September 11, 2007

Research Associate: Smita Singh, M.Fin. Editor: Jewel Saha, ACS.

Zacks Research Digest Sr. Ed.: Ian Madsen, CFA; [email protected] 800-767-3771 x 9417 www.zackspro.com 111 N. Canal Street, Suite 1101 Chicago, IL 60606

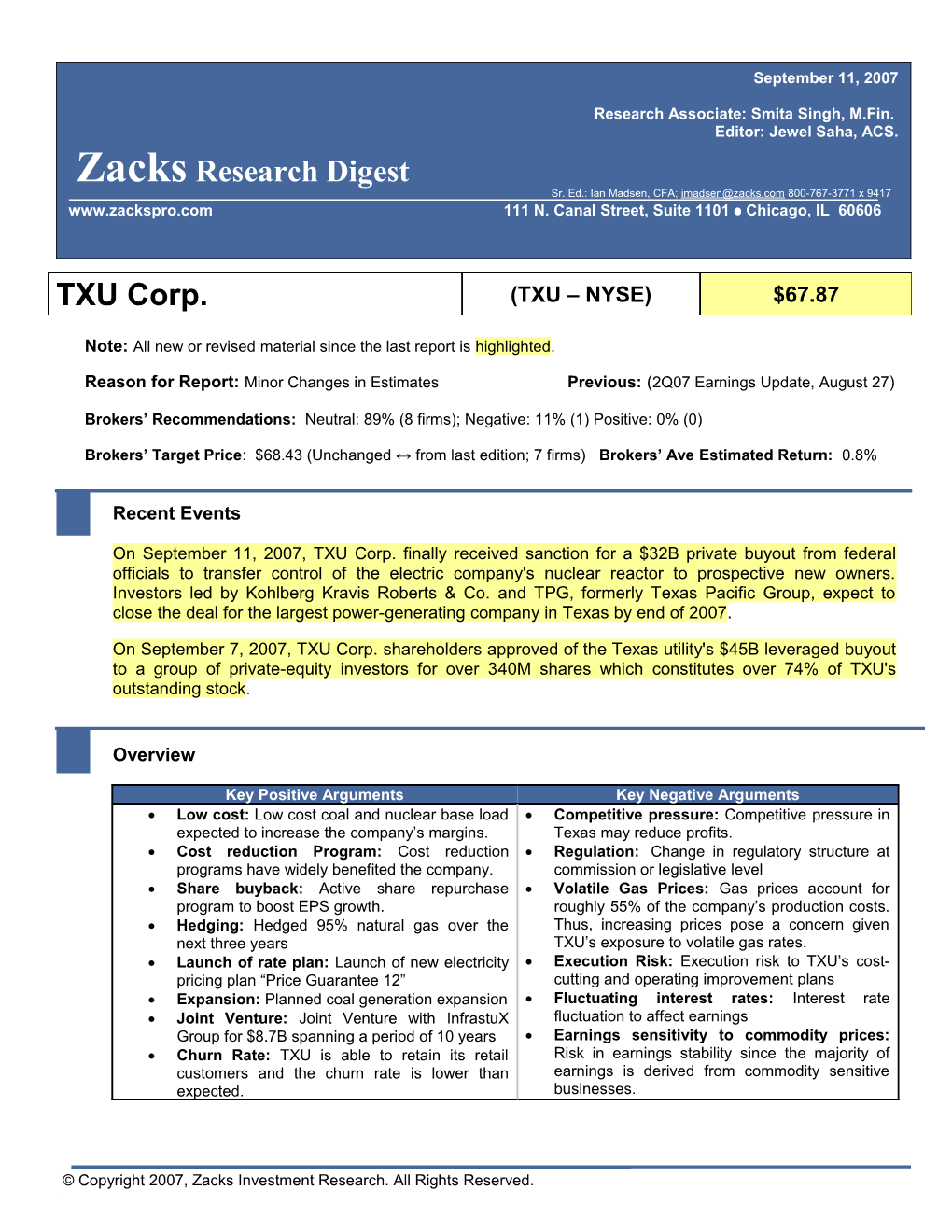

TXU Corp. (TXU – NYSE) $67.87

Note: All new or revised material since the last report is highlighted.

