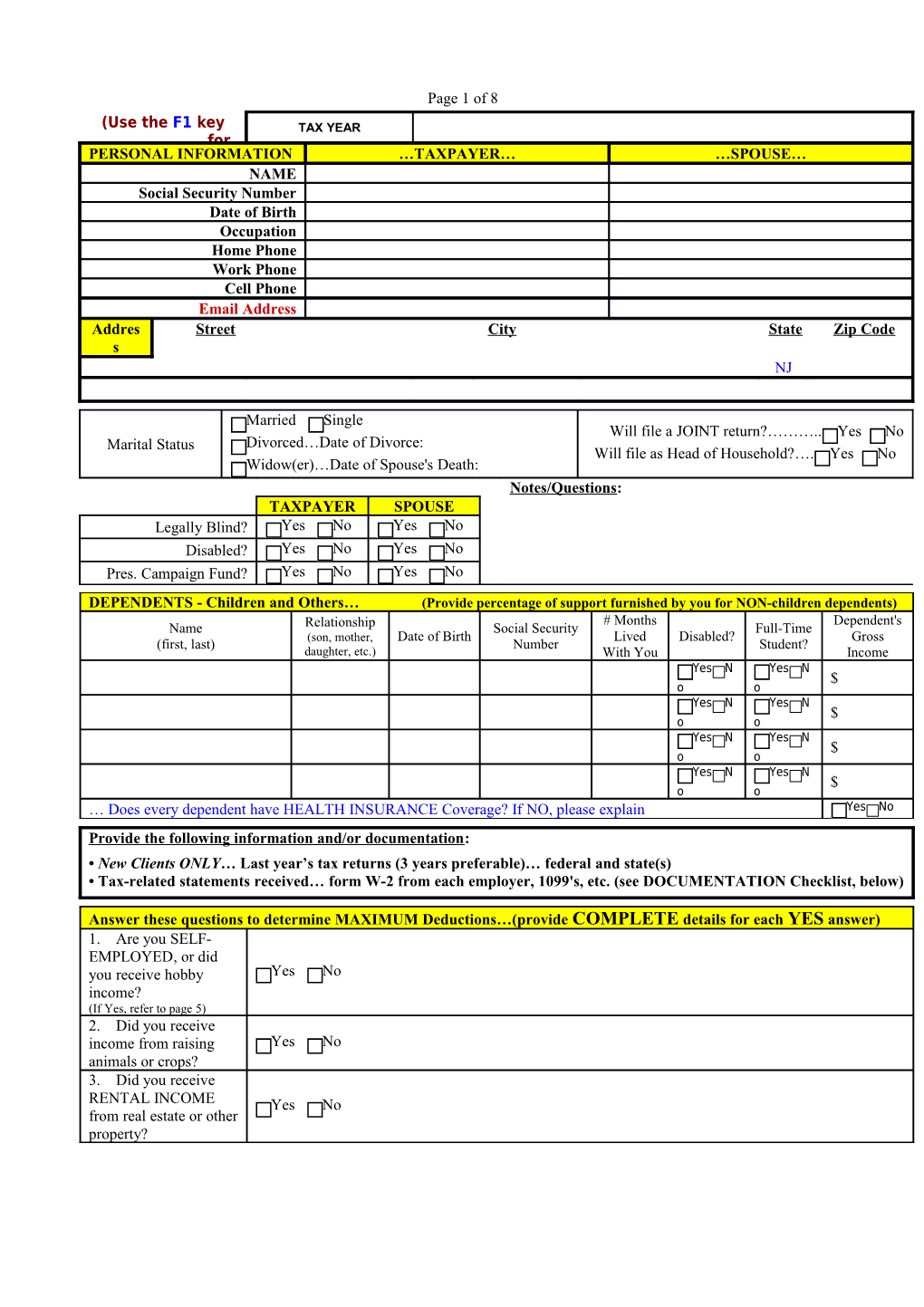

Page 1 of 8 (Use the F1 key TAX YEAR for PERSONAL INFORMATION …TAXPAYER… …SPOUSE… NAME Social Security Number Date of Birth Occupation Home Phone Work Phone Cell Phone Email Address Addres Street City State Zip Code s NJ

Married Single Will file a JOINT return?……….. Yes No Marital Status Divorced…Date of Divorce: Will file as Head of Household?…. Yes No Widow(er)…Date of Spouse's Death: Notes/Questions: TAXPAYER SPOUSE Legally Blind? Yes No Yes No Disabled? Yes No Yes No Pres. Campaign Fund? Yes No Yes No

