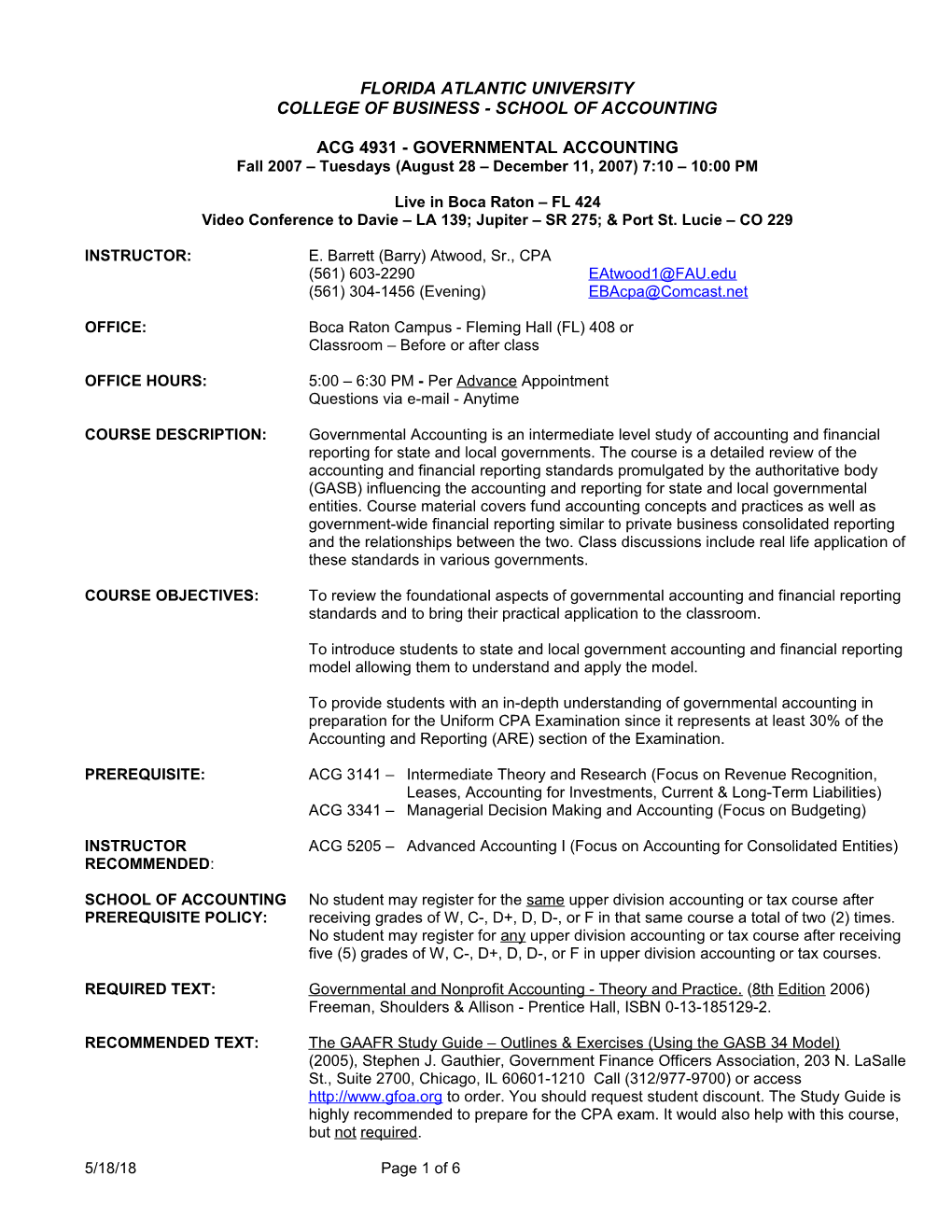

FLORIDA ATLANTIC UNIVERSITY COLLEGE OF BUSINESS - SCHOOL OF ACCOUNTING

ACG 4931 - GOVERNMENTAL ACCOUNTING Fall 2007 – Tuesdays (August 28 – December 11, 2007) 7:10 – 10:00 PM

Live in Boca Raton – FL 424 Video Conference to Davie – LA 139; Jupiter – SR 275; & Port St. Lucie – CO 229

INSTRUCTOR: E. Barrett (Barry) Atwood, Sr., CPA (561) 603-2290 [email protected] (561) 304-1456 (Evening) [email protected]

OFFICE: Boca Raton Campus - Fleming Hall (FL) 408 or Classroom – Before or after class

OFFICE HOURS: 5:00 – 6:30 PM - Per Advance Appointment Questions via e-mail - Anytime

COURSE DESCRIPTION: Governmental Accounting is an intermediate level study of accounting and financial reporting for state and local governments. The course is a detailed review of the accounting and financial reporting standards promulgated by the authoritative body (GASB) influencing the accounting and reporting for state and local governmental entities. Course material covers fund accounting concepts and practices as well as government-wide financial reporting similar to private business consolidated reporting and the relationships between the two. Class discussions include real life application of these standards in various governments.

