NATIONAL STOCK EXCHANGE OF INDIA LIMITED FUTURES AND OPTIONS MARKET CIRCULAR

Circular No.: NSE/F&O/0062/2004 Download No.: NSE/FAOP/5458

Date: September 24, 2004

Dear Members,

Sub: Securities Transaction Tax

This has reference to the Securities Transaction Tax (STT) introduced in the Finance Act 2004 and SEBI circular no MRD/DoP/SE/Cir-32/04 dated September 23, 2004 in this regard (copy enclosed).

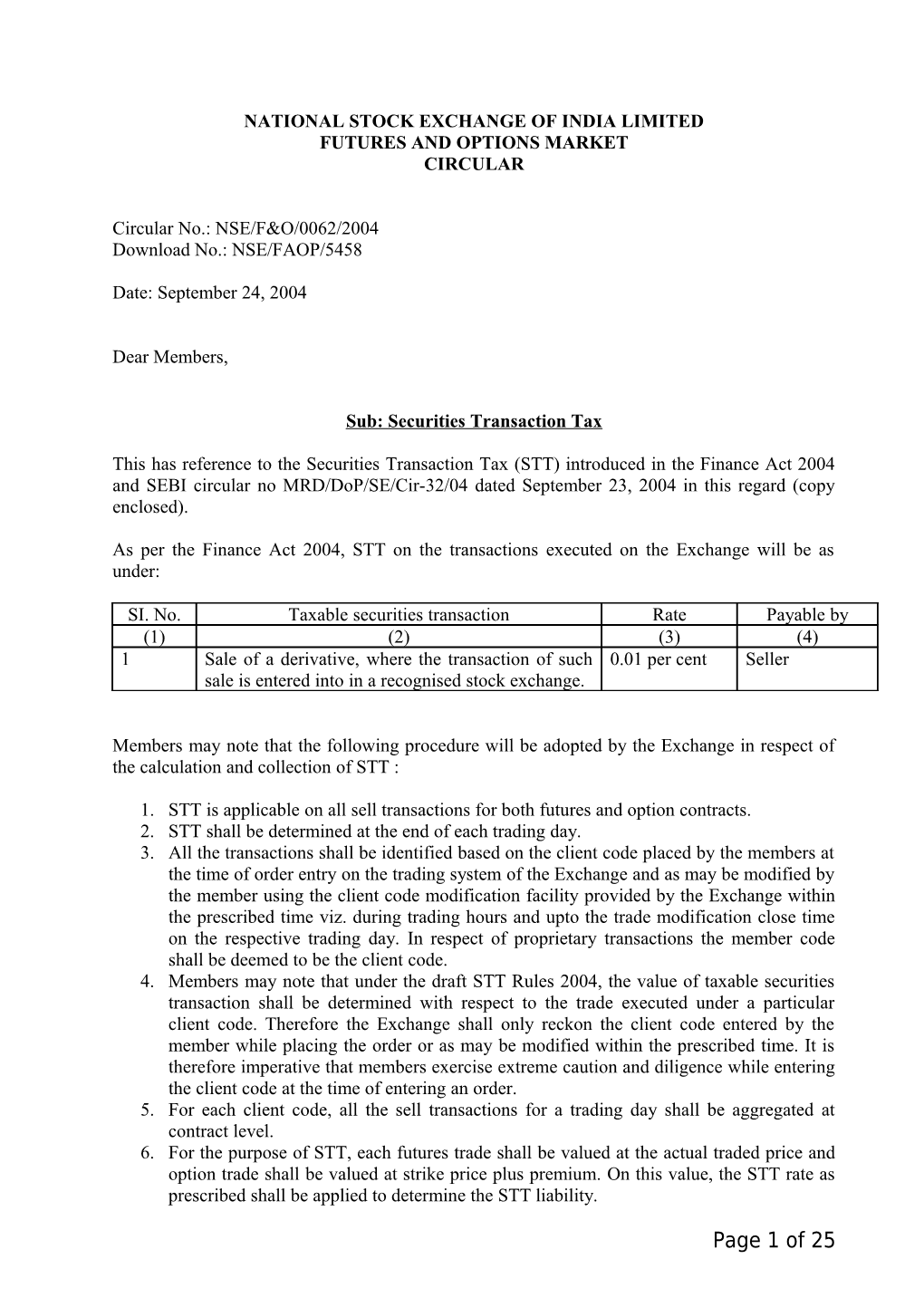

As per the Finance Act 2004, STT on the transactions executed on the Exchange will be as under:

SI. No. Taxable securities transaction Rate Payable by (1) (2) (3) (4) 1 Sale of a derivative, where the transaction of such 0.01 per cent Seller sale is entered into in a recognised stock exchange.