DEPENDENTS - Children and Others… (Provide percentage of support furnished by you for NON-children dependents) # Months Dependent's Name Relationship Social Security Full-Time (son, mother, Date of Birth Lived Disabled? Gross (first, last) Number Student? daughter, etc.) With You Income Yes N Yes N $ o o Yes N Yes N $ o o Yes N Yes N $ o o Yes N Yes N $ o o … Does every dependent have HEALTH INSURANCE Coverage? If NO, please explain Yes No Provide the following information and/or documentation: • New Clients ONLY… Last year’s tax returns (3 years preferable)… federal and state(s) • Tax-related statements received… form W-2 from each employer, 1099's, etc. (see DOCUMENTATION Checklist, below)

Answer these questions to determine MAXIMUM Deductions…(provide COMPLETE details for each YES answer) 1. Are you SELF- EMPLOYED, or did you receive hobby Yes No income? (If Yes, refer to page 5) 2. Did you receive income from raising Yes No animals or crops? 3. Did you receive RENTAL INCOME Yes No from real estate or other property? 4. Did you receive income from gravel, timber, minerals, oil, Yes No gas, copyrights, or patents? 5. Did you withdraw or write checks from a mutual fund? (Broker Yes No Fund Statements: Dates, Selling Price, Purchase Cost) 6. Did you have a FOREIGN bank Yes No account, trust, or business? 7. Did you provide a home for or help support anyone not Yes No listed above as a dependent? 8. Did you receive any correspondence from the IRS or a State Yes No Dept. of Taxation? (if Yes, provide copies) 9. Were there any births, deaths, marriages, divorces, or Yes No adoptions in your immediate family? 10. Did you give a gift of more than $13,000 in cash or property to one Yes No or more people (directly or in trust)? 11. Did you go through bankruptcy Yes No proceedings? 12. Did you purchase gasoline, oil, or special Yes No fuels for non-highway vehicles? 13. If you paid RENT, how much did you pay $ $ (at each address)? 14. If you lived at more than one address during the year---provide the addresses, dates, and number of days at each address…

15. Did you pay interest on a student loan for yourself, Yes No spouse, or a dependent during the year? 16. Did you pay expenses for yourself, spouse, or a dependent Yes No to attend classes beyond high school? Page 3 of 8 17. Did you incur a Casualty/Theft Loss? (Property damage/loss Yes No resulting from a sudden, unexpected, or unusual event) 18. Did you buy a Hybrid Gas-Electric or all electric car after Yes No 2006? (Date Purchased, Make, Model, Cost) DOCUMENTATION Checklist WAGE, SALARY INCOME Provide form W-2 from each employer. Provide form 1099-INT and year-end broker statements; INTEREST INCOME (Bank, Savings & Loan, etc.) provide information on TAX EXEMPT income, e.g. NJ and Other States Municipal Bonds. DIVIDEND INCOME (Mutual Funds & Stock/Bonds) Provide form 1099-DIV and year-end broker statements. PARTNERSHIP, TRUST, ESTATE INCOME Provide form K-1 from each payer of income from partnerships, limited partnership, S-corporations, trusts, and estates. SECURITIES and INVESTMENTS SOLD (stocks, Provide form 1099-B and broker confirmation slips for each sale bonds, mutual funds, gold/silver, partnership interests) plus date acquired, date sold, purchase cost, and sales price. RENTAL INCOME (refer to page 6) Provide details of all Rental Income and Rental Expenditures for each separate rental unit. Provide form 1099-S and closing statements for both the sale and purchase of each property (both residential & rental PROPERTY / REAL ESTATE SOLD properties). Also, provide dates of residency and a list showing the cost of all major (capital) improvements made to each property.

