Dollars and Sense Volume 4, Number 2 │October 2012

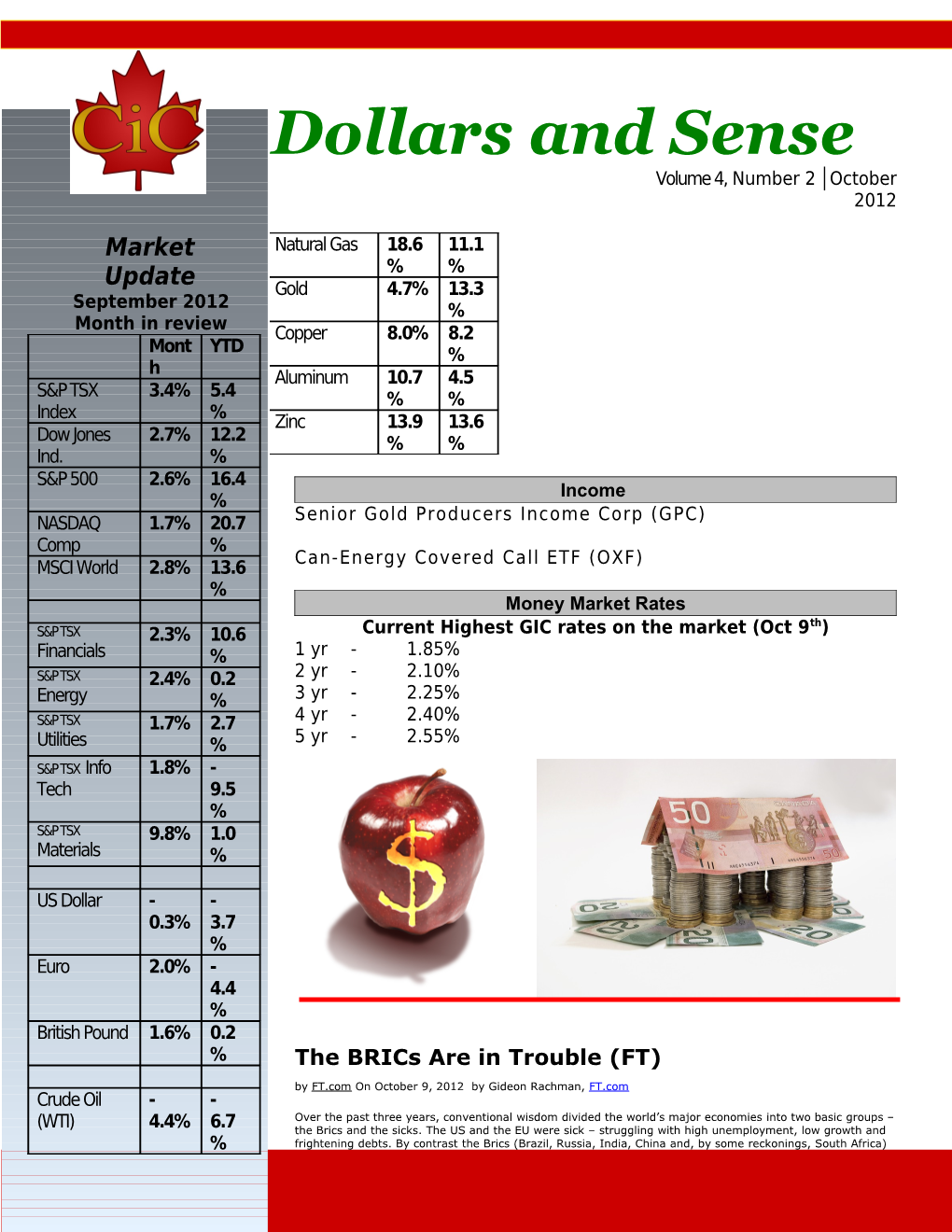

Market Natural Gas 18.6 11.1 % % Update Gold 4.7% 13.3 September 2012 % Month in review Copper 8.0% 8.2 Mont YTD % h Aluminum 10.7 4.5 S&P TSX 3.4% 5.4 % % Index % Zinc 13.9 13.6 Dow Jones 2.7% 12.2 % % Ind. % S&P 500 2.6% 16.4 Income % NASDAQ 1.7% 20.7 Senior Gold Producers Income Corp (GPC) Comp % Can-Energy Covered Call ETF (OXF) MSCI World 2.8% 13.6 % Money Market Rates th S&P TSX 2.3% 10.6 Current Highest GIC rates on the market (Oct 9 ) Financials % 1 yr - 1.85% S&P TSX 2.4% 0.2 2 yr - 2.10% Energy % 3 yr - 2.25% S&P TSX 1.7% 2.7 4 yr - 2.40% Utilities % 5 yr - 2.55% S&P TSX Info 1.8% - Tech 9.5 % S&P TSX 9.8% 1.0 Materials %

US Dollar - - 0.3% 3.7 % Euro 2.0% - 4.4 % British Pound 1.6% 0.2 % The BRICs Are in Trouble (FT)

by FT.com On October 9, 2012 by Gideon Rachman, FT.com Crude Oil - - Over the past three years, conventional wisdom divided the world’s major economies into two basic groups – (WTI) 4.4% 6.7 the Brics and the sicks. The US and the EU were sick – struggling with high unemployment, low growth and % frightening debts. By contrast the Brics (Brazil, Russia, India, China and, by some reckonings, South Africa) Investment Review September 1997 were much more dynamic. Investors, businessmen and western politicians made regular pilgrimages there, to gaze at the future.

But now something odd is happening. The Brics are in trouble. The nature of the problem in each nation is different. But there are also some broad difficulties that link them. First, for all the hopeful talk of “decoupling”, the Brics are all affected by weak western economies. Second, all five nations are finding that endemic corruption is eroding faith in their political systems, and imposing a tax on their economies.

China remains the daddy of the rising powers. It is the second- largest economy in the world – and easily still the fastest growing Bric. And yet the country feels more uncertain about its economic and political future than in many years. As a Chinese friend put it recently: “Our economy is slowing sharply, our next leader has disappeared, and we are sending ships towards Japan.” Xi Jinping has since reappeared – as mysteriously as he disappeared in the first place. But political tensions remain high, with the trial of Bo Xilai about to start and a crucial party congress approaching.

• Page 2 • Investment Review September 1997

over-year except during or just prior to U.S. recessions. This time may be different, but is difficult to see why that expectation is sensible given the broader context of economic evidence. Number Five (Hussman) by John Hussman, Hussman Funds On October 9, 2012

Examine the points in history that the Shiller P/E has been above 18, the S&P 500 has been within 2% of a 4-year high, 60% above a 4- year low, and more than 8% above its 52-week average, advisory bulls have exceeded 45%, with bears less than 27%, and the 10-year Treasury yield has been above its level of 20-weeks prior. While there are numerous similar ways to define an “overvalued, overbought, overbullish, rising-yields” syndrome, there are five small clusters of this one in the post-war record: November-December 1972, July- August 1987, a cluster between late-1999 and early 2000, early 2007, and today. The first four instances preceded the four most violent market declines in the post-war record, though each permitted a few percent of additional upside progress before those declines began in earnest. We do not know what will happen in the present instance, particularly over the short-run. But on the basis of this and a broad ensemble of additional evidence, we estimate that the likelihood of deep losses overwhelms the likelihood of durable gains. To ignore those four prior outcomes as “too small a sample” is like standing directly underneath a falling anvil, on the logic that falling anvils are an extremely rare occurrence.