Members may note that the following procedure will be adopted by the Exchange in respect of the calculation and collection of STT :

1. STT is applicable on all sell transactions for both futures and option contracts. 2. STT shall be determined at the end of each trading day. 3. All the transactions shall be identified based on the client code placed by the members at the time of order entry on the trading system of the Exchange and as may be modified by the member using the client code modification facility provided by the Exchange within the prescribed time viz. during trading hours and upto the trade modification close time on the respective trading day. In respect of proprietary transactions the member code shall be deemed to be the client code. 4. Members may note that under the draft STT Rules 2004, the value of taxable securities transaction shall be determined with respect to the trade executed under a particular client code. Therefore the Exchange shall only reckon the client code entered by the member while placing the order or as may be modified within the prescribed time. It is therefore imperative that members exercise extreme caution and diligence while entering the client code at the time of entering an order. 5. For each client code, all the sell transactions for a trading day shall be aggregated at contract level. 6. For the purpose of STT, each futures trade shall be valued at the actual traded price and option trade shall be valued at strike price plus premium. On this value, the STT rate as prescribed shall be applied to determine the STT liability.

Page 1 of 25 7. STT payable by the clearing member shall be the sum total of STT payable by all trading members clearing under him. The trading member’s liability shall be the aggregate STT liability of clients trading through him.

Information to members

A report shall be provided to the members at the end of each trading day. This report shall contain information on the total STT liability, trading member wise STT liability, client wise STT liability and also the detailed computations for determining the client wise STT liability. The format of the report that is given to the clearing members is placed at Annexure I. The format of the report that is given to the trading members is placed at Annexure II.

Client code modification

As explained in point no. 3, since the Exchange will be reckoning the client code entered by the members, members are advised to carry out client code modification, if any, within the prescribed time viz. during trading hours and up to the trade modification close time on the respective trading day. The Exchange shall not entertain any request for modification thereafter.

Payin of funds

Clearing Members shall be required to pay the STT on T+1 day. The STT amount shall be collected as per the timelines stipulated for the funds payin. A separate transaction shall be created and the monies shall be collected from the settlement account of members through their clearing banks as per the process currently followed in respect of settlement obligations.

Failure to pay funds

Non payment of STT will be treated as non fulfillment of settlement obligations for the purpose of all consequential actions against the member.

Information to clients

The contract note should specify the total securities transaction tax for the transactions mentioned therein. Trading Members shall issue the STT details as provided by the Exchange to their respective clients in the format given at Annexure III, alongwith the contract note for the transactions executed on the Stock Exchange.

Members are also advised to peruse the STT draft rules annexed to the SEBI circular (copy enclosed) referred above for better understanding. The members may note that the provisions of Finance Act and Rules on STT will prevail.

Should you need any clarifications on the subject matter you may kindly contact Ashutosh Bhure, Nipa Simaria and Shruthi Raghunath on telephone numbers 26598253 and 26598219.

For and behalf of National Stock Exchange of India Ltd.

Authorised Signatory

Page 2 of 25 Annexure I

File naming convention For Clearing members F_STT02_

Control record type 10 – STT information at Clearing Member level Sr. No Field Mandatory/Optional Description 1. Record Type Mandatory Value – 10 2. STT date Mandatory DD-MON-YYYY 3. Due Date of payment Mandatory DD-MON-YYYY 4. Clearing Member Code Mandatory 5. Total STT Mandatory

Detail record type 20 – STT information at Trading Member level Sr. No Field Mandatory/Optional Description 1. Record Type Mandatory Value – 20 2. STT date Mandatory DD-MON-YYYY 3. Trading Member Code Mandatory 4. Total STT Mandatory

Details record type 30 – STT information at Client level Sr. No Field Mandatory/Optional Description 1. Record Type Mandatory Value – 30 2. STT date Mandatory DD-MON-YYYY 3. Trading Member Code Mandatory 4. Trading client code Mandatory 5. Total STT Mandatory

Details record type 40 – STT information at client contract level Sr. No Field Mandatory/Optional Description 1. Record Type Mandatory Value – 40 2. STT date Mandatory DD-MON-YYYY 3. Trading Member Code Mandatory 4. Trading Client Code Mandatory 5. Instrument Type Mandatory 6. Symbol Mandatory 7. Expiry Date Mandatory 8. Strike price Mandatory 9. Option Type Mandatory 10. CA level Mandatory 11. Sell quantity Mandatory 12. Sell value Mandatory 13. Taxable sell value futures Mandatory 14. Taxable sell value options Mandatory 15. STT futures Mandatory 16. STT options Mandatory 17. Total STT Mandatory Page 3 of 25 Page 4 of 25 Annexure II