Reason for Report: Minor Changes in Estimates Previous: (2Q07 Earnings Update, August 27)

Brokers’ Recommendations: Neutral: 89% (8 firms); Negative: 11% (1) Positive: 0% (0)

Brokers’ Target Price: $68.43 (Unchanged ↔ from last edition; 7 firms) Brokers’ Ave Estimated Return: 0.8%

Recent Events

On September 11, 2007, TXU Corp. finally received sanction for a $32B private buyout from federal officials to transfer control of the electric company's nuclear reactor to prospective new owners. Investors led by Kohlberg Kravis Roberts & Co. and TPG, formerly Texas Pacific Group, expect to close the deal for the largest power-generating company in Texas by end of 2007.

On September 7, 2007, TXU Corp. shareholders approved of the Texas utility's $45B leveraged buyout to a group of private-equity investors for over 340M shares which constitutes over 74% of TXU's outstanding stock.

Overview

Key Positive Arguments Key Negative Arguments Low cost: Low cost coal and nuclear base load Competitive pressure: Competitive pressure in expected to increase the company’s margins. Texas may reduce profits. Cost reduction Program: Cost reduction Regulation: Change in regulatory structure at programs have widely benefited the company. commission or legislative level Share buyback: Active share repurchase Volatile Gas Prices: Gas prices account for program to boost EPS growth. roughly 55% of the company’s production costs. Hedging: Hedged 95% natural gas over the Thus, increasing prices pose a concern given next three years TXU’s exposure to volatile gas rates. Launch of rate plan: Launch of new electricity Execution Risk: Execution risk to TXU’s cost- pricing plan “Price Guarantee 12” cutting and operating improvement plans Expansion: Planned coal generation expansion Fluctuating interest rates: Interest rate Joint Venture: Joint Venture with InfrastuX fluctuation to affect earnings Group for $8.7B spanning a period of 10 years Earnings sensitivity to commodity prices: Churn Rate: TXU is able to retain its retail Risk in earnings stability since the majority of customers and the churn rate is lower than earnings is derived from commodity sensitive expected. businesses.

© Copyright 2007, Zacks Investment Research. All Rights Reserved. Texas-based TXU Corp. (TXU) manages a portfolio of competitive and regulated energy businesses in North America. Its prime business location is in the state of Texas. Under the firm’s unregulated business, TXU Energy provides electricity and related services to over 2.6 million electricity customers in Texas, and handles more customers than any other retail electric provider in the state. TXU’s businesses include TXU Energy Holdings, TXU Electric Delivery, and Corporate operations. The company owns and operates 18,300 megawatts (MW) of generation in Texas, including 2,300 MW of nuclear-fired and 5,837 MW of lignite/coal-fired generation capacity. The regulated electric distribution and transmission business is the second arm of TXU Corp. This branch provides electricity delivery to consumers. TXU's electric delivery operations are the largest in Texas, providing power to 2.9 million delivery points over more than 100,000 miles of distribution and 14,000 miles of transmission lines. Previously, the company also operated a separate gas business, which was sold to Atmos Energy Corporation. More information can be found at www.txucorp.com. TXU operates on a calendar year basis. TXU’s current annual dividend is $1.73.

Revenue

FY Ends: Dec 31 ($ M) 2Q06A 1Q07A 2Q07A 3Q07E 2006A 2007E 2008E 2009E Energy $2,349.0 $1,316.0 $1,666.0 $2,480.0 $9,549.0 $8,117.0 Energy Delivery $604.0 $619.0 $589.0 $673.0 $2,449.0 $2,473.0 Elimination/Other ($286.0) ($266.0) ($233.0) ($400.0) ($1,142.0) ($1,179.0) Digest Average $2,667.0 $1,669.0 $2,022.0 $3,747.5 $10,856.0 $9,943.8 $10,468.0 $10,084.1 Y-o-Y growth 15.8% -27.6% -24.2% 6.8% 4.0% -8.4% 5.3% -3.7% Sequential Growth -29.7% 21.2% 85.3%

The Zacks Digest average total revenue earned in 2Q07 was $2.02 billion versus $2.67 billion earned in 2Q06 and $1.67 billion earned in 1Q07, which reflects a y-o-y decline of 24.2% and a sequential growth of 21.2%.

