CCLA INVESTMENT MANAGEMENT LIMITED PSDF(17)P10

The Public Sector Deposit Fund Advisory Board

Market Overview

Summary

Money market rates drop across the yield curve and LIBOR rates set new historical lows. (see pages 1 and 2) The BoE said if the economy follows the path its Monetary Policy Committee expects, rates will be higher at the end of its three-year forecast period than the current money market yield curve suggests. (see page 3) European Money Market Fund regulation - The final provisional EU Council document was approved by the Council’s General Affairs Committee on 16 May. It should be published in the Official Journal of the European Union before the end of June. (see pages 5 to 9) The Bank of England introduces new UK Money Market Code. (see page 10) BoE to takeover running the CHAPS payment system. (see page 11)

(A) Money Market Overview

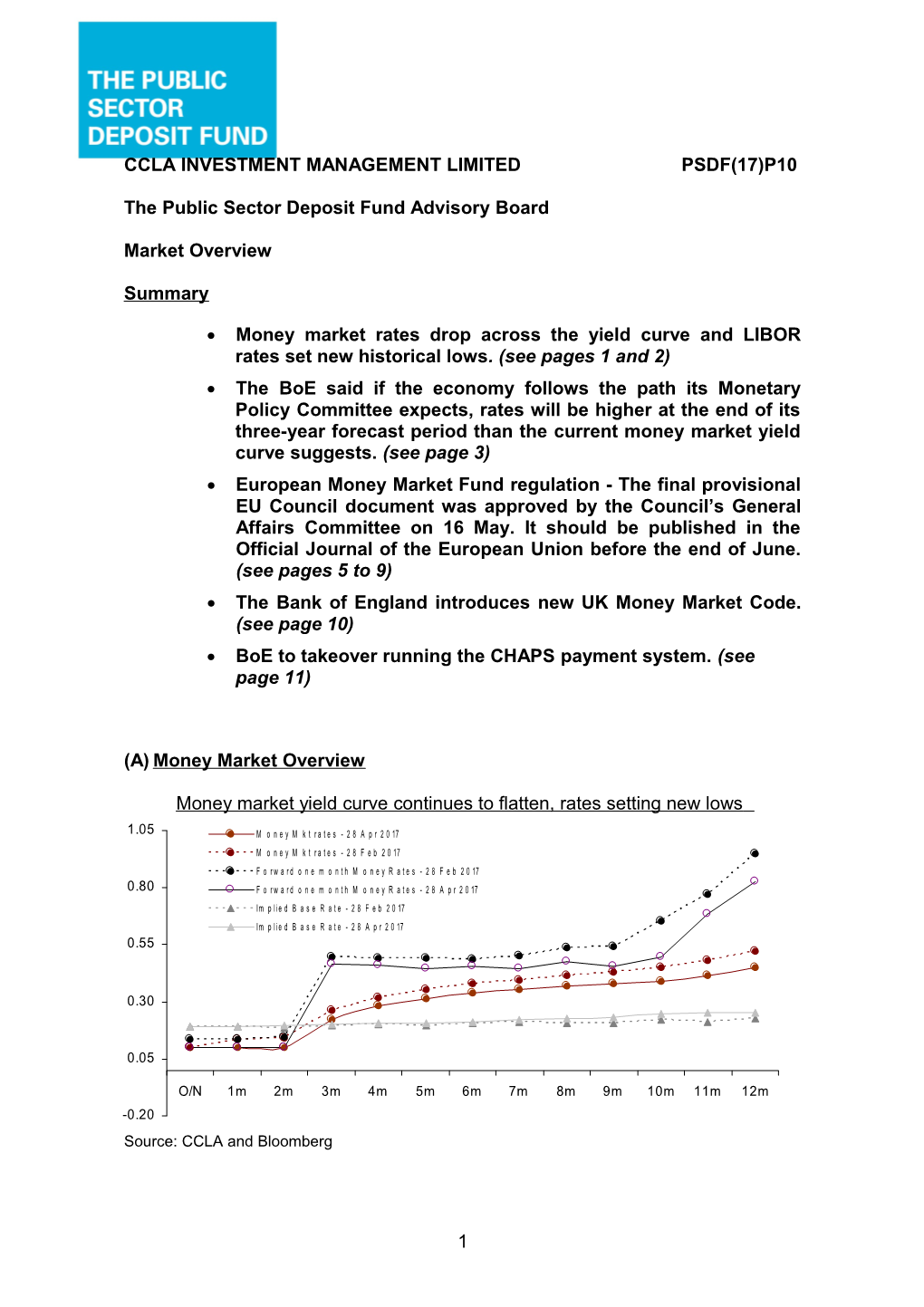

Money market yield curve continues to flatten, rates setting new lows

1.05 M o n e y M k t r a t e s - 2 8 A p r 2 0 17 M o n e y M k t r a t e s - 2 8 F e b 2 0 17 F o r w a r d o n e m o n t h M o n e y R a t e s - 2 8 F e b 2 0 17 0.80 F o r w a r d o n e m o n t h M o n e y R a t e s - 2 8 A p r 2 0 17 Im p l i e d B a s e R a t e - 2 8 F e b 2 0 17 Im p l i e d B a s e R a t e - 2 8 A p r 2 0 17 0.55

0.30

0.05

O/N 1m 2m 3m 4m 5m 6m 7m 8m 9m 10m 11m 12m -0.20 Source: CCLA and Bloomberg

1 Since February, banks have been lowering rates across the curve, the largest falls being at the longer end. Consequently, the yield curve flattened and the forward curve is indicating very little opportunities. When (if) we can find potential bidders for one year deposits at 0.50%, or above, this is the only area of the curve currently offering any value. As the money market yield curve has become flatter and rates reaching record low levels there is less complying reasons for market participants to take on additional risk. This has begun and is observable looking at the traded volumes in the overnight (unsecured and secured) markets which topped over £25 billion on a couple occasion in early May; levels not seen since 2012.

