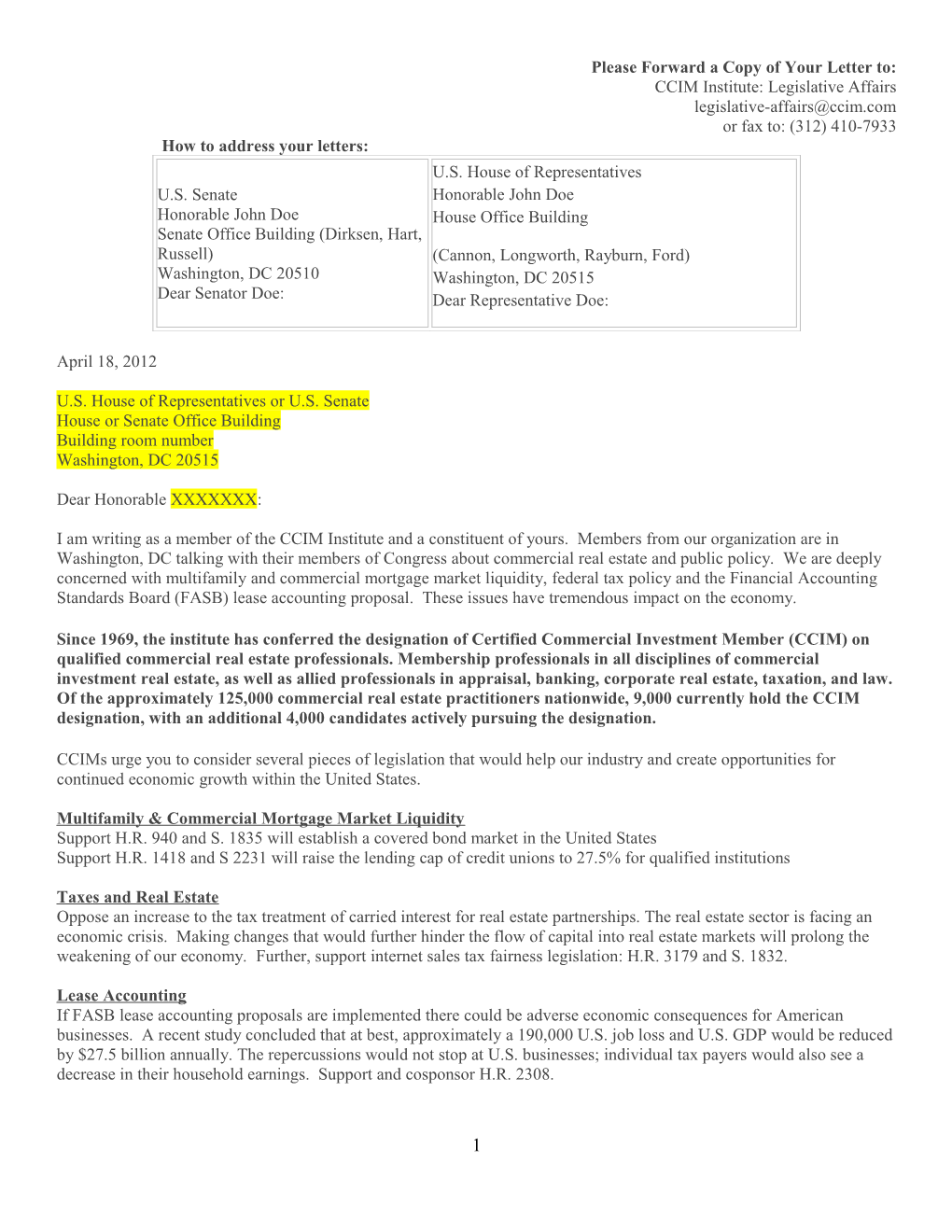

Please Forward a Copy of Your Letter to: CCIM Institute: Legislative Affairs [email protected] or fax to: (312) 410-7933 How to address your letters: U.S. House of Representatives U.S. Senate Honorable John Doe Honorable John Doe House Office Building Senate Office Building (Dirksen, Hart, Russell) (Cannon, Longworth, Rayburn, Ford) Washington, DC 20510 Washington, DC 20515 Dear Senator Doe: Dear Representative Doe:

April 18, 2012

U.S. House of Representatives or U.S. Senate House or Senate Office Building Building room number Washington, DC 20515

Dear Honorable XXXXXXX:

I am writing as a member of the CCIM Institute and a constituent of yours. Members from our organization are in Washington, DC talking with their members of Congress about commercial real estate and public policy. We are deeply concerned with multifamily and commercial mortgage market liquidity, federal tax policy and the Financial Accounting Standards Board (FASB) lease accounting proposal. These issues have tremendous impact on the economy.

