissing shareholders' derivative suits where companies' board members showed that their decision to end shareholders' litigation was in good faith and reasonable under modified business judgment rule. Under N.J. Stat. Ann. ß 14A:2-7(3), the board acted in good faith and with due care in investi- gating the shareholders' allegations where it hired a law firm which conducted an extensive investigation; the board's decision was reasonable, as it was based on the law firm's well-reasoned determination that litigation was not warranted, would not have been in the companies' best interests, and was unlikely to succeed. Fink v. Codey (In re PSE&G S'hold- er Litig.), 173 N.J. 258, 801 A.2d 295, 2002 N.J. LEXIS 1082 (2002).

6. In an action seeking an injunctive relief, the lower court properly dismissed the bill and its claims of insolvency be- cause a de facto corporation did not exist where the failure to file a certificate of incorporation with the secretary of state, as required by former N.J. Rev. Stat. ß ß 14:2-1 and 14:2-4 (now N.J. Stat. Ann. ß 14A:2-1 and 14A:2-7), and be- cause there was an attempt to avoid fees and franchise taxes, under former N.J. Rev. Stat. ß 14:16-1 (now N.J. Stat. Ann. ß 14A:15-2), and the opening of a bank account was the only exercise of corporate powers. Culkin v. Hillside Restaurant, Inc., 126 N.J. Eq. 97, 8 A.2d 173, 1939 N.J. Super. LEXIS 871 (N.J. Super. Ct. 1939).

7. Trial court properly granted summary judgment dismissing shareholders' derivative suits where companies' board members showed that their decision to end shareholders' litigation was in good faith and reasonable under modified business judgment rule. Under N.J. Stat. Ann. ß 14A:2-7(3), the board acted in good faith and with due care in investi- gating the shareholders' allegations where it hired a law firm which conducted an extensive investigation; the board's decision was reasonable, as it was based on the law firm's well-reasoned determination that litigation was not warranted, would not have been in the companies' best interests, and was unlikely to succeed. Fink v. Codey (In re PSE&G S'hold- er Litig.), 173 N.J. 258, 801 A.2d 295, 2002 N.J. LEXIS 1082 (2002).

8. Although the General Corporation Act, former N.J. Stat. Ann. ß 14A:1-1 et seq. (now N.J. Stat. Ann. ß 14A:2-1 et seq.), confers upon a corporation a broad power of amendment of its charter, alteration of a charter for the avowed pur- pose of defeating a relevant aspect of the sovereign's declared public policy cannot achieve judicial approval. State by Furman v. Jefferson Lake Sulphur Co., 36 N.J. 577, 178 A.2d 329, 1962 N.J. LEXIS 274 (1962).

9. Trial court properly granted summary judgment dismissing shareholders' derivative suits where companies' board members showed that their decision to end shareholders' litigation was in good faith and reasonable under modified business judgment rule. Under N.J. Stat. Ann. ß 14A:2-7(3), the board acted in good faith and with due care in investi- gating the shareholders' allegations where it hired a law firm which conducted an extensive investigation; the board's decision was reasonable, as it was based on the law firm's well-reasoned determination that litigation was not warranted, would not have been in the companies' best interests, and was unlikely to succeed. Fink v. Codey (In re PSE&G S'hold- er Litig.), 173 N.J. 258, 801 A.2d 295, 2002 N.J. LEXIS 1082 (2002).

9 LAW REVIEWS

1. 23 Seton Hall L. Rev. 897, TURNING BACK THE TIDE OF DIRECTOR AND OFFICER LIABILITY, 1993.

2. 18 Seton Hall Legis. J. 111, THE NEW JERSEY LIMITED LIABILITY COMPANY STATUTE: BACKGROUND AND CONCEPTS, 1993.

10 25 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 2. PURPOSE AND FORMATION

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:2-8 (2006)

ß 14A:2-8. Organization meeting of directors

On or after the effective date of the certificate of incorporation, an organization meeting of the board named in the certificate of incorporation shall be held, at the call of a majority of the board so named, to adopt by-laws, elect officers, authorize the issuance of shares, and transact such other business as may come before the meeting. The board members calling the meeting shall give at least 5 days' notice thereof by mail to each director named in the certificate of incorpo- ration, which notice shall state the time and place of the meeting.

HISTORY: L. 1968, c. 350; Amended by L. 1973, c. 366, ß 6.

11 26 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 2. PURPOSE AND FORMATION

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:2-9 (2006)

ß 14A:2-9. By-laws; making and altering

(1) The initial by-laws of a corporation shall be adopted by the board at its organization meeting. Thereafter, the board shall have the power to make, alter and repeal by-laws unless such power is reserved to the shareholders in the certifi- cate of incorporation, but by-laws made by the board may be altered or repealed, and new by-laws made, by the share- holders. The shareholders may prescribe in the by-laws that any by-law made by them shall not be altered or repealed by the board. (2) The initial by-laws of a corporation adopted by the board at its organization meeting shall be deemed to have been adopted by the shareholders for purposes of this act. (3) Any provision which this act requires or permits to be set forth in the by-laws may be set forth in the certificate of incorporation with equal force and effect.

HISTORY: L. 1968, c. 350.