File naming convention For Trading members F_STT01_

Control record type 10 – STT information at Trading Member level Sr. No Field Mandatory/Optional Description 1. Record Type Mandatory Value – 10 2. STT date Mandatory DD-MON-YYYY 3. Trading Member Code Mandatory 4. Total STT Mandatory

Details record type 20 – STT information at Client level Sr. No Field Mandatory/Optional Description 1. Record Type Mandatory Value – 20 2. STT date Mandatory DD-MON-YYYY 3. Trading Member Code Mandatory 4. Trading client code Mandatory 5. Total STT Mandatory

Details record type 30 – STT information at client contract level Sr. No Field Mandatory/Optional Description 1. Record Type Mandatory Value – 30 2. STT date Mandatory DD-MON-YYYY 3. Trading Member Code Mandatory 4. Client Code Mandatory 5. Instrument Type Mandatory 6. Symbol Mandatory 7. Expiry Date Mandatory 8. Strike price Mandatory 9. Option Type Mandatory 10. CA level Mandatory 11. Sell quantity Mandatory 12. Sell value Mandatory 13. Taxable sell value futures Mandatory 14. Taxable sell value options Mandatory 15. STT futures Mandatory 16. STT options Mandatory 17. Total STT Mandatory

Page 5 of 25 Annexure III

Statement of Securities Transaction Tax for derivative

Stock Exchange

Stock Broker Code Stock Broker Name

Trading Client Code Trading Client Name

Trading Client PAN Trading Client MAPIN

Contract Note No. Contract Note Date

Serial No. Security Expiry Date Value of transactions Value of transactions Total STT Futures Options Sale STT Sale STT

TOTAL

For ______

Place : Date : Authorised Signatory

Page 6 of 25 DEPUTY GENERAL MANAGER MARKET REGULATION DEPARTMENT

MRD/DoP/SE/Cir-32/04 September 23, 2004

1. The Executive Directors/Managing Directors/Administrators of All Stock Exchanges 2. All Mutual Funds registered with SEBI 3. Association of Mutual Funds in India (AMFI)

Dear Sirs/Madam,

Sub: Securities Transaction Tax (STT) – Draft Rules, 2004

1. Please refer to circular No.MRD/DoP/SE/Cir-28/2004 dated August 23, 2004 on the captioned subject.

2. Pursuant to the enactment of the Finance (No.2) Act, 2004, the Government of India is expected to notify the Securities Transaction Tax Rules, 2004, very shortly. Meanwhile, in order to facilitate the stock exchanges, their members and mutual funds to put in place the necessary systems and procedures for proper implementation, the draft rules on the captioned subject along with the proposed format of the necessary forms are enclosed.

3. Accordingly, the stock exchanges, their members and mutual funds are hereby advised to ensure that necessary software and procedures for the levy, collection and remittance of STT are put in place immediately in accordance with the enclosed draft Rules.

Yours faithfully,

V S SUNDARESAN

Encl: Copy of draft Rules along with the proposed format of forms.

Page 7 of 25 SECURTIES TRANSACTION TAX (DRAFT) RULES

1. Short title and commencement -

(1) These rules may be called the Securities Transaction Tax (draft) Rules (2) They shall come into force on the day of , 2004.

2. Definitions -

(1) In these rules, unless the context otherwise requires,-

(a) “Act” means the Finance (No.2) Act, 2004 ( 29 of 2004);

(b) “authorised bank” means any bank as may be appointed by the Reserve Bank of India as its agent under the provisions of sub-section (1) of section 45 of the Reserve Bank of India Act, 1934 (2 of 1934);

(c) “Form” means a Form set out in the Appendix hereto.

(2) Words and expressions used but not defined in these Rules and defined in the Act, or the Securities Contracts (Regulation) Act, 1956, or the Income-tax Act, 1961, shall have the meanings respectively assigned to them in those Acts.

3. Value of taxable securities transaction –

For the purposes of clause (c) of section 99 of the Act, the value of a taxable securities transaction, being a purchase or sale of an equity share in a company or a unit of an equity oriented fund, entered into in a recognised stock exchange, shall be determined in the following manner, namely:-

(a) where the equity share or unit is purchased or sold by a person on a trading day in the netted settlement mode,-

(i) the quantity of shares or units purchased or sold in each trade in that equity share or unit executed by the person on that day, shall be multiplied by the price at which the trade is executed, to determine the trade value of each such trade; (ii) the aggregate trade value of all trades in the equity share or unit by the person on that day shall be arrived at by totalling the trade values determined under sub-clause (i);

(iii) the aggregate trade value arrived at under sub-clause (ii), shall be divided by the total quantity of the equity share or unit traded by the person on that day, to determine the volume weighted average price of that equity share or unit for that person for that day;

(iv)such volume weighted average price (rounded off to the nearest paisa) shall be taken to be the value of the taxable securities transaction relating to the equity share or unit.

