Objective 5.01

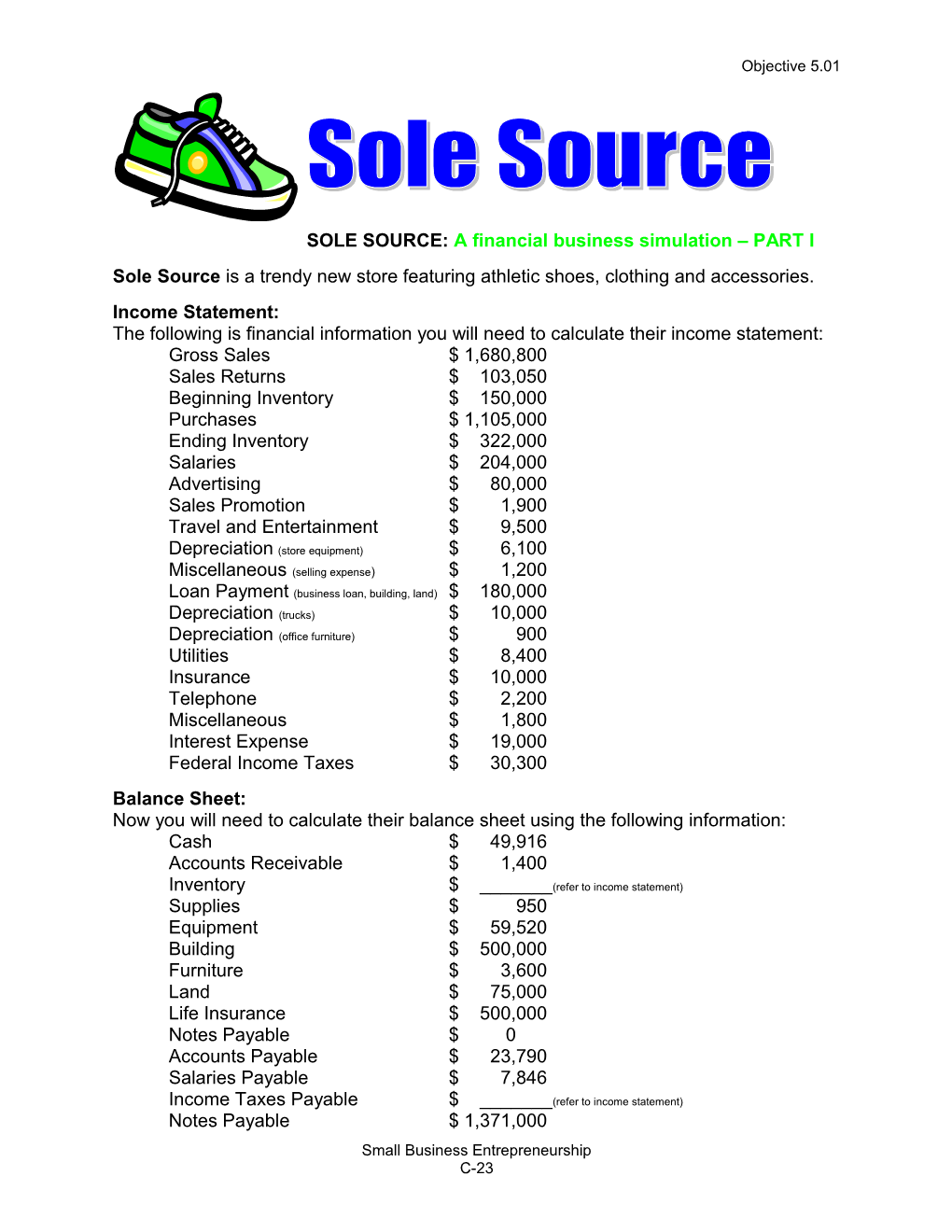

SOLE SOURCE: A financial business simulation – PART I Sole Source is a trendy new store featuring athletic shoes, clothing and accessories. Income Statement: The following is financial information you will need to calculate their income statement: Gross Sales $ 1,680,800 Sales Returns $ 103,050 Beginning Inventory $ 150,000 Purchases $ 1,105,000 Ending Inventory $ 322,000 Salaries $ 204,000 Advertising $ 80,000 Sales Promotion $ 1,900 Travel and Entertainment $ 9,500 Depreciation (store equipment) $ 6,100 Miscellaneous (selling expense) $ 1,200 Loan Payment (business loan, building, land) $ 180,000 Depreciation (trucks) $ 10,000 Depreciation (office furniture) $ 900 Utilities $ 8,400 Insurance $ 10,000 Telephone $ 2,200 Miscellaneous $ 1,800 Interest Expense $ 19,000 Federal Income Taxes $ 30,300 Balance Sheet: Now you will need to calculate their balance sheet using the following information: Cash $ 49,916 Accounts Receivable $ 1,400 Inventory $ ______(refer to income statement) Supplies $ 950 Equipment $ 59,520 Building $ 500,000 Furniture $ 3,600 Land $ 75,000 Life Insurance $ 500,000 Notes Payable $ 0 Accounts Payable $ 23,790 Salaries Payable $ 7,846 Income Taxes Payable $ ______(refer to income statement) Notes Payable $ 1,371,000 Small Business Entrepreneurship C-23 Objective 5.01 Sole Source Income Statement Activity Year Ended December 31, 20__

Revenue from Sales

Gross Sales ______Less Sales Returns and Allowances ______Net Sales ______

Cost of Goods Sold Beginning Inventory ______Purchases ______Total Goods Available for Sale ______Less Ending Inventory ______Total Cost of Goods Sold ______

Gross Profit on Sales ______

Operating Expenses

Salaries ______Advertising ______Sales Promotion ______Travel and Entertainment ______Depreciation ______Miscellaneous ______Loan Payment ______Depreciation-delivery equipment ______Depreciation – office furniture ______Utilities ______Insurance ______Telephone ______Miscellaneous General Expenses ______

Total Operating Expenses ______

Net Income from Operations ______

Less Interest Expense ______

Net Income Before Taxes ______

Less Federal Income Taxes ______

Net Income After Taxes ======