INDIVIDUAL RETIREMENT ACCOUNTS (IRA) CONTRIBUTIONS for CURRENT TAX YEAR Amount Date Conventional or Roth IRA? Taxpayer $ Conventional Roth Spouse $ Conventional Roth Amounts Withdrawn from IRA Accounts (Provide forms 1099-R & 5498) Plan Trustee Reason for Withdrawal Amount Withdrawn by: Rolled Over? $ Taxpayer Spouse Yes No $ Taxpayer Spouse Yes No $ Taxpayer Spouse Yes No

PENSION, ANNUITY INCOME (Provide form 1099-R and statements from employer or insurance company with information on cost of or contributions to the plan) Payer Amount Reason for Payment Reinvested? $ Yes No $ Yes No $ Yes No

Did you receive: TAXPAYER SPOUSE Social Security Benefits? Yes No Yes No (If Yes, provide forms SSA Railroad Retirement? Yes No Yes No 1099 and/or RRB 1099)

OTHER INCOME (including NON-TAXABLE Income) Alimony Received $ Jury Duty $ Commissions $ Workers' Compensation $ Child Support $ Disability Income $ Scholarships (Grants) $ Veteran's Pension $ Unemployment Compensation (less repayments) $ Payments from Prior Installment Sale $ Prizes, Bonuses, Awards $ NJ State Income Tax Refunds $ Unreported Tips $ NJ Homestead Rebate $ Director or Executor Fees $ NJ Property Tax Reimbursement - Senior Freeze $ Gambling, Lottery Winnings $ Other State Income Tax Refunds- $ Gambling, Lottery LOSSES $ ( ) Other- $ ESTIMATED TAXES PAID Due Date Date Paid FEDERAL-IRS STATE of NJ State (other)- State (other)- Applied From Prior Year's Refund $ $ $ $ 1st Qtr-APRIL 15 $ $ $ $ 2nd Qtr-JUNE 15 $ $ $ $ 3rd Qtr-SEPT 15 $ $ $ $ 4th Qtr-JAN 15 $ $ $ $

MEDICAL & DENTAL EXPENSES Long-Term Care Insurance Premiums Husband $ Wife $ Dependent (name) $ Insurance Premiums-Medical, Dental, Medicare $ Insulin; Weight Loss Expenses $ Prescription Drugs (no "over the counter" drugs) $ Medical Therapy, Psychotherapy $ Doctors, Dentists, Psychological Counseling $ Hospitals, Nursing Home, Nursing Care $ Glasses, Contact Lens & Supplies $ Lodging, Parking Fees, Phone (toll calls) $ Hearing Aids & Batteries $ Other (describe) $ Labs & X-Rays; Medical Equipment & Supplies $ INSURANCE Reimbursement Received $ Health Savings Medical Auto Accounts Mileage-- $ (HSA) number of contributions miles

TAXES PAID Real Estate/Property Tax (provide bills) $ Balance(s) due and paid with last year’s $ Personal Property Tax (auto, boat, plane, etc.) $ STATE income tax return(s) Sales Tax Paid on new vehicle or boat $ Other- $ purchases Sales Tax Paid on all other purchases $ Other- $

HOME MORTGAGE INTEREST EXPENSE (provide form 1098 and HUD-1 Settlement Statement for sales/purchases) Mortgage Interest Paid to a Bank, S&L, etc. $ Interest paid to an Individual for your home $ Points Paid to a Bank, S&L, etc. $ (provide amortization schedule) Home Equity Lines / Loans $ Paid to: Mortgage Insurance Premiums $ Name- Other- $ Social Security Number- Address-

CHARITABLE CONTRIBUTIONS Religious, Church, Temple $ Other- $ United Way, Red Cross $ Other- $ Scouts $ Expenses in connection with a charitable $ Telethons $ organization- Colleges, Public TV/Radio $ NON-CASH (clothing, other articles, etc.-- Heart, Lung, Cancer, etc. $ if over $500 provide: name of charity, $ Wildlife Fund $ address, date, & amount of each donation) Salvation Army, Goodwill $ Mileage--number of miles used for charity

CHILD & OTHER DEPENDENT CARE EXPENSES (show Amounts Paid for each child) Social Security Amount Name of Care Provider Address of Care Provider Number or Employer Paid ID No. $ $

JOB-RELATED MOVING EXPENSES Page 5 of 8 Date of Move (attach IRS Form 4782) Other (describe) $ Cost to Move Household Goods $ Miles from old home to old place of work mi. Lodging Cost During Move $ Miles from old home to new place of work mi.