Page 8 of 25 Explanation.- For the removal of doubts, it is hereby clarified that the determination of the value of the taxable securities transaction under this clause in a case where the equity share or unit is purchased or sold through a member of the stock exchange, shall be made with reference to the trades executed in the equity share or unit under a particular client Code through that member;

(b) where the equity share or unit is purchased or sold by a person in the trade-for-trade settlement mode, the value of the taxable securities transaction shall be the price at which the equity share or unit is purchased or sold;

(c) where the equity share or unit is purchased in the auction settlement mode, the value of the taxable securities transaction shall be the volume weighted average price of the equity share or unit, determined in the manner specified in clause (a), in respect of all trades in that equity share or unit carried out in the auction session;

(d) where the equity share or unit is sold in the auction settlement mode, the value of the taxable securities transaction shall be the price at which the equity share or unit is sold.

Explanation.- For the purposes of this rule –

(i) “netted settlement mode” means a mode of settlement of transactions in a recognised stock exchange where the quantity of an equity share or unit purchased by a person on a trading day is set off against the quantity of that equity share or unit sold by him on that day and actual delivery is required to be taken or given by him as the case may be, only in respect of the net quantity purchased or sold as has not been so set off;

(ii) “ trade-for-trade settlement mode” means a mode of settlement of transactions in a recognised stock exchange where each trade is compulsorily required to be settled by actual delivery;

(iii) “ auction settlement mode” means a mode of settlement, in a stock exchange, of transactions carried out in the auction session, being a trading session in which the stock exchange makes purchases of equity shares or units through an auction process initiated by it, so as to settle transactions where there has been a failure to deliver such equity shares or units which were required to be delivered.

4. Rounding off value of taxable securities transaction, securities transaction tax, etc. -

The value of taxable securities transaction and the amount of securities transaction tax, interest and penalty payable, and the amount of refund due, under the provisions of Chapter VII of the Act shall be rounded off to the nearest rupee and, for this purpose, where such amount contains a part of rupee consisting of paise then, if such part is fifty paise or more, it shall be increased to one rupee and if such part is less than fifty paise it shall be ignored.

5. Person responsible for collection and payment of securities transaction tax in case of a Mutual Fund –

Page 9 of 25 In the case of a Mutual Fund, the person responsible for collection and payment of securities transaction tax in accordance with sub-sections (2), (3) and (4) of section 100 of the Act, shall be the trustee of the Fund, or such other person managing the affairs of the Mutual Fund as may be duly authorised by the trustee in this behalf.

6. Payment of Securities Transaction Tax -

Every recognised stock exchange, or, as the case may be, the trustee of every Mutual Fund or the person authorised by the trustee, who is required to collect and pay securities transaction tax under section 100, shall pay the amount of such tax to the credit of the Central Government by remitting it into any branch of the Reserve Bank of India or of the State Bank of India or of any authorised bank accompanied by a securities transaction tax challan.

7. Return of taxable securities transactions -

(1) The return of taxable securities transactions required to be furnished under sub- section (1) of section 101 of the Act shall, -

(a) in the case of a recognised stock exchange, be in Form No. 1 and be verified in the manner indicated therein; (b) in the case of a Mutual Fund, be in Form No. 2 and be verified in the manner indicated therein.

(2) The details required to be furnished in the schedules to Form No. 1 and Form No. 2 referred to in sub-rule (1) shall be furnished on a computer media, in accordance with the following, -

(a) the computer media conforms to the following specifications:-

i) CD ROM of 650 MB capacity or higher capacity; or ii) 4mm 2GB/ 4GB (90M/ 120M) DAT Cartridge, or iii) Digital Video Disc;

(b) if the data relating to the schedules is copied using data compression or backup software utility, the corresponding software utility or procedure for its decompression or restoration shall also be furnished;

(c) the return shall be accompanied by a certificate regarding clean and virus free data.

(3) In the case of a Mutual Fund, the return referred to in sub-rule (1) shall be furnished by the trustee of the Fund, or such other person managing the affairs of the Mutual Fund as may be duly authorised by the trustee in this behalf.

(4) The return of taxable securities transaction entered into during a financial year shall be furnished on or before the 30th June immediately following that financial year.

8. Return by whom to be signed -

The return under sub-section (1) of section 101 of the Act shall be signed and verified –

Page 10 of 25 (a) in the case of a recognised stock exchange –

(i)being a company, by the managing director or a director thereof; (ii) in any other case, by the principal officer thereof.

(b) in the case of a Mutual Fund, by the trustee or such other person managing the affairs of the Mutual Fund as may be duly authorised by the trustee in this behalf.