On the economic front, Friday’s employment report was interesting in that total non-farm payrolls (the “establishment survey” figure most widely quoted in news reports) came in slightly below expectations, but total civilian employment (the “household survey” figure used to Meanwhile, the balance sheet of the Federal Reserve presently comes compute the unemployment rate) jumped enough to produce a drop in to about $2.8 trillion, with an average duration of 7.3 years, meaning the unemployment rate to 7.8%. While the difference was certainly an that a 100 basis point change in interest rates would be expected to outlier in terms of typical correlations between establishment and impact the Fed’s position by about 7.3% on the basis of bond price household figures, it wasn’t the sort of outlier that would justify the changes. Now, keep in mind that the Fed presently has just $54.7 suggestions of political conspiracy that were bandied about over the billion in capital, which means that the balance sheet is leveraged by weekend. over 50-to-1, or put differently, the balance sheet has just 1.95% capital coverage. The unpleasant arithmetic here is that a 27 basis The fact is that on a month-to-month basis, there is only a 50% point change in bond yields (1.95%/7.30%) would effectively wipe out correlation between the establishment and household employment the Fed’s capital. While the Fed doesn’t mark its balance sheet to figures, rising to about 90% correlation for year-over-year changes. market, and can therefore run an insolvent balance sheet without The household data is notably more volatile, but the establishment immediate consequence, it should at least be a subject of public figure makes up for the lower volatility with significant after-the-fact understanding that monetary policy becomes fiscal policy 27 basis revisions, particularly around economic turning points. The month-to- points from here. Over time, of course, the Fed earns interest on its month changes above and below the 12-month average are about bond holdings, and that interest is normally handed over to the 50% larger in each direction for the household survey than for the Treasury for public benefit. Presently, a 30 basis point increase in establishment survey. What’s interesting is that these changes are yields over a one-year period would wipe out even this interest, at often matched by changes in the reported size of the labor force, which point the government would be paying interest on its debt which is why they don’t usually result in large changes in the simply to cover the Fed’s losses, with no net benefit to the public. That unemployment rate from month-to-month. For example, in January is, unless one believes that the Federal Reserve’s manipulation of 2000, the household figure jumped by over 2 million jobs, while the financial markets is of equivalent benefit in and of itself. We don’t, and establishment figure increased by only 248,000 jobs. But the it is likely that investors will discover that in an uncomfortable way unemployment rate held steady at 4% because the reported labor over the coming quarters. force also increased by over 2 million workers. The foregoing comments represent the general investment From that perspective, the unusual feature of last month’s report was analysis and economic views of the Advisor, and are provided that the increase in reported household data exceeded the increase in solely for the purpose of information, instruction and the reported labor force by an amount that statistically occurs only discourse. Only comments in the Fund Notes section relate about 6% of the time. Yes, it was an outlier, but it wasn’t even a two specifically to the Hussman Funds and the investment positions standard deviation event. I would expect some give-back in that of the Funds. “excess” household survey growth, and based on the extent of revisions to establishment survey data around economic turning Fund Notes points, I also expect that the September establishment survey figure will ultimately be revised to show a net loss of jobs on the month. So As of last week, the stock market remained characterized by an as a whole, my impression is certainly that the September report overvalued, overbought, overbullish syndrome and a variety of other presents a healthier picture of the employment situation than will conditions, and we continue to estimate very weak prospective returns survive later revisions, but there isn’t evidence to suggest any per unit of risk on a blended horizon from 2-weeks to about 18 manipulation of the data. months. The longer-term outcomes from overvalued, overbought, overbullish syndromes have been more reliably negative than the At the same time, nothing in the most recent data changes my view short-term outcomes, where unfavorable long-term conditions are that the U.S. economy