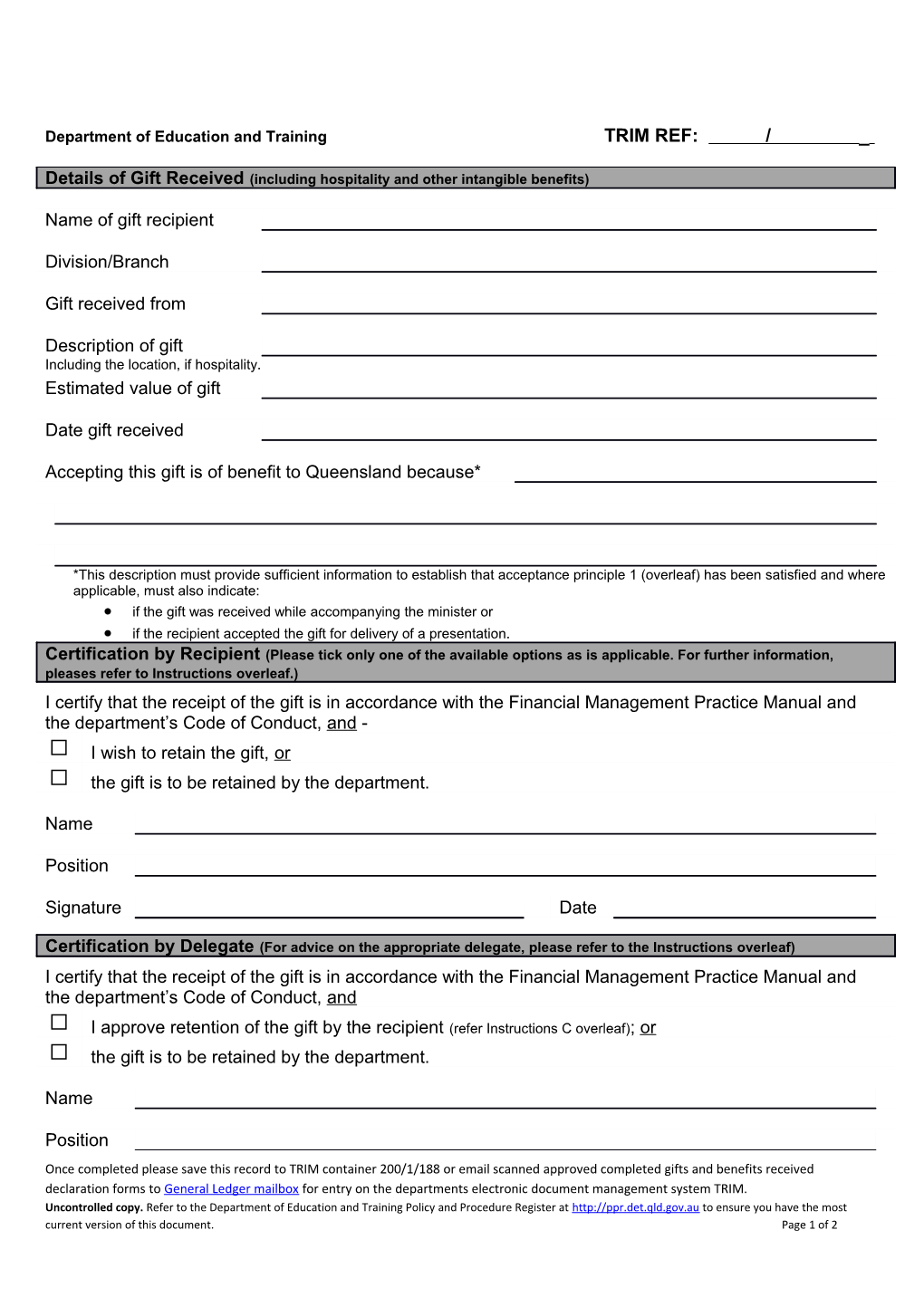

Department of Education and Training TRIM REF: / _

Details of Gift Received (including hospitality and other intangible benefits)

Name of gift recipient

Division/Branch

Gift received from

Description of gift Including the location, if hospitality. Estimated value of gift

Date gift received

Accepting this gift is of benefit to Queensland because*

*This description must provide sufficient information to establish that acceptance principle 1 (overleaf) has been satisfied and where applicable, must also indicate: if the gift was received while accompanying the minister or if the recipient accepted the gift for delivery of a presentation. Certification by Recipient (Please tick only one of the available options as is applicable. For further information, pleases refer to Instructions overleaf.) I certify that the receipt of the gift is in accordance with the Financial Management Practice Manual and the department’s Code of Conduct, and - I wish to retain the gift, or the gift is to be retained by the department.

