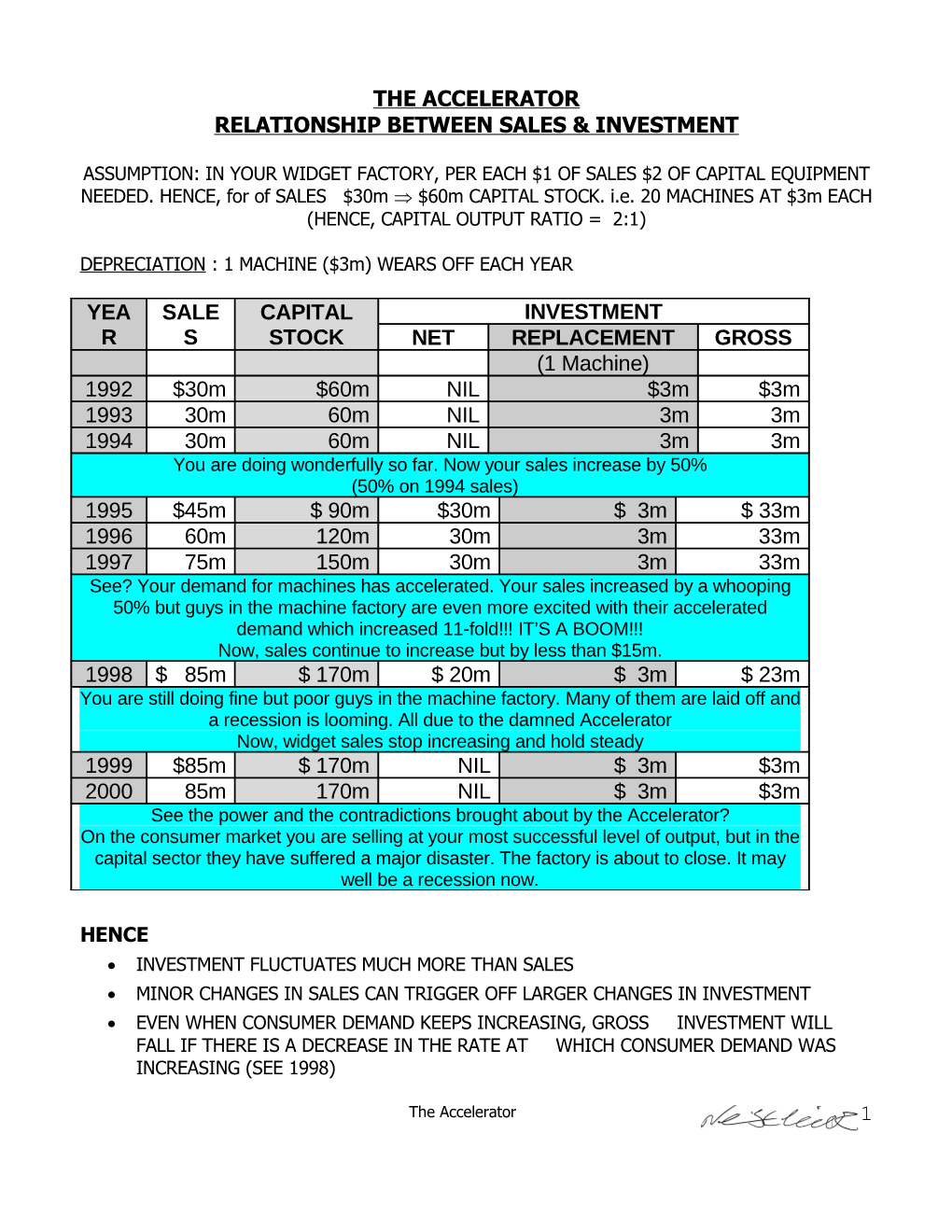

THE ACCELERATOR RELATIONSHIP BETWEEN SALES & INVESTMENT

ASSUMPTION: IN YOUR WIDGET FACTORY, PER EACH $1 OF SALES $2 OF CAPITAL EQUIPMENT NEEDED. HENCE, for of SALES $30m $60m CAPITAL STOCK. i.e. 20 MACHINES AT $3m EACH (HENCE, CAPITAL OUTPUT RATIO = 2:1)

