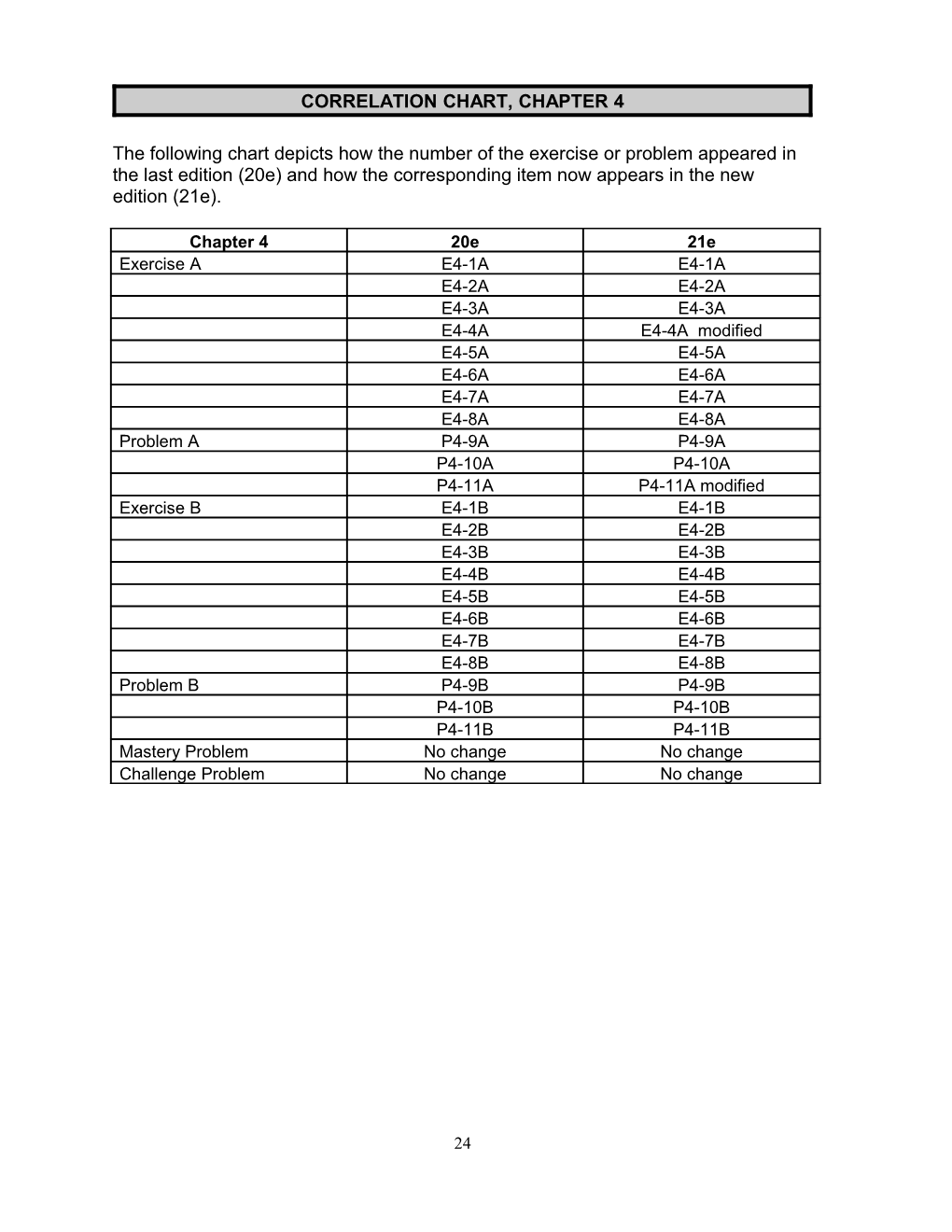

CORRELATION CHART, CHAPTER 4

The following chart depicts how the number of the exercise or problem appeared in the last edition (20e) and how the corresponding item now appears in the new edition (21e).