has already entered a recession. The ISM often ignored by speculators in pursuit of short-term momentum. That purchasing managers data came in slightly above expectations, but has always made our investment discipline uncomfortable in late-stage broader data from regional ISM surveys as well as Federal Reserve bull markets, as we saw in 2000 and 2007. That said, our “two data surveys remain well below-average. European purchasing managers sets” challenge in 2009-early 2010 (see the most recent Annual Report data has been dismal. As Markit notes, “It seems inevitable that the for an extensive discussion) makes it easy to assume that our region will have fallen back into recession in the third quarter.” And investment stance is simply pinned to a defensive mode – despite the even if we take the recent employment report at face value, the year- fact that we removed most of our hedges in early 2003 when we had over-year growth in non-farm payrolls is presently just 1.37%, and no such concerns about the relevance of Depression-era data. we’ve never yet seen a decline in payroll growth below 1.4% year- • Page 3 • Investment Review September 1997 While we place a great deal of emphasis on reducing the potential for “My solution to the current market,” the Great Winfield said, “Kids. deep capital losses, it would be incorrect to assume that our This is a kid’s market. This is Billy the Kid, Johnny the Kid, and investment stance is inherently defensive regardless of market Sheldon the Kid.” “Aren’t they cute?” the Great Winfield asked. “Aren’t conditions. This is particularly true for Strategic Growth Fund, which they fuzzy? Look at them, like teddy bears. It’s their market. I have has the ability not only to remove all hedges, but also to leverage its taken them on for the duration. I give them a little stake, they find the investment position using call options. While the Fund has not taken stocks, and we split the profits,” he said. “Billy the Kid here started that sort of position since the inception of the Fund, that outcome is with five thousand dollars and has run it up over half a million in the the result of market conditions that have produced a 13-year period of last six months.” “Wow!” I said. I asked Billy the Kid how he did it. total returns for the S&P 500 that – even today – remains below the “Computer leasing stocks, sir!” he said, like a cadet being quizzed by total return achieved by holding Treasury bills. Market conditions will an upperclassman. “The need for computers is practically infinite,” said change; valuations will change – and when those changes emerge, we Billy the Kid. ”Leasing has proved the only way to sell them, and will not have to concern ourselves again with the question of whether computer companies themselves do not have the capital. Therefore, our hedging approach is robust to Depression-era data. earnings will be up 100% this year, will double next year, and will double again the year after that. The surface has barely been Particularly in Strategic Growth Fund, it is important to recognize that scratched. The rise has scarcely begun.” while we are conservative with respect to the risk of major capital losses, the Fund’s strategy is aggressive in its ability to vary its “Look at the skepticism on the face of this dirty old man,” said the exposure to market risk. Presently, that aggressiveness may be on the Great Winfield, pointing at me. “Look at him, framing questions about defensive side, but there is a reason why aggressively positive depreciation, about how fast these computers are written off. I know exposures are part of our investment strategy and are written into the what he’s going to ask. He’s going to ask what makes a finance Fund Prospectus, and that reason is that we fully expect market company worth fifty times earnings. Right?” “Right,” I admitted. Billy conditions that warrant those positive exposures. I doubt that we’ll the Kid smiled tolerantly, well aware that the older generation has observe another market cycle that does not allow for such positions. trouble figuring out the New Math, the New Economics, and the New Market. “You can’t make any money with questions like that,” said the There is no doubt that we have been uncomfortable with a defensive Great Winfield. “They show you’re middle-aged, they show your stance and extremely negative return/risk estimates – as we were in generation. Show me a portfolio, I’ll tell you the generation.” 