Since 1969, the institute has conferred the designation of Certified Commercial Investment Member (CCIM) on qualified commercial real estate professionals. Membership professionals in all disciplines of commercial investment real estate, as well as allied professionals in appraisal, banking, corporate real estate, taxation, and law. Of the approximately 125,000 commercial real estate practitioners nationwide, 9,000 currently hold the CCIM designation, with an additional 4,000 candidates actively pursuing the designation.

CCIMs urge you to consider several pieces of legislation that would help our industry and create opportunities for continued economic growth within the United States.

Multifamily & Commercial Mortgage Market Liquidity Support H.R. 940 and S. 1835 will establish a covered bond market in the United States Support H.R. 1418 and S 2231 will raise the lending cap of credit unions to 27.5% for qualified institutions

Taxes and Real Estate Oppose an increase to the tax treatment of carried interest for real estate partnerships. The real estate sector is facing an economic crisis. Making changes that would further hinder the flow of capital into real estate markets will prolong the weakening of our economy. Further, support internet sales tax fairness legislation: H.R. 3179 and S. 1832.

Lease Accounting If FASB lease accounting proposals are implemented there could be adverse economic consequences for American businesses. A recent study concluded that at best, approximately a 190,000 U.S. job loss and U.S. GDP would be reduced by $27.5 billion annually. The repercussions would not stop at U.S. businesses; individual tax payers would also see a decrease in their household earnings. Support and cosponsor H.R. 2308.

1 We sincerely hope that you carefully consider these issues. I have attached more information about these issues for your review. Please contact me directly if you would like more information. Thank you for your attention to this matter.

Sincerely, Member name, CCIM Contact Information

2 2012 Legislative Priorities: Points to Lobby

Multifamily & Commercial Mortgage Market Liquidity

While the broader economy is starting to turn around, the commercial real estate sector continues to struggle due to reduced operating income, property values and equity. Additionally, commercial practitioners continue to experience difficulty in obtaining financing and refinancing for mortgages, construction and land development loans, small business loans, and short-term loans for capital improvements.

Covered Bonds - Economists now believe that covered bonds in the United States have the potential to supplement securitization and to form part of a well-diversified liquidity management program for financial institutions and other issuers. H.R. 940 and S. 1835 will establish standards for a covered bond market in the United States.

o HOUSE ACTION – Cosponsor H.R. 940 by Reps Garrett (R-NJ) and Maloney (D-NY)

o SENATE ACTION – Cosponsor S. 1835 by Senators Hagan (D-NC) and Corker (R-TN)

Credit Union Lending Cap - Credit unions have been providing business loans for more than 100 years. Today, however, credit unions are hampered by a business lending cap of 12.25% of total assets. Expanding the lending cap for qualified credit unions could support significant economic growth and development. H.R. 1418 and S. 2231 will raise the lending cap to 27.5% for qualified credit unions.

o HOUSE ACTION – Cosponsor H.R. 1418 by Reps. Royce (R-CA) and McCarthy (D-NY)

o SENATE ACTION – Cosponsor S. 2231 by Sen. Udall (D-CO) and Snowe (R-ME)

Taxes and Real Estate Real estate is strongly affected by the way it is taxed. The turmoil in the industry created by tax changes, of the Tax Reform Act of 1986, provide evidence of how the tax treatment of real estate matters. Real estate tax laws should bear a rational relationship to the economics of the real estate transaction. Carried Interest - Real estate partnerships are often organized as limited partnerships (or LLCs) in which the limited partners provide capital and the general partner(s) provides operational expertise. A carried interest is designed to act as an incentive for a general partner to maintain and enhance the value of the real estate so that the operation of the property is a value-added proposition. Unlike hedge fund managers, capital

3 gains treatment for general partners involved in real estate partnerships is an appropriate incentive for risk- taking. o HOUSE & SENATE ACTION – Oppose an increase to the tax treatment of carried interest for real estate partnerships. The real estate sector is facing an economic crisis. Making changes that would further hinder the flow of capital into real estate markets will prolong the weakening of our economy.