9. Time limit to be specified in the notice calling for return of taxable securities transaction -

Where an assessee fails to furnish the return under sub-section (1) of section 101 of the Act within the time specified in sub-rule (4) of rule 7, the Assessing Officer may issue a notice to such person requiring him to furnish, within thirty days from the date of service of the notice, a return in the Form prescribed in rule 7 as applicable to him and verified in the manner indicated therein.

10. Notice of demand -

Where any tax, interest or penalty is payable in consequence of any order passed under the provisions of Chapter VII of the Act, a notice of demand in Form No. 3 specifying the sum so payable shall be served upon the assessee.

11. Prescribed time for refund of tax the person from whom such amount was collected - Every assessee, in case any amount is refunded to it on assessment under sub- section (2) of section 102 of the Act, shall, within thirty days from the date of receipt of such amount, refund the same to the concerned person from whom it was collected.

12. Form of Appeals to Commissioner of Income-tax (Appeals) -

(1) An appeal under sub-section (1) of section 110 to the Commissioner (Appeals) shall be made in Form No. 4.

(2) The form of appeal prescribed by sub-rule (1), the grounds of appeal and the form of verification appended thereto relating to an assessee shall be signed and verified by the person who is authorised to sign the return of taxable securities transactions under rule 8, as applicable to the assessee.

13. Form of appeals to Appellate Tribunal -

(1) An appeal under sub-section (1) or sub-section (2) of section 111 of the Act to the Appellate Tribunal shall be made in Form No. 5, and where the appeal is made by the assessee, the form of appeal, the grounds of appeal and the form of verification appended thereto shall be signed by the person specified in rule 8.

Page 11 of 25 APPENDIX FORM NO. 1 [See rule 7 of Securities Transaction Tax Rules, 2004] RETURN OF TAXABLE SECURITIES TRANSACTIONS STTS – 1 For recognised stock exchanges . Please follow instructions. . Use block letters only. ACKNOWLEDGEME NT 1. NAME OF THE STOCK EXCHANGE For Office use only

Receipt No. 2. ADDRESS OF THE STOCK EXCHANGE Date …………… . …….

Seal and Signature of 3. PERMANENT ACCOUNT NUMBER (PAN)

4. FINANCIAL YEAR (TRANSACTIONS RELATING TO WHICH ARE REPORTED) - 5. WARD/ CIRCULE/ RANGE 6. VALUE OF TAXABLE SECURITIES TRANSACTIONS CODE* (Schedule) VALUE (IN RS.) 01. (A[7])

02. (A[8])

03. (A[9])

04. (B[8])

05. (B[9])

TOTAL

7. TOTAL SECURITIES TRANSACTION TAX COLLECTIBLE

CODE* (Schedule) AMOUNT (IN RS.) 01. (A[10])

02. (A[11])

03. (A[12])

04. (B[10])

05. (B[11])

TOTAL

Page 12 of 25 Page 13 of 25 (Schedule) 8. TOTAL SECURTIES TRANSACTION TAX COLLECTED (C[5])

9. TOTAL SECURTIES TRANSACTION TAX PAID (C[6])

10. SECURITIES TRANSACTION TAX PAYABLE/ REFUNDABLE (7-9)

11. INTEREST PAYABLE UNDER SECTION 104 (C[7])

12. INTEREST PAID (C[8])

VERIFICATION I, ______(full name in block letters), son/ daughter of ______solemnly declare that to the best of my knowledge and belief the information given in this return and schedules accompanying it is correct and complete and that the total value of taxable securities transactions and other particulars shown therein are truly stated and are in accordance with provisions of Chapter VII of the Finance (No.2) Act, 2004 and Securities Transaction Tax Rules, 2004. I further declare that I am making this return in my capacity as ______and I am also competent to make this return and verify it.

Date ______Place ______( Name and Signature )

*CODES IN RESPECT OF TAXABLE SECURITIES TRANSACTION . S.NO NATURE OF TRANSACTION CODE 1. Purchase of an equity share in a company or a unit of an 01 equity oriented fund, where – (a) the transaction of such purchase is entered into in a recognised stock exchange; and (b) the contract for the purchase of such share or unit is settled by the actual delivery or transfer of such share or unit. 2. Sale of an equity share in a company or a unit of an 02 equity oriented fund, where – (a) the transaction of such sale is entered into in a recognised stock exchange; and (b) the contract for the sale of such share or unit is settled by the actual delivery or transfer of such or unit. 3. Sale of an equity share in a company or a unit of an 03 equity oriented fund, where – (a) the transaction of such sale is entered into in a recognised stock exchange; and (b) the contract for the sale of such share or unit is settled otherwise than by the actual delivery or transfer of such share or unit. 4. Sale of a derivative being “option in securities”, where 04 the transaction of such sale is entered into in a recognised stock exchange. Page 14 of 25 5. Sale of a derivative being “futures”, where the 05 transaction of such sale is entered into in a recognised stock exchange.