12 27 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 2. PURPOSE AND FORMATION

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:2-10 (2006)

ß 14A:2-10. By-laws and other powers in emergency

(1) The board of a corporation may adopt emergency by-laws, subject to repeal or change by action of the sharehold- ers, which shall, notwithstanding any different provision elsewhere in this act or in the certificate of incorporation or by- laws, be operative during any emergency in the conduct of the business of the corporation resulting from an attack on the United States or any nuclear or atomic disaster. The emergency by-laws may make any provision that may be practi- cal and necessary for the circumstances of the emergency, including provisions that (a) a meeting of the board may be called by any officer or director in such manner and under such conditions as shall be prescribed in the emergency by-laws; (b) the director or directors in attendance at the meeting, or any greater number fixed by the emergency by-laws, shall constitute a quorum; and (c) the officers or other persons designated in a list approved by the board before the emergency, all in such order of priority and subject to such conditions and for such period of time, not longer than reasonably necessary after the ter- mination of the emergency, as may be provided in the emergency by-laws or in the resolution approving the list, shall, to the extent required to provide a quorum at any meeting of the board, be deemed directors for such meeting. (2) Before or during any such emergency, the board may provide, and from time to time modify, lines of succession in the event that during such an emergency any or all officers or agents of the corporation shall for any reason be ren- dered incapable of discharging their duties. (3) Before or during any such emergency, the board may change the head office or designate several alternative head offices or regional offices, or authorize the officers so to do, said change to be effective during the emergency. (4) To the extent not inconsistent with any emergency by-laws so adopted, the by-laws of the corporation shall re- main in effect during any such emergency and upon its termination the emergency by-laws shall cease to be operative. (5) Unless otherwise provided in emergency by-laws, notice of any meeting of the board during any such emergen- cy need be given only to such of the directors as it may be feasible to reach at the time and by such means as may be feasible at the time, including publication, or other means of mass communication. (6) To the extent required to constitute a quorum at any meeting of the board during any such emergency, the offi- cers of the corporation who are present shall, unless otherwise provided in emergency by-laws, be deemed, in order of rank and within the same rank in order of seniority, directors for such meeting. (7) No officer, director or employee acting in accordance with any emergency by-laws shall be liable except for willful misconduct. No officer, director or employee shall be liable for any action taken by him in good faith in such an emergency in furtherance of the ordinary business affairs of the corporation even though not authorized by the by-laws then in effect.

13 HISTORY: L. 1968, c. 350.

14 28 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 3. POWERS

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:3-1 (2006)

ß 14A:3-1. General powers

(1) Each corporation, subject to any limitations provided in this act or any other statute of this State, or in its certifi- cate of incorporation, shall have power (a) to have perpetual duration unless a limited period is stated in its certificate of incorporation; (b) to sue and be sued, complain and defend and participate as a party or otherwise in any judicial, administrative, arbitrative or other proceeding, in its corporate name; (c) to have a corporate seal which may be altered at pleasure, and to use the same by causing it, or a facsimile there- of, to be impressed or affixed or in any other manner reproduced; (d) to purchase, lease or otherwise acquire, own, hold, improve, use and otherwise deal in and with, real or personal property, or any interest therein, wherever situated; (e) to sell, convey, mortgage, create a security interest in, lease, exchange, transfer and otherwise dispose of all or any part of its property and assets; (f) to purchase, subscribe for, or otherwise acquire, own, hold, vote, use, employ, sell, exchange, mortgage, lend, create a security interest in, or otherwise dispose of, and otherwise use and deal in and with, shares or other interests in, or obligations of, other domestic or foreign corporations, associations, partnerships or individuals, or direct or indirect obligations of any domestic or foreign government or instrumentality thereof; (g) to make contracts and guarantees and incur liabilities, borrow money, issue its bonds, and secure any of its obli- gations by mortgage of or creation of a security interest in all or any of its property, franchises and income; (h) to lend money, invest and reinvest its funds, and take and hold real and personal property as security for the payment of funds so loaned or invested; (i) to conduct its business, carry on its operations, and have offices and exercise the powers granted by this act any- where in the universe; (j) to elect or appoint officers, employees and agents of the corporation, and define their duties and fix their com- pensation; (k) to make and alter by-laws for the administration and regulation of the affairs of the corporation; (l) to pay pensions and establish pension, profit-sharing, stock option, stock purchase, incentive and deferred com- pensation plans, and plans of similar nature for, and to furnish medical services, life, sickness, accident, disability or un- employment insurance and benefits, education, housing, social and recreational services and other similar aids and ser- vices to, any or all of its directors, officers, employees, and agents, their families, dependents or beneficiaries;

15 (m) to participate with others in any corporation, partnership, limited partnership, joint venture, or other association of any kind, or in any transaction, undertaking or arrangement which the participating corporation would have power to conduct by itself, whether or not such participation involves sharing or delegation of control with or to others; (n) at the request of the United States government or of any of its agencies, to transact any lawful business in time of war or other national emergency, notwithstanding the purpose or purposes set forth in its certificate of incorporation; (o) to provide for its benefit life insurance and other insurance with respect to the services of any or all of its direc- tors, officers, employees, and agents, or on the life of any shareholder for the purpose of acquiring at his death shares of its stock owned by such shareholder; (p) to have and exercise all other powers necessary or convenient to effect any or all of the purposes for which the corporation is organized. (2) It shall not be necessary to set forth in the certificate of incorporation any corporate powers enumerated in this act.

HISTORY: L. 1968, c. 350; Amended by L. 1969, c. 102, ß 1.

