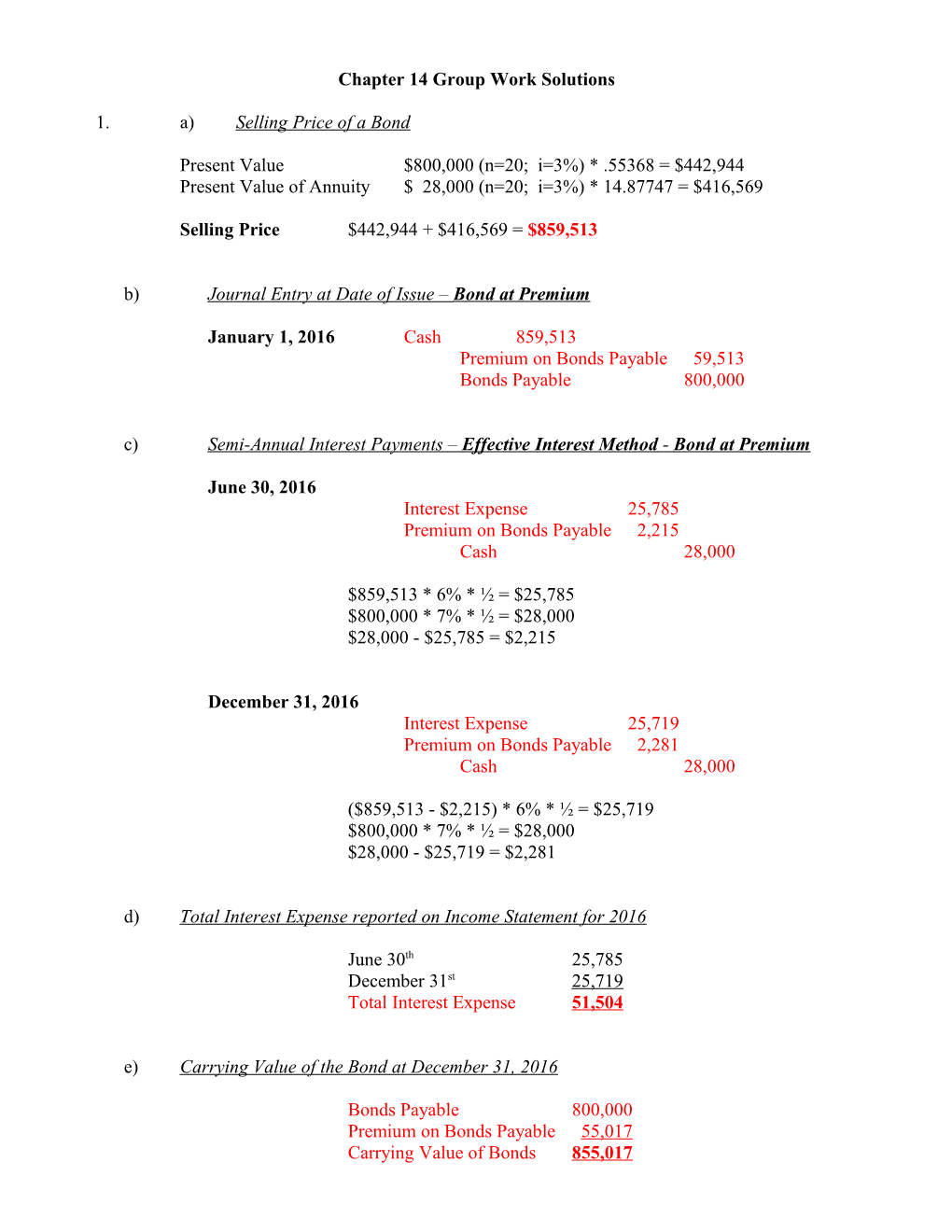

Chapter 14 Group Work Solutions

1. a) Selling Price of a Bond

Present Value $800,000 (n=20; i=3%) * .55368 = $442,944 Present Value of Annuity $ 28,000 (n=20; i=3%) * 14.87747 = $416,569

Selling Price $442,944 + $416,569 = $859,513

b) Journal Entry at Date of Issue – Bond at Premium

January 1, 2016 Cash 859,513 Premium on Bonds Payable 59,513 Bonds Payable 800,000

c) Semi-Annual Interest Payments – Effective Interest Method - Bond at Premium

June 30, 2016 Interest Expense 25,785 Premium on Bonds Payable 2,215 Cash 28,000

$859,513 * 6% * ½ = $25,785 $800,000 * 7% * ½ = $28,000 $28,000 - $25,785 = $2,215

December 31, 2016 Interest Expense 25,719 Premium on Bonds Payable 2,281 Cash 28,000

