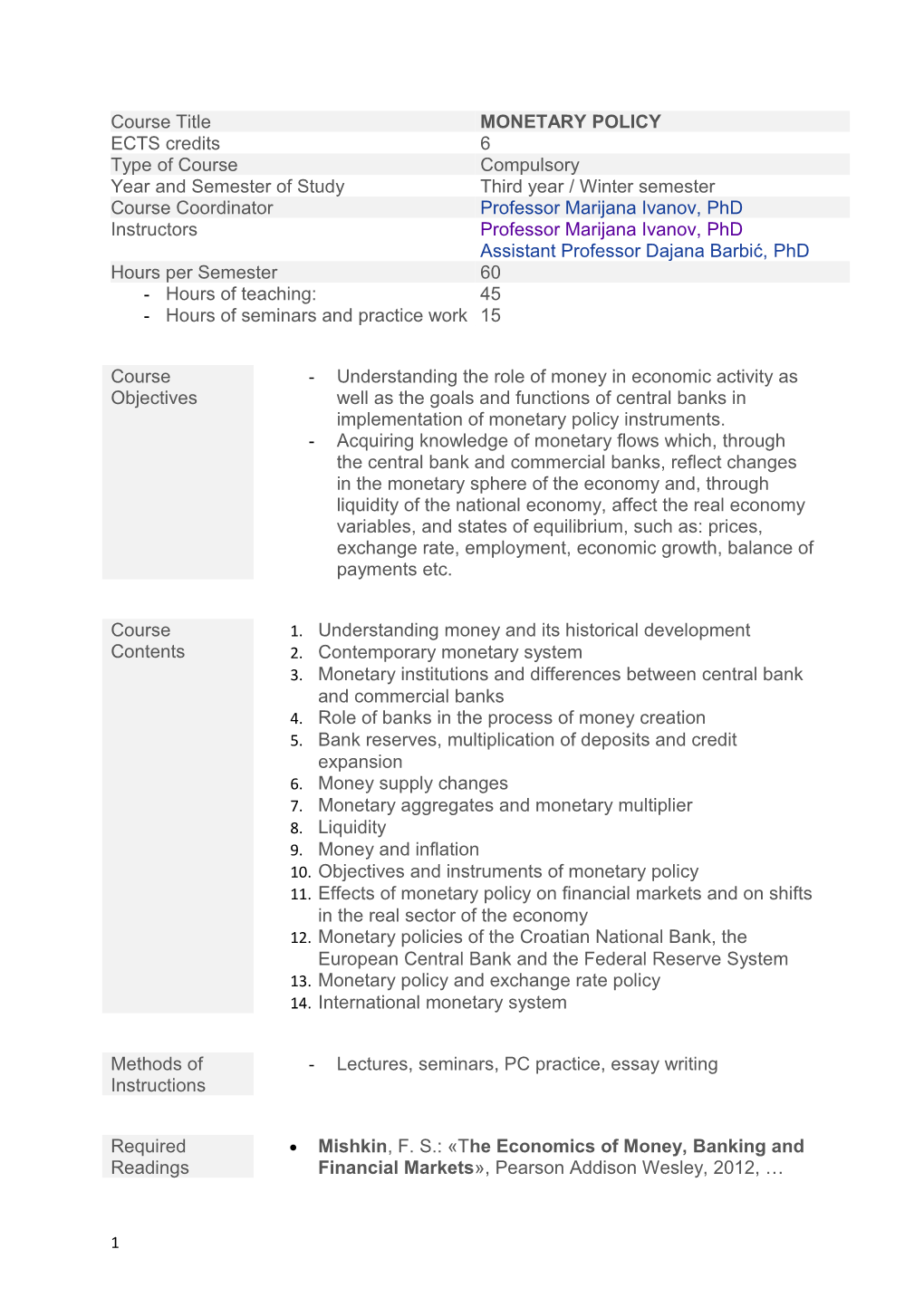

Course Title MONETARY POLICY ECTS credits 6 Type of Course Compulsory Year and Semester of Study Third year / Winter semester Course Coordinator Professor Marijana Ivanov, PhD Instructors Professor Marijana Ivanov, PhD Assistant Professor Dajana Barbić, PhD Hours per Semester 60 - Hours of teaching: 45 - Hours of seminars and practice work 15

