CITY OF NEDLANDS

Intention to Levy Differential General Rates

Local Government Act 1995 (section 6.36)

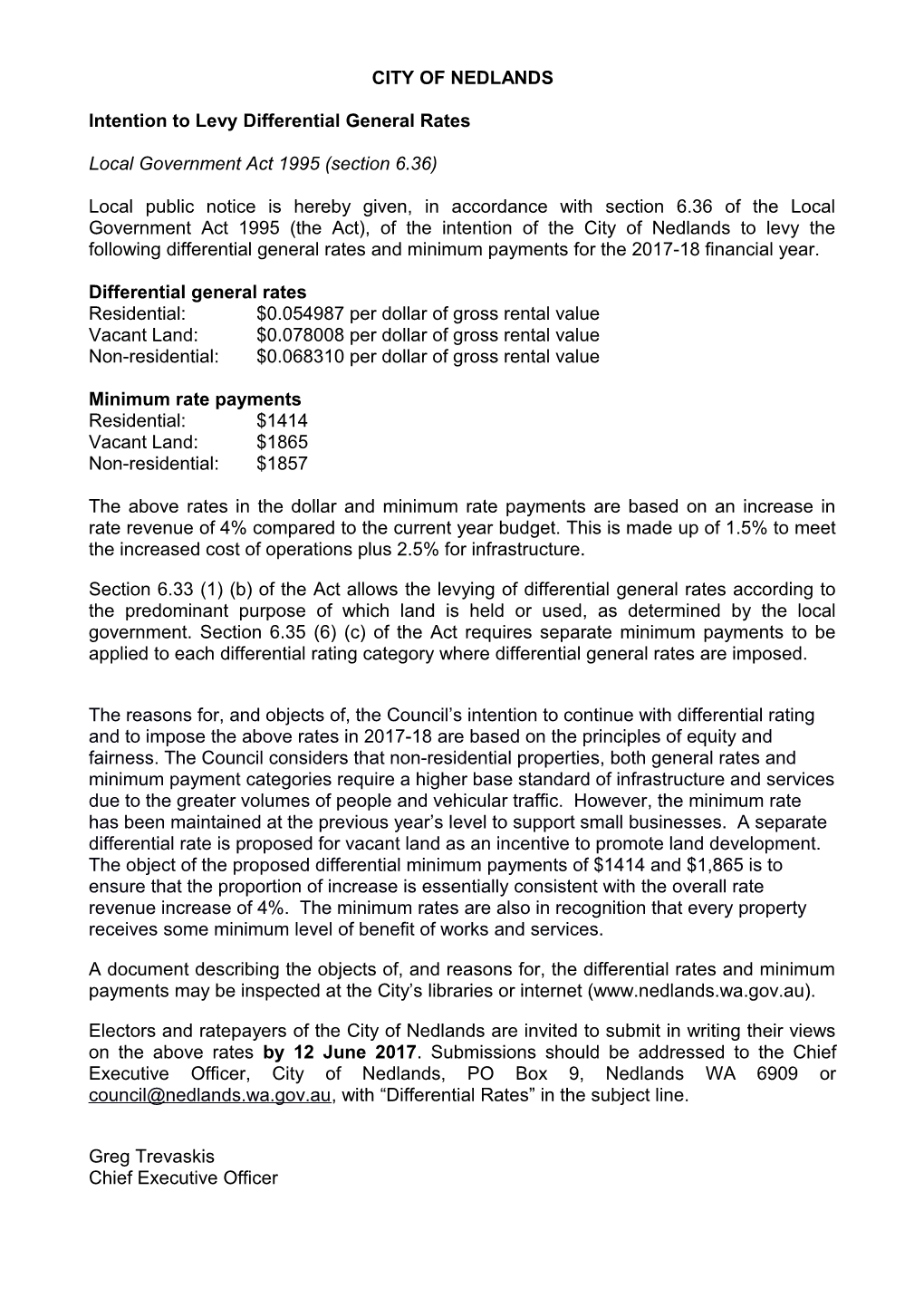

Local public notice is hereby given, in accordance with section 6.36 of the Local Government Act 1995 (the Act), of the intention of the City of Nedlands to levy the following differential general rates and minimum payments for the 2017-18 financial year.

Differential general rates Residential: $0.054987 per dollar of gross rental value Vacant Land: $0.078008 per dollar of gross rental value Non-residential: $0.068310 per dollar of gross rental value

Minimum rate payments Residential: $1414 Vacant Land: $1865 Non-residential: $1857

The above rates in the dollar and minimum rate payments are based on an increase in rate revenue of 4% compared to the current year budget. This is made up of 1.5% to meet the increased cost of operations plus 2.5% for infrastructure.

Section 6.33 (1) (b) of the Act allows the levying of differential general rates according to the predominant purpose of which land is held or used, as determined by the local government. Section 6.35 (6) (c) of the Act requires separate minimum payments to be applied to each differential rating category where differential general rates are imposed.

The reasons for, and objects of, the Council’s intention to continue with differential rating and to impose the above rates in 2017-18 are based on the principles of equity and fairness. The Council considers that non-residential properties, both general rates and minimum payment categories require a higher base standard of infrastructure and services due to the greater volumes of people and vehicular traffic. However, the minimum rate has been maintained at the previous year’s level to support small businesses. A separate differential rate is proposed for vacant land as an incentive to promote land development. The object of the proposed differential minimum payments of $1414 and $1,865 is to ensure that the proportion of increase is essentially consistent with the overall rate revenue increase of 4%. The minimum rates are also in recognition that every property receives some minimum level of benefit of works and services.

A document describing the objects of, and reasons for, the differential rates and minimum payments may be inspected at the City’s libraries or internet (www.nedlands.wa.gov.au).

Electors and ratepayers of the City of Nedlands are invited to submit in writing their views on the above rates by 12 June 2017. Submissions should be addressed to the Chief Executive Officer, City of Nedlands, PO Box 9, Nedlands WA 6909 or [email protected], with “Differential Rates” in the subject line.

Greg Trevaskis Chief Executive Officer