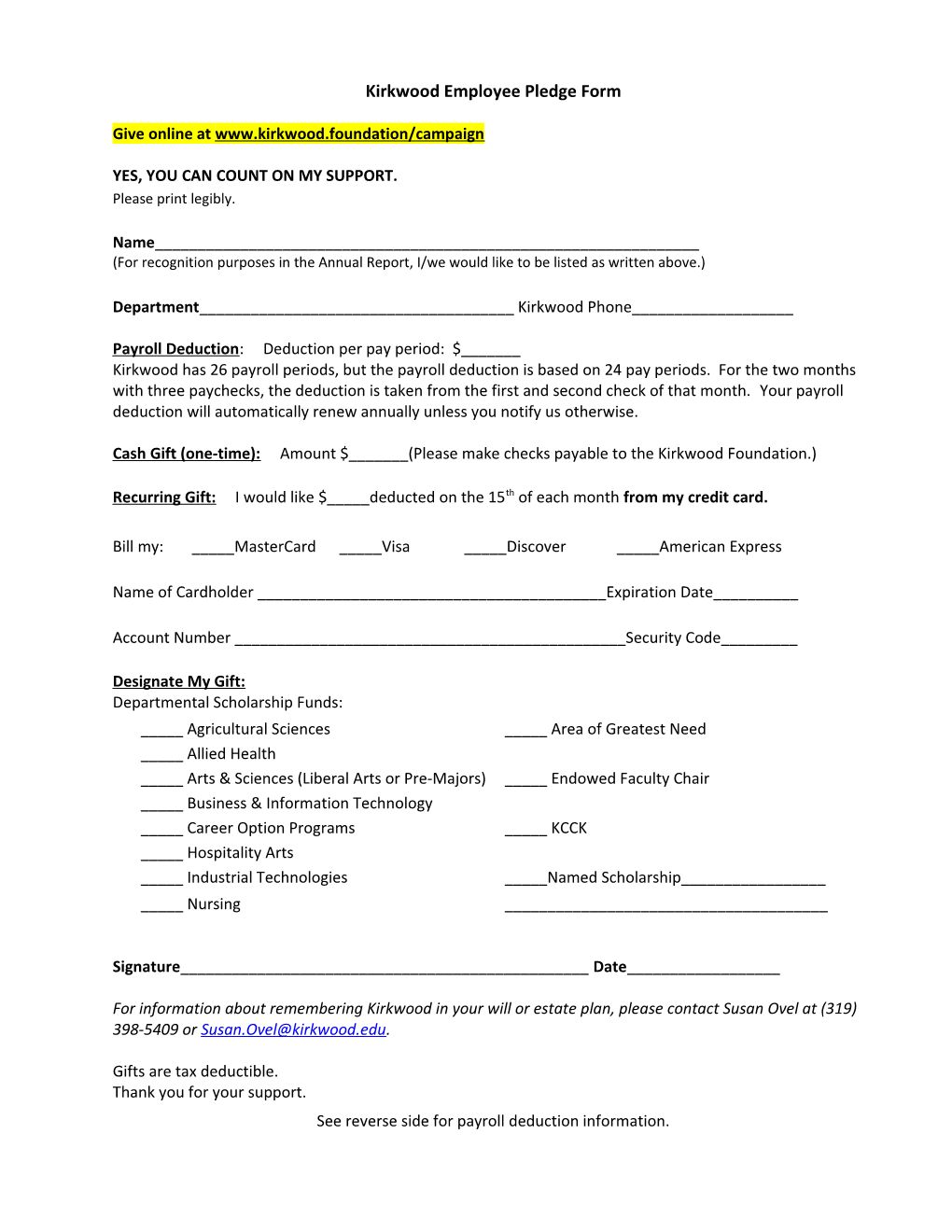

Kirkwood Employee Pledge Form

Give online at www.kirkwood.foundation/campaign

YES, YOU CAN COUNT ON MY SUPPORT. Please print legibly.

Name______(For recognition purposes in the Annual Report, I/we would like to be listed as written above.)

Department______Kirkwood Phone______

Payroll Deduction: Deduction per pay period: $______Kirkwood has 26 payroll periods, but the payroll deduction is based on 24 pay periods. For the two months with three paychecks, the deduction is taken from the first and second check of that month. Your payroll deduction will automatically renew annually unless you notify us otherwise.

Cash Gift (one-time): Amount $______(Please make checks payable to the Kirkwood Foundation.)

Recurring Gift: I would like $_____deducted on the 15th of each month from my credit card.

Bill my: _____MasterCard _____Visa _____Discover _____American Express

Name of Cardholder ______Expiration Date______

Account Number ______Security Code______

Designate My Gift: Departmental Scholarship Funds: _____ Agricultural Sciences _____ Area of Greatest Need _____ Allied Health _____ Arts & Sciences (Liberal Arts or Pre-Majors) _____ Endowed Faculty Chair _____ Business & Information Technology _____ Career Option Programs _____ KCCK _____ Hospitality Arts _____ Industrial Technologies _____Named Scholarship______Nursing ______

Signature______Date______

For information about remembering Kirkwood in your will or estate plan, please contact Susan Ovel at (319) 398-5409 or [email protected].

Gifts are tax deductible. Thank you for your support. See reverse side for payroll deduction information. Payroll Deduction Examples

Donation per pay period Annual gift

$5 $120

$10 $240

$20 $480

$30 $720 $1,008 - Invitation to join Kirkwood’s $42 President’s Circle

$50 $1,200

Kirkwood has 26 payroll periods, but the payroll deduction is based on 24 pay periods. For the two months with three paychecks, the deduction is taken from the first and second check of that month. What does my gift support? A full-time Kirkwood student will pay nearly $5,000 annually for tuition and books, and this doesn’t include expenses such as housing, food and gas. Your gift will provide financial assistance through student scholarships. Can I designate my gift? Using the online employee pledge form, you can designate your gift to one of the following funds - Departmental Scholarship Fund, Golden Opportunity Scholarship, Endowed Faculty Chair, Named Scholarship, or KCCK. How do I sign up for a payroll deduction? Complete the online employee pledge form at www.kirkwood.edu/foundation/campaign. Please make sure to carefully fill out the information requested so your gift goes to the area you want to support. When will my payroll deduction pledge begin and end? All payroll deductions will begin on the next pay period after we receive your form. Your payroll deduction will automatically renew annually unless you notify us otherwise. Questions? Please contact Sarah Peters at (319) 398-5457 or [email protected].