LexisNexis (R) Notes:

CASE NOTES

1. Pursuant to N.J. Stat. Ann. ß 14A:3-1, a corporation had the right to conduct its business in any jurisdiction it pleased, subject to the requirement of N.J. Stat. Ann. ß 14A:4-1 to maintain a registered office and agent in New Jersey, and the corporation was permitted to move its assets to another state. Pilat v. Broach Sys., Inc., 108 N.J. Super. 88, 260 A.2d 13, 1969 N.J. Super. LEXIS 336 (N.J. Super. Ct. 1969).

16 29 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 3. POWERS

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:3-2 (2006)

ß 14A:3-2. Ultra vires transactions

No act of a corporation and no conveyance or transfer of real or personal property to or by a corporation shall be in- valid by reason of the fact that the corporation was without capacity or power to do such act or to make or receive such conveyance or transfer, but such lack of capacity or power may be asserted: (a) In a proceeding by a shareholder against the corporation to enjoin the doing of any act or acts or the transfer of real or personal property by or to the corporation. If the unauthorized acts or transfer sought to be enjoined are being, or are to be, performed or made pursuant to any contract to which the corporation is a party, the court may, if all of the par- ties to the contract are parties to the proceeding and if it deems the same to be equitable, set aside and enjoin the perfor- mance of such contract, and in so doing may allow to the corporation or to the other parties to the contract, as the case may be, compensation for the loss or damage sustained by either of them which may result from the action of the court in setting aside and enjoining the performance of such contract, but anticipated profits to be derived from the perfor- mance of the contract shall not be awarded by the court as a loss or damage sustained. (b) In a proceeding by the corporation, whether acting directly or through a receiver, trustee, or other legal repre- sentative, or through shareholders in a representative suit, against the incumbent or former officers or directors of the corporation. (c) In a proceeding by the Attorney General, as provided in this act, to dissolve the corporation, or in a proceeding by the Attorney General to enjoin the corporation from the transaction of unauthorized business.

HISTORY: L. 1968, c. 350.

LexisNexis (R) Notes:

CASE NOTES

1. Where a cooperative corporation entered into a loan and mortgage agreement with a bank by which it mortgaged co- operative apartments and represented to the bank that the requisite number of shareholders approved the terms of the loan and mortgage, the shareholders, who never sued the corporation claiming that the agreement was ultra vires, could

17 not prevent foreclosure of the mortgage on the ground that they had never voted for the loan and mortgage agreement. Anchor Sav. Bank v. Waters Ebb Owens, Inc., 1992 U.S. Dist. LEXIS 11384 (D.N.J. July 27 1992).

2. Where a cooperative corporation entered into a loan and mortgage agreement with a bank by which it mortgaged co- operative apartments and represented to the bank that the requisite number of shareholders approved the terms of the loan and mortgage, the shareholders, who never sued the corporation claiming that the agreement was ultra vires, could not prevent foreclosure of the mortgage on the ground that they had never voted for the loan and mortgage agreement. Anchor Sav. Bank v. Waters Ebb Owens, Inc., 1992 U.S. Dist. LEXIS 11384 (D.N.J. July 27 1992).

3. Where a cooperative corporation entered into a loan and mortgage agreement with a bank by which it mortgaged co- operative apartments and represented to the bank that the requisite number of shareholders approved the terms of the loan and mortgage, the shareholders, who never sued the corporation claiming that the agreement was ultra vires, could not prevent foreclosure of the mortgage on the ground that they had never voted for the loan and mortgage agreement. Anchor Sav. Bank v. Waters Ebb Owens, Inc., 1992 U.S. Dist. LEXIS 11384 (D.N.J. July 27 1992).

LAW REVIEWS

1. 18 Seton Hall Legis. J. 111, THE NEW JERSEY LIMITED LIABILITY COMPANY STATUTE: BACKGROUND AND CONCEPTS, 1993.

18 30 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 3. POWERS

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:3-3 (2006)

ß 14A:3-3. Guaranty not in furtherance of business interest

(1) A corporation may give a guaranty not in furtherance of its direct or indirect business interests only when autho- rized at a meeting of shareholders by the affirmative vote of all of the votes cast by the holders of each class and series of shares entitled to vote thereon. If authorized by such a vote, the guaranty may be secured by a mortgage of or a secu- rity interest in all or any part of the corporate property, or any interest therein, wherever situated. (2) Nothing in subsection 14A:3-3(1) shall be deemed to diminish the rights, if any, of the corporation's creditors.

HISTORY: L. 1968, c. 350; Amended 1973, c. 366, ß 7; 1988, c. 94, ß 11.

19 31 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 3. POWERS

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:3-4 (2006)

ß 14A:3-4. Contributions by corporations

(1) Any corporation organized for any purpose under any general or special law of this State, unless otherwise provid- ed in its certificate of incorporation or by-laws, shall have power, irrespective of corporate benefit, to aid, singly or in cooperation with other corporations and with natural persons, in the creation or maintenance of institutions or organiza- tions engaged in community fund, hospital, charitable, philanthropic, educational, scientific or benevolent activities or patriotic or civic activities conducive to the betterment of social and economic conditions, and the board may authorize the making of contributions for those purposes in money, securities, including shares of the corporation, or other proper- ty, in such reasonable amounts as the board may determine; provided, that a contribution shall not be authorized hereun- der if at the time of the contribution or immediately thereafter the donee institution shall own more than 10% of the vot- ing stock of the donor corporation or one of its subsidiaries. (2) The provisions of this section shall not be construed as directly or indirectly minimizing or interpreting the rights and powers of corporations, as heretofore existing, with reference to appropriations, expenditures or contributions of the nature above specified.