Small Business Entrepreneurship C-24 Objective 5.01 Sole Source Balance Sheet Activity December 31, 20__

ASSETS CURRENT ASSETS Cash $______Accounts Receivable $______Inventory $______Supplies $______FIXED ASSETS Equipment $______Building $______Furniture $______Land $______OTHER ASSETS Life Insurance $______TOTAL ASSETS $ ======LIABILITIES CURRENT LIABILITIES Notes Payable $______Accounts Payable $______Salaries Payable $______Income Taxes Payable $______LONG-TERM LIABILITIES Notes Payable $______NET WORTH Sole Source $______TOTAL LIABILITIES & NET WORTH $ ======

Small Business Entrepreneurship C-25 Objective 5.01 Sole Source (ANSWER KEY) Income Statement Year Ended December 31, 20__

Revenue from Sales Gross Sales $ 1,680,800 Less Sales Returns and Allowances 103,050 Net Sales $1,577,750

Cost of Goods Sold Beginning Inventory $ 150,000 Purchases 1,105,000 Total Goods Available for Sale $ 1,255,000 Less ending inventory 322,000 Total Cost of Goods Sold 933,000

Gross Profit on Sales $644,750

Operating Expenses Salaries $ 204,000 Advertising 80,000 Sales Promotion 1,900 Travel and Entertainment 9,500 Depreciation-store equipment 6,100 Miscellaneous 1,200 Loan Payment 180,000 Depreciation-delivery equipment 10,000 Depreciation – office furniture 900 Utilities 8,400 Insurance 10,000 Telephone 2,200 Miscellaneous General Expenses 1,800 Total Operating Expenses _ 516,000

Net Income from Operations $ 128,750 Less Interest Expense 19,000

Net Income Before Taxes $109,750 Less Federal Income Taxes 30,300

Net Income After Taxes $79,450 ======

Small Business Entrepreneurship C-26 Objective 5.01 Sole Source Balance Sheet (ANSWER KEY) December 31, 20__

ASSETS CURRENT ASSETS Cash $ 49,916_ _ Accounts Receivable $ 1,400_ _ Inventory $ 322,000__ Supplies $ 950__ FIXED ASSETS Equipment $ 59,520__ Building $ 500,000__ Furniture $ 3,600__ Land $ 75,000 _ OTHER ASSETS

Life Insurance $ 500,000 __ TOTAL ASSETS $1,512,386 ======LIABILITIES CURRENT LIABILITIES Notes Payable $ __ 0_____ Accounts Payable $ 23,790 __ Salaries Payable $ 7,846_ _ Income Taxes Payable $ 30,300_ _ LONG-TERM LIABILITIES Notes Payable $1,371,000__ NET WORTH Sole Source $ 79,450 _ TOTAL LIABILITIES & NET WORTH $1,512,386 ======

Small Business Entrepreneurship C-27