Course - Understanding the role of money in economic activity as Objectives well as the goals and functions of central banks in implementation of monetary policy instruments. - Acquiring knowledge of monetary flows which, through the central bank and commercial banks, reflect changes in the monetary sphere of the economy and, through liquidity of the national economy, affect the real economy variables, and states of equilibrium, such as: prices, exchange rate, employment, economic growth, balance of payments etc.

Course 1. Understanding money and its historical development Contents 2. Contemporary monetary system 3. Monetary institutions and differences between central bank and commercial banks 4. Role of banks in the process of money creation 5. Bank reserves, multiplication of deposits and credit expansion 6. Money supply changes 7. Monetary aggregates and monetary multiplier 8. Liquidity 9. Money and inflation 10. Objectives and instruments of monetary policy 11. Effects of monetary policy on financial markets and on shifts in the real sector of the economy 12. Monetary policies of the Croatian National Bank, the European Central Bank and the Federal Reserve System 13. Monetary policy and exchange rate policy 14. International monetary system

Methods of - Lectures, seminars, PC practice, essay writing Instructions

Required Mishkin, F. S.: «The Economics of Money, Banking and Readings Financial Markets», Pearson Addison Wesley, 2012, …

1 2015 Lectures (presentations and other sources) http://www.efzg.unizg.hr/default.aspx?id=11284

Additional Mayer, T. A.; Duesenbery, J.S.; Aliber, R.Z.: «Money, Readings Banking and the Economy», W.W. Norton & Company, 1997;

Student Active participation in all forms of class. Writing homework Obligations assignments on specific topics and reviews of current issues in the field of monetary policy.

Method of Assessment will be carried out continuously, during the Assessment pedagogical work with students (lectures, practical work, individual problem solving and case studies). The final grade will depend on two written mid-term tests, and the success at the final oral exam. Each written mid-term test carries 50 possible points, and together make up a 100 possible points.

For each test, the student should get at least 60% of possible points.

During the seminar classes, students can further explore and present a topic related to the course content and thus collect (from 1 to 5) extra points. Total points for final grade: 91 and more – excellent (5) from 81 to 90 – very good (4) from 71 to 80 – good (3) from 60 to 70 – sufficient (2) less than 60 – insufficient (1).

Course and Internal evaluation will be carried out by an anonymous teaching quality survey among the students that will be organized by the assurance Faculty during the last few weeks of a semester. method (method of monitoring the quality of the course and its teaching)

MONETARY POLICY

2 Schedule (2016/17): Topics of lectures

4.10.2016. Understanding money and its historical development 11.10.2016. Contemporary monetary system 18.10.2016. Monetary institutions and differences between central bank and commercial banks - Appendix: Financial institutions and markets 25.10.2016. Role of banks in the process of money creation - Appendix: Lending capacity of commercial banks 8.11.2016. Bank reserves, multiplication of deposits and credit expansion - Examples 1-6 - Appendix: Risk management in banking 15.11.2016. Money supply changes - How the central bank can affect the reserves of commercial banks? Monetary aggregates and monetary multiplier - Balance sheet of the central bank 22.11.2016. Liquidity Demand for money - Monetary theory 29.11.2016 1 ST MID-TERM TEST

Money and inflation - Monetarist view - Keynesian view - High employment targets and inflation 6.12.2016. Objectives and instruments of monetary policy 13.12.2016. Effects of monetary policy on financial markets and on shifts in the real sector of the economy - The main transmission channels of monetary policy 20.12.2016. Monetary policies of the Croatian National Bank 10.1.2017. Monetary policies of the European Central Bank and the Federal Reserve System 17.1.2017. Monetary policy and exchange rate policy International monetary system 24.1.2017. 2nd MID-TERM TEST

Selected topics: International financial system – from crisis to prosperity

3