Chapter 4 20e 21e Exercise A E4-1A E4-1A E4-2A E4-2A E4-3A E4-3A E4-4A E4-4A modified E4-5A E4-5A E4-6A E4-6A E4-7A E4-7A E4-8A E4-8A Problem A P4-9A P4-9A P4-10A P4-10A P4-11A P4-11A modified Exercise B E4-1B E4-1B E4-2B E4-2B E4-3B E4-3B E4-4B E4-4B E4-5B E4-5B E4-6B E4-6B E4-7B E4-7B E4-8B E4-8B Problem B P4-9B P4-9B P4-10B P4-10B P4-11B P4-11B Mastery Problem No change No change Challenge Problem No change No change

24 Chapter 4 Journalizing and Posting Transactions

Learning Objectives

LO1 Describe the flow of data from source documents through the trial balance. LO2 Describe and explain the purpose of source documents. LO3 Describe the chart of accounts as a means of classifying financial information. LO4 Journalize transactions. LO5 Post to the general ledger and prepare a trial balance. LO6 Explain how to find and correct errors.

LO1

I. Flow of Data (See Figure 4-1) A. Analyze transactions using source documents and chart of accounts. B. Enter journal transactions in the general journal in proper form. C. Post entries to the accounts in the general ledger. D. Prepare a trial balance.

LO2

III. Source Documents (See Figure 4-2) A. Are almost any document that provides information about a business transaction. B. Trigger the analysis of what has happened. C. Serve as objective evidence and to verify the accuracy of accounting records.

Teaching Tips

Point out the chart of accounts on the inside back cover of the text.

Encourage your students to use the chart of accounts order for listing expenses on the income statement. This is often easier than listing by amount when doing the homework.

Most accounting software contains a standard chart of accounts. You might bring one in and briefly explain that all charts are organized in a systematic manner.

LO3

II. The Chart of Accounts (See Figure 4-3) A. Is a list of all accounts used by a business. B. Arranged according to the accounting equation. 1. Asset accounts begin with “1.” 2. Liability accounts begin with “2.” 3. Owner’s equity accounts begin with “3.” 4. Revenue accounts begin with “4.” 25 5. Expense accounts begin with “5.”

In-Class Exercise: Complete Exercises E4-1A, E4-1B (5 minutes each)

Teaching Tip

Emphasize that source documents provide objective, verifiable evidence of the transaction. These documents are important if anyone challenges the accuracy of the accounting records.

LO4

IV. The General Journal A. Referred to as a book of original entry. 1. It is here that the first formal accounting record of a transaction is made. 2. It shows the date of each transaction, the title of the account to be debited and the account to be credited, and the amounts of each debit and credit.

Teaching Tip

Perhaps comparing the journal to a day-to-day diary or log would be helpful.

B. Two-column general journal (See Figure 4-4) 1. Named because it has only two amount columns, one for debit amounts and one for credit amounts. 2. Contents (See Figure 4-4) a) Column 1 – Date b) Column 2 – Description (1) The account(s) to be debited are listed first. (2) The account(s) to be credited are indented and listed after the debits. c) Column 3 – Posting Reference d) Column 4 – Debit Amount e) Column 5 – Credit Amount

Teac hing Tips

The transactions introduced for Jessie Jane’s Campus Delivery are repeated in this chapter. This will allow the student to focus on the new topics to be learned: journalizing and posting.

Remind your students of the three main questions to ask when analyzing a transaction: 1. What happened? 2. Which accounts are affected? Classify these accounts as assets, liabilities, owner’s equity, revenue, or expenses. 3. How is the accounting equation affected? Determine whether the accounts have increased or decreased. Determine whether the accounts should be debited or credited. 26 C. Journalizing (See Figure 4-6 and Figure 4-7) 1. Act of entering transactions in a journal: a) Enter the date. b) Enter the account title and amount of the debit. c) Enter the account title and amount of the credit. d) Enter the explanation. 2. Skip a line between transactions. 3. The four-step process is repeated for each transaction. 4. A general journal entry that affects more than two accounts, thus having more than one debit and/or one credit is called a compound entry.

Teaching Tips

Stress using the proper format and account titles when entering transactions in the journal.

