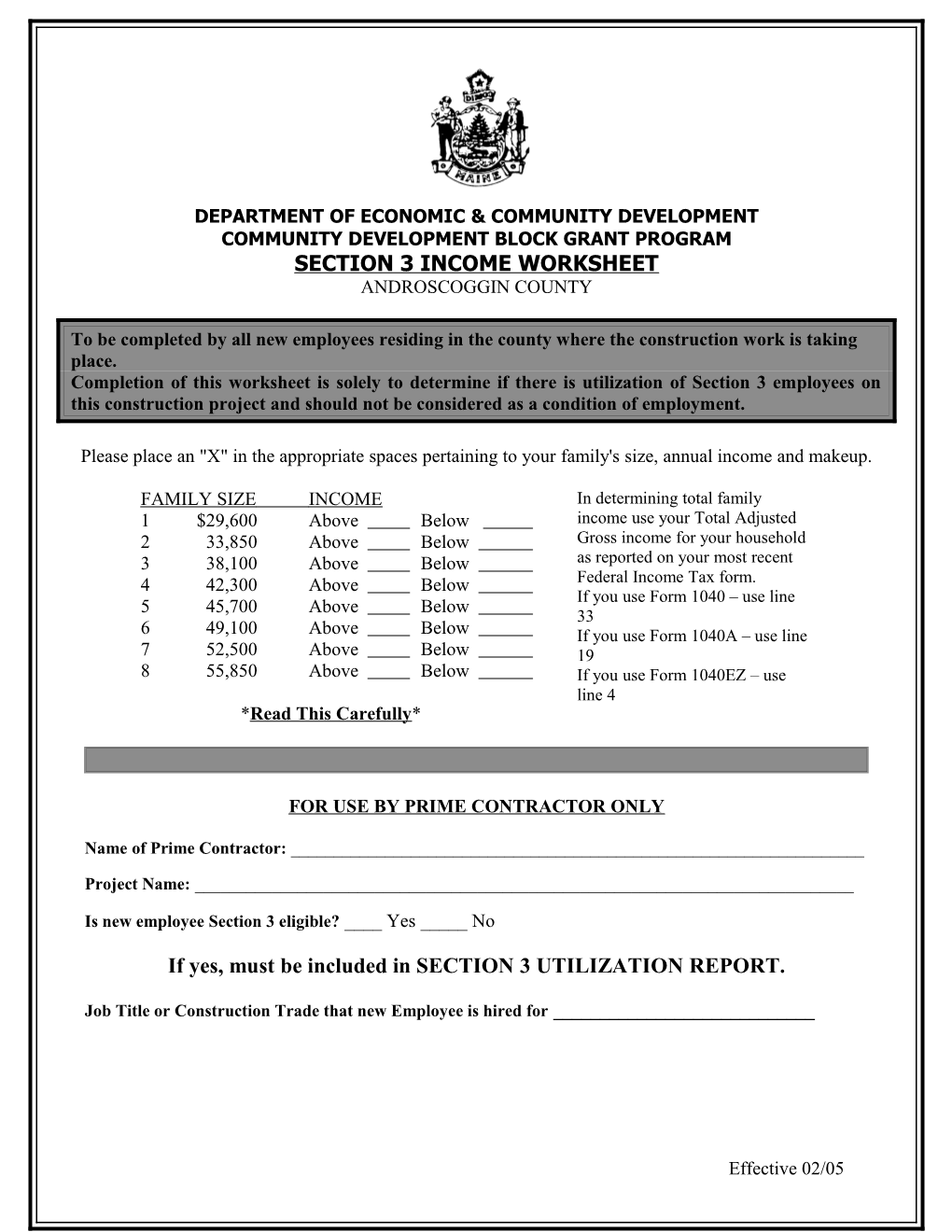

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET ANDROSCOGGIN COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $29,600 Above Below income use your Total Adjusted 2 33,850 Above Below Gross income for your household 3 38,100 Above Below as reported on your most recent 4 42,300 Above Below Federal Income Tax form. If you use Form 1040 – use line 5 45,700 Above Below 33 6 49,100 Above Below If you use Form 1040A – use line 7 52,500 Above Below 19 8 55,850 Above Below If you use Form 1040EZ – use line 4 *Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05 DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET AROOSTOOK COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $27,600 Above Below income use your Total Adjusted Gross income for your household 2 31,550 Above Below as reported on your most recent 3 35,550 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 39,450 Above Below 33 5 42,600 Above Below If you use Form 1040A – use line 6 45,750 Above Below 19 7 48,900 Above Below If you use Form 1040EZ – use 8 52,050 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05 DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET CUMBERLAND COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $32,400 Above Below income use your Total Adjusted Gross income for your household 2 37,000 Above Below as reported on your most recent 3 41,650 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 46,250 Above Below 33 5 49,950 Above Below If you use Form 1040A – use line 6 53,650 Above Below 19 7 57,350 Above Below If you use Form 1040EZ – use 8 61,050 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No Effective 02/05 If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET FRANKLIN COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $27,600 Above Below income use your Total Adjusted Gross income for your household 2 31,550 Above Below as reported on your most recent 3 35,500 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 39,450 Above Below 33 5 42,600 Above Below If you use Form 1040A – use line 6 45,750 Above Below 19 7 48,900 Above Below If you use Form 1040EZ – use 8 52,050 Above Below line 4

*Read This Carefully* Effective 02/05 FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET HANCOCK COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME 7 52,950 Above 1 $29,900 Above Below Below 8 56,350 Above 2 34,150 Above Below Below 3 38,450 Above Below 4 42,700 Above Below *Read This Carefully* 5 46,100 Above Below In determining total family 6 49,550 Above Below income use your Total Adjusted Gross income for your household Effective 02/05 as reported on your most recent Federal Income Tax If you use Form 1040EZ – use form. line 4 If you use Form 1040 – use line 33 If you use Form 1040A – use line 19

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET KENNEBEC COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME 4 43,200 Above 1 $30,250 Above Below Below 5 46,650 Above 2 34,550 Above Below Below 3 38,900 Above Below Effective 02/05 6 50,100 Above Below If you use Form 1040 – use line 7 53,550 Above Below 33 8 57,000 Above Below If you use Form 1040A – use line 19 *Read This Carefully* If you use Form 1040EZ – use line 4 In determining total family income use your Total Adjusted Gross income for your household as reported on your most recent Federal Income Tax form.