The Pie chart analysis of revenue segments is given below

Revenue Segm ents 2006A Re venue Segm e nts 2007E

20% 23%

Energy Energy Energy Delivery Energy Delivery

80% 77%

Zacks Investment Research Page 2 www.zackspro.com Outlook

The Zacks consensus model forecasts revenue of $9.94 billion for 2007, $10.47 billion for 2008, and $10.08 billion for 2009, which represents a y-o-y decline of 8.4% in 2007, growth of 5.3% in 2008, and a decline of 3.7% in 2009. The estimated compound annual growth rate (CAGR) on realized 2005 revenue comes to 0.1%.

Please refer to the TXU Zacks Research Digest spreadsheet “Consensus Model” for specific revenue estimates.

Margins

Margins 2Q06A 1Q07A 2Q07A 3Q07E 2006A 2007E 2008E 2009E

EBITDA Margin 52.3% 21.0% 29.4% 41.0%↔ 50.3% 45.0%↔ 46.0%↔ 53.5%↔

Operating Margin 44.8% 9.0% 19.7% 36.7%↔ 43.0% 36.0%↔ 37.9%↔ 44.5%↔

Pretax Margin 30.3% -46.1% 4.7% 30.5%↔ 34.8% 25.2%↔ 30.7%↔ 35.4%↔

Net Margin 24.2% 26.8% 21.2% 19.7%↔ 23.3% 19.1%↔ 20.2%↔ 22.9%↔

Year-to-date operational earnings decreased to $873 million, or $1.88 per share, from $1,179 million, or $2.51 per share, in the comparable period in 2006. The downside was primarily due to a reduction in contribution margin (operating revenues less fuel, purchased power and delivery fees) of $0.71 per share, including the effect of lower average pricing ($0.33 per share), milder weather, reduced average weather-adjusted mass market consumption, customer attrition, increased coal fuel costs due to the effects on lignite mining of abnormally high rainfall during May and June, and planned baseload plant outages.

Depreciation and amortization decreased $7 million, or 3%, to $200 million in 2Q07. The decreased expense reflects lower amortization of the regulatory assets associated with the securitization bonds and lower depreciation due to the impairment of natural gas-fueled generation plants in the second quarter of 2006. SG&A expenses increased $46 million, or 25%, to $227 million in 2Q07. Interest expense and related charges increased $3 million, or 1%, to $221 million in 2Q07 reflecting $21 million due to higher average borrowings, partially offset by $14 million in increased capitalized interest and $4 million from lower average interest rates. Income tax benefit on income from continuing operations totaled $21 million in 2Q07 compared to income tax expense of $310 million on income from continuing operations in 2Q06.

The Zacks consensus model forecasts operating income of $3.58 billion for 2007, $3.96 billion for 2008, and $4.49 billion for 2009, which reflects a y-o-y decline of 23.3% in 2007, and a growth of 10.8% in 2008 and 13.3% in 2009.

The Zacks consensus model forecasts net income of $1.89 billion for 2007, $2.11 billion for 2008, and $2.31 billion for 2009, which reflects a y-o-y decline of 25.1% in 2007 and a y-o-y growth of 11.4% in 2008 and 9.4% in 2009.

Please refer to the TXU Zacks Research Digest spreadsheet “Consensus Model” for more details on margin estimates.

Zacks Investment Research Page 3 www.zackspro.com Earnings per Share

FY Ends: Dec 2Q06A 1Q07A 2Q07A 3Q07E 2006A 2007E 2008E 2009E Zacks Consensus EPS $1.59 $0.96 $0.93 $1.60 $5.55 $4.77 $4.95 Company Guidance Digest Average EPS $1.39 $0.96 $0.93 $1.60↔ $5.55 $4.68↑ $4.99↑ $5.63↔ Digest High $1.39 $1.00 $0.93 $1.81 $5.58 $5.35 $5.80 $6.05 Digest Low $1.39 $0.95 $0.93 $1.36 $5.55 $4.09 $4.35 $5.20

Zacks Digest average earnings per share at TXU in 2Q07 were $0.93 versus $1.39 in 2Q06 and $0.96 in 1Q07, reflecting a y-o-y decline of 33.1% and a sequential decline of 3.4%. The change was primarily due to a reduction in contribution margin of $0.50 per share, including the effect of milder weather, reduced average weather-adjusted mass market consumption, customer attrition, lower average pricing ($0.14 per share), including the previously announced residential price cuts, increased coal fuel costs due to the effects on lignite mining of abnormally high rainfall during May and June, and planned baseload plant outages.