COURSE OBJECTIVES: To review the foundational aspects of governmental accounting and financial reporting standards and to bring their practical application to the classroom.

To introduce students to state and local government accounting and financial reporting model allowing them to understand and apply the model.

To provide students with an in-depth understanding of governmental accounting in preparation for the Uniform CPA Examination since it represents at least 30% of the Accounting and Reporting (ARE) section of the Examination.

PREREQUISITE: ACG 3141 – Intermediate Theory and Research (Focus on Revenue Recognition, Leases, Accounting for Investments, Current & Long-Term Liabilities) ACG 3341 – Managerial Decision Making and Accounting (Focus on Budgeting)

INSTRUCTOR ACG 5205 – Advanced Accounting I (Focus on Accounting for Consolidated Entities) RECOMMENDED:

SCHOOL OF ACCOUNTING No student may register for the same upper division accounting or tax course after PREREQUISITE POLICY: receiving grades of W, C-, D+, D, D-, or F in that same course a total of two (2) times. No student may register for any upper division accounting or tax course after receiving five (5) grades of W, C-, D+, D, D-, or F in upper division accounting or tax courses.

REQUIRED TEXT: Governmental and Nonprofit Accounting - Theory and Practice. (8th Edition 2006) Freeman, Shoulders & Allison - Prentice Hall, ISBN 0-13-185129-2.

RECOMMENDED TEXT: The GAAFR Study Guide – Outlines & Exercises (Using the GASB 34 Model) (2005), Stephen J. Gauthier, Government Finance Officers Association, 203 N. LaSalle St., Suite 2700, Chicago, IL 60601-1210 Call (312/977-9700) or access http://www.gfoa.org to order. You should request student discount. The Study Guide is highly recommended to prepare for the CPA exam. It would also help with this course, but not required.

5/18/18 Page 1 of 6 ACG 4931 - GOVERNMENTAL ACCOUNTING

STUDENT E-MAIL: Outside of Blackboard, contact to students will only be made through the student’s assigned FAU e-mail address. To find out your user name (also known as FAUNetID, go to http://myfau.fau.edu and click on Account Information then select How to Look Up Your FAUNet ID.

COMPUTER ACCESS: Students will need internet access and a computer with Microsoft Word, Excel and PowerPoint software to access quizzes, case study templates, solutions, class slides and e-mail via “Blackboard” at FAU.

PowerPoint Slides - The 8th edition includes a comprehensive set of PowerPoint slides to reinforce what you will learn in the classroom. The weekly lecture uses these slides as a discussion outline. Microsoft PowerPoint or the PowerPoint Viewer is required to view these files. Recommend printing in “grayscale”, black and white, and three to a page to allow space for taking notes.

Quizzes – Weekly quizzes along with an answer sheet to complete at home prior to each class are included under each Chapter. Microsoft Word and Microsoft Excel is required to view these files.

Solution Templates for Harvey City Comprehensive Case - Receive maximum benefit from the comprehensive case by downloading and using electronic solution templates for solving the case problems. Solutions templates are Excel files that require use of Microsoft Excel or compatible spreadsheet. These problems are not collected, but they are included on the exams.

Solutions to Chapter Questions, Exercises and Problems are available via Blackboard.

GOVERNMENT GASB: http://www.gasb.org/ ACCOUNTING WEB SITES: GFOA: http://www.gfoa.org/

COURSE Students should apply analytical thought processes to all subject material and REQUIREMENTS: display sound logic to issues addressed and discussed. Students will be challenged to develop both their written and oral presentation skills in preparing assignments and during each class discussion. You should review the separate “Class Policies & Procedures” along with the following paragraphs.

ASSESSMENT This course moves very rapidly and introduces governmental accounting material PROCEDURES: that is totally new and unfamiliar to most students. Students will be assessed based on their readiness and participation as demonstrated by completion of assignments and quiz grades in addition to exam grades. Students should fully prepare assignments BEFORE class or it will be virtually impossible to be adequately prepared for exams. Students should -

Assume responsibility for remaining current with all assignments, Read assigned materials in advance of attending class, Prepare answers to questions, exercises, problems and case study materials assigned for each chapter in the text before coming to class, Compare their answers to the solutions provided on Blackboard to advance understanding and seek clarifications in class, if needed, Plan to attend all class sessions, ask questions and participate in class discussions, Respond to and submit a weekly quiz (take-home and in class) on assigned material, and Focus on individual preparation and class participation as experience notes this is not something to defer until the term's closing and final grades are due.