As we had suggested, the UK economy advanced 0.3% in the first quarter to March 2017, easing from a 0.7% growth in the previous period and below market expectations of a 0.4% expansion, the preliminary estimate showed. It was the slowest rate of growth since the first quarter of 2016, as services output expanded at a slower pace. The services aggregate grew 0.3% in the first quarter after rising by 0.8% in the previous period; and contributed 0.23% to growth. Production, construction and agriculture contributed 0.04%, 0.01% and 0.00% to the headline figure respectively. While having proved to be a little less reliable of late, the UK Purchasing Managers Indices published by Markit at the beginning of May do suggest that the economy is currently growing at twice the pace than that seen in the first quarter of the year. The composite index points to UK GDP growth rate in the second quarter of 0.6% but there are warning signs on the horizon; the prices charged by service sector firms rose at their fastest rate since July 2008. Rising inflation is likely to eventually slow UK economic growth in the second half of the year.

2 Activity in the UK’s services sector for April at 55.8 grew at its fastest monthly pace this year. Activity in the UK’s manufacturing sector grew at its fastest pace in April for three years, rising to 57.3 from 54.2 in March. Activity in the UK’s construction sector picked up in April, rising to 53.1 from 52.2 in March.

Since the Brexit vote, the Bank of England (BoE) has been contending with the conflicting forces of a strong domestic economy, inflationary pressures and its projection a Brexit related slowdown may surface. Having not held a meeting in April, the MPC May meeting coincided with the Bank’s Quarterly Inflation Report and the release of the MPC minutes on the second “Super Thursday” of the year. In line with market expectations, the BoE left interest rates and its asset purchase programme unchanged. A 7-1 vote (the Committee is one member down at present after the resignation of Charlotte Hogg) despite speculation that the newest member Michael Saunders could have been on the verge of a rate hike, Kristin Forbes remained the sole dissenter. Given the imminent retirement of Forbes’ her influence can be somewhat ignored. The Inflation Report projections included a downgrade to the near-term growth profile. GDP growth for 2017 was nudged lower to 1.9% from 2.0%, largely reflecting the weaker start to activity this year following the 0.3% rise in Q1 – although the Bank believes this will be revised up to 0.4% eventually, but still below the 0.5% assumed in February. Further out, 2018 growth was raised to 1.7%, up from 1.6% forecast previously and 2019 growth up to 1.8% from 1.7%.