HISTORY: L. 1968, c. 350; Amended 1988, c. 94, ß 12.

LexisNexis (R) Notes:

CASE NOTES

1. Under former N.J. Stat. Ann. ß ß 14:3-13.1, 14:13.2, and 14:13.3 (now N.J. Stat. Ann. ß 14A:3-4), a corporation had the power to make a charitable contribution of corporate funds to a private university. A. P. Smith Mfg. Co. v. Barlow, 26 N.J. Super. 106, 97 A.2d 186, 1953 N.J. Super. LEXIS 435 (N.J. Super. Ct. 1953), affirmed by 13 N.J. 145, 98 A.2d 581, 1953 N.J. LEXIS 186, 39 A.L.R.2d 1179 (1953).

2. Corporation's donation to the university was not illegal because a corporation was allowed to make charitable dona- tions provided that the contribution was not made to an institution that owned more than ten percent of the voting stock of the corporation and the donation did not exceed one percent of the capital and surplus of the corporation; the stock- holders were not entitled to judgment in their favor. A. P. Smith Mfg. Co. v. Barlow, 13 N.J. 145, 98 A.2d 581, 1953

20 N.J. LEXIS 186, 39 A.L.R.2d 1179 (1953), appeal dismissed by 346 U.S. 861, 98 L. Ed. 373, 74 S. Ct. 107, 1953 U.S. LEXIS 1621 (1953).

21 32 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 3. POWERS

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:3-5 (2006)

ß 14A:3-5. Indemnification of directors, officers and employees

(1) As used in this section, (a) "Corporate agent" means any person who is or was a director, officer, employee or agent of the indemnifying corporation or of any constituent corporation absorbed by the indemnifying corporation in a consolidation or merger and any person who is or was a director, officer, trustee, employee or agent of any other enterprise, serving as such at the request of the indemnifying corporation, or of any such constituent corporation, or the legal representative of any such director, officer, trustee, employee or agent; (b) "Other enterprise" means any domestic or foreign corporation, other than the indemnifying corporation, and any partnership, joint venture, sole proprietorship, trust or other enterprise, whether or not for profit, served by a corporate agent; (c) "Expenses" means reasonable costs, disbursements and counsel fees; (d) "Liabilities" means amounts paid or incurred in satisfaction of settlements, judgments, fines and penalties; (e) "Proceeding" means any pending, threatened or completed civil, criminal, administrative or arbitrative action, suit or proceeding, and any appeal therein and any inquiry or investigation which could lead to such action, suit or pro- ceeding; and (f) References to "other enterprises" include employee benefit plans; references to "fines" include any excise taxes assessed on a person with respect to an employee benefit plan; and references to "serving at the request of the indemni- fying corporation" include any service as a corporate agent which imposes duties on, or involves services by, the corpo- rate agent with respect to an employee benefit plan, its participants, or beneficiaries; and a person who acted in good faith and in a manner the person reasonably believed to be in the interest of the participants and beneficiaries of an em- ployee benefit plan shall be deemed to have acted in a manner "not opposed to the best interests of the corporation" as referred to in this section. (2) Any corporation organized for any purpose under any general or special law of this State shall have the power to indemnify a corporate agent against his expenses and liabilities in connection with any proceeding involving the cor- porate agent by reason of his being or having been such a corporate agent, other than a proceeding by or in the right of the corporation, if (a) such corporate agent acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation; and (b) with respect to any criminal proceeding, such corporate agent had no reasonable cause to believe his conduct was unlawful. The termination of any proceeding by judgment, order, settlement, conviction or upon a plea of nolo con-

22 tendere or its equivalent, shall not of itself create a presumption that such corporate agent did not meet the applicable standards of conduct set forth in paragraphs 14A:3-5(2)(a) and 14A:3-5(2)(b). (3) Any corporation organized for any purpose under any general or special law of this State shall have the power to indemnify a corporate agent against his expenses in connection with any proceeding by or in the right of the corpora- tion to procure a judgment in its favor which involves the corporate agent by reason of his being or having been such corporate agent, if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best in- terests of the corporation. However, in such proceeding no indemnification shall be provided in respect of any claim, is- sue or matter as to which such corporate agent shall have been adjudged to be liable to the corporation, unless and only to the extent that the Superior Court or the court in which such proceeding was brought shall determine upon application that despite the adjudication of liability, but in view of all circumstances of the case, such corporate agent is fairly and reasonably entitled to indemnity for such expenses as the Superior Court or such other court shall deem proper. (4) Any corporation organized for any purpose under any general or special law of this State shall indemnify a cor- porate agent against expenses to the extent that such corporate agent has been successful on the merits or otherwise in any proceeding referred to in subsections 14A:3-5(2) and 14A:3-5(3) or in defense of any claim, issue or matter therein. (5) Any indemnification under subsection 14A:3-5(2) and, unless ordered by a court, under subsection 14A:3-5(3) may be made by the corporation only as authorized in a specific case upon a determination that indemnification is prop- er in the circumstances because the corporate agent met the applicable standard of conduct set forth in subsection 14A:3-5(2) or subsection 14A:3-5(3). Unless otherwise provided in the certificate of incorporation or bylaws, such de- termination shall be made (a) by the board of directors or a committee thereof, acting by a majority vote of a quorum consisting of directors who were not parties to or otherwise involved in the proceeding; or (b) if such a quorum is not obtainable, or, even if obtainable and such quorum of the board of directors or commit- tee by a majority vote of the disinterested directors so directs, by independent legal counsel, in a written opinion, such counsel to be designated by the board of directors; or (c) by the shareholders if the certificate of incorporation or bylaws or a resolution of the board of directors or of the shareholders so directs. (6) Expenses incurred by a corporate agent in connection with a proceeding may be paid by the corporation in ad- vance of the final disposition of the proceeding as authorized by the board of directors upon receipt of an undertaking by or on behalf of the corporate agent to repay such amount if it shall ultimately be determined that he is not entitled to be indemnified as provided in this section. (7) (a) If a corporation upon application of a corporate agent has failed or refused to provide indemnification as re- quired under subsection 14A:3-5(4) or permitted under subsections 14A:3-5(2), 14A:3-5(3) and 14A:3-5(6), a corporate agent may apply to a court for an award of indemnification by the corporation, and such court (i) may award indemnification to the extent authorized under subsections 14A:3-5(2) and 14A:3-5(3) and shall award indemnification to the extent required under subsection 14A:3-5(4), notwithstanding any contrary determination which may have been made under subsection 14A:3-5(5); and (ii) may allow reasonable expenses to the extent authorized by, and subject to the provisions of, subsection 14A:3- 5(6), if the court shall find that the corporate agent has by his pleadings or during the course of the proceeding raised genuine issues of fact or law. (b) Application for such indemnification may be made (i) in the civil action in which the expenses were or are to be incurred or other amounts were or are to be paid; or (ii) to the Superior Court in a separate proceeding. If the application is for indemnification arising out of a civil ac- tion, it shall set forth reasonable cause for the failure to make application for such relief in the action or proceeding in which the expenses were or are to be incurred or other amounts were or are to be paid. The application shall set forth the disposition of any previous application for indemnification and shall be made in such manner and form as may be required by the applicable rules of court or, in the absence thereof, by direction of the court to which it is made. Such application shall be upon notice to the corporation. The court may also direct that notice

