Installment Sales Example & Homework Problem

Example: 1. ABC Corp. sold a piece of real estate on January 2, 2009 for $5,000,000. It had purchased the property in 2002 for $4,500,000 in cash. At that time the land was worth $450,000 and the remainder was attributed to the building. At the time of the sale, the carrying value of the building was $3,650,000. The terms of the sale were as follows: Downpayment $ 250,000 Note Receivable $4,750,000 Interest rate 10% Length of mortgage 20 years Annual payment $ 557,933 due at end of each year The sale has been consummated, the seller's receivable is not subject to future subordination, and the seller has no continuing involvement with the property. However, because the initial investment is inadequate, the seller must use the installment method to account for this sale. REQUIRED: Journal entries needed in 2009, 2010. Solution to Installment Accounting Example 1. Gross profit percentage = 18% [(5,000-3650-450)/5000 or $900,000 deferred gross profit divided by $5,000,000 selling price 1/2/09 Cash 250,000 Notes Receivable 4,750,000 Acc'd Depreciation 400,000 Land 450,000 Building 4,050,000 Deferred gross profit on installment sale of land 900,000 12/28/09 Cash 557,933 Interest revenue 475,000 Notes receivable 82,933 12/31/09 Deferred gross profit {(82,933+250,000)*18%} 59,928 Gain on installment sale of land 59,928 12/31/10 Cash 557,933 Interest Revenue 466,707 Note receivable 91,227 12/31/10 Deferred gross profit (18% * 91,227) 16,421 Gain on installment sale of land 16,421