Name

Position

Signature Date

Certification by Delegate (For advice on the appropriate delegate, please refer to the Instructions overleaf) I certify that the receipt of the gift is in accordance with the Financial Management Practice Manual and the department’s Code of Conduct, and

I approve retention of the gift by the recipient (refer Instructions C overleaf); or the gift is to be retained by the department.

Name

Position Once completed please save this record to TRIM container 200/1/188 or email scanned approved completed gifts and benefits received declaration forms to General Ledger mailbox for entry on the departments electronic document management system TRIM. Uncontrolled copy. Refer to the Department of Education and Training Policy and Procedure Register at http://ppr.det.qld.gov.au to ensure you have the most current version of this document. Page 1 of 2 Signature Date INSTRUCTIONS

Once completed please save this record to TRIM container 200/1/188 or email scanned approved completed gifts and benefits received declaration forms to General Ledger mailbox for entry on the departments electronic document management system TRIM. Uncontrolled copy. Refer to the Department of Education and Training Policy and Procedure Register at http://ppr.det.qld.gov.au to ensure you have the most current version of this document. Page 2 of 2 A. Acceptance Principles Before accepting the gift or benefit, you must comply with all of the following principles: It does not influence, or have the potential to influence, you in such a way as to compromise or appear to compromise your integrity and impartiality or to create a conflict of interest or perception of conflict of interest. It is not related to your advice or decisions about (but not limited to):

- granting licences; - inspecting and regulating businesses; and - giving approvals. The obligation or potential obligation implied in acceptance of the gift or benefit of all values and types has been discussed with your manager. It does not involve time away from your official duties at public expense.

It is received in the course of your official duties and relates to the work of the Department or has a benefit to the Queensland community or it is normal in the donor's culture and rejection of the gift or benefit could cause offence. Costs incurred in receiving hospitality or event-related gifts is regarded as non-official, private expenditure and is NOT to be charged to the department. Examples of such costs include the use of departmental cab charge card/vouchers, corporate card and the claiming of parking fees through petty cash. For more information about matters that should be considered before accepting a gift or benefit, please refer to the Policy and Procedure Register on Receipt of Gifts and Benefits by Employees of the Department B. Delegate to Approve Acceptance of Gift or Benefit – Gift retained by Department This form must be forwarded to your Supervisor/Manager (AO8 equivalent or higher) for certification of the receipt of the gift or benefit: All gifts and benefits must be declared to the delegate with the exception of:- a) items received whilst attending a meeting, seminar or conference in the course of official public service duties such as stationery (e.g. pens and notepads), handouts, folders and light refreshments (e.g. tea, coffee, biscuits, pastries) Product samples received at presentations must be declared. b) Gifts by students, parents or parent organisations to teachers where the value is less than $150 in a year.

C. Delegate to Approve Retention of the Gift by a Recipient A gift or benefit, not of cultural or historic significance, may remain your property or you may benefit from it, when its fair retail value - . is $150 or less; or . is between $150 and $350, and is approved by an Assistant Director-General, or higher, in appropriate circumstances; or . is more than $350 and is approved by the Director-General, or Deputy Director-General, in exceptional circumstances. All gifts of cultural or historical significance must remain the property of the Department, regardless of value.

D. Gift purchased by Recipient If approval is not given to retain a gift or benefit with a value in excess of $150, you may offer to purchase the gift or benefit for the difference between the fair retail value and the $150 reportable threshold. Written offers should be forwarded to the Executive Director, Financial Services, Finance Branch including supporting documentation proving the value of the gift, for example, by a quote from a supplier of this good or service. If this is not available the Executive Director, Financial Services, Finance Branch, will determine a value. A tax invoice will be issued to you by the Department.

Once completed please save this record to TRIM container 200/1/188 or email scanned approved completed gifts and benefits received declaration forms to General Ledger mailbox for entry on the departments electronic document management system TRIM. Uncontrolled copy. Refer to the Department of Education and Training Policy and Procedure Register at http://ppr.det.qld.gov.au to ensure you have the most current version of this document. Page 3 of 2