Sometimes students think that dollar signs should be used in the journal and general ledger. Explain that dollar signs are used only on formal reports and financial statements.

Once more, point out to your students that payments “on account,” such as June 6 (d), affect only the Cash account and the liability account – Accounts Payable. Receipts “on account,” such as June 20 (k), affect only the Cash account and the asset account—Accounts Receivable.

Remind your students that supplies and prepaid insurance are assets because they provide future benefits. The supplies purchased June 16 (i) will last more than one month and the insurance premium paid June 18 (j) covers eight months. Some students might ask when an expense will be recognized. Encourage them to wait as this will be discussed in Chapter 5.

Students sometimes have a difficult time remembering the exact account titles. Although this is understandable, the account titles listed in the firm’s chart of accounts must be used for journalizing. With practice, using proper account titles will seem easy.

In-Class Exercise: Complete Exercises E4-2A, E4-2B (5 minutes each)

LO5

V. The General Ledger

A. A complete set of all of the accounts used by a business. 1. Provides a complete record of the transactions entered into each account. 2. Accounts are numbered and arranged in the same order as the chart of accounts. Teaching Tip

Stress that the journal and ledger are different books. 27 B. General Ledger Account (See Figure 4-8) 1. Date column 2. Item column 3. Posting Reference column 4. Debit entry column 5. Credit entry column 6. Debit balance column 7. Credit balance column 8. Heading (account title and account number)

Teaching Tip

The “Item” column is also used to identify correcting, adjusting, closing, and reversing entries made at the end of the accounting period. These will be discussed at the end of this chapter and in Chapters 5, 6 and 16.

C. Costing to the General Ledger (See Figure 4-9 and Figure 4-10)

Teaching Tip

Point out that transactions should be entered in the journal as they occur. However, posting can wait until enough transactions have accumulated to use posting time efficiently. Of course, all transactions must be entered and posted prior to preparing financial statements.

1. Copying the debits and credits from the journal to the ledger accounts. 2. In the ledger account: a) Enter the date of the transaction in the Date column. b) Enter the amount of the debit or credit in the Debit or Credit column. c) Enter the new sum in the Balance columns under debit or credit.

Teaching Tip

Encourage your students to double check their math as they go along. This can save hours of searching for an error later.

d) Enter the journal page number from which each transaction is posted in the Posting Reference column. e) The Item column is left blank except for special reasons (i.e., indicating the beginning balance, adjusting, correcting, closing, or reversing entries). 3. In the journal: a) Enter the ledger account number in the Posting Reference column for each transaction that is posted.

Teaching Tip

28 Posting is mechanical. The transactions do not need to be analyzed again. In computerized accounting systems, the posting is done automatically by the computer.

4. A cross reference is the link between the journal and ledger as shown by information in the posting reference columns of the journal and the ledger. (See Figure 4-11 and Figure 4-12)

In-Class Exercise: Complete Exercises E4-3A, E4-3B (5 minutes each)

D. The Trial Balance (See Figure 4-13) 1. Used to prove the totals of the debits and credits in the ledger accounts are equal. 2. All transactions should be journalized and posted before the trial balance is prepared. 3. The accounts are listed in the order used in the chart of accounts.

Teaching Tips

To determine the final account balance when posting, use the following chart:

Account Balance Posted Amount Math Debit Debit Add Debit Credit Subtract Credit Debit Subtract Credit Credit Add

Students should be reminded that journalizing and posting are not just doing activities. They are a thinking process as well. Journalizing can be an automatic process once the student gains some experience. This is the time when mistakes are often made. Don’t take any part of this process for granted. The explanation is a perfect example. The student may think the explanations listed after each transaction in this chapter just repeat the transaction. Explanations are given for the readers of the general journal as well. They may provide information or computations which clarify the transaction.

Be sure to show your students the link between the trial balance and the ledger account. Have them flip back to the ledger accounts to see that the balance of each account was copied to the trial balance.

