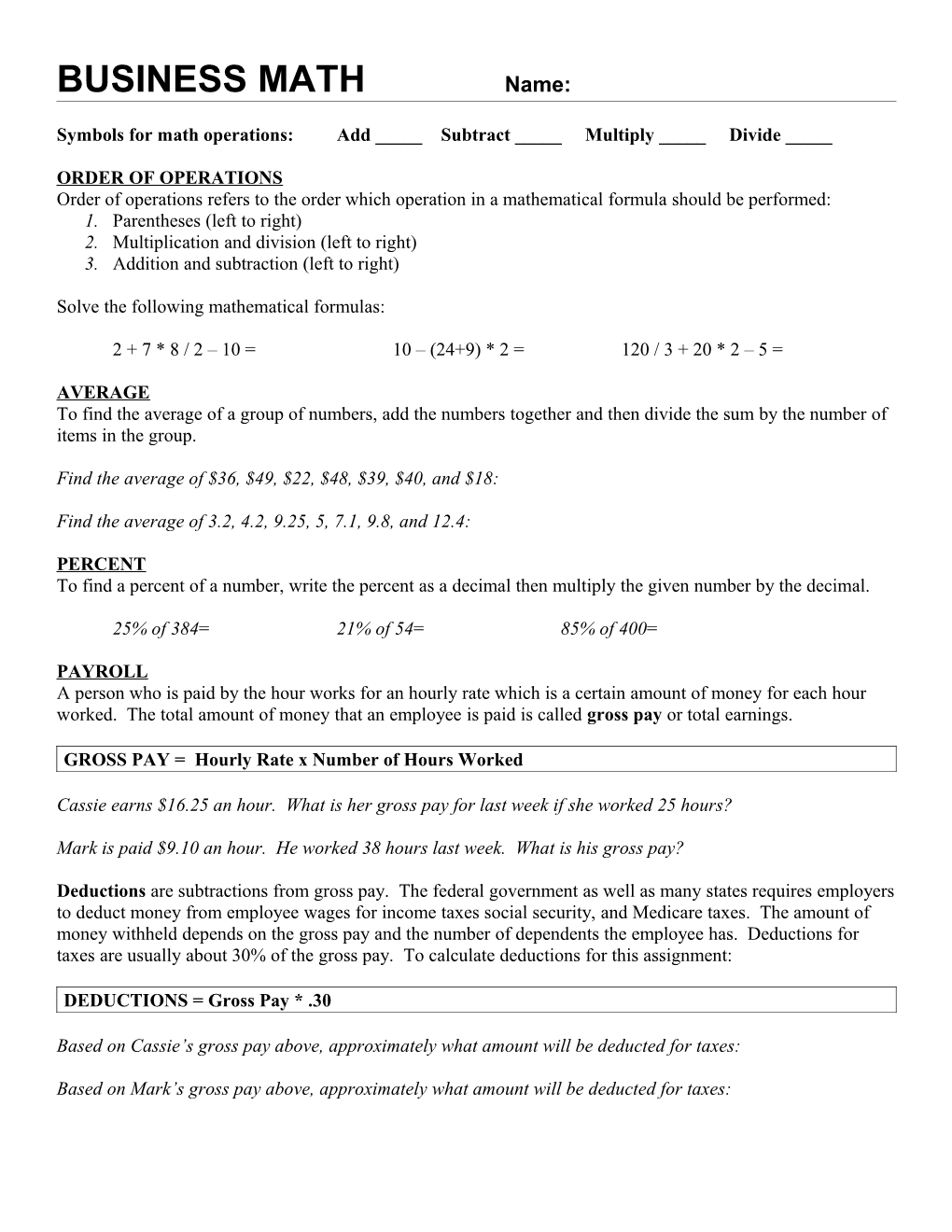

BUSINESS MATH Name:

Symbols for math operations: Add _____ Subtract _____ Multiply _____ Divide _____

ORDER OF OPERATIONS Order of operations refers to the order which operation in a mathematical formula should be performed: 1. Parentheses (left to right) 2. Multiplication and division (left to right) 3. Addition and subtraction (left to right)

Solve the following mathematical formulas:

2 + 7 * 8 / 2 – 10 = 10 – (24+9) * 2 = 120 / 3 + 20 * 2 – 5 =

AVERAGE To find the average of a group of numbers, add the numbers together and then divide the sum by the number of items in the group.