2000 and 2007, as the market comments from those points will attest. We view the market as richly valued on the basis of normalized … “The Money Game” by Adam Smith earnings and prospective cash flows, with overbullish sentiment, overbought market action, and facing the prospect of an unrecognized “The Money Game” was penned by an acquaintance of mine, namely recession already in progress. The evidence is not encouraging with Jerry Goodman, who took the nom de plume of legendary economist respect to what has normally happened next. Adam Smith, author of the groundbreaking book “The Wealth of Nations,” first published in 1776. I met Jerry a few years ago at the We are very familiar with the tendency of investors to believe that offices of my friend Craig Drill, eponymous captain of Drill Capital, prevailing conditions are immutable and that some new feature of the where another icon hangs his hat. That icon (Dr. Albert Wojnilower) is investment landscape has changed the way that the markets work. If also from an era gone by when he, and his counterpart, rattled anything, my impression is that we risk having overestimated the markets every time they spoke. Back in the 1970s and 1980s Al prospective growth rate of future cash flows, which would leave our Wojnilower was affectionately referred to as “Dr. Gloom,” and his estimate of 10-year S&P 500 total returns somewhat too high at about counterpart Dr. Henry Kaufman was deemed “Dr. Doom,” but I 4% nominal. Nevertheless, what matters is that valuations and digress. prospective returns will fluctuate, and we have no need for the market to move to deep undervalue in order to justify removing our hedges. It Expanding on the Great Winfield’s wisdom about a “kid’s market,” he certainly did not achieve deep undervalue in 2003. Of course, the 2009 goes on to say, “the strength of my kids is that they’re too young to low represented moderate undervaluation on our estimates (our remember anything bad, and they are making so much money they estimate of 10-year prospective total returns moved briefly above 10% feel invincible.” He rented kids with the idea that one day the music annually), but we had profound concerns about the out-of-sample will stop (it did partially in 1969-70, then completely stopped in 1973- nature of market conditions at the time. The coming cycle will have a 74) and all of them will be broke but one. That one will be the Arthur whole range of aggressive and defensive opportunities, and we are Rock* of the new generation; Winfield will keep him. looking ahead to those. At present, market conditions are associated with some of the most negative market outcomes in the historical I revisit “A Kid’s Market” this morning because of my opening “wily record. Our investment stance is sensitive to the prospective returns wag” quote and given the fact that most of the investors I talk to that and risks that we estimate. Present conditions are what they are. What are currently under-performing the S&P 500 (SPX/1460.93) are pretty is certain is that those conditions will change. young and thus have little fear of the downside. Indeed, with the SPX better by 16.17% YTD the bar has been set fairly high. Interestingly, while the SPX rallied 1.3% last week, the real winner was the recently maligned D-J Transportation Average (TRAN/5046.43) that rallied more than 3%. Recall that back in mid-May many pundits were chanting about the breakdown in the TRAN, below its March reaction low, and scared investors by not only suggesting a BIG decline was coming for the D-J Industrial Average (INDU/13620.15), but that a “A Kid’s Market” (Saut) Dow Theory “sell signal” had been registered. At the time I argued against that view because according to the way I was taught Dow by Jeffrey Saut, Raymond James On October 9, 2012 @ 9:29 am In Theory the reaction “low” being used was not correct. To be sure, what Markets | Comments Disabled subsequently happened was a downside non-confirmation, leading to a greater than 12% gain for the Industrials from that June 4th low, “A Kid’s Market” which brings us to this week. by Jeffrey Saut, Chief Investment Strategist, Raymond James Over the weekend many market mavens have been chanting about the yearly market leaders, like Apple (AAPL/$652.59/ Outperform), failing to rally with the overall stock market last week. While true, I don’t October 8, 2012 think such observations are a predecessor of a major stock market decline. Likely, the recent market strength was anticipating Friday’s Last week a particularly wily Wall Street wag asked me, “Hey Jeff, do better than expected employment report and trading types “sold” the you know why everyone is underperforming the S&P 500?” “Not good news. And despite partisan conspiracy-theorizing (like GE’s really,” I responded. He said, “Because the S&P has no fear!” former CEO Jack Welsh who opined, “Unbelievable jobs numbers … these Chicago guys will do anything … can’t debate, so change That exchange caused me to recall an excerpt from the book The numbers”), Friday’s employment numbers were impressive. However, Money Game. I like this story: drilling down into those numbers shows that of the 873,000 people that found jobs, 600,000 had to settle for part-time work. Moreover, of

