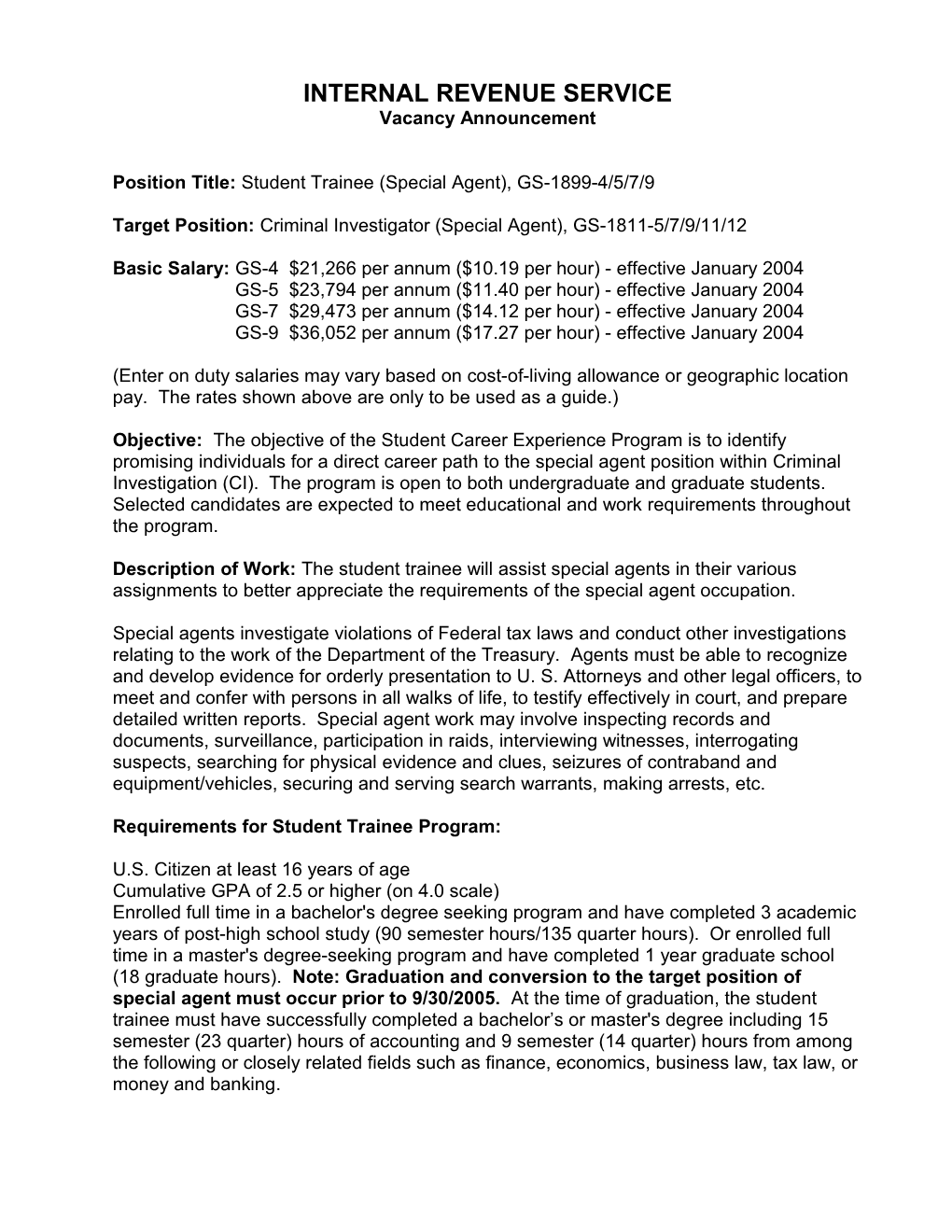

INTERNAL REVENUE SERVICE Vacancy Announcement

Position Title: Student Trainee (Special Agent), GS-1899-4/5/7/9

Target Position: Criminal Investigator (Special Agent), GS-1811-5/7/9/11/12

Basic Salary: GS-4 $21,266 per annum ($10.19 per hour) - effective January 2004 GS-5 $23,794 per annum ($11.40 per hour) - effective January 2004 GS-7 $29,473 per annum ($14.12 per hour) - effective January 2004 GS-9 $36,052 per annum ($17.27 per hour) - effective January 2004

(Enter on duty salaries may vary based on cost-of-living allowance or geographic location pay. The rates shown above are only to be used as a guide.)

Objective: The objective of the Student Career Experience Program is to identify promising individuals for a direct career path to the special agent position within Criminal Investigation (CI). The program is open to both undergraduate and graduate students. Selected candidates are expected to meet educational and work requirements throughout the program.

Description of Work: The student trainee will assist special agents in their various assignments to better appreciate the requirements of the special agent occupation.

Special agents investigate violations of Federal tax laws and conduct other investigations relating to the work of the Department of the Treasury. Agents must be able to recognize and develop evidence for orderly presentation to U. S. Attorneys and other legal officers, to meet and confer with persons in all walks of life, to testify effectively in court, and prepare detailed written reports. Special agent work may involve inspecting records and documents, surveillance, participation in raids, interviewing witnesses, interrogating suspects, searching for physical evidence and clues, seizures of contraband and equipment/vehicles, securing and serving search warrants, making arrests, etc.

Requirements for Student Trainee Program:

U.S. Citizen at least 16 years of age Cumulative GPA of 2.5 or higher (on 4.0 scale) Enrolled full time in a bachelor's degree seeking program and have completed 3 academic years of post-high school study (90 semester hours/135 quarter hours). Or enrolled full time in a master's degree-seeking program and have completed 1 year graduate school (18 graduate hours). Note: Graduation and conversion to the target position of special agent must occur prior to 9/30/2005. At the time of graduation, the student trainee must have successfully completed a bachelor’s or master's degree including 15 semester (23 quarter) hours of accounting and 9 semester (14 quarter) hours from among the following or closely related fields such as finance, economics, business law, tax law, or money and banking. Students selected for this program must:

(1) Pass an agency-provided medical examination for the special agent position upon selection for the student trainee program. Prior to placement in the target position of special agent (GS-1811) and if the initial examination is more than 24 months old, student must take another medical examination and be certified as medically qualified.

(2) Have a background investigation (BI) for a public trust/high risk position and tax audit initiated prior to appointment to the student trainee position, and receive a satisfactory suitability determination based on the BI prior to placement in the target position of special agent (GS-1811). If the background investigation results are unsatisfactory, the student will be terminated from employment in the student trainee program.

(3) Prior to appointment as a student trainee, the student must agree to nationwide availability when placed in the target position of special agent (GS-1811). This means the student agrees that in accepting the student trainee position, he/she will accept assignment to a duty location anywhere in the United States or the Commonwealth of Puerto Rico when placed in the target position of special agent (GS-1811).

Notice to Applicants

The Treasury Inspector General for Tax Administration (TIGTA) has oversight and investigative responsibilities throughout IRS. TIGTA has authority to initiate investigations to identify IRS employees who have violated or are violating laws, rules or regulations related to the performance of their duties. TIGTA does this in part through computer matching programs.

2