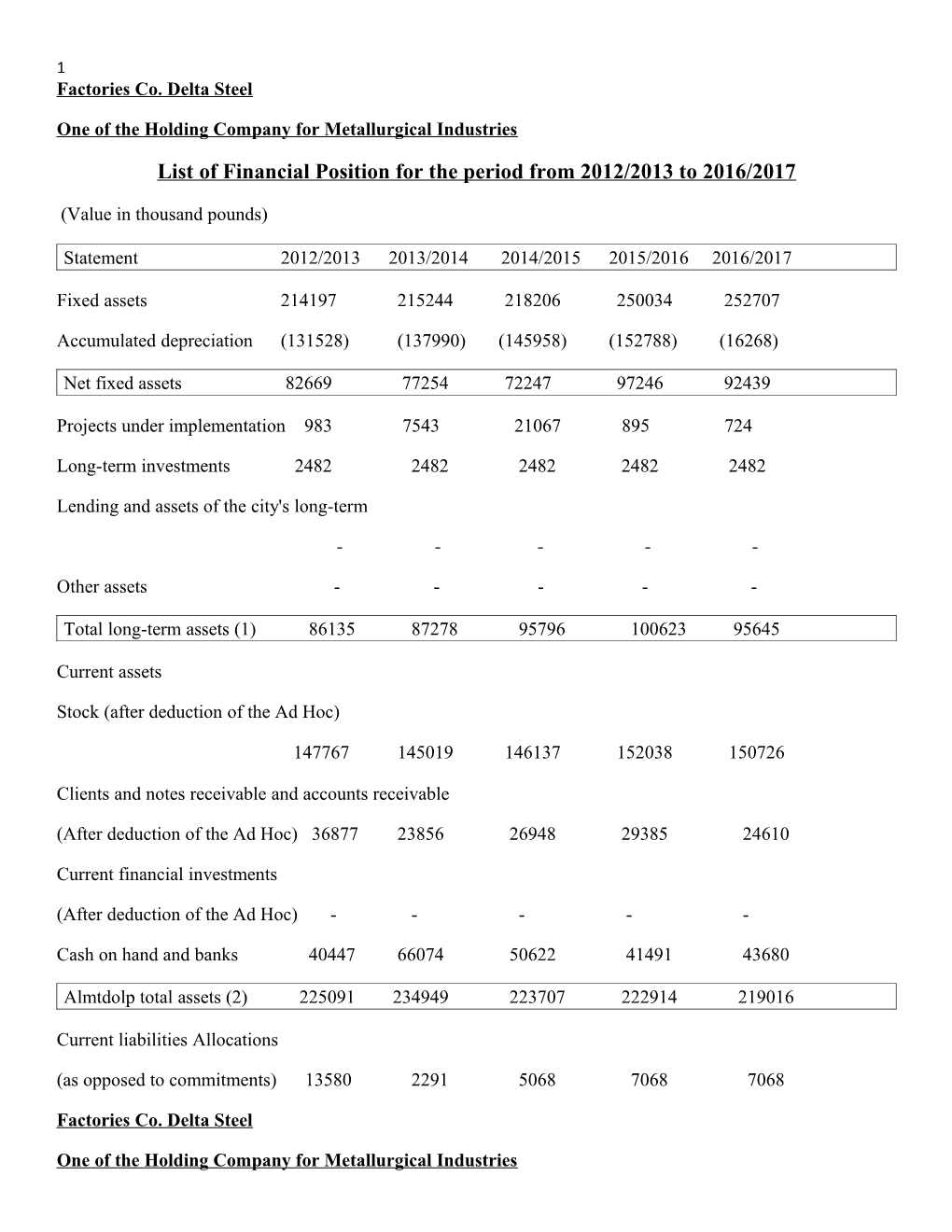

1 Factories Co. Delta Steel

One of the Holding Company for Metallurgical Industries

List of Financial Position for the period from 2012/2013 to 2016/2017

(Value in thousand pounds)

Statement 2012/2013 2013/2014 2014/2015 2015/2016 2016/2017

Fixed assets 214197 215244 218206 250034 252707

Accumulated depreciation (131528) (137990) (145958) (152788) (16268)

Net fixed assets 82669 77254 72247 97246 92439

Projects under implementation 983 7543 21067 895 724

Long-term investments 2482 2482 2482 2482 2482

Lending and assets of the city's long-term

- - - - -

Other assets - - - - -

Total long-term assets (1) 86135 87278 95796 100623 95645

Current assets

Stock (after deduction of the Ad Hoc)