• Page 4 • Investment Review September 1997 the 114,000 jobs added last month, 110,000 were in what the Liscio Report termed, “The eat, drink and get sick” group, namely bars, restaurants, and healthcare. As Barron’s notes, “All, and then some of these revisions, came via the 101,000 jobs added in the local government education category. What the Liscio duo calls ‘excitable types’ [and] professes to see evidence of political manipulation.”

Manipulated, or not, while the cries of a “double top” in the SPX around 1475 are pervasive, I don’t believe them, just like I didn’t believe them a few months ago. As scribed in this report two months ago, when many sages were talking about a double top referencing the March/April 2012 highs at 1422 basis the SPX, I noted that the S&P 500 Total Return Index (and many other indices) was already trading to new all-time highs and was pointing the way higher. That’s still the case. Further, trading volume is abysmal (see chart on page 3), suggesting portfolio managers are still too defensively positioned. That gleaning is reinforced by an insufficient net-long position in the hedge fund community of only 46.5%, as well as a five-year high “short sale” position. Meanwhile, the money supply is surging, commodity prices are at the same level as five years ago (save gold), dividend increases in the SPX companies are at a record high (+20% y/y) despite those companies’ dividend payout ratios plumbing generational lows, a “put option” from the world’s central banks (read: liquidity), epoch low mortgage rates that are heading lower (see chart on page 3), rising home prices, well you get the idea.