TXU’s 2Q07 GAAP earnings were $121 million, or $0.26 per share, versus $497 million, or $1.07 per share, reported in 2Q06. Reported earnings in 2Q07 included net after- tax expenses of $320 million, or $0.69 per share, treated as special items and income from discontinued operations of $11 million, or $0.02 per share, in additional insurance proceeds received related to the 2005 TXU Europe settlement. 2Q07 special items included $301 million, or $0.65 per share, of unrealized mark-to-market and cash flow hedge ineffectiveness net losses associated with the company's long-term hedging program.

Outlook

TXU did not provide an updated 2007 EPS guidance in its earnings release, which probably reflects the change in strategy and uncertainties of the company, resulting from the pending agreement to be taken private.

One firm (Jefferies) has lowered the earnings estimate for 2007 from $5.05 to $4.65 and for 2008 from $4.95 to $4.90 based on 2Q07 results, higher level of retail rate reductions implemented in 2007 and other updates to the forecast model.

One firm (Goldman) lowered the 2007 EPS estimate from $4.26 to $4.09 but raised the 2008 EPS estimate from $5.38 to $5.40 and the 2009 EPS estimate from $5.93 to $6.05 to reflect additional hedging of natural gas and higher than previously anticipated long-term retail margins.

The Zacks consensus model forecasts EPS of $4.68 for 2007, $4.99 for 2008, and $5.63 for 2009, which reflects a y-o-y decline of 15.8% in 2007, and a growth of 6.7% in 2008 and 12.8% in 2009. The CAGR on realized 2005 EPS comes to 14.4%.

Zacks Investment Research Page 4 www.zackspro.com 2007 forecasts (9 in total) range from $4.09 (Goldman) to $5.35 (Argus Fundamental Research); the average is $4.68.

2008 forecasts (8 in total) range from $4.35 (Citigroup) to $5.80 (Argus Fundamental Research); the average is $4.99.

2009 forecasts (2 in total) range from $5.20 (Citigroup) to $6.05 (Goldman); the average is $5.63.

Please refer to the TXU Zacks Research Digest spreadsheet “EPS” tab for more extensive EPS figures.

Target Price/Valuation

Of the 10 brokerage firms following TXU, 8 firms rendered Neutral ratings, 1 firm rendered a Negative rating on the stock, while 1 broker did not rate the stock. The Digest average target price $68.43 (↔ from previous report; 0.8% upside from current price). The price targets range from a low of $65.00 (Wachovia) (4.2% downside from the current price) to a high of $69.25 (Citigroup) (2.0% upside from the current price).

The brokerage firm (Citigroup) with the highest target price has rated the stock Hold and the firm with lowest target price (Wachovia) has rated the stock Market perform. None of the firms has revised their target prices since the last report.

Rating Distribution Positive 0% Neutral 89% Negative 11% Average Target Price $68.43↔ Digest High $69.25 Digest Low $65.00 Number of Analysts with Target Price/Total 7/10

General risks that may affect the target price are a significant pull back in commodity prices, a material rise in long-term interest rates, a material increase in retail customer churn rates, potential demand destruction from rising power prices, and higher-than-expected construction costs for TXU’s new generation plants.

Please refer to Zacks Research Digest spreadsheet “Valuation” tab for further details on valuation.

Capital Structure/Solvency/Cash Flow/Governance/Other

Share Repurchase

TXU Corp. has its Board of Directors' authority to repurchase up to 23 million shares of TXU Corp. common stock through the end of 2007. Under this authority, TXU Corp. repurchased 153 thousand shares in the second quarter of 2007. The merger agreement generally prohibits TXU Corp. from making common stock repurchases without the prior approval of the sponsors.

Zacks Investment Research Page 5 www.zackspro.com Cash Flow

Cash flow used in operating activities in the six months ended June 30, 2007, totaled $55 million compared to cash flow provided by operating activities of $1.9 billion in the comparable period in 2006.

CAPEX

Capital expenditure in the first six months ended June 30, 2007, was $1,641 million versus $855 million in the same period last year. The $786 million, or 91.9%, increase in capital expenditure was driven by new generation facility development spending.

Dividend

On August 16, 2007, TXU Corporation announced that its Board of Directors has declared a regular quarterly dividend of $0.4325 per share on the common stock of the Company. The dividend will be paid on October 1, 2007, to shareholders of record at the close of business on September 7, 2007.