147767 145019 146137 152038 150726

Clients and notes receivable and accounts receivable

(After deduction of the Ad Hoc) 36877 23856 26948 29385 24610

Current financial investments

(After deduction of the Ad Hoc) - - - - -

Cash on hand and banks 40447 66074 50622 41491 43680

Almtdolp total assets (2) 225091 234949 223707 222914 219016

Current liabilities Allocations

(as opposed to commitments) 13580 2291 5068 7068 7068

Factories Co. Delta Steel

One of the Holding Company for Metallurgical Industries 2 List of Financial Position for the period from 2012/2013 to 2016/2017

(Value in thousand pounds)

Statement 2012/2013 2013/2014 2014/2015 2015/2016 2016/2017

Creditor banks - 1516 9921 26801 29612

Suppliers and sweet and payable and accounts payables

103474 204053 248102 280899 351345

Total current liabilities 117054 207860 263091 314768 388025

Working Capital (2) 108037 27088 (39384) (91853) (169008)

Total investment (1+ 2) 194172 114367 56412 8770 (73363)

And is financed as follows: -

Paid-in capital 150000 150000 150000 150000 150000

Reserves (+) 10732 10732 10733 10733 10733

Retained earnings (loss) (419161) (13196) (83899) (146445) (218386)

Treasury shares (-) - - - - -

Total equity (3) 114676 (30128) 14287 41309 (105755)

Long-term obligations (4) 79496 144495 42125 50078 32391

Total funding for investment (3 +4)

194172 114367 56412 8770 (73363)

Activity revenues 245832 282477 271053 233095 424168

Deduct the cost of activity revenues

(277952) (319945) (331312) (267198) (446883)

Factories Co. Delta Steel

One of the Holding Company for Metallurgical Industries

List of Financial Position for the period from 2012/2013 to 2016/2017

(Value in thousand pounds) 3 Statement 2012/2013 2013/2014 2014/2015 2015/2016 2016/2017

In addition, subsidies may be granted - - - - -

Gross profit (32120) (48835) (48892) (34103) (22715)

Add to it: -

Investment income of financial holding companies / sister

- - - - -

Other financial investment income 55 55 55 55 55

(Other than a custom stock prices fall) 548 70 70 - 387

Other income and profits 3225 5754 6734 815 2617

Total regular income 3828 5879 6859 870 3059

Deducting there from: -

Cut the salaries of attendance allowances and the movement of the members of the Board of Directors

344 325 363 430 225

Other administrative expenses 15777 15582 (20124) (20326) 23586

Allocations (other than depreciation and falling prices of stock)

1373 681 (3000) (2000) -

Donations - - - - -

Burdens and other losses 1013 237 (86) (58) (6655)

Total expenditures regular 18507 16825 (22747) (22814) (30466)

Factories Co. Delta Steel

One of the Holding Company for Metallurgical Industries

List of Financial Position for the period from 2012/2013 to 2016/2017

(Value in thousand pounds)

Statement 2012/2013 2013/2014 2014/2015 2015/2016 2016/2017 4 Net profit / loss activity (46799) (59781) (65732) (56046) (50122)

(Before interest and financing expenses)

Financing expenses (-) (80) (72) - (33) (99)

Benefits payable (+) 2633 2512 4252 1910 2609

Net profit / loss of activity (44246) (57341) (61480) (54169) (47414)

Add to it: -

Profit differences Currency 79 - - - -

Income of previous years 840 - 797 72 -

Profits of Capitalism - - - - 43

Extraordinary revenue - - - - -

Extraordinary total of revenue 919 - 797 72 43

Deducting there from: -

Differences in currency losses - - - - -

Expenses of previous years 2051 (1533) (1863) (1499) -

Capital losses - - - - -

Extraordinary losses - - - - -

Total expenses in the extraordinary

2051 (1533) (1863) (1499) -

Factories Co. Delta Steel

One of the Holding Company for Metallurgical Industries

List of Financial Position for the period from 2012/2013 to 2016/2017

(Value in thousand pounds)

Statement 2012/2013 2013/2014 2014/2015 2015/2016 2016/2017

Profit before tax 45379 (58874) (62547) (55596) (47371)

Income Tax (-) - - - - - 5 Deferred tax (-) 259 - - - (731)

Profit after tax (58874) (62547) (62547) (55596) (48102)

Transfer to reserves of capitalism (-)

Net profit approved by the General Assembly

(58874) (62547) (62547) (55596) (48102)