To these points, increasing home prices, combined with better stock prices, are lifting consumers’ net worth and encouraging “fence sitters” to buy a house (University of Michigan “good time to buy a house” survey is at its highest level since 2004). That in turn is helping the banking system, which is why bank stocks are up about 26% YTD. While there are numerous Strong Buy-rated bank stocks, with yields, from our fundamental analysts, such as Huntington Bancshares (HBAN/$7.19), BB&T (BBT/$33.64), and Community Bank System (CBU/$28.41), I continue to think one of the best ways to invest in the banking complex is using the FBR Small Cap Financial Fund (FBRSX/ $19.84) managed by David Ellison. I met David in the 1980s when he was managing Fidelity’s Select Financial Funds before associating with Friedman, Billings & Ramsey. David is my kind of investor because, like me, he considers “cash” to be an asset class. He demonstrated that when in the 1Q08 he raised 40% cash in his mutual funds, QED!

The call for this week: Third quarter earnings season kicks off this Thursday with Alcoa’s 3Q12 report. Plainly, for the rally to stay intact earnings cannot disappoint. And despite my sense that CEOs have stepped to the sideline on any spending until the November election and a resolution on the fiscal cliff, last week’s economic reports were good. Both PMIs were better than expected, vehicle sales jumped to 14.9 million units, refinance applications surged by 47%, and Friday’s employment report implies Industrial Production will probably look good on the next release. Therefore, despite this morning negative earnings story in The Wall Street Journal, I think the upcoming earnings reports will not disappoint. This morning, however, such worries, combined with Iran hostilities, the Syria/Turkey situation, a slowing economy, the presidential election, the fiscal cliff, and talk of a double-top in the SPX, are all coming together, leaving the pre- opening futures off 7 points. What the bears fail to realize, however, is that in the short-run there is not a linear relationship between the fundamentals and stock prices. Near-term support exists at 1450 – 1455. Major support resides at 1400 – 1422. With a full load of internal energy I think any pullback will be contained by one of those support zones.

*An American venture capitalist who was an early investor in companies like: Intel, Apple, Teledyne, etc.

• Page 5 • Investment Review September 1997

Chart of the Month

Printing Money Like Crazy Sometimes Leads To Burning Witches At The Stake

An interesting observation from SocGen's Dylan Grice, who in his latest note discusses how currency debasement leads to social debasement: A similar dynamic seems evident during Europe's medieval inflations, only now, the confused and vain effort to make sense of the enveloping turmoil saw the blame focus on suspected witches. The following chart shows the UK price index over the period with the incidence of witchcraft trials. Note the peak in trials coinciding with the peak of the price revolution.