Internet Sales Tax Fairness - Under current law, purchases made online are subject to sales tax through what is known as a use tax. Consumers who live in states with a sales tax are legally required to pay sales tax, but few even are aware of the obligation. States cannot require online retailers to collect the tax on their own. Only Congress can create a level playing field for online and brick and mortar retailers. H.R. 3179 and S.1832 will provide tax collection authority to states who meet minimum levels of simplification for collection of sales tax. o HOUSE ACTION – Cosponsor H.R. 3179 by Reps. Womack (R-AR) and Speier (D-CA) o SENATE ACTION – Cosponsor S. 1832 by Sens. Enzi (R-WY), Durbin (D-IL) and Alexander (R-TN)

Lease Accounting In 2010 the Financial Accounting Standards Board (FASB) proposed new lease accounting rule changes that, if implemented, could have adverse economic consequences for American businesses and the commercial real estate industry. Under the proposal, U.S. companies that lease office, industrial, and retail space would be required to capitalize the costs of that lease – similar to as if they purchased the property – instead of recognizing the true costs of the lease transaction.

A recent study found that the proposal would have very detrimental consequences for the American economy. Best case scenarios include a loss of “approximately 190,000 U.S. jobs and U.S. GDP would be reduced by $27.5 billion annually.” The repercussions would not stop at U.S. businesses; individual tax payers would also see a decrease in their household earnings.

o HOUSE ACTION – Sign the Congressional letter to FASB asking them to obtain a cost-benefit analysis before proceeding with the Rule. Also, cosponsor H.R. 2308, the “SEC Regulatory Accountability Act,” by Rep Garrett (R-NJ), requiring the SEC to fully assess the economic impact of any regulation and adopt it only if the benefits justify the costs.

o SENATE ACTION – Write to FASB asking them to obtain a cost-benefit analysis before proceeding with the Rule.

4 Covered Bonds

Covered bonds are securities created from loans, including mortgage loans. They are similar to mortgage-based securities (MBS), but with one major difference. The loans backing the bond remain on the balance sheets of the issuing banks. Covered bonds have long been an important sector to strengthen financial markets in other countries.

Several economists now believe that covered bonds in the United States have the potential to supplement securitization and to form part of a well-diversified liquidity management program for financial institutions and other issuers. Covered bonds allow banks to raise funds by selling bonds to investors. The bond is backed by the collateral of the asset and the banks contract to repay. Investors like covered bonds because the investor has recourse against both the financial institution who issued the bond and the assets that back the bond. Therefore, banks who issue bonds have a stake in assuring the long-term viability of the mortgages underlying the bond.

Reps. Scott Garrett (R-NJ) and Carolyn Maloney (D-NY) have introduced H.R. 940, the “United States Covered Bond Act of 2011.” H.R. 940 will establish standards for covered bond programs and a covered bond regulatory oversight program. A companion bill has been introduced in the Senate. S. 1835 by Senators Kay Hagan (D- NC) and Bob Corker (R-TN) is identical to H.R. 940.

ACTION: IREM and CCIM Institute urge Congress to pass H.R. 940 and S. 1835, which will allow for the development of a covered bond market in the United States.

5 Credit Union Lending

During previous economic crises consumers and businesses have relied on credit unions to fill in the gaps where banks could not serve them. Credit unions have been providing business loans for more than 100 years. Today, however, credit unions are hampered by a business lending cap of 12.25% of total assets. Many commercial real estate professionals have reported having strong, long-lasting relationships with credit unions, which could help them refinance and sustain their properties but find the lending cap presents an obstacle. More than half of the outstanding business loans held by credit unions have been extended by those approaching or at the cap. That means credit unions with experience in handling commercial loans are unable to support significant economic growth and development.

H.R. 1418 and S. 2231 would increase the credit union business lending cap to 27.5% for qualified credit unions. These bills, sponsored by Rep. Royce (R-CA) and McCarthy (D-NY); and Sen. Udall (D-CO) and Snowe (R- ME), would only allow increased business lending for those credit unions that meet safety and soundness criteria.

ACTION: IREM and CCIM Institute urge Congress to pass H.R. 1418 and S. 2231, to increase liquidity for small businesses.

6 Carried Interest

Real estate partnerships are often organized as limited partnerships (or LLCs) in which the limited partners provide capital and the general partner(s) provides operational expertise. When the partnership property is sold, the limited partners generally receive the profits in proportion to their capital investment. Often, however, the limited partners grant a profits interest to general partner(s). This profits interest is known as a “carried interest.”

A carried interest is designed to act as an incentive for a general partner to maintain and enhance the value of the real estate so that the operation of the property is a value-added proposition. The carried interest of general partner(s) has historically been taxed at capital gains rates, just as the limited partners’ gains are taxed at capital gains rates. The current tax rate on capital gains is 15%.