Merger of TXU with KKR/TPG

On September 7, 2007, shareholders of TXY finally approved of the merger valued at $46.7B between TXU and the private group-KKR/TPZ, coupled with a $37.35B credit commitment by a banking group, following the announcement of the same on February 26, 2007. The merger agreement entailed that an investor group led by Kohlberg Kravis Roberts & Co. (KKR) and Texas Pacific Group (TPG), two of the nations' leading private equity firms, will acquire TXU in a transaction valued at $45 billion or more. Under the terms of the agreement, shareholders will receive $69.25 per share at closing, which represents a 25% premium to the 20 trading day average closing share price on February 22, 2007. TXU’s Board of Directors and shareholders have consented to merge. KKR/TPG targets to close the transaction in six months. The deal will require two-thirds majority approval from TXU shareholders and also require federal regulatory approvals including those by the SEC, the Federal Energy Regulatory Commission, Nuclear Regulatory Commission, Department of Justice, and the Federal Trade Commission.

The termination clause of the merger agreement requires the deal to close by March 15, 2008, allowing more than a year for KKR/TPG to agree to a satisfactory deal structure with Texas regulators.

TXU Energy expects to provide more than $300 million in annual savings through a 10% price reduction (6% implemented within 30 days of the merger agreement and an additional 4% at closing) for residential customers in its traditional service area.

Utility Services Joint Venture

TXU Corp. and InfrastruX Group announced the formation of a joint venture, InfrastruX Energy Services (IES). TXU Corp. also announced an agreement between Oncor Electric Delivery and IES under which Oncor Electric Delivery would receive utility services from the joint venture. In April 2007, TXU Corp., Oncor Electric Delivery and InfrastruX Group amended their agreements to remove the March 31, 2007 end date and to permit either party to terminate the agreements at any time. TXU Corp. and InfrastruX Group have suspended activities related to the joint venture and Oncor Electric Delivery and IES have suspended activities related to the utility services agreement. The parties expect to terminate these agreements upon closing of the proposed merger.

Other

Zacks Investment Research Page 6 www.zackspro.com TXU Energy launched the ‘Pick Your Plan’ initiative to enable customers to save up to 10% to 15% of electricity charges and announced plans to expand TXU Energy's Demand-Side Management Program, which provides opportunities for further savings through lower consumption or changes in consumption by time of day.

On January 11, 2006, the TXU Electric Delivery Company announced an agreement with a steering committee that represents certain cities in Texas (Cities) served by the company to defer the filing of the company’s system-wide rate case at the Public Utility Commission of Texas till June 30, 2008. TXU will pay $40 million to the Cities from January 2006 to mid-2009, inclusive of $18 million for beneficial public use. The company plans to extend the benefits to its other service areas for an additional cost of $12 million. Further, the company and the Cities agreed to resolve some franchise issues that would increase the company’s franchise fees by $28 million over the period from January 2006 to mid-2009. The total incremental expenses are expected to be $80 million. Payments are expected to be made until new tariffs become effective, which is projected for mid-2009 based upon an assumed June 2008 rate case filing.

Potentially Severe Problems

There are none other than those discussed in other sections of this report.

Long-Term Growth

Of the 10 brokerage firms, 3 have projected long-term EPS growth rates. The growth rates range from 6% (Zacks Investment Research) to10% (Wachovia), with an average of 7.3%.

The company announced a $2.5 billion investment plan to build two new lignite-fired generation facilities, the 1,720 megawatt Oak Grove and 600 megawatt Sandow coal plant. Management notes these sites should allow it to build new generation plants at a cost of $1,100/kw compared to about $1,600/kw for other generators to build in Texas. TXU expects Sandow completion in 2009 and the two Oak Grove units in 2009 and 2010.

TXU focuses on the Energy Delivery segment and plans to invest over $800 million per year over the next five years. The key objective of the plan is to drive the business to a higher efficiency level. In addition, TXU is seeking to add to its operation scale by exporting its perceived operating strength to other Transmission & Distribution companies in the region.

As part of the announced merger of TXU with KKR/TPG, the company is going to scale back its previous plans to construct 11 coal fired generation plants. Instead, TXU plans to build only three. The company had been under increasing pressure relative to its aggressive plans for adding more coal fired plants, particularly from environmental groups. As a result of this shift in strategy, the transaction has been endorsed by the Environmental Defense and Natural Resources Defense Council. TXU will also offer a 10% discount to retail customers and invest $400 million in alternative energy and demand reduction program. The funding of the merger will not result in any new debt incurred at the regulated utility business.