Grice goes on to write that the French Revolution, Weimar Germany, and the fall of the Roman Empire all displayed a similar correlation to that above – as governments lost control of inflation, the people began to turn on each other.

• Page 6 • Investment Review September 1997

Company Snapshot – Oct. 2012 Fundamental Analysis Total S A (TOT) Market Cap $112.2 billion TOT - (October 10th) $49.08/share Distribution $0.73 BUY @ $48 Yield 5.91% Summary – P/E ratio 8.01x TOTAL SA is a France-based integrated international oil Price/BV 1.19x and gas company. With operations in more than 130 countries, TOTAL engages in all aspects of the petroleum industry, including Upstream operations (oil Technical Analysis and gas exploration, development and production, liquefied natural gas (LNG) and Downstream operations Longer term – quadrant 1 – Buy (refining, marketing and the trading and shipping of crude oil and petroleum products). It also produces base chemicals (petrochemicals and fertilizers) and specialty Intermediate term – quadrant 3 – Sell chemicals for the industrial and consumer markets. In (short term, buy @ $48) addition, TOTAL has interests in the coal mining and power generation sectors. It is also active in solar- photovoltaic power, both in Upstream and Downstream activities. The Company operates various subsidiaries, including Elf Aquitaine, Total Venezuela, Total E&P Nigeria SAS, and Total E&P USA, Inc., among others.

• Page 7 • Investment Review September 1997

FLLC Portfolio Tracker Current Company Symbol 52 Week Initially Recent P/E Yield Added Price

Hi Low Date Price Sell Brookfield BIP.un 19.50 15.50 Feb 26, 2010 17.30 22.05 19x 5.3% Intrastructure Sold Partners LP

SELL Gold Participation GPF.un 12.25 10.12 Mar 26, 2010 10.75 12.65 6.4% and Income Fund Sell date Sold Nov 3, 2010 Sell Perpetual Energy PMT 5.90 3.31 April 27, 2010 5.03 2.84 8.7% (formerly Paramount Sell date Sold Energy Resources) Aug 24, 2011 SELL New Flyer NFI.un 11.76 7.32 May 31, 2010 9.65 11.48 11.8% Sell date Sold Nov 3, 2010 SELL Labrador Iron Ore LIF.un 55.80 30.03 June 29, 2010 41.60 64.25 8.7x 10.8 Sell date Sold Nov 3, 2010 SELL Maple Leaf Foods MFI 12.06 8.47 July 30, 2010 9.21 12.21 12x 1.4% Sell date Sold Mar 5, 2011 SELL UIL Holdings Corp UIL 30.33 23.79 Aug. 30, 2010 25.90 30.53 19x 5.6% Sold

Sell Black Pearl PXX 3.98 1.94 Oct 7, 2010 3.90 5.02 (speculative stock with Sell date Sold high growth potential, Aug 24, 2011 NOT Blue chip) Buy AGF Management Ltd AGF.b 19.25 13.36 Oct 28, 2010 16.45 11.63 12x 5.68% Sold

SELL Canadian Oil Sands COS.un 33.05 24.24 Oct 28, 2010 26.69 31.78 17x 8.07% Sell date Sold Mar 5, 2011 Buy Pfizer PFE 20.36 14 Dec 3, 2010 16.70 24.01 22X 4.25%

Buy Home Equity Bank HEQ 8.33 6.12 Jan 3, 2011 6.55 9.50 4.27% Taken over Buy China Security and CSR 8.89 4.09 Feb 3, 2011 4.90 6.50 6.5x Surveillance Taken *current buyout offer of $6.50 over SELL Proshares Ultrashort EUO 26.40 17.64 Apr 6, 2011 17.45 18.87 Euro Sell date Sold Sept 12, 2011 SELL Nuvista Energy NVA 12.51 8.55 May 6, 2011 9.30 6.01 Sold