ATTENDANCE: Students are expected to attend all class sessions. The instructor should be notified in advance of an upcoming absence and the reason for the absence if you will not be in class. A student may be excused in advance from one (1) session. However, each subsequent absence as evidenced by failure to turn in a quiz will lower that Quiz Grade by 10%, but only if the assignment is turned in by the class date. Assignments not turned in by the class date will not receive credit.

5/18/18 Page 2 of 6 ACG 4931 - GOVERNMENTAL ACCOUNTING

PREPARATION AND It is necessary for each student to prepare for each class session in advance by studying the PARTICIPATION: text assignments; preparing solutions to cases, problems, and questions assigned for that session; and noting questions to raise during the class session and to participate actively and professionally in each class session. Each student should read the entire chapter prior to the class time covering the chapter. The instructor may call on students to offer oral explanations of assigned quizzes, case studies, problems or other topics.

CLASS SCHEDULE: The schedule and assignments found on Blackboard provide a detailed guide to your successful completion of this course. The schedule indicates the pages requiring careful study. Stay up-to-date as each new chapter builds on prior chapters. If you get behind, catch up ASAP as the course moves quickly. Staying current is essential to success in this course.

You need to develop expertise in “study” topics, whereas you need only a working knowledge of “scan” material. Should you have difficulty in a given area, I will work with you during office hours (either before class or anytime at my office, at your advance request) and/or suggest additional questions for you to answer/work in order to develop the necessary competence.

ASSIGNMENTS: Students are to read the assigned material and prepare all assigned homework problems prior to class. Collected assignments are due only by the respective class dates. In case of an absence excused in advance, e-mail assignments to me at [email protected] and/or [email protected] prior to the class time to receive credit. Assignments received after the class time will not receive credit. It is the student’s responsibility to obtain notes for missed classes. Power point slides for each chapter are available on Blackboard.

1. Problem, Question and Exercise assignments should help you master this course. You should complete them to the best of your ability before the class meeting on the date assigned. These supplemental questions and problems are to assist you achieve an adequate understanding of the main points of the chapter. If you cannot answer the questions, then additional study time is appropriate.

2. Harvey City Comprehensive Case assignments should be completed prior to the class period of the chapter that includes the assignment. Case solution “Excel” templates are available on Blackboard beginning with Chapter 4 and continuing through Chapter 15. There are in excess of 50 requirements to complete. While the requirements are not collected, students should complete the Case as exam problems frequently come from the Case.

3. Solutions to exercises, problems and questions as well as the Harvey City Case requirements are available via Blackboard. While solutions are available to students, each student should develop their answers prior to referring to the solution in order to understand the concepts completely.

4. Course Notebook s should be maintained and organized by chapter. The PowerPoint slides printed by chapter (Handouts, 3 to a page suggested) provide an excellent outline of each chapter and allow space for class lecture notes and discussions. Class lectures generally follow the text, but with further explanation and practical, real-life application. The notebook should also contain your solutions to assigned quizzes, questions, exercises, problems, and the Harvey City case requirements. You will need these to study for exams.

ACADEMIC A fundamental principle of academic, business and community life is honesty. Violation of HONESTY: this ethical concept will result in penalties ranging from a grade of “F” in the course to dismissal from the University. All penalties will include a letter of fact in the student’s file.

5/18/18 Page 3 of 6 ACG 4931 - GOVERNMENTAL ACCOUNTING

QUIZZES & EXAMS: Students must keep pace with advance preparation of assignments, as this is a fast- paced class. It will be nearly impossible to participate in class discussions and to be adequately prepared for quizzes and exams without advance preparation.

Quizzes are of two types; (1) assigned home quizzes provided via Blackboard for each Chapter and due at the beginning of class and (2) unannounced quizzes given during various class meetings at the instructor's discretion. You are encouraged to discuss your answers with other students prior to handing them in. Students cannot make up missed quizzes. Students can expect a 20-question quiz each class session based on the assigned materials. You will have about 350 quiz questions in total during the semester.

Examinations appear on the indicated dates per the Class Schedule. Note the exam dates on your calendar immediately. Students may not make up missed exams without prior approval of the instructor. Approximately 50% of exam questions draw from prior case assignments, quizzes, text questions, exercises, and problems. The third and final exam will be comprehensive emphasizing topics covered after the second exam, but also including questions drawn 100% from prior exams, quizzes, text questions, exercises, and problems. Exams are approximately two to two and one-half hours in length and average approximately 130 questions for each exam. They include multiple choice, true false, journal entry, problems and short answer questions. Calculators may be used, but no other aids are permitted.

GRADING CRITERIA: Final grades consider a combination of weights for quizzes and exams as follows.

25% - Quizzes – The aggregate score for all quizzes comprise 25% of the final grade. Students should complete and submit any missed quiz (as many exam questions are taken from quizzes), but the missed quiz will receive a zero grade for that quiz. In-class quizzes are unannounced, but are usually (but not always) given the class period before each exam as a review.