23 shall be given at the expense of the corporation to the shareholders and such other persons as it may designate in such manner as it may require. (8) The indemnification and advancement of expenses provided by or granted pursuant to the other subsections of this section shall not exclude any other rights, including the right to be indemnified against liabilities and expenses in- curred in proceedings by or in the right of the corporation, to which a corporate agent may be entitled under a certificate of incorporation, bylaw, agreement, vote of shareholders, or otherwise; provided that no indemnification shall be made to or on behalf of a corporate agent if a judgment or other final adjudication adverse to the corporate agent establishes that his acts or omissions (a) were in breach of his duty of loyalty to the corporation or its shareholders, as defined in subsection (3) of N.J.S.14A:2-7, (b) were not in good faith or involved a knowing violation of law or (c) resulted in re- ceipt by the corporate agent of an improper personal benefit. (9) Any corporation organized for any purpose under any general or special law of this State shall have the power to purchase and maintain insurance on behalf of any corporate agent against any expenses incurred in any proceeding and any liabilities asserted against him by reason of his being or having been a corporate agent, whether or not the cor- poration would have the power to indemnify him against such expenses and liabilities under the provisions of this sec- tion. The corporation may purchase such insurance from, or such insurance may be reinsured in whole or in part by, an insurer owned by or otherwise affiliated with the corporation, whether or not such insurer does business with other in- sureds. (10) The powers granted by this section may be exercised by the corporation, notwithstanding the absence of any provision in its certificate of incorporation or bylaws authorizing the exercise of such powers. (11) Except as required by subsection 14A:3-5(4), no indemnification shall be made or expenses advanced by a cor- poration under this section, and none shall be ordered by a court, if such action would be inconsistent with a provision of the certificate of incorporation, a bylaw, a resolution of the board of directors or of the shareholders, an agreement or other proper corporate action, in effect at the time of the accrual of the alleged cause of action asserted in the proceed- ing, which prohibits, limits or otherwise conditions the exercise of indemnification powers by the corporation or the rights of indemnification to which a corporate agent may be entitled. (12) This section does not limit a corporation's power to pay or reimburse expenses incurred by a corporate agent in connection with the corporate agent's appearance as a witness in a proceeding at a time when the corporate agent has not been made a party to the proceeding.

HISTORY: L. 1968, c. 350; Amended 1973, c. 366, ß 8; 1987, c. 35, ß 2; 1988, c. 94, ß 13; 1989, c. 17, ß 2.

LexisNexis (R) Notes:

CASE NOTES

1. Independent outside counsel was not entitled to indemnification under N.J. Stat. Ann. ß ß 14A:3-5(2), which provid- ed for permissive corporate indemnification of certain persons in certain circumstances, and since he could not show that he was entitled to indemnification under any other statutory provision, the trial court's indemnification order en- tered in his favor on his request for indemnification for representing himself against the ultimately dismissed claim of the shareholders of the corporation that he committed legal malpractice in representing the corporation in the hiring of a property manager had to be reversed. Cohen v. Southbridge Park, 369 N.J. Super. 156, 848 A.2d 781, 2004 N.J. Super. LEXIS 164 (App.Div. 2004).

2. Trial court erred in relying on N.J. Stat. Ann. ß 14A:3-5(4) to order that independent outside attorney be indemnified by corporation after the independent outside attorney was dismissed from a derivative lawsuit brought by the sharehold- ers of the corporation alleging that he committed legal malpractice in representing the corporation regarding the hiring of a property manager, which was the subject of a separate suit; the independent outside attorney was not a "corporate agent" under N.J. Stat. Ann. ß 14A:3-5(4), which listed the corporate members entitled to indemnification and, thus,

24 was not entitled to indemnification. Cohen v. Southbridge Park, 369 N.J. Super. 156, 848 A.2d 781, 2004 N.J. Super. LEXIS 164 (App.Div. 2004).