Page 15 of 25 FORM NO. 2 [See rule 7 of Securities Transaction Tax Rules, 2004] RETURN OF TAXABLE SECURITIES TRANSACTIONS STTS – 2 For Mutual Funds . Please follow instructions. . Use block letters only. ACKNOWLEDGEMENT For Office use only 1. NAME OF MU TUAL FUND Receipt No. Date …………… .……. 2. DATE OF REGISTRATION OF TRUST DEED FOR THE MUTUTAL FUND UNDER THE INDIAN REGISTERATION ACT, 1908

3. NAMES AND ADDRESSES OF TRUSTEES – SCHEDULE - A Seal and Signature of 4. NAME AND ADDRESS OF ASSET MANAGEMENT COMPANY FOR THE FUND Receiving Official

5. PERMANENT ACCOUNT NUMBER (PAN) OF ASSET MANAGEMENT COMPANY FOR THE FUND

6. FINANCIAL YEAR (TRANSACTIONS RELATING TO WHICH ARE REPORTED) - 7. WARD/ CIRCULE/ RANGE 8. NUMBER OF EQUITY ORIENTED FUNDS (Schedule) (IN RS.) 9. VALUE OF TAXABLE SECURITIES TRANSACTIONS 10. TOTAL SECURITIES TRANSACTION TAX COLLECTIBLE (B[8]) 11. TOTAL SECURITIES TRANSACTION TAX COLLECTED (C[6]) 12. TOTAL(B[7]) SECURITIES TRANSACTION TAX PAID (C[7]) 13. SECURITIES TRANSACTION TAX PAYABLE/REFUNDABLE (10-12) 14. INTEREST PAYABLE UNDER SECTION 104 (C[8]) 15. INTEREST PAID (C[9]) VERIFICATION I, ______(full name in block letters), son/ daughter of ______solemnly declare that to the best of my knowledge and belief the information given in this return and schedules accompanying it is correct and complete and that the total value of taxable securities transactions and other particulars shown therein are truly stated and are in accordance with provisions of Chapter VII of the Finance (No.2) Act, 2004 and Securities Transaction Tax Rules, 2004. I further declare that I am making this return in my capacity as ______and I am also competent to make this return and verify it.

Date ______Place ______( Name and Signature )

Page 16 of 25 FORM NO. 3 [See rule 10 of Securities Transaction Rules, 2004] Notice of demand To ……………………… ………………………. Status……………… ……………………….. PAN….. ……………..

1. This is to give you notice that for the financial year ……. a sum of Rs. ………….., details of which are given on the reverse, has been determined to be payable by you.

2. The amount should be paid to the Manager, authorized bank/ State Bank of India/ Reserve Bank of India at …… within 30 ………. days of the service of this notice. The previous approval of the Additional/ Joint Commissioner of Income-tax has been obtained for allowing a period of less than 30 days for the payment of the above sum. A challan is enclosed for the purpose of payment.

3. If you do not pay the amount within the period specified above, you shall be liable to pay simple interest at one per cent for every month or part of a month from the date commencing after end of the period aforesaid in accordance with section 220(2) of the Income-tax Act read with section 109 of the Finance (No.2) Act, 2004.

4. If you do not pay the amount of the tax within the period specified above, penalty (which may be as much as the amount of tax in arrear) may be imposed upon you after giving you a reasonable opportunity of being heard in accordance with section 221 of the Income-tax Act read with section 109 of the Finance (No.2) Act, 2004.

5. If you do not pay the amount within the period specified above, proceedings for the recovery thereof will be taken in accordance with section 222, 227, 229 and 232 of the Income-tax Act, 1961 read with section 109 of the Finance (No.2) Act, 2004.

6. If you intend to appeal against the assessment/ penalty, you may present an appeal under section 110 of Chapter VII of the Finance (No.2) Act, 2004, to the Commissioner of Income-tax (Appeals) …… within thirty days of the receipt of this notice, in Form NO. 4 duly stamped and verified as laid down in that form.

7. The amount has become due as a result of the order of the Commissioner of Income-tax (Appeals) under section 110 of the Chapter VII of the Finance (No.2) Act, 2004. If you intend to appeal against the aforesaid order, you may present an appeal under section 111 of Chapter VII of the said Act to the Income-tax Appellate Tribunal ……within sixty days of the receipt of that order, in Form No. 5, duly stamped and verified as laid down in that form.