75% - Examinations – The course includes two interim exams (25% each) and a comprehensive final exam (25%) given during announced regular class hours. This will cause no conflicts; therefore, all students may take the exams only on these dates. There is no provision for make-up exams.

Students should not solely rely on high grades received on the home quizzes in order to pass the course as each student must pass at least one exam in order to pass the course.

Grades will be assigned on a 10-point scale as follows:

A = 98.0 & over A = 92.0 – 97.99 A - = 90.0 – 91.99 B+ = 88.0 – 89.99 B = 82.0 – 87.99 B - = 80.0 – 81.99 C+ = 78.0 – 79.99 C = 72.0 – 77.99 C - = 70.0 – 71.99 D+ = 68.0 – 69.99 D = 62.0 – 67.99 D - = 60.0 – 61.99 F = 59.9 & under

BIBLIOGRAPHY: Although the following are not required texts, they may prove useful to expand your understanding of governmental accounting and reporting; especially for students planning to take the Uniform CPA Examination.

Codification of Governmental Accounting and Financial Reporting Standards. (2006-2007 Annual Bound Edition) Governmental Accounting Standards Board, Norwalk, CT 06856. Order Department. (800) 748-0659 or (203) 847-0700, Ext. 287. Request student 20% academic discount.

Governmental Accounting, Auditing and Financial Reporting (Using the GASB 34 Model) (2005), Government Finance Officers Association, 203 N. LaSalle St., Suite 2700, Chicago, IL 60601-1210.

Guide to Preparing Governmental Financial Statements (Seventh Edition, October 2005 or latest edition), E. Barrett Atwood, Sr., Winford L. Paschall, Meryl L. Reed, Practitioners Publishing Company, P.O. Box 966, Fort Worth, TX 76101.

Miller Governmental GAAP Guide (2007 or latest Edition), Michael A. Crawford and D. Scott Loyd, CCH, P.O. Box 5490, Chicago, IL 60680-9882.

5/18/18 Page 4 of 6 ACG 4931 - GOVERNMENTAL ACCOUNTING

INSTRUCTOR: E. Barrett (Barry) Atwood, Sr., CPA

EDUCATIONAL: University of Connecticut, B.S. Degree , College of Business Administration, Accounting Major Florida Atlantic University, Adjunct Professor of Accounting – Governmental Accounting

PROFESSIONAL, GOVERNMENT & NOT-FOR-PROFIT POSITIONS: Partner, KPMG Peat Marwick, Waterbury, CT, New York, NY, Rochester, NY, Dallas, TX Finance Director, City of Gainesville, FL Finance Director, County of Prince William, Woodbridge, VA Finance Director, South Florida Water Management District, West Palm Beach, FL Finance Director, Broward County Aviation, Fort Lauderdale-Hollywood International Airport, FL Chief Financial Officer, Christ Fellowship, Palm Beach Gardens, FL

PROFESSIONAL ASSOCIATIONS: Government Finance Officers Association (GFOA), served as: National Executive Board Member Chair, Accounting, Auditing & Financial Reporting Committee National Reviewer of Distinguished Budget Awards Program National Reviewer of Popular Annual Financial Reporting Program Florida Government Finance Officers Association (FGFOA), served as: Chair, Technical Resources Committee Government Accounting Standards Advisory Council (GASAC) to the Governmental Accounting Standards Board (GASB), served as: Chair, Communications Committee American Institute of Certified Public Accountants (AICPA), served as: Government Accounting & Auditing Committee Member City of Greenacres, Florida Member, Board of Trustees, Retirement Plan for Firefighters / Public Safety Officers American Association of Airport Executives (AAAE) Airports Council International - North America (ACI - NA), served as: GASB 34 Task Force Member Chair, Finance Subcommittee

AUTHOR (TEXTS, ARTICLES, AND PAPERS): Government Finance Officers Association (Articles & Book Reviews) Florida Government Finance Officers Association (Articles and Project Papers) Practitioners Publishing Company (Preparing Governmental Financial Statements) Prentice Hall (Governmental & Nonprofit Accounting) American Institute of CPAs (Uniform CPA Exam – Government Accounting Questions) Airports Council International - North America (Applying GASB 34 to U.S. Airports)

SPEAKER (NATIONAL, STATE & LOCAL CONFERENCES): Government Finance Officers Association (GFOA) Florida Government Finance Officers Association (FGFOA) American Institute of Certified Public Accountants (AICPA) Florida Institute of Certified Public Accountants (FICPA) Airports Council International - North America (ACI – NA) American Association of Airport Executives (AAAE) National Institute of Governmental Purchasing (NIGP) Institute for International Research Arthur Andersen LLP

5/18/18 Page 5 of 6 ACG 4931 - GOVERNMENTAL ACCOUNTING

5/18/18 Page 6 of 6