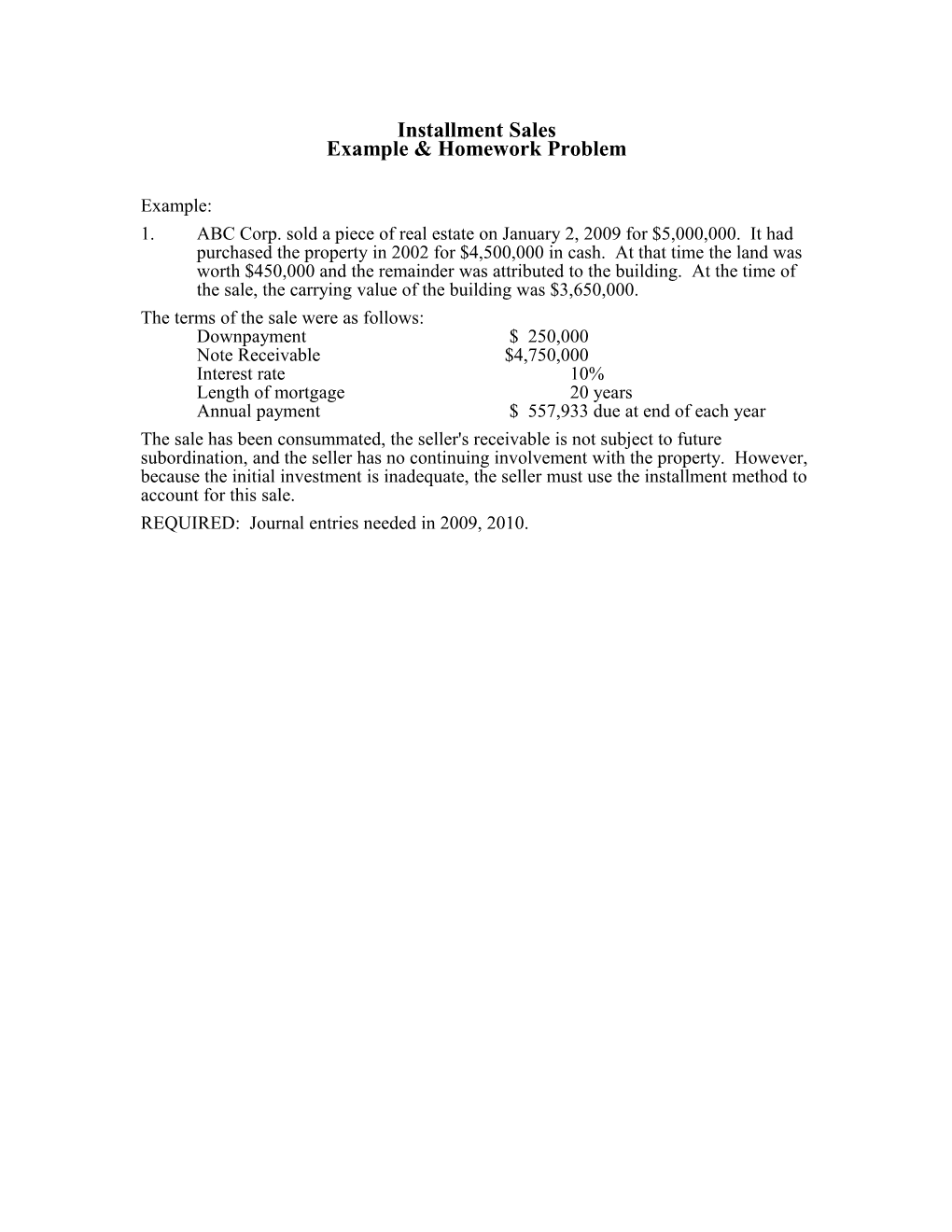

10.00% GROSS BALANCE YEAR PAYMENT INTEREST PRINCIPAL BALANCE PROFIT DEFERRED REVENUE RECOGNIZEDPROFIT $ 5,000,000 $ 900,000 DWNPYMT $ 250,000 $250,000 $4,750,000 $45,000 $855,000 2009 $557,933 $475,000 $82,933 $4,667,067 $14,928 $840,072 2010 $557,933 $466,707 $91,227 $4,575,840 $16,421 $823,651 2011 $557,933 $457,584 $100,349 $4,475,491 $18,063 $805,588 2012 $557,933 $447,549 $110,384 $4,365,107 $19,869 $785,719 2013 $557,933 $436,511 $121,422 $4,243,685 $21,856 $763,863 2014 $557,933 $424,369 $133,564 $4,110,121 $24,042 $739,822 2015 $557,933 $411,012 $146,921 $3,963,200 $26,446 $713,376 2016 $557,933 $396,320 $161,613 $3,801,587 $29,090 $684,286 2017 $557,933 $380,159 $177,774 $3,623,812 $31,999 $652,286 2018 $557,933 $362,381 $195,552 $3,428,261 $35,199 $617,087 2019 $557,933 $342,826 $215,107 $3,213,154 $38,719 $578,368 2020 $557,933 $321,315 $236,618 $2,976,536 $42,591 $535,776 2021 $557,933 $297,654 $260,279 $2,716,257 $46,850 $488,926 2022 $557,933 $271,626 $286,307 $2,429,949 $51,535 $437,391 2023 $557,933 $242,995 $314,938 $2,115,011 $56,689 $380,702 2024 $557,933 $211,501 $346,432 $1,768,579 $62,358 $318,344 2025 $557,933 $176,858 $381,075 $1,387,504 $68,594 $249,751 2026 $557,933 $138,750 $419,183 $968,322 $75,453 $174,298 2027 $557,933 $96,832 $461,101 $507,221 $82,998 $91,300 2028 $557,933 $50,722 $507,220 $0 $91,300 $0 $ 11,408,660 $6,408,670 $5,000,000 $900,000 Homework Problem:

2. RVO Corp. sold a piece of real estate on January 2, 2009 for $10,000,000. It had purchased the property in 2001 for $6,500,000 in cash. At that time the land was worth $500,000. At the time of the sale, the carrying value of the building was $4,500,000. The terms of the sale were as follows: Downpayment $ 500,000 Note Receivable $ 9,500,000 Interest rate 12% Length of mortgage 20 years Annual payment $ 1,115,866 due at end of each year

The sale has been consummated, the seller's receivable is not subject to future subordination, and the seller has no continuing involvement with the property. However, because the initial investment is inadequate, the seller must use the installment method to account for this sale. REQUIRED: Journal entries needed in 2009, and 2010