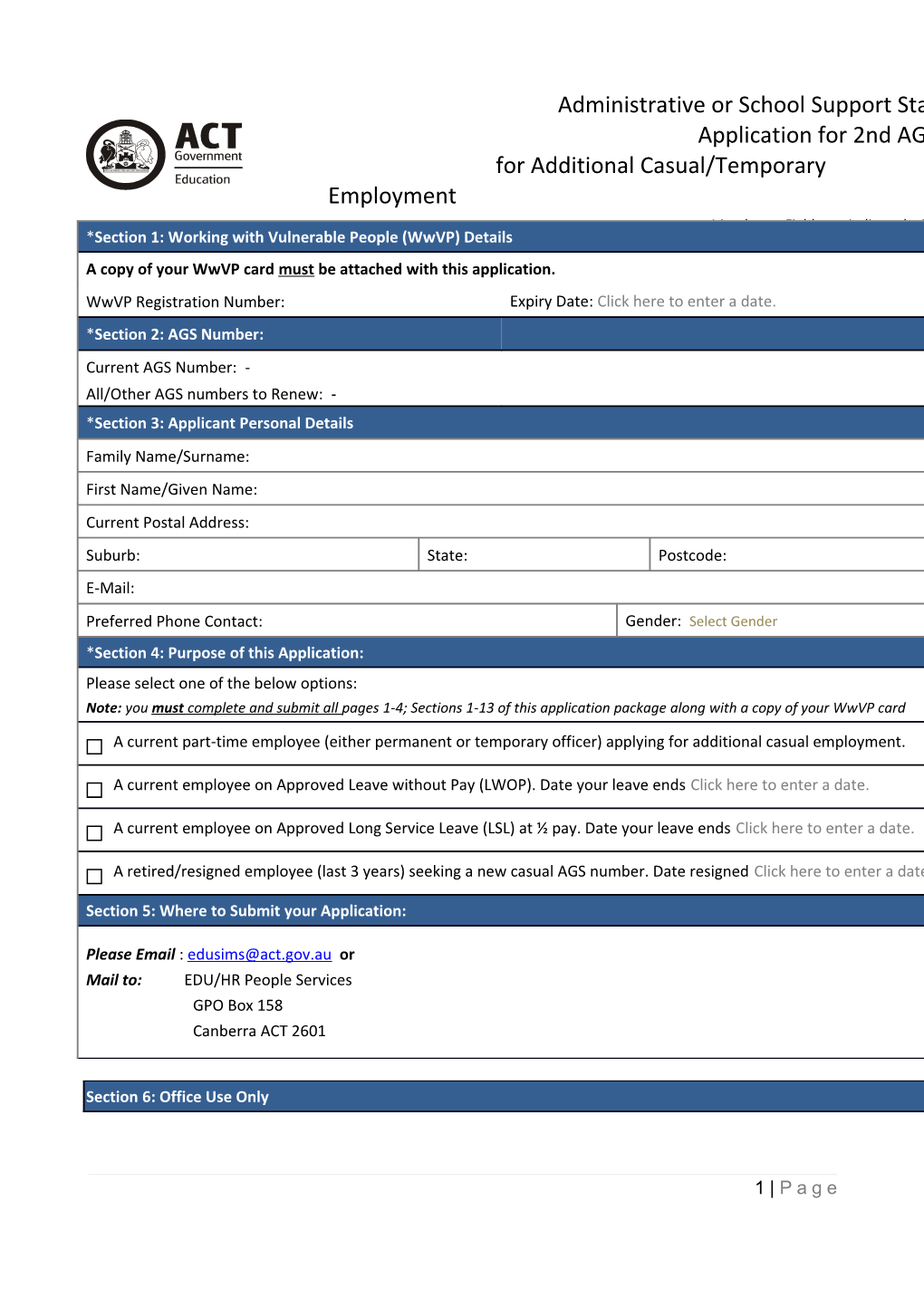

Administrative or School Support Staff Application for 2nd AGS for Additional Casual/Temporary Employment Mandatory Fields are indicated with * *Section 1: Working with Vulnerable People (WwVP) Details A copy of your WwVP card must be attached with this application. WwVP Registration Number: Expiry Date: Click here to enter a date. *Section 2: AGS Number: Current AGS Number: - All/Other AGS numbers to Renew: - *Section 3: Applicant Personal Details Family Name/Surname: First Name/Given Name: Current Postal Address: Suburb: State: Postcode: E-Mail:

Preferred Phone Contact: Gender: Select Gender *Section 4: Purpose of this Application: Please select one of the below options: Note: you must complete and submit all pages 1-4; Sections 1-13 of this application package along with a copy of your WwVP card

A current part-time employee (either permanent or temporary officer) applying for additional casual employment.

A current employee on Approved Leave without Pay (LWOP). Date your leave ends Click here to enter a date.

