The University of Newcastle Research & Research Training Services

Research Income Collection – Consultancies

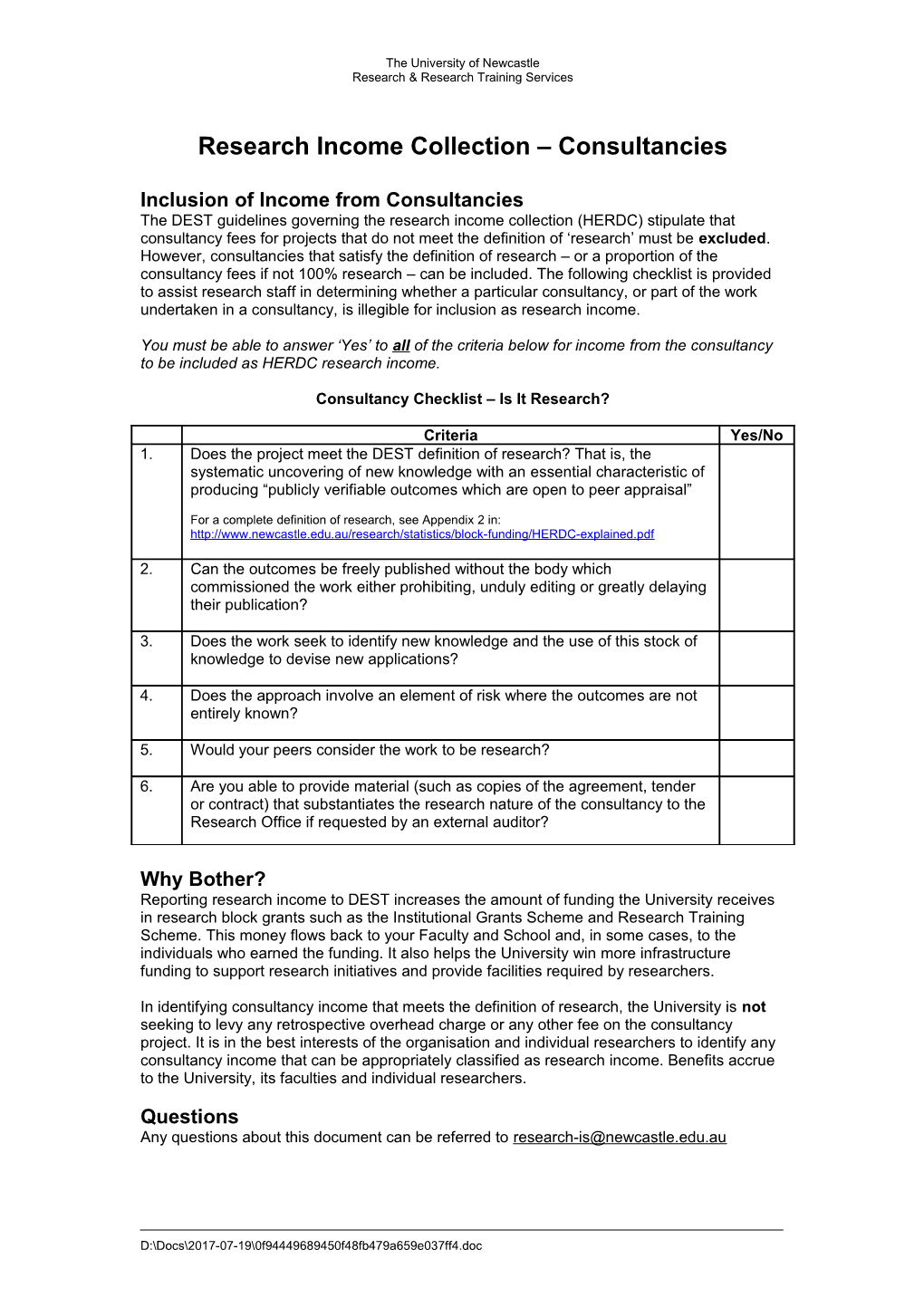

Inclusion of Income from Consultancies The DEST guidelines governing the research income collection (HERDC) stipulate that consultancy fees for projects that do not meet the definition of ‘research’ must be excluded. However, consultancies that satisfy the definition of research – or a proportion of the consultancy fees if not 100% research – can be included. The following checklist is provided to assist research staff in determining whether a particular consultancy, or part of the work undertaken in a consultancy, is illegible for inclusion as research income.

You must be able to answer ‘Yes’ to all of the criteria below for income from the consultancy to be included as HERDC research income.

Consultancy Checklist – Is It Research?

Criteria Yes/No 1. Does the project meet the DEST definition of research? That is, the systematic uncovering of new knowledge with an essential characteristic of producing “publicly verifiable outcomes which are open to peer appraisal”

For a complete definition of research, see Appendix 2 in: http://www.newcastle.edu.au/research/statistics/block-funding/HERDC-explained.pdf

2. Can the outcomes be freely published without the body which commissioned the work either prohibiting, unduly editing or greatly delaying their publication?

3. Does the work seek to identify new knowledge and the use of this stock of knowledge to devise new applications?

4. Does the approach involve an element of risk where the outcomes are not entirely known?

5. Would your peers consider the work to be research?

6. Are you able to provide material (such as copies of the agreement, tender or contract) that substantiates the research nature of the consultancy to the Research Office if requested by an external auditor?

Why Bother? Reporting research income to DEST increases the amount of funding the University receives in research block grants such as the Institutional Grants Scheme and Research Training Scheme. This money flows back to your Faculty and School and, in some cases, to the individuals who earned the funding. It also helps the University win more infrastructure funding to support research initiatives and provide facilities required by researchers.

In identifying consultancy income that meets the definition of research, the University is not seeking to levy any retrospective overhead charge or any other fee on the consultancy project. It is in the best interests of the organisation and individual researchers to identify any consultancy income that can be appropriately classified as research income. Benefits accrue to the University, its faculties and individual researchers.

Questions Any questions about this document can be referred to [email protected]

D:\Docs\2017-07-19\0f94449689450f48fb479a659e037ff4.doc