3. Independent outside attorney was not a "corporate agent" as that term was defined in N.J. Stat. Ann. ß 14A:3-5(1)(a), which identified "corporate agents" as any person who is or was a director, officer, employee, or agent of the indemni- fying corporation since he did not fall within any of those categories in his position as outside counsel for the corpora- tion; accordingly, he was not entitled to indemnification from the corporation for defending himself against a legal mal- practice claim brought in a shareholder derivative lawsuit that alleged he should not have represented the corporation in the main case involving the hiring of a property manager. Cohen v. Southbridge Park, 369 N.J. Super. 156, 848 A.2d 781, 2004 N.J. Super. LEXIS 164 (App.Div. 2004).

LAW REVIEWS

1. 23 Seton Hall L. Rev. 897, TURNING BACK THE TIDE OF DIRECTOR AND OFFICER LIABILITY, 1993.

2. 18 Seton Hall Legis. J. 111, THE NEW JERSEY LIMITED LIABILITY COMPANY STATUTE: BACKGROUND AND CONCEPTS, 1993.

3. 29 Seton Hall Legis. J. 11, Article: A GUIDE TO NEW JERSEY CORPORATE POLITICAL ACTION COMMIT- TEES AFTER THE 2004 CAMPAIGN FINANCE LEGISLATION AND EXECUTIVE ORDER, 2004.

25 33 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 3. POWERS

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:3-6 (2006)

ß 14A:3-6. Provisions relating to actions by shareholders

(1) No action shall be brought in this State by a shareholder in the right of a domestic or foreign corporation unless the plaintiff was a holder of shares or of voting trust certificates therefor at the time of the transaction of which he com- plains, or his shares or voting trust certificates thereafter devolved upon him by operation of law from a person who was a holder at such time. (2) In any action hereafter instituted in the right of any such corporation by the holder or holders of shares of such corporation or of voting trust certificates therefor, the court having jurisdiction, upon final judgment and a finding that the action was brought without reasonable cause, may require the plaintiff or plaintiffs to pay to the parties named as de- fendant the reasonable expenses, including fees of attorneys, incurred by them in the defense of such action. (3) In any action now pending or hereafter instituted or maintained in the right of any such corporation by the hold- er or holders of less than 5% of the outstanding shares of any class or series of such corporation or of voting trust cer- tificates therefor, unless the shares or voting trust certificates so held have a market value in excess of $ 25,000.00, the corporation in whose right such action is brought shall be entitled at any time before final judgment to require the plain- tiff or plaintiffs to give security for the reasonable expenses, including fees of attorneys, that may be incurred by it in connection with such action or may be incurred by other parties named as defendant for which it may become legally li- able. Market value shall be determined as of the date that the plaintiff institutes the action or, in the case of an interven- er, as of the date that he becomes a party to the action. The amount of such security may from time to time be increased or decreased, in the discretion of the court, upon showing that the security provided has or may become inadequate or excessive. The corporation shall have recourse to such security in such amount as the court having jurisdiction shall de- termine upon the termination of such action.

HISTORY: L. 1968, c. 350; Amended by L. 1973, c. 366, ß 9.

LexisNexis (R) Notes:

CASE NOTES

1. Plaintiff, a former shareholder who transferred all of her shares to her husband in a divorce proceeding, had standing to maintain her shareholder's derivative action because the action arose out of events that occurred during plaintiff's

26 ownership of shares and neither N.J. Stat. Ann. ß 14A:3-6(1) nor N.J. Ct. R. 4:32-5 required continued ownership throughout the litigation. Brown v. Brown, 323 N.J. Super. 30, 731 A.2d 1212, 1999 N.J. Super. LEXIS 249 (N.J. Super. Ct. App. Div. 1999).

2. Preferred shareholder had no standing under N.J. Stat. Ann. ß 14A:3-6(1) of the New Jersey Business Corporation Act, and N.J. Ct. R. 4:32-5, to a settlement agreement resolving a class action and derivative suit where he was not a shareholder at the time the objectionable transaction occurred. Pogostin v. Leighton, 216 N.J. Super. 363, 523 A.2d 1078, 1987 N.J. Super. LEXIS 1020 (N.J. Super. Ct. 1987).

3. Derivative action suit against casualty company and directors by policyholder was dismissed because policyholder did not own policy at time alleged improper transactions occurred, which was required under general corporation law to bring such suit. Amabile v. Lerner, 64 N.J. Super. 507, 166 A.2d 603, 1960 N.J. Super. LEXIS 381 (N.J. Super. Ct. 1960), affirmed by 74 N.J. Super. 443, 181 A.2d 520, 1962 N.J. Super. LEXIS 593 (N.J. Super. Ct. 1962).

4. Where a shareholder initiated a legal action against the corporation and others, he was required, under former N.J. Stat. Ann. ß 14:3-15 (now N.J. Stat. Ann. ß 14A:3-6), to deposit a security for reasonable expenses that included coun- sel fees because the shareholder held less than five percent of the aggregate par value or stated capital value of all out- standing shares of the corporation's stock. Moldoff v. Mar-dale Manor, Inc., 50 N.J. Super. 607, 143 A.2d 4, 1958 N.J. Super. LEXIS 521 (N.J. Super. Ct. 1958).