The Bank raised its CPI inflation number for the final quarter of 2017 marginally to 2.8%. The 2018 inflation forecast is lowered to 2.2% from 2.56% and 2019 inflation is lowered from 2.26% from 2.36%.

The Bank also expects real incomes will fall in 2017 as average earnings slows down more than previously thought. Their forecasts show average weekly earnings only rising by 2% in 2017 as inflation peaks at 2.8%. Longer- term wage prices are however forecast to rise notably in the longer-term and this should place upward pressure on inflation.

The Governor made it clear the forecasts were all on the assumption that the Brexit would occur under a smooth transition process, he continued to reiterate its limited tolerance to above-target inflation. He wrapped up his opening statement with, if the economy follows the path the Committee expects, rates will be higher at the end of its three-year forecast period than the current money market yield curve suggests. The implied yield curve only had around one 25 basis point interest rate hike by mid-2020 priced in at the time that the forecasts were made.

3 The Governor was unable to shift investors' rate expectations though as there appeared to be too many obvious risks around Brexit, where the BoE's central scenario is for a smooth transition with a trade deal. The big surprise that the MPC are not modelling for a disorderly outcome. The pound fell modestly, yields on two-year gilts down a couple of basis points and the longer dated gilts were unchanged at the end of Super Thursday.

4 (B) Money Market Fund European regulation

The Commission, Parliament and Council agreed "Confirmation of the final compromise text with a view to agreement" on 30 November 2016 under reference 14939/16. The compromised text 14939/16 plus a number of minor revisions in EU Parliament’s paper, A8-0041/2015 Amendment 12 (summary of which is outlined on pages 5-8), were debated by Parliament in its plenary session on 4 April 2017. On 5 April, a majority of members voted in favour of the new regulation 514 for, 179 against, 9 abstained.

The final provisional document, Ref PE-CONS 59/16 was published on 26 April 2017 reflected the Parliament’s Amendment 12 and the Council paper 7240/17 dated 10 April 2017 and was passed to the EU Council of Ministers.

On 16 May 2017 the EU Council of Ministers in the configuration of its General Affairs Council adopted the proposed Money Market Fund regulation. Luxembourg was the only member to vote against the legislation.

5 Once the new regulation is published in the Official Journal of the European Union (OJE), the legislation will enter force 20 days after the publication. Then all present MMF UCITS and “look-alike” AIF's will have just 18 months to submit a new full application to their appropriate Authorities. The Authorities then have a commitment to authorise or dismiss that application within two months.

The Public Sector Deposit Fund (PSDF) is a CNAV FCA UK Qualifying Money Market Fund (QMMF) and registered as a UCITS fund. CCLA has already started planning a change programme and once the final EU Act has been signed an engagement process with the relevant UK authorities will begin.

If there are no significant changes to the final Act it is envisaged the PSDF will follow the new Low Volatility Net Asset Value (LVNAV) format sometime in late 2018/early 2019.

6 Summary of the EU Parliament Paper A8-0041/2015 Amendment 12

a) Scope The Regulation will apply to all MMFs that are established, managed or marketed in the EU. A MMF is a UCITS or an AIF that invests in short term assets and has distinct or cumulative objectives to offer returns in line with money market rates or preserve the value of investments.

b) Types of MMFs According to the regulation, there are three types of MMFs: i) Variable NAV MMF (“VNAV”), ii) Public Debt Constant NAV MMF (“Public Debt CNAV” or “CNAV”), and iii) Low Volatility NAV MMF (“LVNAV”)

Their main features of the three categories: VNAV MMFs: VNAV MMFs calculates their Net Asset Value (NAV) using mark-to-market prices, or, by default, mark-to-model prices. The use of amortised cost is not allowed anymore. Public Debt CNAV MMFs: Public Debt CNAV MMFs aims at maintaining an unchanged NAV (or constant NAV), through daily distribution of income, the use of amortised cost method and rounding of the nearest percentage point. They will be required to invest 99.5% of their assets in public debt instruments or cash. LVNAV MMFs: LVNAV MMF’s will be able to apply amortised costs to money market instruments with a remaining maturity below 75 days, as long as the difference between such amortised cost and market price of the instruments remain below 10 basis points and as long as the cumulated difference (difference between the NAV calculated under this method and the NAV calculated under the VNAV method) deviates by not more than 20 basis points.