Place ………………… ………………. Date………….. Assessing Officer ………………….. Address Notes: 1. Delete in appropriate paragraphs and words. 2. If you wish to pay the amount by cheque, the cheque should be drawn in favour of the Manager, authorized bank/ State Bank of India/ Reserve Bank of India. 3. If you intend to seek extension of time for payment of the amount or propose to make the payment by instalments, the application for such extension or as the case may be, permission to pay by instalments, should be made to the Assessing Officer before the expiry of the period specified in paragraph 2. Any request received after the expiry of the said period will not entertained in view of the specific provisions of section 220(3) of the Income-tax Act.

Page 17 of 25 FORM NO. 4 [See rule 12 of Securities Transaction Rules, 2004] Appeal to the Commissioner of Income-tax (Appeals) Designation of the Commissioner (Appeals) *No…………..of …………………

1. Name and address of the appellant 2. Permanent Account Number 3. Financial year in connection with which the appeal is preferred 4. Assessing Officer passing the order appealed against 5. Section and sub-section of the Chapter VII of the Finance (No.2) Act, 2004, under which the Assessing Officer passed the order appealed against and the date of such order 6. Where the appeal relates to any assessment or penalty, the date of service of the relevant notice of demand 7. In any other case, the date of service of the intimation of the order appealed against 8. Section and sub-section of the Chapter VII of the Finance (No.2) Act, 2004, under which the appeal is preferred 9. Where a return has been filed by the appellant for the financial year in connection with which the appeal is preferred, whether tax due on the value of taxable securities transaction returned has been paid in full (if the answer is in the affirmative, give details of date of payment and amount paid) 10. Relief claimed in appeal 11. **Where an appeal in relation to any other financial year is pending in the case of the appellant with any Commissioner (Appeals), give the details as to the - (a) Commissioner (Appeals), with whom the appeal is pending; (b) financial year in connection with which the appeal has been preferred; (c) Assessing Officer passing the order appealed against; (d) section and sub-section of the Chapter VII of the Finance (No.2) Act, under which the Assessing Officer passed the order appealed against and the date of such order 12. Address to which notices may be sent to the appellant …………….. Signed (Appellant) STATEMENT OF FACTS GROUNDS OF APPEAL …………….. Signed (Appellant) Form of Verification I, …………………., the appellant, do hereby declare that what is stated above is true to the best of my information and belief.

Place …………. …….…………. Date ………….. Signature ………………… Status of appellant Notes: 1. The form of appeal, grounds of appeal and the form of verification appended thereto shall be signed by a person in accordance with the provisions of rule 9 of Securities Transaction Rules, 2004. 2. The memorandum of appeal, statement of facts and the grounds of appeal must be in duplicate and should be accompanied by a copy of the order appealed against and the notice of demand in original, if any. 3. Delete the inappropriate words. 4. *These particulars will be filled in in the office of the Commissioner (Appeals). 5. If the space provided herein is insufficient, separate enclosures may be used for the purpose.

Page 18 of 25 6. **If appeals are pending in relation to more than one financial year, separate particulars in respect of each financial year may be given. 7. The memorandum of appeal shall be accompanied by a fee of one thousand rupees. 8. The fee should be credited in a branch of the authorized bank or a branch of the State Bank of India or a branch of the Reserve Bank of India after obtaining a challan from the Assessing Officer.

FORM NO. 5 [See rule 13 of Securities Transaction Rules, 2004] Form of appeal to the Appellate Tribunal In the Income-tax Appellate Tribunal ……………………………………………………………………………………………………………… *Appeal No……………..of ………………….. Versus …………………………… ……………………………… APPELLANT RESPONDENT

1. The State in which the assessment was made 2. Section of the Chapter VII of the Finance (No.2) Act, 2004 under which the order appealed against was passed 3. The Commissioner (Appeals) passing the appealed against 4. Financial year in connection with which the appeal is preferred 5. Total value of taxable securities transactions declared by the assessee for the financial year referred to in item 3 6. Total value of taxable securities transactions as computed by the Assessing Officer for the financial year referred to in item 3 7. The Assessing Officer passing the original order 8. Section of the Chapter VII of Finance (No.2) Act, 2004 under which the Assessing Officer passed the order 9. Date of communication of the order appealed against 10. Address to which notices may be sent to the appellant 11. Address to which notices may be sent to the respondent 12. Relief claimed in appeal

GROUNDS OF APPEAL 1. 2. 3. 4. etc.

…………………………… …….…………. Signed Signed (Authorised representative, if any) (Appellant)

Verification I, …………………., the appellant, do hereby declare that what is stated above is true to the best of my information and belief.