($859,513 - $2,215) * 6% * ½ = $25,719 $800,000 * 7% * ½ = $28,000 $28,000 - $25,719 = $2,281

d) Total Interest Expense reported on Income Statement for 2016

June 30th 25,785 December 31st 25,719 Total Interest Expense 51,504

e) Carrying Value of the Bond at December 31, 2016

Bonds Payable 800,000 Premium on Bonds Payable 55,017 Carrying Value of Bonds 855,017 f) Semi-Annual Interest Payments – Straight-Line Method - Bond at Premium

June 30, 2016 Interest Expense 25,024 Premium on Bonds Payable 2,976 Cash 28,000

$59,513/20 = $2,976 $800,000 * 7% * ½ = $28,000 $28,000 - $2,976 = $25,024

December 31, 2016 Interest Expense 25,024 Premium on Bonds Payable 2,976 Cash 28,000

$59,513/20 = $2,976 $800,000 * 7% * ½ = $28,000 $28,000 - $2,976 = $25,024 g) Total Interest Expense reported on Income Statement for 2016

June 30th 25,024 December 31st 25,024 Total Interest Expense 50,048

h) Carrying Value of the Bond at December 31, 2016

Bonds Payable 800,000 Premium on Bonds Payable 53,561 Carrying Value of Bonds 853,561 2. a) Journal Entry at Date of Issue – Bond at Discount

January 1, 2016 Cash 864,100 Discount on Bonds Payable 135,900 Bonds Payable 1,000,000

b) Semi-Annual Interest Payments – Effective Interest Method - Bond at Discount

June 30, 2016 Interest Expense 34,564 Cash 30,000 Discount on Bonds Payable 4,564

$864,100 * 8% * ½ = $34,564 $1,000,000 * 6% * ½ = $30,000 $34,564 - $30,000 = $4,564

December 31, 2016 Interest Expense 34,747 Cash 30,000 Discount on Bonds Payable 4,747

($864,100 + $4,564) * 8% * ½ = $34,747 1,000,000 * 6% * ½ = $30,000 $34,747 - $30,000 = $4,747

c) Total Interest Expense reported on Income Statement for 2016

June 30th 34,564 December 31st 34,747 Total Interest Expense 69,311

d) Carrying Value of the Bond at December 31, 2016

Bonds Payable 1,000,000 Discount on Bonds Payable (126,589) Carrying Value of Bonds 873,411 e) Semi-Annual Interest Payments – Straight-Line Method - Bond at Discount

June 30, 2016 Interest Expense 36,795 Discount on Bonds Payable 6,795 Cash 30,000

$135,900/20 = $6,795 $1,000,000 * 6% * ½ = $30,000 $30,000 + $6,795 = $36,795

December 31, 2016 Interest Expense 36,795 Discount on Bonds Payable 6,795 Cash 30,000

$135,900/20 = $6,795 $1,000,000 * 6% * ½ = $30,000 $30,000 + $6,795 = $36,795

f) Total Interest Expense reported on Income Statement for 2016

June 30th 36,795 December 31st 36,795 Total Interest Expense 73,590

g) Carrying Value of the Bond at December 31, 2016

Bonds Payable 1,000,000 Discount on Bonds Payable (122,310) Carrying Value of Bonds 877,690 3. Issuing Bonds Between Interest Payment Periods

a) March 1, 2016 Cash 304,000 Bonds Payable 300,000 Interest Expense 4,000

300,000 * .08 * 2/12 = $4,000

b) June 30, 2016 Interest Expense 12,000 Cash 12,000

300,000 * .08 * 6/12 = $12,000

4. Retirement of Callable Bond Issuance

September 1, 2016 Bonds Payable 3,000,000 Loss on Retirement 203,000 Cash 3,090,000 Discount on Bonds Payable 98,000 Unamortized Bond Issue Costs 15,000

($3,090,000+$98,000+$15,000)-$3,000,000 = $203,000 Loss 5. Acquiring an Asset with a Note

a) January 1, 2016

Machine 350,261 Discount on Note Payable 49,739 Note Payable 400,000

Present Value $400,000 (n=3; i=10%) * .75131 = $300,524 Present Value of Annuity $ 20,000 (n=3; i=10%) * 2.48685 = $49,737 $350,261

b) December 31, 2016

Interest Expense 35,026 Discount on Note Payable 15,026 Cash 20,000

Carrying Value * Market Rate = Interest Expense 350,261 * .10 = 35,026

New Carrying Value after the above posting =

Note Payable 400,000 Discount (34,713) New Carrying Value 365,287

c) December 31, 2017

Interest Expense 36,529 Discount on Note Payable 16,529 Cash 20,000

Carrying Value * Market Rate = Interest Expense 365,287 * .10 = 36,529

New Carrying Value after the above posting =

Note Payable 400,000 Discount ( 18,184) New Carrying Value 381,816