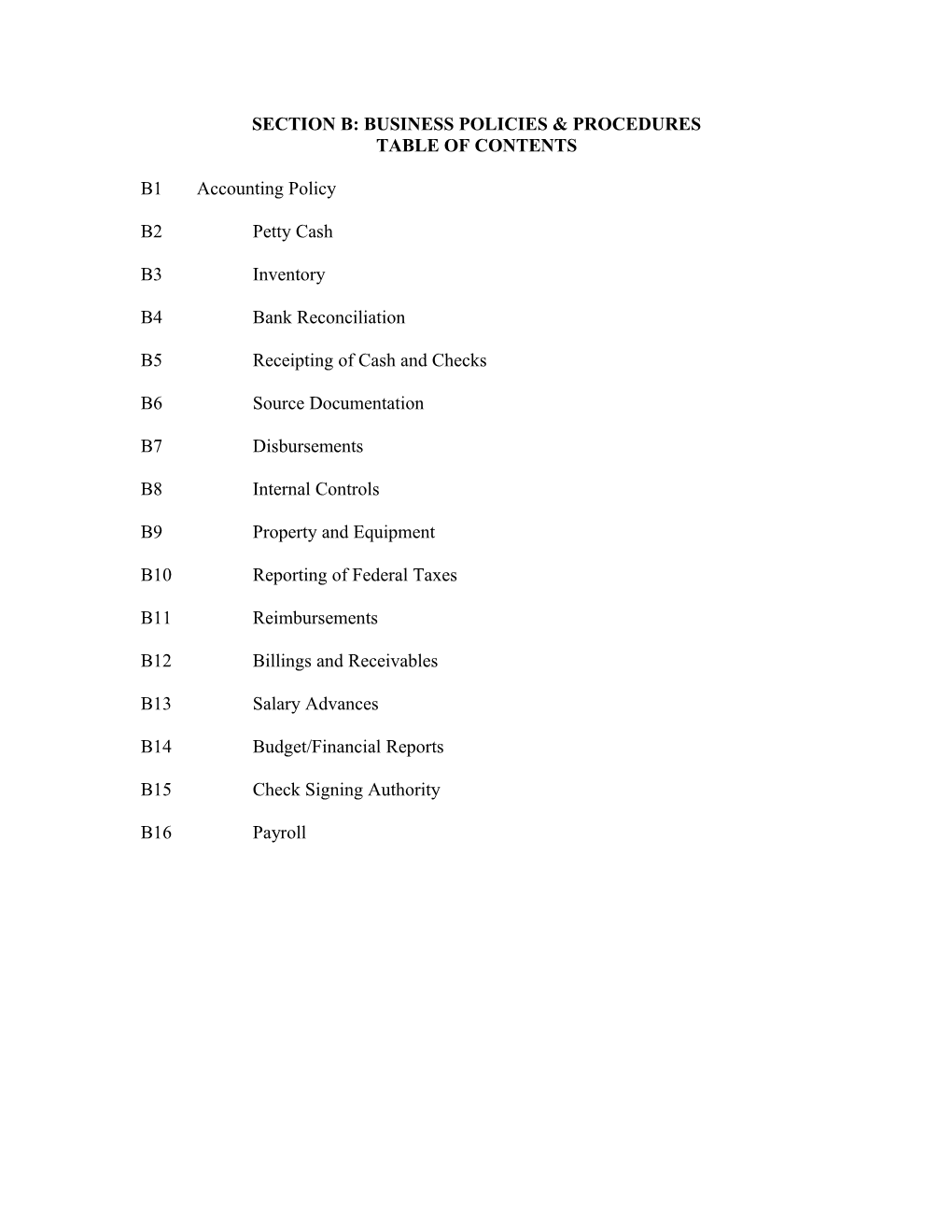

SECTION B: BUSINESS POLICIES & PROCEDURES TABLE OF CONTENTS

B1 Accounting Policy

B2 Petty Cash

B3 Inventory

B4 Bank Reconciliation

B5 Receipting of Cash and Checks

B6 Source Documentation

B7 Disbursements

B8 Internal Controls

B9 Property and Equipment

B10 Reporting of Federal Taxes

B11 Reimbursements

B12 Billings and Receivables

B13 Salary Advances

B14 Budget/Financial Reports

B15 Check Signing Authority

B16 Payroll Ability1st Policy B-1 ACCOUNTING POLICY

The Center for Independent Living of North Florida, doing business as Ability1st, is a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code.

Accounting records are kept in conformity with generally accepted accounting principles. Ability1st maintains an internal control procedure necessary to provide for an accurate and detailed audit trail for all financial transactions.

A yearly audit is conducted after the close of fiscal year (September 30) by an independent CPA in accordance with generally accepted auditing standards and with the audit requirements set forth by the audit guide issued by our funding sources and consistent with federal regulations. Ability1st Policy B-2 PETTY CASH

Ability1st has $200.00 in petty cash for the general office.

The Director of Finance is custodian of petty cash funds.

