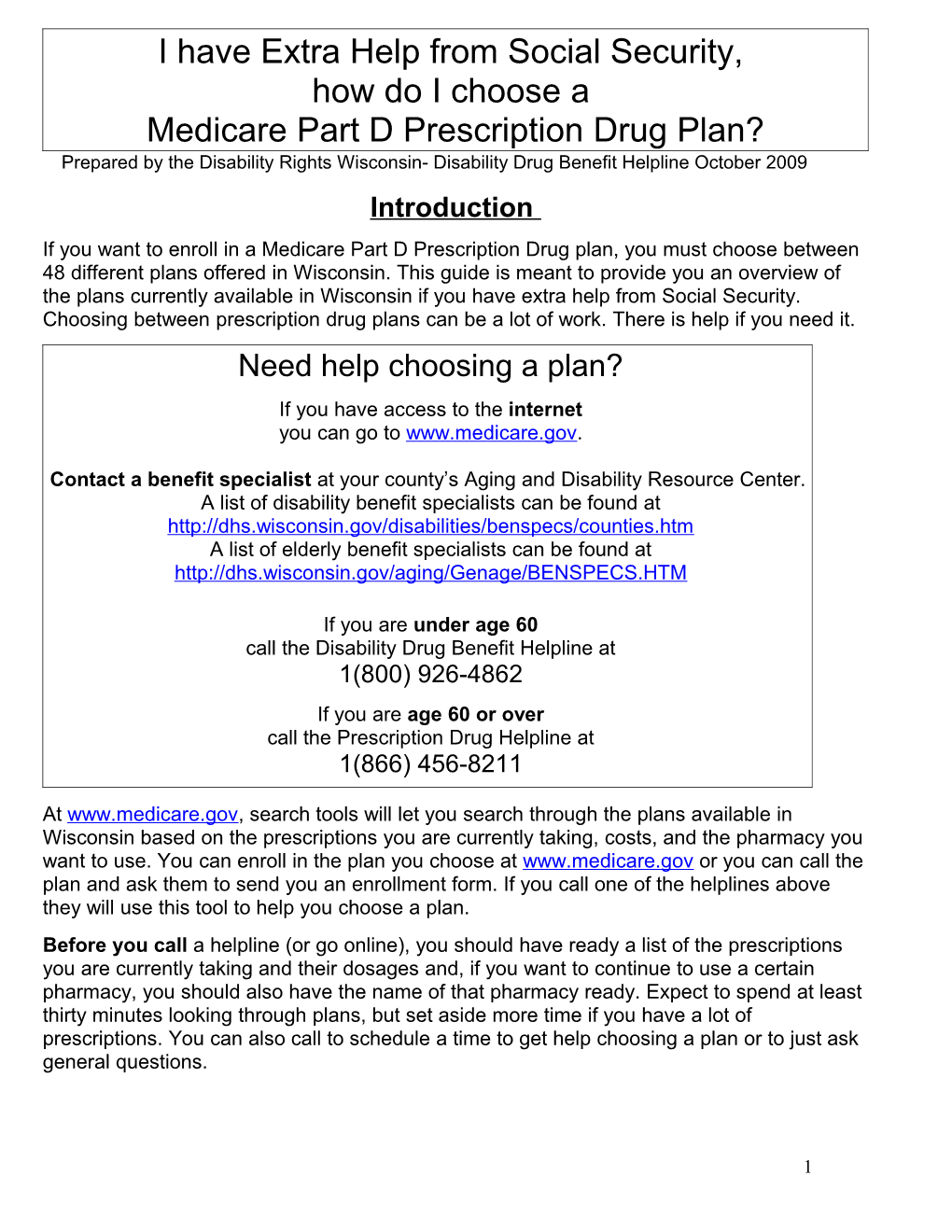

I have Extra Help from Social Security, how do I choose a Medicare Part D Prescription Drug Plan? Prepared by the Disability Rights Wisconsin- Disability Drug Benefit Helpline October 2009 Introduction If you want to enroll in a Medicare Part D Prescription Drug plan, you must choose between 48 different plans offered in Wisconsin. This guide is meant to provide you an overview of the plans currently available in Wisconsin if you have extra help from Social Security. Choosing between prescription drug plans can be a lot of work. There is help if you need it. Need help choosing a plan? If you have access to the internet you can go to www.medicare.gov.

Contact a benefit specialist at your county’s Aging and Disability Resource Center. A list of disability benefit specialists can be found at http://dhs.wisconsin.gov/disabilities/benspecs/counties.htm A list of elderly benefit specialists can be found at http://dhs.wisconsin.gov/aging/Genage/BENSPECS.HTM

If you are under age 60 call the Disability Drug Benefit Helpline at 1(800) 926-4862 If you are age 60 or over call the Prescription Drug Helpline at 1(866) 456-8211

At www.medicare.gov, search tools will let you search through the plans available in Wisconsin based on the prescriptions you are currently taking, costs, and the pharmacy you want to use. You can enroll in the plan you choose at www.medicare.gov or you can call the plan and ask them to send you an enrollment form. If you call one of the helplines above they will use this tool to help you choose a plan. Before you call a helpline (or go online), you should have ready a list of the prescriptions you are currently taking and their dosages and, if you want to continue to use a certain pharmacy, you should also have the name of that pharmacy ready. Expect to spend at least thirty minutes looking through plans, but set aside more time if you have a lot of prescriptions. You can also call to schedule a time to get help choosing a plan or to just ask general questions.