5. Preferred shareholder had no standing under N.J. Stat. Ann. ß 14A:3-6(1) of the New Jersey Business Corporation Act, and N.J. Ct. R. 4:32-5, to a settlement agreement resolving a class action and derivative suit where he was not a shareholder at the time the objectionable transaction occurred. Pogostin v. Leighton, 216 N.J. Super. 363, 523 A.2d 1078, 1987 N.J. Super. LEXIS 1020 (N.J. Super. Ct. 1987).

6. Appeal by corporation and its officer was dismissed because they failed to file security for the appeal; however, the court ruled that the payment of the security under former N.J. Stat. Ann. ß 14:3-15 (now N.J. Stat. Ann. ß 14A:3-6), N.J. Ct. R. 4:55-6(a), 4:55-7 was not a fund of the court and was for future costs and future counsel fees, not past ones; thus, the security was not a subject of the litigation. De Bow v. Lakewood Hotel & Land Ass'n, 52 N.J. Super. 288, 145 A.2d 493, 1958 N.J. Super. LEXIS 407 (N.J. Super. Ct. 1958).

7. Appeal by corporation and its officer was dismissed because they failed to file security for the appeal; however, the court ruled that the payment of the security under former N.J. Stat. Ann. ß 14:3-15 (now N.J. Stat. Ann. ß 14A:3-6), N.J. Ct. R. 4:55-6(a), 4:55-7 was not a fund of the court and was for future costs and future counsel fees, not past ones; thus, the security was not a subject of the litigation. De Bow v. Lakewood Hotel & Land Ass'n, 52 N.J. Super. 288, 145 A.2d 493, 1958 N.J. Super. LEXIS 407 (N.J. Super. Ct. 1958).

LAW REVIEWS

1. 18 Seton Hall Legis. J. 111, THE NEW JERSEY LIMITED LIABILITY COMPANY STATUTE: BACKGROUND AND CONCEPTS, 1993.

27 41 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 5. SHAREHOLDERS' MEETINGS, ELECTIONS, RIGHTS AND LIABILITIES

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:5-2 (2006)

ß 14A:5-2. Annual meeting of shareholders

An annual meeting of the shareholders shall be held at such time as may be provided in the by-laws, or as may be fixed by the board pursuant to authority granted in the by-laws, and, in the absence of such a provision, at noon on the first Tuesday of April. Failure to hold the annual meeting at the designated time, or to elect a sufficient number of direc- tors at such meeting or any adjournment thereof, shall not affect otherwise valid corporate acts or work a forfeiture or dissolution of the corporation. If the annual meeting for election of directors is not held on the date designated therefor, the directors shall cause the meeting to be held as soon thereafter as convenient. If there is a failure to hold an annual meeting for a period of 30 days after the date designated therefor, or if no date has been designated for a period of 13 months after the organization of the corporation or after its last annual meeting, the Superior Court may, upon the appli- cation of any shareholder, summarily order the meeting or the election, or both, to be held at such time and place, upon such notice and for the transaction of such business as may be designated in such order. At any meeting ordered to be called pursuant to this section, the shareholders present in person or by proxy and having voting powers shall constitute a quorum for the transaction of the business designated in such order.

HISTORY: L. 1968, c. 350; Amended by L. 1969, c. 102, ß 4.

LexisNexis (R) Notes:

LAW REVIEWS

1. 29 Rutgers Computer & Tech. L.J. 423, NOTE & COMMENT: Online Shareholder Meetings: Corporate Law Anom- alies or the Future of Governance?, 2003.

28 48 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 5. SHAREHOLDERS' MEETINGS, ELECTIONS, RIGHTS AND LIABILITIES

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:5-9 (2006)

ß 14A:5-9. Quorum of shareholders

(1) Unless otherwise provided in the certificate of incorporation or this act, the holders of shares entitled to cast a ma- jority of the votes at a meeting shall constitute a quorum at such meeting. The shareholders present in person or by proxy at a duly organized meeting may continue to do business until adjournment, notwithstanding the withdrawal of enough shareholders to leave less than a quorum. Less than a quorum may adjourn. (2) Whenever the holders of any class or series of shares are entitled to vote separately on a specified item of busi- ness, the provisions of this section shall apply in determining the presence of a quorum of such class or series for the transaction of such specified item of business.

HISTORY: L. 1968, c. 350.

29 49 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 5. SHAREHOLDERS' MEETINGS, ELECTIONS, RIGHTS AND LIABILITIES

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:5-10 (2006)

ß 14A:5-10. Voting of shares

Each outstanding share shall be entitled to one vote on each matter submitted to a vote at a meeting of shareholders, unless otherwise provided in the certificate of incorporation.

HISTORY: L. 1968, c. 350.

30 50 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 5. SHAREHOLDERS' MEETINGS, ELECTIONS, RIGHTS AND LIABILITIES

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:5-11 (2006)

ß 14A:5-11. Votes required

(1) Whenever any action, other than the election of directors, is to be taken by vote of the shareholders, it shall be au- thorized by a majority of the votes cast at a meeting of shareholders by the holders of shares entitled to vote thereon, un- less a greater plurality is required by the certificate of incorporation or another section of this act. (2) The certificate of incorporation may provide that any class or classes of shares, or any series thereof, shall vote as a class to authorize any action, including amendments to the certificate of incorporation. Such voting as a class shall be in addition to any other vote required by this act. Where voting as a class or series is provided in the certificate of in- corporation, it shall be by the proportionate vote provided in the certificate or, if no proportionate vote is so provided, then for any action other than the election of directors, by a majority of the votes cast at such meeting by the holders of shares of such class or series entitled to vote thereon. (3) Where voting as a class or series is required by this act to authorize any action, such action shall be authorized by a majority of the votes cast at such meeting by the holders of shares of each such class or series entitled to vote there- on, unless a greater vote is required by the certificate of incorporation or another section of this act. Such voting as a class shall be in addition to any other vote required by this act.