EMPLOYMENT-RELATED EXPENSES PAID (NOT SELF-EMPLOYMENT EXPENSES) Dues--Union, Professional $ Entertainment & Meals $ Books, Subscriptions, Supplies $ Continuing Education (tuition, fees, supplies) $ Licenses, Fees $ Other (describe) $ Tools, Equipment, Safety Equipment $ Other (describe) $ Uniforms (including cleaning expense) $ Educator Expenses (grades K-12) $

OFFICE IN THE HOME Employee ONLY --- if Self-Employed, go to page 5, BUSINESS INCOME and EXPENSE Square footage of entire home sq. ft. Rent $ Maintenance $ Square footage of home office sq. ft. Insurance $ Other (describe) Square footage of space used for storage sq. ft. Utilities $ Provide HUD Closing Statement for home Purchase $ nd cost of all major capital improvements since the 2nd Phone $ purchase (e.g., new roof, room addition, driveway, etc.)

Employee BUSINESS MILEAGE (using your personal vehicle) BUSINESS TRAVEL Is there evidence to support the deductions? Yes No If you are not reimbursed for the exact If YES, do you have written records? Yes No amount, provide the total expenses. Do you sell or trade in a used car used for business? Yes No Airfare, Train, etc. $ (if Yes, provide a copy of the purchase agreement) Lodging and Tips $ Vehicle #1 Vehicle #2 Meals and Tips $ Who used the vehicle? You Spouse You Spouse Meals-number of days Amount Reimbursed by Employer $ $ Taxi, Automobile Rental $ Make of Vehicle Laundry, Valet $ Year of Vehicle Other- $ Date Originally Acquired Other- $ COST of Vehicle $ $ Reimbursement Received $ TOTAL Miles (personal & business) miles miles Bank DEPOSIT/WITHDRAWAL & Business Miles (NOT to and from work) miles miles Electronic Filing Information Driving for your employer miles miles Do NOT file electronically From 1st to 2nd job miles miles Bank Name: Education (one-way, work to school) miles miles Job Seeking, Temporary Job Sites miles miles Branch Name, if applicable: Other Business; Rental Car miles miles Round Trip Commuting Distance miles miles Routing Transit Number (RTN): Gas, oil, lubrication, repairs $ $ Batteries, tires, etc. $ $ Depositor Account Number: Licenses and taxes $ $ Wash & wax, garage rent $ $ Type of Account: Checking Other Insurance $ $ (Provide a copy of a VOID or canceled Interest on vehicle loan $ $ check from the above bank account) LEASE Payments - per MONTH $ $ Ownership of Account: LEASE Payments – yearly total $ $ Self Spouse Joint Date of first lease payment Term of Lease (months) months months Cost at beginning of lease, if purchased $ $

EDUCATION EXPENSES (Tuition and Fees, Books and Supplies, Room and Board, Student Loan Interest) Student's Name Type of Expense Amount Student's Name Type of Expense Amount $ $ $ $ $ $ $ $ MISCELLANEOUS DEDUCTIONS Alimony paid to: Investment Consultants $ $ Social Security Number: IRA or Keogh Fees $ Investment & Margin Interest Paid $ Tax Preparation and Consulting Fees $ Safe Deposit Box Rental $ Other- $ Mutual Fund Fees $ Other- $ QUESTIONS, COMMENTS, and OTHER INFORMATION While a resident of NJ, did you purchase any items in another state for use in NJ (e.g., mail order)-on which no sales tax was paid? Yes No Or, on which sales tax was paid, but at a rate less than the NJ sales tax rate of 7.00 % Yes No

To the best of my knowledge the enclosed information is correct and includes all income, deductions, and other Taxpayer Signature Date information necessary for the preparation of this year's income tax returns for which I (we) have adequate supporting records and documentation. Spouse Signature Date

BUSINESS (self-employment) INCOME & EXPENSES (sole proprietorship or single member LLC) NAME of Proprietor Social Security # Note: if filing a JOINT return, enter the spouse who is the owner & principal operator. If jointly owned & operated, check here Business Name Federal Tax ID # Address Business Phone Email Address Principal Business Activity (include product or service) Accounting Method: Cash Accrual Other (explain) If there was any change in determining inventory values, check here If any expenses are for the business use of your home, check here and enter the expenses in the appropriate section below.

