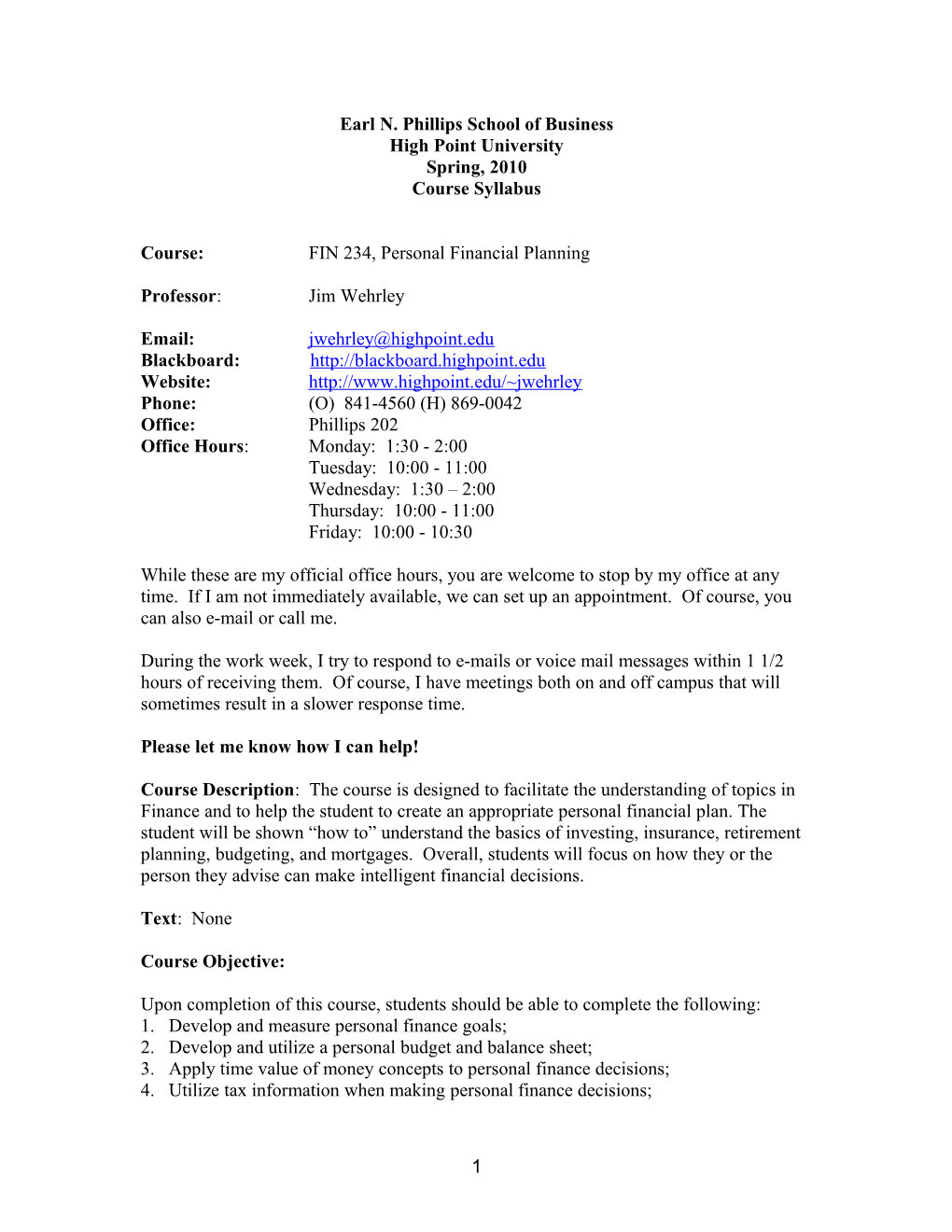

Earl N. Phillips School of Business High Point University Spring, 2010 Course Syllabus

Course: FIN 234, Personal Financial Planning

Professor: Jim Wehrley

Email: [email protected] Blackboard: http://blackboard.highpoint.edu Website: http://www.highpoint.edu/~jwehrley Phone: (O) 841-4560 (H) 869-0042 Office: Phillips 202 Office Hours: Monday: 1:30 - 2:00 Tuesday: 10:00 - 11:00 Wednesday: 1:30 – 2:00 Thursday: 10:00 - 11:00 Friday: 10:00 - 10:30

While these are my official office hours, you are welcome to stop by my office at any time. If I am not immediately available, we can set up an appointment. Of course, you can also e-mail or call me.

During the work week, I try to respond to e-mails or voice mail messages within 1 1/2 hours of receiving them. Of course, I have meetings both on and off campus that will sometimes result in a slower response time.

Please let me know how I can help!

