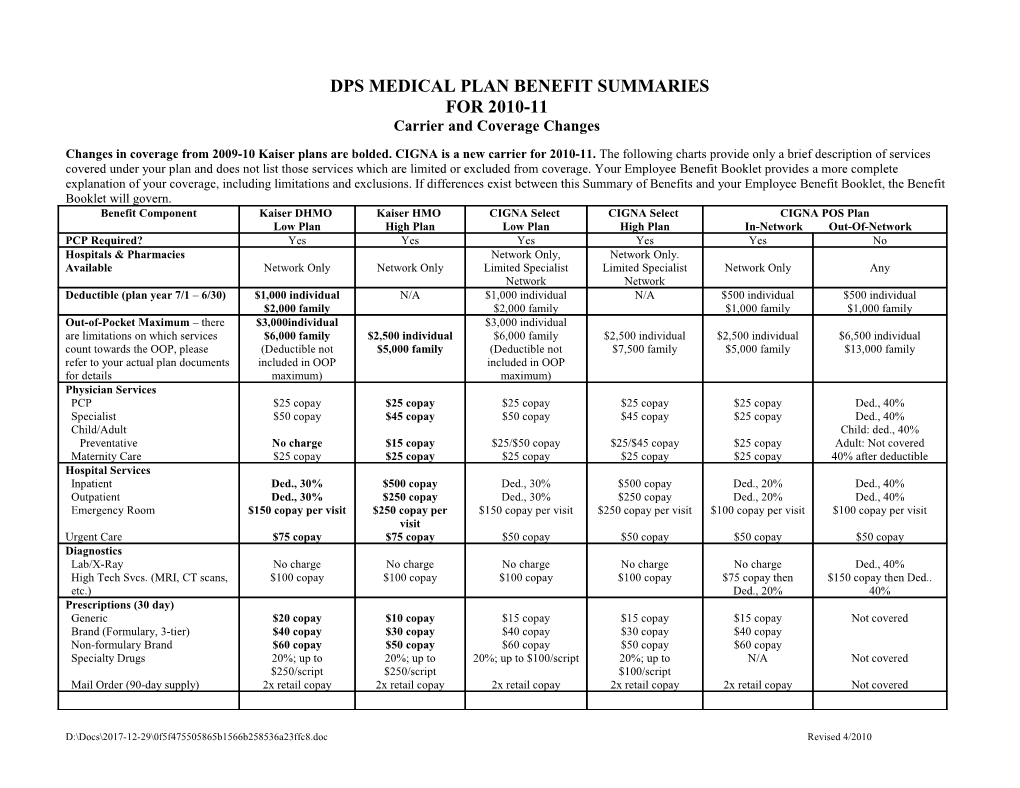

DPS MEDICAL PLAN BENEFIT SUMMARIES FOR 2010-11 Carrier and Coverage Changes

Changes in coverage from 2009-10 Kaiser plans are bolded. CIGNA is a new carrier for 2010-11. The following charts provide only a brief description of services covered under your plan and does not list those services which are limited or excluded from coverage. Your Employee Benefit Booklet provides a more complete explanation of your coverage, including limitations and exclusions. If differences exist between this Summary of Benefits and your Employee Benefit Booklet, the Benefit Booklet will govern. Benefit Component Kaiser DHMO Kaiser HMO CIGNA Select CIGNA Select CIGNA POS Plan Low Plan High Plan Low Plan High Plan In-Network Out-Of-Network PCP Required? Yes Yes Yes Yes Yes No Hospitals & Pharmacies Network Only, Network Only. Available Network Only Network Only Limited Specialist Limited Specialist Network Only Any Network Network Deductible (plan year 7/1 – 6/30) $1,000 individual N/A $1,000 individual N/A $500 individual $500 individual $2,000 family $2,000 family $1,000 family $1,000 family Out-of-Pocket Maximum – there $3,000individual $3,000 individual are limitations on which services $6,000 family $2,500 individual $6,000 family $2,500 individual $2,500 individual $6,500 individual count towards the OOP, please (Deductible not $5,000 family (Deductible not $7,500 family $5,000 family $13,000 family refer to your actual plan documents included in OOP included in OOP for details maximum) maximum) Physician Services PCP $25 copay $25 copay $25 copay $25 copay $25 copay Ded., 40% Specialist $50 copay $45 copay $50 copay $45 copay $25 copay Ded., 40% Child/Adult Child: ded., 40% Preventative No charge $15 copay $25/$50 copay $25/$45 copay $25 copay Adult: Not covered Maternity Care $25 copay $25 copay $25 copay $25 copay $25 copay 40% after deductible Hospital Services Inpatient Ded., 30% $500 copay Ded., 30% $500 copay Ded., 20% Ded., 40% Outpatient Ded., 30% $250 copay Ded., 30% $250 copay Ded., 20% Ded., 40% Emergency Room $150 copay per visit $250 copay per $150 copay per visit $250 copay per visit $100 copay per visit $100 copay per visit visit Urgent Care $75 copay $75 copay $50 copay $50 copay $50 copay $50 copay Diagnostics Lab/X-Ray No charge No charge No charge No charge No charge Ded., 40% High Tech Svcs. (MRI, CT scans, $100 copay $100 copay $100 copay $100 copay $75 copay then $150 copay then Ded.. etc.) Ded., 20% 40% Prescriptions (30 day) Generic $20 copay $10 copay $15 copay $15 copay $15 copay Not covered Brand (Formulary, 3-tier) $40 copay $30 copay $40 copay $30 copay $40 copay Non-formulary Brand $60 copay $50 copay $60 copay $50 copay $60 copay Specialty Drugs 20%; up to 20%; up to 20%; up to $100/script 20%; up to N/A Not covered $250/script $250/script $100/script Mail Order (90-day supply) 2x retail copay 2x retail copay 2x retail copay 2x retail copay 2x retail copay Not covered