DEPRECIATION : 1 MACHINE ($3m) WEARS OFF EACH YEAR

YEA SALE CAPITAL INVESTMENT R S STOCK NET REPLACEMENT GROSS (1 Machine) 1992 $30m $60m NIL $3m $3m 1993 30m 60m NIL 3m 3m 1994 30m 60m NIL 3m 3m You are doing wonderfully so far. Now your sales increase by 50% (50% on 1994 sales) 1995 $45m $ 90m $30m $ 3m $ 33m 1996 60m 120m 30m 3m 33m 1997 75m 150m 30m 3m 33m See? Your demand for machines has accelerated. Your sales increased by a whooping 50% but guys in the machine factory are even more excited with their accelerated demand which increased 11-fold!!! IT’S A BOOM!!! Now, sales continue to increase but by less than $15m. 1998 $ 85m $ 170m $ 20m $ 3m $ 23m You are still doing fine but poor guys in the machine factory. Many of them are laid off and a recession is looming. All due to the damned Accelerator Now, widget sales stop increasing and hold steady 1999 $85m $ 170m NIL $ 3m $3m 2000 85m 170m NIL $ 3m $3m See the power and the contradictions brought about by the Accelerator? On the consumer market you are selling at your most successful level of output, but in the capital sector they have suffered a major disaster. The factory is about to close. It may well be a recession now.

HENCE INVESTMENT FLUCTUATES MUCH MORE THAN SALES MINOR CHANGES IN SALES CAN TRIGGER OFF LARGER CHANGES IN INVESTMENT EVEN WHEN CONSUMER DEMAND KEEPS INCREASING, GROSS INVESTMENT WILL FALL IF THERE IS A DECREASE IN THE RATE AT WHICH CONSUMER DEMAND WAS INCREASING (SEE 1998)

The Accelerator 1 IT IS NOT ENOUGH TO SUSTAIN HIGH LEVELS OF SALES, A RECESSION CAN WORSEN IF SALES DO NOT KEEP GROWING

THEREFORE, THE LEVEL OF INVESTMENT DOES NOT DEPEND ON HIGH OR LOW LEVELS OF SALES BUT RATHER ON THE RATE OF CHANGE OF SALES (OR OF CONSUMER DEMAND) WONDERFUL PIECE OF THEORY, ISN’T IT? Do you buy the idea? or IS THE ACCELERATOR PRINCIPLE VALID IN REAL LIFE? Not always, EFFECTS CAN BE AVOIDED BY IDLE CAPACITY IN THE MACHINE FACTORY (there is no need for the accelerator) THEREFORE, THE PRINCIPLE OF THE ACCELERATOR ASSUMES CAPACITY PRODUCTION. AVAILABILITY OF STOCKS THEREFORE, THE PRINCIPLE ASSUMES NO STOCKS PROPORTIONS ARE NOT CONSTANT RATIO OF CAPITAL STOCK TO SALES MIGHT CHANGE, e.g. GREATER OUTPUT CAN BE ACHIEVED BY KEEPING THE CAPITAL STOCK FIXED AND INCREASING THE AMOUNT OF LABOUR EITHER WITH OVERTIME OR EXTRA SHIFTS. REMEMBER ALSO THE LAW OF DIMINISHING MARGINAL RETURNS. (PRINCIPLE ASSUMES CONSTANT RETURNS)

PRINCIPLE OF THE ACCELERATOR ASSUMES CAPITAL WIDENING AND NOT CAPITAL DEEPENING.

CAPITAL WIDENING MORE OF THE SAME MACHINES: capital stock is increasing at the same rate as the labour force, thus capital per worker remains constant. The economy will expand in terms of aggregate output, but productivity per worker will remain constant.

CAPITAL DEEPENING ACQUISITION OF NEWER MACHINES, Capital per worker increases. It is an increase in the capital intensity. Capital deepening is often measured by the capital stock per labour hour. Overall, the economy will expand, and productivity per worker will increase. Hence, no accelerator when one new and better machine can replace several old-fashioned machines.

The Accelerator 2