1 Each prescription drug plan is different in important ways. This document will explain how the plans available in Wisconsin are alike and how they are different. Some important rules all plans must follow will be explained below. The plans will be compared and will give you a list of the plans that cover the highest number of your drugs and will be ordered with the ones with the lowest annual estimated costs at the top. You will be able to view the following information about each plan: 1. Costs: plans have different monthly premiums, copays, coinsurances, and coverage gaps. 2. Pharmacy access: each plan will have a different list of pharmacies you can go to get your drugs, called Network Pharmacies. 3. Formulary: each plan will have a different list of drugs they will cover, called a formulary. 4. Other Important Questions. The two basic types of Medicare prescription drug plans The two types of Medicare Prescription drug plans are: 1. Stand alone Medicare prescription drug plans (also called PDP’s or Medicare Part D). These are plans that only cover prescription drugs. If you choose a stand alone plan, you can continue to use your Medicare Part A and B benefits and Medicaid benefits (under your Forward card) as before. All of these plans cover Wisconsin residents, statewide. 2. Medicare Advantage plans (also called Medicare Health Plans, MA-PDP’s, or Medicare Part C). These are HMO or PPO plans that cover all your Medicare benefits with a specific list of providers. (These plans are not Medicare Supplement Policies.) If you choose one of these plans, you may have to change doctors or hospitals for your Medicare Part A and B benefits since you are often required to go to a certain list of providers. Many of these plans are only available in specific regions or counties of the state. This guide only discusses Stand alone Medicare prescription drug plans. If you have questions about Medicare Advantage or about Medicare Supplement policies, call the Medigap Helpline at 1(800)242-1060. Before choosing any plan it is important to understand how it works with your current health insurance. Costs VERY IMPORTANT! If you were granted “extra help” to pay for your prescription drug plan from Social Security, You will have lower PREMIUMS, DEDUCTIBLES, CO-INSURANCE, and COPAYS than other Medicare beneficiaries.

If you were granted “extra help” to pay for your Medicare Part D prescription drug plan, look at your “Notice of Award” letter from Social Security to determine how much help you will receive, or call Social Security at 1(800) 772-1213. Some people may only have co- 2 payments of $1.10 generics and $3.30 brand names or $2.50 generics and $6.30 for brand names depending on income. People with full extra help will have no monthly premium if in one of the 10 low cost plans, no coverage gap or “donut hole,” no deductible, and low co- payments. People with partial extra help will have no coverage gap or “donut hole,” pay lower deductibles, lower premiums, and lower co-insurances than people with no extra help. See page 6 for information about low cost plans in 2010.

Pharmacy Access Generally, you MUST get your prescriptions from a network pharmacy. The plans each have a complete list of all the pharmacies you can go to, called a pharmacy directory. If you want to search for plans that work with a specific pharmacy, you can go to each plan’s website, to www.medicare.gov to compare Medicare prescription drug plans, or you can call a Helpline for help. Most plans allow a beneficiary to mail order their prescriptions (usually you can order up to a 3 month supply and only pay two co-payments). 3 plans do not offer mail order. These are the plans offered by Community Care Rx. Formulary lists Each drug plan will have a list of drugs it covers, called a “formulary.” If you want to see a “comprehensive formulary” or an “abridged formulary” for a specific plan, you can go to the plan’s website or call the plan and request that one be sent to you. If you want to find plans that cover all or most of the drugs you need, you can go to the “Formulary Finder” at www.medicare.gov. You can search through the plans based on the prescriptions and dosage you are currently taking. There are many rules that each drug plan must follow when it makes its formulary. Even if a drug is included on a drug list, you still might have to ask your doctor for help with “drug management” like prior authorization or step therapy. 2. Drug management. Most plans will have special requirements that must be met before you can fill certain prescriptions. These are usually brand name, expensive prescriptions. The most common drug management techniques are: Prior Authorization (sometimes called pre-certification): This usually requires your doctor to write a special note to the drug plan indicating your prescription is medically necessary. If a drug has a prior authorization requirement, you can ask the plan ahead of time for a coverage determination to make sure you can get the prescription filled when you need it (see paragraph 4 below). Step Therapy: This usually means you have to try a generic or less expensive medication to see if it works for you before you can use the drug with a step therapy requirement. If you have already tried the generic drug or if you have a reason to know it will not work for you or harm you, you can request an exception to the step therapy requirement (see paragraph 4 below).