Course Description: The course is designed to facilitate the understanding of topics in Finance and to help the student to create an appropriate personal financial plan. The student will be shown “how to” understand the basics of investing, insurance, retirement planning, budgeting, and mortgages. Overall, students will focus on how they or the person they advise can make intelligent financial decisions.

Text: None

Course Objective:

Upon completion of this course, students should be able to complete the following: 1. Develop and measure personal finance goals; 2. Develop and utilize a personal budget and balance sheet; 3. Apply time value of money concepts to personal finance decisions; 4. Utilize tax information when making personal finance decisions;

1 5. Manage debt and credit; 6. Purchase and finance a vehicle; and 7. Purchase Life Insurance.

Students should have a financial understanding of the following: 1. Liquidity and savings; 2. Home ownership; 3. Home, auto, health, disability, and life insurance; 4. Investment alternatives and asset allocation; 5. Retirement planning factors and strategies; 6. Estate planning terminology; 7. College planning; 8. “Love and Money” challenges; and 9. Donations to charities.

Honor Code:

The honor code is enforced.

University Honor Code

We, the students of High Point University, believe that honesty and integrity are essential to student development, whether personal, social, or academic. Therefore, we assert that:

Every student is honor-bound to refrain from conduct which is unbecoming of a High Point University student and which brings discredit to the student and/or to the University;

Every student is honor-bound to refrain from cheating; Every student is honor-bound to refrain from collusion; Every student is honor-bound to refrain from plagiarism; Every student is honor-bound to confront a violation of the University Honor Code; Every student is honor-bound to report a violation of the University Honor Code.

Full details of the High Point University Honor Code are found in the Student Handbook and are online.

2 Grading Scale:

There are a total of 53 points broken down as follows:

Task Points Team Modules 23 Quizzes 26 (2 points per quiz) Paper 1 Group-presentation (mandatory) 1 Daily Self-Evaluation (mandatory) 1 Business Student Association/Other Speakers 1 Total 53

Each task is worth 1 point except for quizzes which are worth two points. Final grades are determined based on the following scale:

A 49 - 53 points A- 47 - 48 points B+ 45 - 46 points B 43 - 44 points B- 41 - 42 points C+ 39 - 40 points C 37 - 38 points C- 35 - 36 points D 34 F < 34 points

There is a possibility that other opportunities will be provided; however, the grading scale above will not change.

Team Modules (23 points)

AACSB business accreditation standards state, “The most effective learning takes place when students are involved in their educational experiences. Passive learning is ineffective and of short duration. Faculty members should develop techniques and styles that engage students and make students responsible for meeting learning goals . . . faculty members should encourage students to collaborate . . . Intellectual tasks in some parts of the program should require collaborative learning” (p.54). The team modules are designed to both engage you in the learning process and provide an opportunity to work collaboratively.

You will be assigned to a team in the beginning of the semester. Team members are expected to work together. Normally, every team member must be competent in the subject matter to receive credit for a module. That is, if one team member does not reasonably understand the material in a module, it is unlikely that any team member will be given credit for the module. Therefore, a team should not request grading of a module

3 until all team members believe all other team members have an understanding of the subject matter.

Grading of team modules may be performed using a variety of methods: 1) oral discussion or questioning; 2) collection and grading of the team’s work or one team member’s assignment; 3) input from other teams or other classmates; or 4) a combination of methods. Generally, only one module per team needs to be completed; however, if I believe a team member does not understand the material in a specific module, I reserve the right to request that every team member complete the team module.

Through the learning process, teams will likely work with other teams to help with the learning process. Other team-based guidelines:

1. While not necessarily planned, I may alter the teams throughout the semester. 2. A team member can be fired. I must approve the firing of any team member. A fired team member will work on future assignments individually. 3. Normally, modules will not have a due date. That is, these assignments are to be completed on a self-pace basis. However, if a team is not progressing at a respectable pace, a due date may be imposed. 4. Quizzes cannot be completed until the related team module(s) is(are) complete. 5. Teams who do not pass a module can rework and resubmit modules.

Team Modules (1 point each) 1. Time Value 2. Amortization Table 3. Goal Setting 4. Balance Sheet 5. Understanding Your Risk Profile 6. Taxes and Financial Planning 7. Budgeting 8. Mutual Funds and Exchange Traded Funds (ETFs) 9. Asset Allocation 10. Investment and Income Taxes 11. 401K and IRA 12. Long Term Care Insurance 13. How Much is Needed for Retirement 14. Plan to Meet Financial Retirement Goal 15. Cash Management 16. Insurance 17. Credit Management 18. Home Ownership 19. Estate Planning 20. Purchasing a Vehicle 21. “Love and Money” 22. Donations 23. College Education

4 Quizzes (26 points, 2 points per quiz)

The topics for each quiz are provided below with the appropriate team modules that must be completed before completing the quiz. Obtaining two points on a quiz requires successful completion of all questions and problems on the first try. If you must materially rework one or more questions or problems, the maximum points earned on the quiz will be one point. Failure to successfully complete one or more questions or problems will result in 0 points earned on the quiz. Evaluation of the answers to questions and problems may include oral discussion or questioning. Normally, each team member will complete the quizzes at the same time.