In-Class Exercise: Complete Exercises E4-5A, E4-5B (20 minutes each) In-Class Exercise: Complete Exercises E4-6A, E4-6B (15 minutes each) In-Class Exercise: Complete Exercises E4-7A, E4-7B (15 minutes each)

29 LO6

VI. Finding and Correcting Errors in the Trial Balance A. Tips for Finding Errors in the Trial Balance (See Figure 4-14) 1. Double check your addition. 2. Find the difference between the debits and credits. a) Check for missing debits and credits if the error is the same as the transaction. b) Divide the difference by 2. It could mean two debits and no credits or vice versa. c) Divide the difference by 9. (1) It could mean a slide error. (2) It could mean a transposition error. 3. Retrace your steps through the accounting process.

B. Correcting Errors 1. Ruling Method (See Figure 4-15) a) Used to correct two types of errors: (1) When an incorrect journal entry has been made, but not yet posted. (2) When a proper entry has been made but posted to the wrong account or for the wrong amount. b) Using the ruling method (1) Draw a single line through the incorrect account title or amount. (2) Write the correct information directly above the line. (3) Initial the correction. 2. Correcting Entry Method (See Figure 4-16) a) Used when an incorrect entry has been journalized and posted to the wrong account. b) Using the correcting entry method: (1) Make an entry in the general journal to reverse the original entry. (2) Include an explanation. (3) Post to the related general ledger accounts. (See Figure 4-17) (4) “Correcting” is written in the Item column of the general ledger.

In-Class Exercise: Complete Exercises E4-8A, E4-8B (10 minutes each) In-Class Exercise: Complete Problems P4-11A, P4-11B (10 minutes each)

Learning Activities

1. In earlier chapters, students developed an idea for a business. Ask the students to develop a chart of accounts for that business.

2. Ask students to make a list of the source documents that they have for their own personal transactions and to bring samples of these documents to class.

Critical Thinking Activities

30 1. The chart of accounts is like any numbering system in that it is a process of grouping data in a specific way. To demonstrate this, ask students to list various numbering systems and define what type of data the system is used to organize. For example, the Dewey Decimal system is a way of organizing books in a library. Street addresses are a way of identifying specific houses on a street.

2. Ask students to prepare a chart of accounts for a business of their own choosing or to use the chart of accounts prepared in Learning Activity 1. Then ask them to list two source documents that could be used as evidence of amounts shown in those accounts. The instructor should emphasize the importance of source documents. If the business is audited, the source documents may be used to prove the numbers on the tax return.

Examples:

Cash – check stubs and bank statement Supplies – canceled check and receipt of payment Prepaid Insurance – canceled check and policy Vehicle – purchase agreement and title Rent Expense – canceled check and lease agreement

Homework Suggestions

LO1 Study Guide Review Question 4; End of Chapter Review Question 1 LO2 Study Guide Review Questions 1, 2, 3; End of Chapter Review Questions 2, LO3 End of Chapter Review Question 3, 4 LO4 Study Guide Review Questions 5, 6, 7, 8, 9; Study Guide Exercise 1, 2; End of Chapter Review Questions 5, 6; Exercises E4-4A, E4-4B LO5 Study Guide Review Questions 10, 11, 12, 13, 14, 15; Study Guide Exercises 3, 4; Study Guide Problems 5, 6; End of Chapter Review Questions 7, 8, 9, 10; Problems P4-9A,P4-9B, P4-10A, P4-10B LO6 Study Guide Review Questions 16, 17, 18, 19; Study Guide Problem 7; End of Chapter Review Questions 11, 12, 13, 14, 15 Entire Chapter: Managing Your Writing, Mastery Problem, and Challenge Problem

Ten Questions Your Students Will Always Ask

1. Is all of this work really necessary? 2. Are source documents always provided to the bookkeeper/accountant? 3. Do we have to memorize the chart of accounts numbers? 4. Must you always journalize debits first? 5. Do we have to enter the explanation, even if the entry is obvious? 6. What is the difference between the general ledger and the general journal? 7. In a ledger account, do you balance every time? 8. How often do you post? 9. If my trial balance does not balance, where should I look first? 10. Which method should I use to correct an error if my handwriting is sloppy?

31