A current employee on Approved Long Service Leave (LSL) at ½ pay. Date your leave ends Click here to enter a date.

A retired/resigned employee (last 3 years) seeking a new casual AGS number. Date resigned Click here to enter a date.

Section 5: Where to Submit your Application:

Please Email : [email protected] or Mail to: EDU/HR People Services GPO Box 158 Canberra ACT 2601

Section 6: Office Use Only

1 | P a g e All Required Registrations Verified Casual Tracking 2nd AGS number: CRS SiMS Application Approved/Actioned By: ______Date: ______Letter

Section 8: Information – Purpose and Privacy

What is the purpose of the Employee Information Pack? The purpose of this pack is to collect the minimum information required to process your request for a 2 ND Additional AGS number. A 2 Privacy Statement: Personal information is collected by Shared Services on behalf of ACTPS directorates, agencies and authorities and may be supplied to your employing directorate. Information collected will be used in accordance with the provisions of the Commonwealth Privacy Act 1988 and only for the purpose for which you gave it. Your information will not be disclosed to other persons or organisations without your prior consent unless required by law.

*Section 9: Personal Details Family Name Given Names Preferred Name Previous Name(s) Title Date of Birth Gender Street address

Suburb State Post Code Email Mobile Ph Home Ph

Name of Emergency Contact Emergency Contact Ph Aust.- Driver’s Licence No. *Section 10: Bank Account Details: Your salary will be paid into the account you specify here. Name of Financial Institution Branch Number (BSB) Branch Name 2 Account Number

Account Name

*Section 11: Tax file number declaration Information you provide will help us determine how much tax to withhold from your pay. Further information is available at: https://www.ato.gov.au/forms/tfn-declaration/ What is your Tax File Number (TFN) OR Select a TFN exemption category Basis of Employment (full-time, part-time, etc) Are you an Australian resident for tax purposes If you answered ‘No’, you cannot claim the tax-free threshold Do you want to claim the tax-free threshold from the ACTPS? Only claim the tax free threshold from one employer at a time, unless your total income from all sources for the financial year will be less than the tax-free threshold. If you answered ‘No’, you cannot claim the seniors and pensioners tax offset by reducing the amount withheld

Do you want to claim the seniors and pensioners tax offset by reducing the amount withheld? If you answered yes, complete the Withholding declaration Nat 3093 and refer to https://www.ato.gov.au/forms/tfn-declaration/ for further information

Do you want to claim a zone, overseas forces, dependent spouse or dependent (invalid and career) tax offset by reducing the amount withheld If you answered yes, complete the Withholding declaration Nat 3093 and refer to https://www.ato.gov.au/forms/tfn-declaration/ for further information

Do you have a Higher Education Loan Program (HELP) or Trade Support Loan (TSL) debt?

Do you have a financial supplement debt? *Section 12: Superannuation Comsuper | PSSdb or CSS Members of either the PSSdb or CSS may be required to contribute to this fund. Shared Services will check your status with ComSuper to determine this. PSSdb members may need to complete additional forms from Comsuper as part of reactivating a Comsuper account. PSSap | Access to ComSuper’s PSSap fund is not available to members of the ACTPS. Members of this fund will need to select an alternative fund using the options below.

If you have a Comsuper managed Superannuation Fund (PSSdb or CSS Only) please enter your AGS Number:

OR Standard Choice Instructions for completing the following fields are available at: https://www.ato.gov.au/Forms/Superannuation-(super)-standard-choice-form/?page=2#Instructions Additional information regarding superannuation can be downloaded from: http://www.jobs.act.gov.au/about-the-actps/superannuation-entitlements Where would you like your super contributions paid to:

Fund ABN 3 | P a g e Fund Name

Fund Email Address

Fund Address

Fund Phone

Standard Choice: continued

APRA or RSA funds Only

Unique Superannuation Identifier (USI) Account Name (if applicable)

Member No. (if applicable)

Self Managed Super Funds Only Fund Electronic Service Address (ESA)

Fund Account |BSB Code

Fund Account | Number

Superannuation Guarantee – Employee Contribution Rate (Non-Comsuper funds only) The ACT Government is required to pay a minimum of 10% (based on your earnings) for you into the fund of your choice. If you choose to contribute an additional 3% or more of your earnings into your fund, the ACT Government will contribute a further 1% bringing the overall employer contribution up to 11%.

Personal superannuation contribution rate

*Section 13: Acknowledgement

I, Enter Given Names Enter Surname, acknowledge that:

I have been given the opportunity to read and understand my entitlements as established under Commonwealth and ACT Law, specifically, the Fair Work Information Statement, Superannuation Standard Choice, and Superannuation Entitlements.

The information I have provided on this form is true and correct and

I have attached all of the required documentation – Pages 1-4; sections 1-13 of this application package along with a copy of my WwVP card.

*Signature: Date: // Select Date. (type name if emailing)

4 5 | P a g e