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET KNOX COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Effective 02/05 Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $30,450 Above Below income use your Total Adjusted Gross income for your household 2 34,800 Above Below as reported on your most recent 3 39,150 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 43,500 Above Below 33 5 47,000 Above Below If you use Form 1040A – use line 6 50,450 Above Below 19 7 53,950 Above Below If you use Form 1040EZ – use 8 57,400 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET LINCOLN COUNTY

Effective 02/05 To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $31,450 Above Below income use your Total Adjusted Gross income for your household 2 35,900 Above Below as reported on your most recent 3 40,400 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 44,900 Above Below 33 5 48,500 Above Below If you use Form 1040A – use line 6 52,100 Above Below 19 7 55,700 Above Below If you use Form 1040EZ – use 8 59,250 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT

Effective 02/05 COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET OXFORD COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $27,600 Above Below income use your Total Adjusted Gross income for your household 2 31,550 Above Below as reported on your most recent 3 35,500 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 39,450 Above Below 33 5 42,600 Above Below If you use Form 1040A – use line 6 45,750 Above Below 19 7 48,900 Above Below If you use Form 1040EZ – use 8 52,050 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05 DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET PENOBSCOT COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $27,600 Above Below income use your Total Adjusted Gross income for your household 2 31,550 Above Below as reported on your most recent 3 35,500 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 39,450 Above Below 33 5 42,600 Above Below If you use Form 1040A – use line 6 45,750 Above Below 19 7 48,900 Above Below If you use Form 1040EZ – use 8 52,050 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05 DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET PISCATAQUIS COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $27,600 Above Below income use your Total Adjusted Gross income for your household 2 31,550 Above Below as reported on your most recent 3 35,500 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 39,450 Above Below 33 5 42,600 Above Below If you use Form 1040A – use line 6 45,750 Above Below 19 7 48,900 Above Below If you use Form 1040EZ – use 8 52,050 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05 DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET SAGADAHOC COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME *Read This Carefully* 1 $34,350 Above Below In determining total family income use your Total Adjusted 2 39,250 Above Below Gross income for your household 3 44,150 Above Below as reported on your most recent 4 49,050 Above Below Federal Income Tax form. If you use Form 1040 – use line 5 52,950 Above Below 33 6 56,900 Above Below If you use Form 1040A – use line 7 60,800 Above Below 19 8 64,750 Above Below If you use Form 1040EZ – use line 4

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05 DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET SOMERSET COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME In determining total family 1 $27,600 Above Below income use your Total Adjusted Gross income for your household 2 31,550 Above Below as reported on your most recent 3 35,500 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 39,450 Above Below 33 5 42,600 Above Below If you use Form 1040A – use line 6 45,750 Above Below 19 7 48,900 Above Below If you use Form 1040EZ – use 8 52,050 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05 DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET WALDO COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup.

FAMILY SIZE INCOME *Read This Carefully* 1 $28,050 Above Below In determining total family income use your Total Adjusted 2 32,100 Above Below Gross income for your household 3 36,100 Above Below as reported on your most recent 4 40,100 Above Below Federal Income Tax form. If you use Form 1040 – use line 5 43,300 Above Below 33 6 46,500 Above Below If you use Form 1040A – use line 7 49,700 Above Below 19 8 52,950 Above Below If you use Form 1040EZ – use ______line 4

FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

Effective 02/05 If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET WASHINGTON COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup

FAMILY SIZE INCOME In determining total family 1 $27,600 Above Below income use your Total Adjusted Gross income for your household 2 31,550 Above Below as reported on your most recent 3 35,500 Above Below Federal Income Tax form. If you use Form 1040 – use line 4 39,450 Above Below 33 5 42,600 Above Below If you use Form 1040A – use line 6 45,750 Above Below 19 7 48,900 Above Below If you use Form 1040EZ – use 8 52,050 Above Below line 4

*Read This Carefully*

FOR USE BY PRIME CONTRACTOR ONLY

Effective 02/05 Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM SECTION 3 INCOME WORKSHEET YORK COUNTY

To be completed by all new employees residing in the county where the construction work is taking place. Completion of this worksheet is solely to determine if there is utilization of Section 3 employees on this construction project and should not be considered as a condition of employment.

Please place an "X" in the appropriate spaces pertaining to your family's size, annual income and makeup

FAMILY SIZE INCOME *Read This Carefully* 1 $34,050 Above Below In determining total family income use your Total Adjusted 2 38,900 Above Below Gross income for your household 3 43,800 Above Below as reported on your most recent 4 48,650 Above Below Federal Income Tax form. If you use Form 1040 – use line 5 52,550 Above Below 33 6 56,450 Above Below If you use Form 1040A – use line 7 60,350 Above Below 19 8 64,200 Above Below If you use Form 1040EZ – use line 4

Effective 02/05 FOR USE BY PRIME CONTRACTOR ONLY

Name of Prime Contractor: ______

Project Name: ______

Is new employee Section 3 eligible? ____ Yes _____ No

If yes, must be included in SECTION 3 UTILIZATION REPORT.

Job Title or Construction Trade that new Employee is hired for ______

Effective 02/05