Find the average of $36, $49, $22, $48, $39, $40, and $18:

Find the average of 3.2, 4.2, 9.25, 5, 7.1, 9.8, and 12.4:

PERCENT To find a percent of a number, write the percent as a decimal then multiply the given number by the decimal.

25% of 384= 21% of 54= 85% of 400=

PAYROLL A person who is paid by the hour works for an hourly rate which is a certain amount of money for each hour worked. The total amount of money that an employee is paid is called gross pay or total earnings.

GROSS PAY = Hourly Rate x Number of Hours Worked

Cassie earns $16.25 an hour. What is her gross pay for last week if she worked 25 hours?

Mark is paid $9.10 an hour. He worked 38 hours last week. What is his gross pay?

Deductions are subtractions from gross pay. The federal government as well as many states requires employers to deduct money from employee wages for income taxes social security, and Medicare taxes. The amount of money withheld depends on the gross pay and the number of dependents the employee has. Deductions for taxes are usually about 30% of the gross pay. To calculate deductions for this assignment:

DEDUCTIONS = Gross Pay * .30

Based on Cassie’s gross pay above, approximately what amount will be deducted for taxes:

Based on Mark’s gross pay above, approximately what amount will be deducted for taxes: In addition to taxes, other deductions may also be subtracted from total wages or gross pay such as premiums for health and life insurance. After all deductions are subtracted from gross pay, the amount that remains is called net pay.

NET PAY = Gross Pay – Deductions

What is Cassie’s net pay?

What is Mark’s net pay?

MARKDOWN When a business decides to put items on sale they apply a markdown to their original selling price.

To calculate the price of an item that is marked down:

Percentage of markdown * Regular Price = Amount of Markdown then Regular Price – Amount of Markdown = Selling Price or

100% - Percent of Markdown = Percent of Regular Price that will be paid then Regular Price * Percent of Original Price that will be paid

If the marked price of a backpack is $70 and it is advertised on sale as 15% off, what is the sale price?

A man’s suit with a price of $270 is being offered at a 20% discount. What is the sale price of the suit?

SALES TAX In most states, when you purchase items you pay the price of the item plus sales tax. Sales tax is a percentage of the total cost of the items you purchase. In Utah, the sales tax rate is 6.6% or .066.

To calculate Sales Tax:

Purchase Amount * Tax Rate = Amount of Tax then Purchase Amount + Amount of Tax = Total.

A customer buys items with a total purchase price of $72. What is the amount they will pay for these items with sales tax?

A customer buys items with a total purchase price of $37. What is the amount they will pay for these items with sales tax? BUSINESS MATH ASSIGNMENT

1. Use the correct order of operations to solve the following formulas:

a. 7 * 2 + (50-30)/5 = c. 250 / 3 + 479 – 41 * 6 =

b. 927 – 64 * 4 + (840 / 12) = d. (752 + 338) / 6 + (413 + 607) /3 =

2. Find the average of each set of numbers:

a. 545, 425, 600, 562, 399, 457 Average =

b. 260, 362, 302, 381, 295, 332, 280 Average =

c. 135.05, 241.62, 5452.13, 105.95, 261.48 Average =

3. Calculate the gross pay, deductions, and net pay for the following employees (deductions should be 30% of gross pay):

NAME HOURLY RATE HOURS WORKED GROSS PAY DEDUCTIONS NET PAY Susan $8.15 25 Mike $9.20 30 Maria $12.50 40 Tony $10.35 40 Ann $11.40 35

4. Find the sale price of each of the following items based on the discount percent given:

REGULAR ITEM PRICE MARKDOWN % AMOUNT OF MARKDOWN SALE PRICE Chair $228 25% Tent $85 20% Stroller $159.95 25% DVD Movies $19.99 15% Computer $875 25%

5. Find the amount owed for each of the following purchases (use .066 as the sales tax rate):

AMOUNT OF PURCHASE SALES TAX AMOUNT TOTAL AMOUNT OWED $29.30 $554.90 $72.85 $13,749