INCOME Cost of Goods Sold (if applicable) Gross receipts/sales-not on 1099-MISC $ Inventory at beginning of year $ Returns and allowances $ Purchases for the year $ Income reported on 1099-MISC $ Inventory withdrawn for personal use $ Commissions received $ - Direct Labor (for processing of goods sold only) $ Other- $ - Materials & supplies (for processing of goods sold only) $ Other- $ - Other (goods sold processing only)- $ Other- $ Inventory at end of year $ EXPENSES Advertising $ Legal & professional services $ Bad Debts from sales or services $ Office expense $ Provide for EACH Vehicle used in the business: Pension & profit-sharing plans $ TOTAL Miles (personal & business) miles Rental of vehicles, machinery & equipment $ Business Miles only miles Rental of other business property (office, etc.) $ Make of Vehicle Repairs and maintenance $ Year of Vehicle Supplies (not included in cost of goods sold) $ Date Originally Acquired Taxes and licenses $ COST of Vehicle $ Travel $ Gas, oil, lubrication, repairs $ Meals (enter 100% of the cost spent) $ Batteries, tires, etc. $ Entertainment (enter 100% of the cost spent) $ Licenses and taxes $ Utilities (light, heat, water, telephone) $ Page 7 of 8 Wash & wax, garage rent $ Wages (do NOT include wages to the owner) $ Insurance $ Bank service charges $ Interest on vehicle loan $ Credit card fees/costs $ LEASE Payments - per MONTH $ Dues and publications $ LEASE Payments – yearly total $ Employment taxes $ Date of first lease payment Postage/Freight/UPS/FEDEX charges $ Term of Lease (months) mos. Printing and typesetting $ Cost of vehicle at beginning of lease (if you Equipment, computers, software, vehicles, $ $ were to buy the vehicle (capitalized cost) furniture, other assets (provide detailed listing) Commissions and fees $ Continuing & Professional education costs $ Employee benefit programs $ Independent contractor payments (1099-MISC) $ Insurance-health $ Accounting & tax preparation $ Insurance-workers compensation $ Trash removal / Janitorial $ Insurance-other $ Other- $ Mortgage interest paid to banks $ Other- $ Other interest expense $ Other- $ BUSINESS USE OF HOME Square footage of entire home sq. ft. Rent $ Maintenance $ Square footage of home office sq. ft. Insurance $ Other (describe) Square footage of space used for storage sq. ft. Utilities $ Provide HUD Closing Statement for home purchase $ and cost of all major capital improvements since the 2nd Phone $ purchase (e.g., new roof, room addition, driveway, etc.) RENTAL PROPERTY --- INCOME and EXPENSES

Description of Property Location of Property Property A Property B Property C For each rental property listed above, did you or your family use it for personal purposes for more than the greater of 14 days or 10% of the total days rented at fair market value during the tax year? Yes No If YES, circle Property A, B, C, and/or D. If a property is rented for the FIRST time this year… Provide the HUD Closing Statement for the purchase of the property AND the costs of all major capital improvements made since the purchase (e.g., new roof, trees, shrubs, walkway, driveway, room addition, etc.) Property A Property B Property C Property D Rental Income (not reported on form 1099) $ $ $ $ Rental Income (reported on form 1099) $ $ $ $ Royalties received $ $ $ $ RENTAL EXPENSES Advertising $ $ $ $ Travel $ $ $ $ Cleaning and maintenance $ $ $ $ Commissions $ $ $ $ Insurance-fire and hazard $ $ $ $ Insurance-liability $ $ $ $ Legal & other professional fees $ $ $ $ Management fees $ $ $ $ Mortgage Interest paid to banks $ $ $ $ Mortgage Interest-other $ $ $ $ Interest-other $ $ $ $ Repairs $ $ $ $ Supplies $ $ $ $ Real Estate Taxes $ $ $ $ Other Taxes $ $ $ $ Utilities (water, heat, electricity) $ $ $ $ Other-telephone $ $ $ $ Other-association dues $ $ $ $ Other-management fees and wages $ $ $ $ Other-garbage and janitorial $ $ $ $ Other- $ $ $ $ Other- $ $ $ $ Provide for EACH Vehicle used in the RENTAL business: VEHICLE #1 VEHICLE #2 NOTES TOTAL Miles (personal & business) miles miles Business Miles only miles miles Make of Vehicle Year of Vehicle Date Originally Acquired COST of Vehicle $ $ Gas, oil, lube, repairs, batteries, tires, etc. $ $ Licenses and taxes $ $ Wash & wax, garage rent $ $ Insurance $ $ Interest on vehicle loan $ $ LEASE Payments - per MONTH $ $ LEASE Payments – yearly total $ $ Date of first lease payment $ Term of Lease (months) mos. $ Cost of vehicle at beginning of lease (if you $ $ were to buy the vehicle)