Real estate investments are designed as long-term investments. The capital is "patient" because property owners take major risks and hold the asset for long periods of time before seeing a gain, thus should be taxed at capital gains rates. Unlike hedge fund managers, capital gains treatment for general partners involved in real estate partnerships is an appropriate incentive for risk-taking. The direct risks include environmental issues, loan guarantees, and lawsuits, to name a few. If carried interest rates increase, it may drive investors to put their money elsewhere such as stocks with much more favorable tax treatment. It creates a disincentive to invest in real estate since many would no longer earn a reasonable profit.

Proposals to restructure carried interest tax rates are based off of invalid and flawed assumptions. It is believed that the majority of those who pay the carried interest tax rate are largely Wall Street hedge funds or private equity funds. This is not the case. Real estate accounts for almost 50% of the 2.5 million partnerships in the United States. In reality, the 133% rate increase is an increase on a substantial amount of real estate activity in an already volatile and recovering market.

ACTION: IREM and CCIM Institute urge Congress to oppose an increase to the tax treatment of carried interest for real estate partnerships. The real estate sector is facing an economic crisis. Making changes that would further hinder the flow of capital into real estate markets will prolong the weakening of our economy.

7 Internet Sales Tax Fairness

Under current law, purchases made online are subject to sales tax through what is known as a use tax. Consumers who live in states with a sales tax are legally obligated to report and pay sales taxes on purchases made online, although the majority of them are unaware of this obligation, and very few pay this sales tax. Conversely, brick-and- mortar retailers are required by law to collect the tax on behalf of the state.

States cannot require online retailers to collect the tax on their own. In the 1992, the U.S. Supreme Court case Quill vs. North Dakota, the Court determined that states could not compel out-of-state sellers to collect their sales taxes because the burden would be a violation of interstate commerce. In fact, the Supreme Court stated in the Quill decision that the problem "is not only one that Congress may be better qualified to resolve, but also one that Congress has the ultimate power to resolve."

To date, 24 states have simplified their sales tax systems through the Streamlined Sales and Use Tax Agreement (SSUTA) to provide one uniform system to administer and collect sales tax, eliminating the burden of the country’s diverse sales tax systems on retailers. However, because this is a matter of interstate commerce, Congressional authorization is still required to allow states to collect taxes from out-of-state sellers and online retailers.

H.R. 3179, the Marketplace Equity Act, introduced by Reps. Steve Womack (R-AR) and Jackie Speier (D-CA), and the companion S. 1832 by Sens. Mike Enzi (R-WY), Dick Durbin (D-IL) and Lamar Alexander (R-TN) would require states to provide a minimum level of simplification in order to compel remote sellers to collect sales taxes.

ACTION: IREM and CCIM urge Congress to support H.R. 3179 and S. 1832 to modernize our nation’s tax policy and provide equity between online and brick-and-mortar retailers.

8 Lease Accounting

The Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) are organizations that establish accounting standards for either national (FASB) or international (IASB) businesses and/or nongovernmental entities. Under Sarbanes/Oxley, the SEC has regulatory oversight of FASB.

In 2010 FASB and IASB proposed new lease accounting rule changes that, if implemented, could have adverse economic consequences for American businesses and the commercial real estate industry. Under the proposal, U.S. companies that lease office, industrial, and retail space would be required to capitalize the costs of that lease – similar to as if they purchased the property – instead of recognizing the true costs of the lease transaction.

For businesses leasing space, especially small businesses, this will change real estate leases into a major liability. As a result, many businesses will shorten lease terms to minimize the impact. This will create instability in future rental costs and uncertainty about availability of space, as frequent renewals will be required. For commercial real estate property owners and investors the impact will be even greater. Among other things, this proposal may jeopardize income property fundamentals, loan structures, property valuations, financing covenants, and the underlying economics of commercial real estate – all during the worst real estate crisis since the Great Depression.

IREM and CCIM Institute submitted several comment letters to FASB and IASB. As a result of these letters, FASB and IASB have delayed their initial implementation timeline. The NATIONAL ASSOCIATION of REALTORS®, of which IREM and CCIM Institute are affiliates, has also helped in funding a research study to determine the economic impact of the proposal.

The results of the study confirmed early fears of detrimental consequences for the American economy. Of particular concern from the study is that the “proposed accounting standard would increase the apparent liabilities of U.S. publicly traded companies by $1.5 trillion, the equivalent Gross State Product of 20 states. Approximately $1.1 trillion of this would be attributable to balance sheet recognition of real estate operating leases while the remainder would come from recognizing equipment and other leases as liabilities.” Best case scenarios include a loss of “approximately 190,000 U.S. jobs and U.S. GDP would be reduced by $27.5 billion annually.” Worst case scenarios include “a loss of 3.3 million U.S. jobs and the U.S. GDP would be lowered by $478.6 billion.” The repercussions would not stop at U.S. businesses; individual tax payers would also see a decrease in their household earnings.