HISTORY: L. 1968, c. 350.

31 51 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 5. SHAREHOLDERS' MEETINGS, ELECTIONS, RIGHTS AND LIABILITIES

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:5-12 (2006)

ß 14A:5-12. Greater voting requirements

(1) The provisions of the certificate of incorporation shall control whenever, with respect to any action to be autho- rized by the shareholders of a corporation, including the election of directors, the certificate of incorporation requires the affirmative vote of a greater proportion of the votes cast, including a unanimous vote, by the holders of shares enti- tled to vote thereon, or by the holders of shares of any class or series thereof, than is required by this act with respect to such action. (2) An amendment of the certificate of incorporation which changes or deletes such a provision shall be authorized by the same vote as would be required to take action under the provision.

HISTORY: L. 1968, c. 350; Amended 1988, c. 94, ß 18.

LexisNexis (R) Notes:

LAW REVIEWS

1. 24 Seton Hall L. Rev. 234, CORPORATIONS EVENLY DIVIDED: JUDICIAL REMEDIES FOR EQUAL SHARE- HOLDERS, 1993.

32 58 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 5. SHAREHOLDERS' MEETINGS, ELECTIONS, RIGHTS AND LIABILITIES

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:5-19 (2006)

ß 14A:5-19. Proxy voting

Proxy voting. (1) Every shareholder entitled to vote at a meeting of shareholders or to express consent without a meeting may au- thorize another person or persons to act for him by proxy. Every proxy shall be executed in writing by the shareholder or his agent, except that a proxy may be given by a shareholder or his agent by telegram, cable, telephonic transmission or by any other means of electronic communication so long as that telegram, cable, telephonic transmission or other means of electronic communication either sets forth or is submitted with information from which it can be determined that the proxy was authorized by the shareholder or his agent. No proxy shall be valid for more than 11 months, unless a longer time is expressly provided therein. Unless it is irrevocable as provided in subsection 14A:5-19(3), a proxy shall be revocable at will. The grant of a later proxy revokes any earlier proxy unless the earlier proxy is irrevocable. A proxy shall not be revoked by the death or incapacity of the shareholder, but the proxy shall continue to be in force until re- voked by the personal representative or guardian of the shareholder. The presence at any meeting of any shareholder who has given a proxy does not revoke the proxy unless the shareholder files written notice of the revocation with the secretary of the meeting prior to the voting of the proxy or votes the shares subject to the proxy by written ballot. (2) A person named in a proxy as the attorney or agent of a shareholder may, if the proxy so provides, substitute an- other person to act in his place, including any other person named as an attorney or agent in the same proxy. The substi- tution shall not be effective until an instrument effecting it is filed with the secretary of the corporation. (3) A proxy which states that it is irrevocable is irrevocable if coupled with an interest either in the stock itself or in the corporation and, in particular and without limitation, if it is held by any of the following or a nominee of any of the following: (a) A pledgee; (b) A person who has purchased or agreed to purchase the shares; (c) A creditor of the corporation who has extended credit or has agreed to continue to extend credit to the corpora- tion if the proxy is given in consideration of the extension or continuation; (d) A person who has agreed to perform services as an employee of the corporation if the proxy is given in consid- eration of the agreement; or (e) A person designated pursuant to the terms of an agreement as to voting between two or more shareholders. An irrevocable proxy becomes revocable when the interest which supports the proxy has terminated. (4) Unless noted conspicuously on the share certificate, an otherwise irrevocable proxy may be revoked by a person who becomes the holder of the shares without actual knowledge of the restriction.

33 HISTORY: L. 1968, c. 350; Amended 1973, c. 366, ß 15; 1988, c. 94, ß 20; 1998, c. 144.

LexisNexis (R) Notes:

CASE NOTES

1. Under former N.J. Stat. Ann. ß 15:1-4(e) (now N.J. Stat. Ann. ß 14A:5-19), in the absence of statutory authority cou- pled with suitable provisions in the by-laws of a corporation, voting on corporate matters must be by the members of the corporation in person and not by proxy. Lo Curto v. River Edge Girl Scout Ass'n, 59 N.J. Super. 408, 157 A.2d 862, 1960 N.J. Super. LEXIS 614 (N.J. Super. Ct. 1960).

34 59 of 274 DOCUMENTS

LexisNexis (TM) New Jersey Annotated Statutes

*** THIS SECTION IS CURRENT THROUGH NEW JERSEY 212TH LEGISLATURE *** *** 1ST ANNUAL SESSION, (P.L. 2006 CH. 3) AND NOVEMBER 2005 ELECTION *** *** ANNOTATIONS CURRENT THROUGH APRIL 6, 2006 ***

TITLE 14A. CORPORATIONS, GENERAL CHAPTER 5. SHAREHOLDERS' MEETINGS, ELECTIONS, RIGHTS AND LIABILITIES

GO TO THE NEW JERSEY ANNOTATED STATUTES ARCHIVE DIRECTORY

N.J. Stat. ß 14A:5-20 (2006)

ß 14A:5-20. Voting trust