3 Quantity Limits: This means you can generally only get a certain amount of the drug at a time, usually one month at a time. If you need more than one month’s supply at a time or if you need more than most people of a drug in a given month, you can request an exception to the quantity limits (see paragraph 4 below). 3. There are some drugs that even the lowest cost Medicare Part D prescription drug plans can not cover. (Higher cost plans may cover some of these drugs) The drugs that a standard Medicare Part D prescription drug plan can not cover are: benzodiazepines and barbiturates (these are types of anti-anxiety/seizure medications), prescription vitamins, fertility drugs, weight control drugs, and Medicare Part B drugs. Medicare Part B drugs are often given to you by a physician or require some type of medical equipment, like a syringe or an inhaler. Diabetes medicines (insulin) and supplies that are not covered by Medicare Part B will be covered by Medicare Part D prescription drug plans.

If you take some of these drugs, you may need to determine whether it is cheaper for you to enroll in a more expensive plan that covers these drugs or to pay out of pocket for them at the pharmacy. Also, Medicaid will pay for these drugs. Some people who receive extra help may be eligible for Medicaid. Check with you county human services department to find out if you are eligible for Medicaid. A list of these departments can be found at http://dhs.wisconsin.gov/em/imagencies/index.htm. 4. Exceptions and coverage determinations. You can request an exception or coverage determination to get drugs not covered by your drug plan’s formulary, that have step therapy requirement or quantity limit that will not work for you, or reduced to a lower co-payment (plans will not reduce brand name drug costs down to the generic price, but can reduce co-payments for a brand name drug to a lower cost for brand names.) You can also find out if your prior authorization will be accepted by asking for a coverage determination. You should request an exception directly from your drug plan before your prescription is written if you can. (You do not ask your pharmacist for an exception) Your drug plan usually must cover your medication if your doctor can show 1) it is medically necessary and 2) other drugs on the list of drugs your plan covers are not as effective or are harmful to you. To find out more about this process, call the Disability Drug Benefit Helpline at 1 (800) 926-4862 or go to our website at www.drwi.org to download a copy of our appeals booklet. Other Important Questions How do I enroll in a drug plan?

4 Once you have chosen the plan you want, you can enroll 1) at www.medicare.gov, 2) by calling the drug plan and requesting an enrollment, or 3) by calling 1(800)Medicare to request an enrollment form for the plan you want. If you are changing plans, you simply need to enroll in the new plan you want and your old plan should send you a dis-enrollment notice once your new plan accepts your enrollment form. You should also get a notice to confirm enrollment from your new plan and a new prescription drug plan card to use at the pharmacy. Can I change my drug plan once I have enrolled? Generally, you can only change your plan once a year during the “annual election period:” November 15 – December 31, although anybody with extra help through social security can change plans once a month. Can my plan change the drugs that are on the list of covered drugs? Yes. If you are currently taking a drug and it is removed from the plan’s drug list, the plan must give you 60 days notice before making the change. This is meant to give you and your doctor time to ask the plan to cover the drug or request an “exception.” If you do not get this notice and you try to re-fill a prescription of a drug that has been removed from the list, you should be given a 60 day supply of the drug. If you are not currently taking the drug the plan is not required to notify you. Therefore, each time you are prescribed a new drug you and your doctor should consult your plan and make sure the drug is covered if you can’t a generic version of the drug.

5 2010 Medicare Part D Low Cost Plans (sometimes called Benchmark Plans) Data as of October 31, 2009. Includes all contracts/plans regardless of 2010 approval status. Employer sponsored plans (800 series) are excluded. Plans under sanction are not shown. Plan Name Phone Company $0 Contract Plan prem ID ID . w/ full LIS 1 AARP (800) 745-0922 non-members United Health · S5921 071 MedicareRx (888) 867-5575 members Care Saver 2 Aetna Rx (800) 445-1796 non-members Aetna · S5810 050 Essentials (877) 238-6211 members Medicare 3 BravoRx (800) 723 8209 non-members Bravo Health · S5998 022 (877) 504-7252 members Insurance Company 4 CIGNA (800) 735-1459 non-members CIGNA · S5617 223 Medicare Rx (800) 222-6700 members Medicare Rx Plan One 5 Community (866) 423-5040 non-members Universal · S5803 085 CCRx Basic (866) 684-5353 members American 6 First Health (800) 588-3322 non-members First Health · S5768 083 Part D (866) 865-0662 for members Part D -Permier 7 Health Net (800) 606-3604 non-members Health Net · S5678 038 Orange (800) 806-8811 members Orange Option 1 8 HealthSpring (800) 331-6293 for all HealthSpring · S5932 015 Prescription Prescription Drug Plan- Drug Plan Reg 16 9 PrescribaRx (800) 807-9990 non-members Universal · S5597 250 Bronze (800) 818-0007 members American 10 SilverScript (866) 552-6106 non-members SilverScript · S5601 032 Value (866) 235-5660 members Insurance Company

Plans from 2009 that are no longer on Low Cost List include: 1) Advantage Star Plan by Rx America, 2) Blue Medicare Rx Value, 3)Envision Rx Silver, 4) Medco Medicare Prescription Drug Plan- Value, 5) Medicare Rx Rewards Standard, 6) Wellcare Classic

6