SELL Crescent Point CPG 48.61 35.30 June 8, 2011 45.03 43.30 28x 6.28 Energy Sold

• Page 8 • Investment Review September 1997 Current Company Symbol 52 Week Initially Recent P/E Yield Advice Added Price

Hi Low Date Price SELL Westshore Terminals WTE.un 25.85 17.57 July 28, 2011 22 24.75 16x 5.9% SOLD

Buy Capital Power CPX 28 22.26 July 28, 2011 23.85 20.89 22x 5.1%

Buy France Telecom FTE 24.60 17.21 Aug 26, 2011 18.50 13.16 7.6 9.0%

SELL Proshares Ultrashort TBT 41.54 21.86 Sept 12, 2011 22.10 19.50 20+ year treasuries SOLD

Buy Duke Energy DUK 71.13 50.61 Oct 6, 2011 57.75 63.72 12x 5.2%

Buy WisdomTree Europe DFE 48.15 31.04 Nov 10, 2011 33.90 38.00 5.58% SmallCap dividend

Buy Canadian Oil Sands COS 33.94 18.17 Dec 14, 2011 20.75 21.42 7x 5.62%

Buy Telefonica SA TEF 27.31 16.53 Feb 7, 2012 17.40 14.78 8.5x 7.5%

Buy Canadian Natural CNQ 50.50 27.25 Mar 7, 2012 34.70 23.06 15x 1.0% Resources

Buy Repsol REPYY 34.84 14.41 June 5, 2012 15.50 21.17 9.5x 6.8%

Buy Eni E 49.65 32.44 June 29, 2012 39.50 47.65 8.0x 4.6%

Buy Phoenix PHX 11.70 7.75 Aug 7, 2012 7.85 8.25 9.9 9.14%

Buy CME Group Inc CME 60.92 44.94 Sept 5, 2012 55.10 55.10 12. 3.10% 1

Buy TOT S.A. TOT 57.06 41.75 Oct 10, 2012 48 49.60 8.0 5.91 1

FLLC is not an investment advisor and is not setting any target prices or financial projections. Never invest based on anything FLLC says. Always do your own research and make your own investment decisions. FLLC never recommends to buy or sell any stock. This email is not a solicitation or recommendation to buy, sell, or hold securities. This email is meant for informational and educational purposes only and does not provide investment advice.

• Page 9 • Investment Review September 1997 Technical Analytic View Date: Long Term: MidTerm: Comments: Oct 10, 2012 (6-18 mths) (5-10 wks) TSX 60: • rally may begin to correct here

Dow Jones • rally may begin to correct here Industrials:

90 Day Interest • governments determined to keep short term rates low Rates: for now • some symbolic increases (0.5% to 1.0%)

5 Yr Interest • rates have flattened Rates: 30 Yr Interest • rates should trade sideways for a long time Rates Gold: • longer term trend maybe forming a top • buy in next correction

Canadian • Cdn $ seems to be range bound between $0.95 to 1.05 Dollar: US

LEGEND bottom forming buy top forming Sell

Current Course offerings

Oakville 6 Wednesday Nights, 6:30 – 8:30pm Oct 3, 10, 17, 24, Nov 7, 14 Georgetown 6 Tuesday Nights, 6:30 – 8:30pm Oct 2, 9, 16, 23, 30, Nov 6 Mississauga 6 Tuesday Nights, 6:30 – 8:30pm Oct 9, 16, 23, 30, Nov 6, 13 Burlington 6 Friday Nights, 6:30pm – 8:30pm Oct 12, 19, 26, Nov 2, 9, 16

Please visit our website www.fllc.ca www.canadianinvestorscourse.ca or

Contact us at: 905-828-1392

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither the Financial Literacy Learning Centre Inc. (FLLC) nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis • Page 10 • Investment Review September 1997 and understanding that neither FLLC nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

• Page 11 •