ACTION: IREM and CCIM Institute urge House Members to sign onto the lease accounting coalition letter, which urges FASB to conduct a comprehensive economic impact study of the impacts of the lease accounting rule before implementation. We urge Congressmen to co-sponsor H.R. 2308, the “SEC Regulatory Accountability Act,” introduced by Representative Garrett (R-NJ). This bill would require the SEC to fully assess the economic impact of

9 any intended regulation and adopt it only on the determination that the benefits justify the costs. We encourage Senators to write FASB asking them to obtain a cost-benefit analysis before proceeding with the Rule.

10

CCIM Institute

CCIM Fact Sheet

Background The CCIM Institute is an affiliate of the NATIONAL ASSOCIATION OF REALTORS® (NAR). The Institute confers the Certified Commercial Investment Member (CCIM) designation through an extensive curriculum and experiential requirements. The CCIM designation was established in 1969 and is recognized as the mark of professionalism and knowledge in commercial investment real estate.

Membership Membership includes qualified professionals in all disciplines of commercial investment real estate, as well as allied professionals in appraisal, banking, corporate real estate, taxation, and law. Of the approximately 125,000 commercial real estate practitioners nationwide, 9,000 currently hold the CCIM designation, with an additional 4,000 candidates actively pursuing the designation.

Curriculum Recognized for its preeminence within the industry, the CCIM curriculum represents the core knowledge expected of commercial investment practitioners, regardless of the diversity of specializations within the industry. The CCIM curriculum consists of four core courses that incorporate the essential CCIM skill sets: financial analysis, market analysis, user decision analysis, and investment analysis for commercial investment real estate. Additional curriculum requirements may be completed through CCIM elective courses, transfer credit for graduate education or professional recognition, and qualifying non-CCIM education.

Purpose Founded upon the principles of education, networking, and ethical practice, the CCIM Institute, as an affiliate of the 1.2 million-member NATIONAL ASSOCIATION OF REALTORS®, helps shape policy and legislation affecting the industry and safeguards the interests of commercial investment real estate practitioners.

Headquarters CCIM Institute 430 North Michigan Avenue Chicago, Illinois 60611-4092 Telephone: (312) 321-4460

Fax: (312) 321-4530 Web: www.ccim.com

11 CCIM Institute

What is a CCIM?

A Certified Commercial Investment Member (CCIM) is a recognized expert in the disciplines of commercial and investment real estate. A CCIM is an invaluable resource to the commercial real estate owner, investor, and user, and is among an elite corps of approximately 9,000 professionals across North America and overseas who hold the CCIM designation.

Recognized for its preeminence within the industry, the CCIM curriculum represents the core knowledge expected of commercial investment practitioners, regardless of the diversity of specializations within the industry. The CCIM curriculum consists of four core courses that incorporate the essential CCIM skill sets: financial analysis, market analysis, user decision analysis, and investment analysis for commercial investment real estate. Additional curriculum requirements may be completed through CCIM elective courses, transfer credit for graduate education or professional recognition, and qualifying non-CCIM education. Following the course work, candidates must submit a resume of closed transactions and/or consultations showing a depth of experience in the commercial investment field. After fulfilling these requirements, candidates must successfully complete a comprehensive examination to earn the CCIM designation. This designation process ensures that CCIMs are proficient not only in theory, but also in practice.

With such a wide range of subjects to be mastered and in a dynamic business such as real estate, the educational process doesn't end once the designation is earned; there is a strong commitment among CCIMs to continuing education.

Less than 5 percent of the estimated 125,000 commercial real estate practitioners nationwide hold the CCIM designation, which reflects not only the caliber of the program, but also why it is one of the most coveted and respected designations in the industry. The CCIM membership network mirrors the increasingly changing nature of the industry and includes brokers, leasing professionals, investment counselors, asset managers, appraisers, corporate real estate executives, property managers, developers, institutional investors, commercial lenders, attorneys, bankers and other allied professionals. Through this business network and through enhanced communication with the CCIM electronic network, CCIMs successfully complete thousands of transactions and assignments annually.

Certified Commercial Investment Members are in more marketplaces in North America -- 12 CCIM regions representing 1,000 cities -- than all major real estate companies combined. Regions and chapters provide designees and candidates the opportunities to promote business and educational goals through local and regional forums and meetings.

Conferred by the CCIM Institute, the CCIM designation was established in 1969. Courses leading to the designation are now offered throughout the world. For more information, call (800) 621-7027.

12