c) Eligible assets Derivative contracts will only be allowed for currency and interest rate hedging purposes. Investment in other MMFs will be capped to 17.5%. Exposure to securitisations and ABCP will be limited to 15% (20% if falling under the scope of the Simple, Transparent and Standardised securitisation and ABCP regulation, once adopted). Securities lending, borrowing as well as taking indirect exposure to commodities are not allowed.

7 d) Liquidity requirements MMFs are subject to liquidity requirements that differ depending on the type of MMFs: CNAV and LVNAVs MMFs: at least 10% of daily maturing assets (including cash and reverse repo) and 30% in weekly maturing assets (which may include up to 17.5% of public debts instruments with a residual maturity up to 190 days). VNAV MMFs: at least 7.5% of daily maturing assets (including cash and reverse repo) and 15% in weekly maturing assets (which may include up to 7.5% of assets that may be sold within five business days). e) Liquidity fees and gates Whenever the weekly maturing assets of a CNAV MMF or an LVNAV MMF falls below 30% of the total assets of the MMF and whenever daily redemption request exceeds 10% of the total assets of the MMF, the MMF board of directors will consider whether it is appropriate to apply liquidity fees on redemptions, redemption gates or suspension of redemptions. Whenever the weekly maturing assets falls below 10%, the board applies at least one of these measures. f) Internal credit quality assessment MMFs managers will establish and implement a prudent internal credit quality assessment procedure, which will be reviewed annually by the management and the board. The EU Commission will adopt delegated acts on the credit quality assessment. g) Stress testing Stress tests will be conducted regularly (at least bi-annually), including factors such as changes in liquidity, credit risks, movements in interest rate, hypothetical redemption requests, changes in spreads and macro systemic shocks. In case vulnerabilities are revealed, extensive reports on the results of the stress testing will be submitted to the board of directors of the MMF and reviewed by the national competent authorities who will send them to ESMA. ESMA will issue guidelines on stress testing that will be updated annually based on market developments. h) External support External support (such as cash injection, purchase of assets at inflated prices, purchase of units to maintain liquidity or providing guarantees) is prohibited.

8 i) Transparency requirements Daily: CNAVs and LVNAVs have to publish daily on their website the difference between the NAV/unit they apply to subscription and redemption (calculated using amortised costs as described above) and the NAV per unit calculated using the variable NAV methodology (valuing assets to mark-to market or mark-to-model). Weekly: All MMFs must make available weekly information on maturity breakdown of the portfolio, credit profile, WAM, WAL, ten largest holding, total value of assets and net yield. Quarterly reporting to competent authorities or annually if AUM is less than EUR 100 millions). ESMA will prepare draft Implementing Technical Standards within six months of entry into force. j) Know your customer (KYC) policy MMFs managers will have to implement procedures and due diligence processes in order to be in a position to anticipate the effects of concurrent redemptions requests. If the value of the units or shares held by a single investor exceeds the amount of daily liquidity requirement of the fund, MMFs managers shall consider several factors amongst which the type of investors, the number of shares in the fund owned by a single investor, evolution of inflows and outflows, identifiable patterns in investors cash needs, level of correlation or close links between different investors, risk of aversion of different investors). MMFs managers will have to require necessary information from the intermediary in order to manage the liquidity of the MMF as well as investor concentration. It shall ensure that the value of units or shares held by a single investor does not materially impact the liquidity profile of the MMF. k) Review clause The sunset clause formerly proposed by the EU parliament has been abandoned in favour of the review clause suggested by the Council of the EU. The review of the regulation will take place five years after entry into force. The review will examine the LVNAV and CNAV regimes. It will in particular consider the feasibility of introducing an 80% EU public debt quota for Public debt CNAV MMFs.