Advances to employees for purchase of miscellaneous items to be used in a function of Ability1st must be authorized by the Executive Director, Director of Programs & Services, or Director of Finance.

Persons receiving cash must sign a petty cash log. Receipts for purchase must be submitted to the Director of Finance.

The Director of Finance shall reconcile all receipts for petty cash monthly and the Executive Director will review and sign off. Ability1st Policy B-3 INVENTORY

An inventory of assets is maintained by the Administrative Assistance with cost, source of funds for purchase, description and location if available.

All equipment costing $1,000 will be recorded as a fixed asset.

Inventory will be maintained by the Administrative Assistant who will update it annually (at the end of each fiscal year) and give a copy to the Fiscal Department for the annual audit. Ability1st Policy B-4 BANK RECONCILIATION

The Executive Director receives and reviews all unopened bank statements first, then gives them to the Director of Finance to reconcile all accounts on a monthly basis. The Director of Finance verifies the bank transactions and reconciles the bank statement to the general ledger in QuickBooks. The reconciliation is then placed in a monthly folder that documents all fiscal activities for each given month. A designated member of the board of directors will review monthly. Ability1st Policy B-5

PROCESSING CASH RECEIPTS AND CHECKS

1. The monthly reconciliation of bank statements shall be done by the Director of Finance.

2. The general process for receiving funds is as follows:

a. Cash received will be receipted and logged through the Receptionist or Director of Finance. The checks and/or cash received at the front desk will be placed into an envelope, signed on the outside by the person that took the money and placed in the locked cash box at the front desk. If the receptionist is not available the cash will be given to the Director of Finance. At the end of the day the locked cash box will given to the Director of Finance. If not deposited that day cash and checks will be locked in the safe until the following day.

b. All checks received in the mail will be opened and logged in by the Receptionist or Administrative Assistant. They will then be placed in the locked box kept at the front desk during the day. At the end of every day the locked box is returned to the Director of Finance. The checks should be immediately restrictively endorsed “For Deposit Only”. Copies will be made of all cash and checks received that day. At least weekly or whenever collections exceed $500 a bank deposit will be made.

c. The Accounts Receivable receipts are entered into Quickbooks by the Director of Finance. On a monthly basis the A/R postings are compared to the bank statement. Any discrepancies should be brought to the attention of the Executive Director and resolved immediately. Ability1st Policy B-6 SOURCE DOCUMENTATION

All disbursements must be accompanied by a check request with an authorized signature. The check request must include the payee, description, account, general ledger account code, amount, and authorized approval. All check requests must be accompanied with back up documentation. Everything is paid from an invoice not a statement. Ability1st Policy B-7 DISBURSEMENTS

1. All check requests must be approved by the Executive Director or Director of Programs & Services. Board approval is needed for a non-routine purchase over $2,000.00.

2. All checks must be accounted for and a proper audit paper trail must be maintained. Voided checks will be retained and filed in the void check file folder.

a. All check requests are due by Monday close of business for check disbursement by Wednesday close of business of the same week.

b. After the Executive Director or the Director of Programs and Services approves the expenditures, the Administrative Assistant prepares the checks.

c. The prepared checks and supporting documentation are presented to the Director of Finance for verification of cost center expenditure.

d. The only individuals authorized to sign checks are the Executive Director, Director of Programs & Service and designated officers of the Board.

3. Blank checks are locked in the Administrative Assistant’s office. Access is restricted to the Administrative Assistant, Director of Finance, Director of Programs & Services and Executive Director. Voided checks will be defaced and brought to the Director of Finance’s attention. These checks are retained and filed in the void check file folder.

4. A copy of all disbursement checks and/or the check stub must be attached to all appropriate documentation and stored safely in the Director of Finance’s office.

Ability1st Policy B-8 INTERNAL CONTROLS

In order to protect Ability1st from loss of assets, protect the Fiscal Department and the Executive Director from an unscrupulous employee, and protect honest employees from suspicion, Ability1st maintains internal control in its operation as follows:

1. The Administrative Assistant or Receptionist will open the mail and record all cash and checks in the Accounts Receivable log. The Administrative Assistant initials all transactions. A daily list of receivables is maintained in the QuickBooks general ledger. Director of Finance reviews log monthly and also reviews the reconciliation of the bank statements to the general ledger each month.

2. In order to minimize the probability of someone else cashing a check intended for Ability1st, The Director of Finance will immediately endorse the check with the name of Ability1st’s bank and account number, for deposit only. All cash and checks not yet deposited will be placed in the safe in the Director of Finance’s office at the end of each day.

3. Should Ability1st engage in any sort of activity where collection of money is made at the door, such as a dinner or dance, food concessions, garage sale or other fundraiser or special events, cash collections must be recorded and a receipt given.

4. Bank deposits are made by the Executive Director or Director of Programs and Services, or Administrative Assistant as often as needed or whenever collections exceed $500. Bank deposit slips will be given to the Director of Finance within 24 hours after the deposit is made. Cash is never used to pay bills. All cash must be deposited and bills paid by Ability1st check.