……………………….. Signed

Notes: 1. The memorandum of appeal must be in triplicate and should be accompanied by two copies (at least one of which should be a certified copy) of the order appealed against, two copies of the relevant order of the Assessing Officer, two copies of the grounds of appeal before the first appellate authority, two copies of the statement of facts, if any, filed before the said appellate authority. 2. The memorandum of appeal by an assessee under section 111(1) of the Chapter VII of Finance (No.2) Act, 2004 must be accompanied by a fee of one thousand rupees. It is suggested that the fee should be credited in a branch of the authorized bank or a branch of the State Bank of India or a branch of the Reserve Bank of India after obtaining a challan and the triplicate challan sent to the Appellate Tribunal with a memorandum of appeal. The Appellate Tribunal will not accept cheques, draft, hundies or other negotiable instruments.

Page 19 of 25 3. The memorandum of appeal should be written in English or, if the appeal is filed in a Bench located in any such State as is for the time being notified by the President of the Appellate Tribunal for the purposes of rule 5A of the Income-tax (Appellate Tribunal) Rules, 1963, the, at the option of the appellant, in Hindi, and should set forth, concisely and under distinct heads, the grounds of appeal without any argument or narrative and such grounds should be numbered consecutively. 4. *The number and year of appeal will be filed in the office of the Appellate Tribunal. 5. Delete the inapplicable columns. 6. If the space provided is found insufficient, separate enclosures may be used for the purpose.

Page 20 of 25 Page 21 of 25 SCHEDULE – A S.No. Name Address

SCHEDULE - B Name of equity Unique Client Folio number of Name of PAN of person MAPIN of Value of taxable Securities Securities oriented fund Code of the person from person from from whom person from securities transaction tax transaction tax fund whom units whom units units purchased whom units transactions collectible collected purchased purchased purchased (In Rs.) (In Rs.) (In Rs.) 1 2 3 4 5 6 7 8 9

TOTAL SCHEDULE - C Mont Name Uniqu Value of Securities Securities Securities Interest Interest Particulars of payment of Securities Transaction Tax/ h of e taxable transaction transaction transaction payable paid interest u/s. 104 equity Client securities tax tax tax paid u/s. 104 u/s. 104 Tax/ Name of BSR Date of Serial Amount oriented Code transaction collectible collected Interest the bank code deposit no. of fund of the during the branch of bank challan fund month branch (In Rs.) (In Rs.) (In Rs.) (In Rs.) (In Rs.) (In Rs.) (In Rs.) (In Rs.) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

TOTAL TOTA L

NOTES: 1. This Form must be used by a Mutual Fund only. 2. Details required in Schedules A, B & C may be filed on computer media specified in rule 7. 3. Details required in Schedule B be given separately for each equity oriented fund set up by the Mutual Fund and sub-total for each fund be also given. 4. Details required in Schedule C be given separately for each month for each equity oriented fund set up by the Mutual Fund and sub-total for each month be also given.

Page 22 of 25 SCHEDULE – A Sl.No. Stock Broker Code Trading Client Client Name PAN of Client MAPIN of Value of taxable securities transactions Securities transaction tax collectible Code Client (In Rs.) (In Rs.) Code 01 Code 02 Code 03 Code 01 Code 02 Code 03 1 2 3 4 5 6 7 8 9 10 11 12

TOTAL SCHEDULE – B Sl.No. Clearing Stock Broker Trading Client Code Client Name PAN of MAPIN of Value of taxable securities Securities transaction tax collectible Member Code Client Client transactions (In Rs.) Code (In Rs.) Code 04 Code 05 Code 04 Code 05 1 2 3 4 5 6 7 8 9 10 11

TOTAL SCHEDULE - C Mont Taxable Value of Securities Securities Securities Interest Interest Particulars of payment of securities transaction tax/ interest u/s. 104 h securities taxable transaction transaction transaction payable paid u/s. Tax/ Name of BSR Date of Serial Amount transaction securities tax tax tax paid u/s. 104 104 Interest the bank code of deposit no. of Code transaction collectible collected branch bank challan (In Rs.) s during (In Rs.) (In Rs.) (In Rs.) (In Rs.) (In Rs.) (In Rs.) branch the month 1 2 3 4 5 6 7 8 9 10 11 12 13 14

TOTAL TOTA L NOTES: 1. This Form must be used by a recognised stock exchange only. 2. Details required in Schedules A, B & C may be furnished on computer media specified in rule 7. 3. Details required in Schedules A & B may be given separately for each stock Broker code and Clearing Member Code as the case may be. Particulars of Client Name, PAN and MAPIN of client should be given wherever available. 4. Particulars of Trading Client Code in Schedule A need not be given in respect of purchase transactions conducted by the stock exchange during auction sessions on behalf of stock brokers who have failed to deliver shares or unit in settlement. Page 23 of 25 5. Details required in Schedule C may be given separately for each month for each type of transaction (Codes 01 to 05) and sub-total for each month be also given..

Page 24 of 25 Page 25 of 25