Quiz 1: Time Value 1. Time Value 2. Amortization Table 3. Goal Setting Quiz 2: Personal Balance Sheet 4. Balance Sheet Quiz 3: Risk Module 5. Understanding Your Risk Profile Quiz 4: Taxes 1. Taxes and Financial Planning Quiz 5: Budgeting 2. Budgeting Quiz 6: Investments 3. Mutual Funds and Exchange Traded Funds (ETFs) 4. Asset Allocation 5. Investment and Income Taxes Quiz 7: Retirement 6. 401K and IRA 7. Long Term Care Insurance 8. How Much is Needed for Retirement 9. Plan to Meet Financial Retirement Goal Quiz 8: Cash Management 10. Cash Management Quiz 9: Insurance 11. Insurance Quiz 10: Managing Credit 12. Credit Management Quiz 11: Home Ownership 13. Home Ownership Quiz 12: Estate Planning 14. Estate Planning Quiz 13: Purchasing a Vehicle 15. Purchasing a Vehicle

5 Paper: Are you an Optimist or Pessimist about the Future? (1 point)

Review the IOUSA video. Write a typed, one page, or less, double-spaced paper on whether you are an optimist or pessimist about the future with an explanation of your perspective.

Team Presentation (1 point, mandatory)

You will make a team presentation on a financial planning topic of interest. Failure to pass the team presentation will result in one full letter grade reduction (e.g. A- to a B-) in your final grade. More details will be provided throughout the semester.

Daily Self-Evaluation (1 point, mandatory)

Every class you will complete an evaluation of your performance. You will earn one point as long as you complete and submit all of your daily evaluations.

Business Student Association/Other Speakers (1 point)

Throughout the semester, there will be opportunities for you to attend presentations. To obtain a point, you must attend at least 66 percent of the presentations and write a brief memo commenting on the presentation. Ideally, your comments will be related to this class. Each presentation will be announced in class.

Computer Usage Policy:

During the class, the computer is to be used for FIN 234: Personal Financial Planning purposes only. If you violate this policy, your first violation will result in a warning. For each subsequent violation, there will be a three point reduction to your final grade.

In addition, please do not text message, e-mail, accept telephone calls, or take pictures during class unless related to class. Any such activity during the assessment process will be construed as cheating.

Attendance:

You are allowed two unexcused absences. An excused absence will be based on my judgment. My judgment will be based on whether a “typical” employer would view your reason for the absence to be acceptable. Generally, for an absence to be excused, I must be contacted (e.g., e-mail, voice mail) before the class period you miss. Clearly, in rare situations (e.g., automobile accident), an excused absence may be allowed when I am notified after the class period you miss.

6 Disclaimer:

Because much of the discussion and work in this class may be related to personal financial information, I recommend that you do not discuss or present in any format any personal information that you do not want your colleagues or other people to know. It will be assumed that all financial information is hypothetical.

Because of time limitations, some of the content discussed may not be in-depth enough to allow for an individual to make a sound financial decision. The complexity of topics and the complexity of individuals' financial situations make it difficult to cover every topic adequately for every class member.

Important Notes:

1. All work is expected to include correct grammar, punctuation, and spelling.

2. Late work will be accepted for feedback but not graded.

Academic Services Center:

Students with diagnosed disabilities should contact Ms. Ingersoll, Assistant Director & Coordinator of Disability Services: 841-9037 or [email protected]. Students who need classroom accommodations due to a diagnosed disability should contact Ms. Irene Ingersoll. Accommodation arrangements should be made at the beginning of the semester. Accommodations are not retroactive.

Course Evaluations:

All students are expected to complete course evaluations in the week preceding final exams. These evaluations, which are delivered online, are an important part of High Point University’s assessment program, so your cooperation in completing them is greatly appreciated. As the end of the semester or academic session draws near, you will receive information from the Office of Institutional Research and Assessment about how to complete the online evaluations. IMPORTANT NOTE: All communications from the Office of Institutional Research and Assessment will be sent to your High Point University e-mail account, so please be sure to check and maintain your account regularly.

THE FINAL EXAM PERIOD WILL BE UTILIZED. MONDAY MAY 3, 1:30 P.M.

I'm glad you registered for FIN234. I hope you enjoy the course!!!! Always remember, Personal Finance is Fun and Extremely Valuable, but you MUST execute !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

7