TXU entered into a 10-year, $8.7 billion groundbreaking agreement with InfrastruX Energy Services to form a full-service asset services joint venture of national scale. TXU Electric Delivery will continue to own its distribution and transmission system and associated assets while InfrastruX Energy Services will provide maintenance, construction, power restoration, and other services.

Zacks Investment Research Page 7 www.zackspro.com TXU Wholesale, a subsidiary of TXU Corp., has signed a 125MW agreement with Airtricity, a renewable energy company based in Dublin, Ireland. The agreement increases TXU's contracts for renewable energy to 756 wind turbines from 702 wind turbines. The 15-year deal gives Dallas-based TXU 705 MW of renewable energy, up from 580 MW.

On April 09, 2007, TXU Corp. announced that it is seeking to build the biggest nuclear power plants in the United States. The reactors selected by TXU would be designed and built by Mitsubishi Heavy Industries of Japan, and would be 50% larger than TXU's current nuclear reactors.

Upcoming Event

On November 09, 2007: TXU is expected to release its 3Q07 financial results.

Individual Analyst Opinions

POSITIVE RATINGS (0%)

None

NEUTRAL RATINGS (89%)

BMO Capital – Market Perform ($69 – target price): 08/17/2007 – The brokerage firm maintains a Market Perform rating and a target price of $69.

Hilliard Lyons – Neutral (no target price): 08/30/2007 - The firm retained its Neutral rating on the stock. INVESTMENT SUMMARY: The firm is in favor of the buyout deal, viewing that investors are gaining confidence of the outcome and banks have an upper hand given the lucrative asset base of TXU.

Zacks Investment Research – Hold ($68.25 – target price): 08/08/2007 – The brokerage firm maintains a Hold rating and a target price of $68.25. INVESTMENT SUMMARY: The firm believes that TXU’s successful completion of a two-year, three-phase restructuring program revised strategies targeting operating efficiencies, capital allocation, risk management, and financial flexibility. The potential approval of operating licenses of nuclear plants from the NRC and improved shareholder returns collectively justify motivation for a leveraged buyout of TXU.

B. of America – Neutral ($69.25 – target price): 09/10/2007 – The brokerage firm maintains a Neutral rating and a target price of $69.25. INVESTMENT SUMMARY: The firm is highly appreciative of TXU’s productive asset base, coupled with its leading position in the strong market bubbling with demand and supported by weather.

Citigroup - Hold ($69.25 – target price): 08/14/2007 – The brokerage firm maintained a Hold rating but lowered the target price from $71.00 to $69.25.

Jefferies – Hold ($69 – target price): 08/09/2007 – The brokerage firm maintains a Hold rating with a target price of $69. INVESTMENT SUMMARY: The firm believes TXU is fairly valued trading at a

Zacks Investment Research Page 8 www.zackspro.com modest discount to the merger agreement's offer price of $69.25 in cash for each share of TXU common stock.

UnionBankSwitz. – Neutral ($69.25 – target price): 08/10/2007 – The brokerage firm maintains a Neutral rating on the stock with a target price of $69.25. The firm expects TXU shares to trade based on the terms of the announced deal rather than on intrinsic valuation.

Wachovia – Market Perform ($62–$68 – target price): 08/28/2007 – The brokerage firm maintains a Market Perform rating with a target price in the range of $62–$68. INVESTMENT SUMMARY: The firm believes TXU’s Texas region is expected to experience strong electric demand growth over the next decade.

NEGATIVE RATINGS (11%)

Argus Fundamental Research – Sell (no target price): 08/08/2007 – The firm has retained its Sell rating on the stock.

NOT RATED

Goldman – Not Rated: 08/12/2007 – The firm has not provided any rating or target price on the stock.

DROPPED COVERAGE

MorganStanley: 08/21/2007 – The firm has dropped coverage of TXU due to its proposed sale to Kohlberg Kravis Roberts and Texas Pacific Group.

Research Associate: Smita Singh Copy Editor: Sreela Bose Content Ed: Jewel Saha

Zacks Investment Research Page 9 www.zackspro.com