9 (C) BoE introduces new UK Money Market Code

Following the financial crisis, regulators are trying to re-establish the highest standards of behaviour and best practice in the financial markets. The new, voluntary UK Money Markets Code, published by the BoE on 26 April is an important step on that path of restoring trust. The Code sets out a clear, principals-based framework for how all participants are expected to act in a manner that promotes the integrity of the UK money markets. It covers governance, risk management and execution practices for the UK deposit, repo and securities lending markets. It also sets out best practice when dealing, confirming and settling trades, an area where bad or inconsistent practice can lead to increased error rates, failed trades or possible market disruption. The standards and practical examples set out in the Code will provide greater clarity for market participants about the behaviours expected of them. Importantly, it has been written by the market, for the market: over the past year, a representative group of experienced professionals have worked together to codify expected standards (which included PSDF Advisory Board member Luke Webster). And the BoE Money Markets Committee, comprised of senior representatives from across the UK money market, has endorsed the new Code as providing appropriate guidance for participants. The sub-committee responsible for drawing up the Code will remain in place to ensure the Code remains relevant and up to date as markets continue to evolve. It is hoped that all participants in the UK deposit, repo and securities lending markets to use the Code and embed the best practices it describes within their business. The Code contains a Statement of Commitment to allow firms to demonstrate publically their commitment to the principles outlined. Adherence to the Code is designed to be proportionate, rather than onerous. If a firm only uses one part of the money market – for example, only making unsecured deposits – there is no need for it to consider how it will follow the standards for the other markets. Market participants can make a start now by demonstrably embracing the new Code; the BoE hope that most firms will be in a position to make this commitment in early 2018.

(D) Fitch updates their Global Money Market Criteria On the 27 April, Fitch ratings updated its Global Money Market Criteria which supersedes previous documents. The criteria remain 'principles-based' focusing on the ability of MMFs and other liquidity management products to preserve principle and maintain liquidity through managing credit, market and liquidity risks. Since the focus is on key portfolio risk attributes, the criteria is applicable to constant net asset value (CNAV) funds, variable NAV (VNAV) funds, as well as the European Union's recently proposed Low Volatility NAV (LVNAV) funds, provided the portfolio risk attributes align with Fitch's criteria.

10 There were no significant changes that will affect the functioning of the PSDF.

(E) BoE to takeover running the CHAPS payment system Having identified risks with the way the UK payments system is set up the BoE will take over operating high-value transfers from an industry body. The decision follows a review prompted by a nine-hour outage of the Real Time Gross Settlement (RTGS) infrastructure system in 2014. Improving the system was also deemed necessary because of the increase in mobile technology for payments and the escalation in cyber-security threats. While the BoE runs the RTGS infrastructure, the delivery model for the Payment System is split, with CHAPS Co., owned by a consortium of banks, responsible for governance. The central bank said this division poses a risk to financial stability and it’s proposing to change the structure. The Financial Policy Committee has accepted the recommendation and the handover will take place by the end of the year. The BoE also announced further plans to upgrade RTGS to improve resilience, broaden access, and help user functionality. The new system is scheduled to be in service by the end of 2020.

(F) BoE recommends SONIA to be the “new risk-free” rate

In 2015 the BoE set-up a Working Group with a remit to look at the Sterling Risk Free Reference Rates. The market-led group comprising major sterling swap dealers; ISDA and LCH Ltd participated as observers to provide relevant technical advice. The Bank and the FCA participate as non-voting members. The Group announced on 28 April that SONIA would be preferred near risk-free interest rate benchmark (RFR) for use in sterling derivatives and relevant financial contracts. This expression of market support for SONIA will act as a platform for further work to broaden and promote its use as an alternative to sterling Libor which it is hoped will improve the resilience of the UK financial system. This will mark a key step in the interest rate benchmark reform agenda laid out by the Financial Stability Board (FSB) in 2014. The FSB recommended, alongside the reform of existing benchmarks including LIBOR, the development and adoption of alternative near risk-free benchmarks. The selection of SONIA, which is based on robust transaction volumes and measure overnight interest rates that are considered close to risk-free, as the sterling RFR reflects that, on completion of the SONIA reform process currently underway, it will be a strong and credible benchmark that meets the criteria set out by the Working Group. The Working Group’s recommendation will be subject to a broad market consultation to be held in the middle of 2017.

11