D:\Docs\2017-12-29\0f5f475505865b1566b258536a23ffc8.doc Revised 4/2010 Benefit Component Kaiser HMO Kaiser HMO CIGNA Select CIGNA Select Low Plan High Plan Low Plan High Plan Therapies Mental Health Outpatient, $25 copay; 20 visit $25 copay; 20 visit $25/$50 copay; 60 $25/$45 copay; 60 $25 copay; 60 visit Ded., 40%, 60 visit max Physical, Occupational & Speech max for each type of max for each type of visit max for all visit max for all max for all therapies for all therapies Therapy (outpatient) therapy therapy per plan therapies combined therapies combined combined combined in and out-of- year network

Chiropractic Care Not Covered $25 copay; 20 visit $25/50 copay; 60 visit $25/$45 copay; 60 $25 copay; 60 visit Ded., 40%, 60 visit max max for each type of max for all therapies visits max for all max for all therapies for all therapies therapy per plan combined therapies combined combined combined in and out-of- year network Vision Refractive Exam $25 copay $25 copay Not covered Not covered Not covered Not covered Lifetime Maximum Unlimited Unlimited Unlimited Unlimited Unlimited $1,000,000

DPS DENTAL PLAN SUMMARIES FOR 2010-2011 No coverage changes

The following charts provide only a brief description of services covered under your plan and does not list those services which are limited or excluded from coverage. Your Employee Benefit Booklet provides a more complete explanation of your coverage, including limitations and exclusions. If differences exist between this Summary of Benefits and your Employee Benefit Booklet, the Benefit Booklet will govern. Delta Dental Delta Dental Benefit Component Premier Plan EPO Plan Network Dentist Selection No, but less out-of-pocket costs when using a Delta Dental PPO or Premier Yes, to receive the benefits. Required? participating dentist. Patients receiving services of a dentist not participating with No benefits outside the PPO network. Delta will be responsible for charges in excess of Maximum Plan Allowances Deductible $50 per person/Maximum of 3 per family per calendar year No Maximum Annual Benefits $1500 None Orthodontic Max. Benefit $1000 lifetime N/A Exam: $10 Diagnostic and Preventative 0%, deductible waived, includes exams, cleanings, X-Rays, Sealants, Fluoride Cleaning: No Cost Services Treatment X-Rays: No Cost Fillings: $21 to $73 Restorative Services 20% after deductible (includes fillings) Root Canals: $110 to $297 Oral Surgery: $22 to $100 Gum Surgery: $24 - $284 50% after deductible (includes bridges, crowns, dentures, extractions, root canals, Crowns: $161 to $280 Major Services gum surgery). Patients receiving services of a dentist not participating with Delta Dentures: $349 to $377 will be responsible for charges in excess of Maximum Plan Allowances. Orthodontics Adult: Orthodontics 50% $935 to $2230 Orthodontics Child: $600 to $2030

D:\Docs\2017-12-29\0f5f475505865b1566b258536a23ffc8.doc Revised 4/2010 DPS VISION PLAN SUMMARY FOR 2010-11 No coverage changes

The following charts provide only a brief description of services covered under your plan and does not list those services which are limited or excluded from coverage. Your Employee Benefit Booklet provides a more complete explanation of your coverage, including limitations and exclusions. If differences exist between this Summary of Benefits and your Employee Benefit Booklet, the Benefit Booklet will govern.

Benefit Component In Network Out of Network Benefit Frequency Once every 12 months Once every 12 months (Exam, Lenses, Frames Employee – Covered in full Up to $30 Exams Dependent – Covered in full All single, lined bifocal, lined trifocal lenses covered in full Single: Up to $30, Bifocal: Up to $40, Trifocal: Up to Lenses $50 Frames $120 retail allowance Up to $30 Up to $120 in lieu of glasses Up to $105 in lieu of glasses Elective Contacts Allowance includes contacts, contact lens exam (evaluation & fitting) 20% discount off of frame overages Patients receiving services from a non-participating 30% discount on cosmetic options such as tints, coats and progressive lenses. 15% vision provider will be responsible for charges in Comments discount off of Doctors contact lens exam fees. excess of plan allowances.

D:\Docs\2017-12-29\0f5f475505865b1566b258536a23ffc8.doc Revised 4/2010