5. Financial Statements are prepared monthly by the Director of Finance and reviewed monthly by the Executive Director and the Board Treasurer. Ability1st Policy B-9 PROPERTY AND EQUIPMENT

1. All property and equipment valued in excess of $1,000 is inventoried and registered on a schedule of fixed assets with the following information recorded.

a. historical cost

b. date placed in service

c. source of funds used for the purchase

2. Donated fixed assets are recorded at the estimated fair market value on the date donated.

3. On an annual basis, the property and equipment on hand will be compared to the fixed asset schedule. Obsolete equipment will be disposed of and any other discrepancies will be reconciled by the Administrative Assistant, unless prohibited by funding source. Ability1st Policy B-10

REPORTING OF FEDERAL TAXES

1. On the first day of employment, a new employee of Ability1st must fill out and sign an employee’s withholding allowance certificate (W-4 forms) for payroll purposes.

2. Ability1st may also employ individuals on a contractual basis. Any such employee earning a minimum of $600 within one calendar year receives a copy of IRS Form 1099, which is a statement of earnings. This report is filed with the IRS at the end of each calendar year (by January 31) like the Annual Wage and Tax Statement for permanent and temporary part-time and full-time employees. Contractual employees will be responsible for their own taxes. Contractual employees include freelance interpreters, contract construction labor, personal care assistants, skills instructors, etc. The Director of Finance, or the CPA firm hired by Ability1st, completes all IRS 1099 Forms.

3. Annually Ability1st Director of Finance, or hired CPA firm, completes the required Federal Form 990. Ability1st Policy B-11 REIMBURSEMENTS

All requests for grant contract reimbursements are prepared on a monthly/quarterly basis by the Director of Finance or the Administrative Assistant. A separate reimbursement request is prepared for each contract and an invoice is created in QuickBooks. Any invoice that is a shared expense is allocated proportionally to each grant contract program. If the grant contract does not specify reimbursement for shared expenses, the reimbursement will be allocated to an allowable source. A copy is kept on file of all billings at Ability1st.

A monthly checklist of all contract reimbursements and necessary monthly billing is maintained and reviewed by the Executive Director to ensure that billing is completed. Certain grants are billed on a quarterly basis and those are included on a quarterly checklist. Ability1st Policy B-12 BILLINGS AND RECEIVABLES

1. All billings are prepared by the Fiscal Department, who in turn reconciles the receivables and cash received on a monthly basis. Appropriate invoices are created in QuickBooks.

2. All billing rates are negotiated by the Executive Director/Fiscal Department.

3. All billings are promptly recorded in QuickBooks receivable records and copies of billings maintained in invoice files.

4. The Fiscal Department reviews the status of all accounts receivable at the end of each month. Any receivable overdue shall be brought to the attention of the Executive Director for disposition. Ability1st Policy B-13 SALARY ADVANCES

Salary advances and loans of any nature are prohibited. Ability1st Policy B-14 BUDGET/FINANCIAL REPORTS

The Executive Director, with input from the Director of Finance, shall be responsible for preparing a budget for revenue and expenditures on an annual basis to be reviewed and approved by the Board of Executive Directors before implementation.

The Director of Finance shall prepare a monthly Financial Report for the Board of Directors. Periodic reports detailing year-to-date revenue and expenditures, and comparisons with budget allotments, will also be completed by the Director of Finance for review by the Executive Director and Board.

The Executive Director, Director of Programs & Services and the Director of Finance will review the operating budget monthly. The budget will be reviewed at the six month point and appropriate revisions and modifications will be made.

All records and accounts of Ability1st shall be audited annually by a Certified Public Accounting firm to be selected by the Board of Directors, in consultation with the Executive Director. Ability1st Policy B-15 CHECK-SIGNING AUTHORITY

All check disbursements from any Ability1st account will require two of the following signatures:

1. Executive Director 2. Director of Programs & Services 3. Designated board members

No designated signee will ever sign any check for which they do not have full understanding of purpose of the expenditure.

If there is any question as to the allowability of the expenditure, the regulations will be researched. Each designated signee shall be thoroughly familiar with the regulations regarding allowable costs.

A designated signee may request any backup material necessary pertinent to the check(s) to be signed prior to signing. Ability1st Policy B-16 PAY ROLL

Pay Schedule

All employees are paid every other Thursday for the preceding two-week time period.

Pay Period

The pay period for all employees is the two week period starting on a Monday and ending on a Sunday, to be paid on the following Thursday. Timesheets are due on the Monday of the pay week. If an employee is out for any reason and unable to complete their timesheet, it is the supervisor’s responsibility to complete the employee’s timesheet.

Pay Corrections

Ability1st takes all reasonable steps to ensure that employees receive the correct unit of pay each paycheck and that employees are paid promptly on schedule.

In the unlikely event that there is an error in the amount of pay, the employee should promptly bring this to the attention of the Director of Finance so that corrections can be made as quickly as possible.