Chapter 11 Corporate Organizational Structure

Introduction

This chapter covers the organizational structure of the corporation, which is generally owned by its shareholders, governed by its board of directors, and managed by its officers. Most of the corporations that paralegals work with are not the stereotypical huge publicly traded company. Rather, most paralegals and attorneys will work with or for one of the many corporations that are owned and operated by a handful of people—often just family or friends investing in a small business venture.

Paralegals should have a clear understanding of the rights and duties of corporate shareholders, directors, and officers, particularly the latter two groups. If directors and officers fail to perform their requisite duties, they can and will be held responsible for any breach in their fiduciary responsibilities to the corporation, thus defeating the limited liability protections otherwise available through a corporation.

Lecture Notes

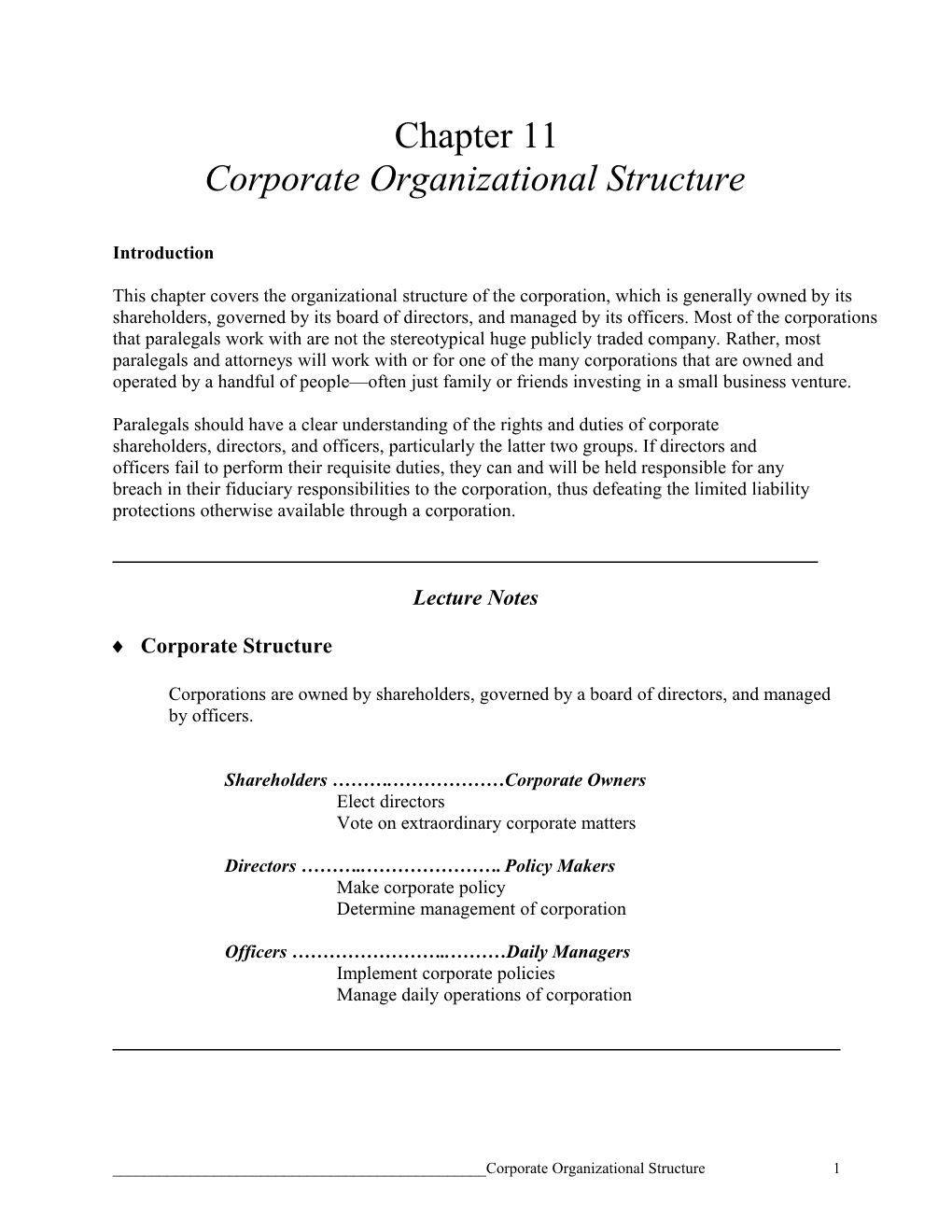

Corporate Structure

Corporations are owned by shareholders, governed by a board of directors, and managed by officers.

Shareholders ……….………………Corporate Owners Elect directors Vote on extraordinary corporate matters

Directors ………..…………………. Policy Makers Make corporate policy Determine management of corporation

Officers ……………………..………Daily Managers Implement corporate policies Manage daily operations of corporation

______Corporate Organizational Structure 1 Shareholders: Corporate Owners

Shareholders are the owners of the corporation. They contribute the investment capital— the money to start the business—in exchange for shares or stock (ownership) in the corporation.

Shareholders generally do not have management rights; therefore, they are not personally liable for the debts or obligations of the corporation.

Shareholders’ Rights

Shareholders “own” the right to receive corporate profits, elect and remove directors, vote on extraordinary corporate matters, and receive corporate assets if the corporation is dissolved.

Voting Rights

Shareholders have the right to elect or remove directors and vote on extraordinary corporate matters (changes to the corporation that affect its structure, such as a merger).

Voting Mechanisms

The corporate bylaws will specify the minimum number of shares necessary for a valid vote. However, the Revised Model Business Corporate Act (RMBCA) provides that a quorum (the majority of shares to be voted) needs to be present for shareholders to vote, and a valid vote or decision can be made by a majority of the quorum.

Note: Voting is based on the number of shares, not the number of shareholders.

Example: ABC Corporation has four shareholders and 1,000 shares issued and outstanding. Shareholder W owns 400 shares, Shareholder X owns 300 shares, Shareholder Y owns 200 shares, and Shareholder Z owns 100 shares. To vote on an issue at a shareholders’ meeting, 501 shares must be present at the meeting. At the annual meeting, only shareholder W and X attend. They may vote on any issues that come before the meeting, because their combined total shares exceed 501.

Proxy Vote

If a shareholder cannot attend a meeting, he or she may give another person the right to vote his or her shares; this is known as a proxy vote.

Notice

______Corporate Organizational Structure 2 Corporations are required to give shareholders reasonable notice of shareholder meetings. However, it is common for shareholders to waive their right to notice of a meeting, to avoid the cumbersome notice requirements.

Shareholder Meetings

The minutes of all corporate meetings must be maintained to (1) demonstrate corporate compliance with shareholder meeting requirements and (2) record the topics and issues addressed. There are three categories of shareholder meetings:

1. Annual Meetings Annual meetings are held to elect new directors and if necessary, to consider extraordinary corporate matters on which shareholders are entitled to vote (amendment of articles of incorporation, mergers, etc.).

2. Special Meetings Special meetings are held when a shareholder vote is required (e.g., a merger) but an annual meeting is not scheduled in the near future.

3. Meetings by Written Consent In lieu of an annual or special meeting, the shareholders can vote on issues in writing (“written consent”). However, the vote must be unanimous; therefore, meetings by written consent are only practical for corporations with few shareholders.

Shareholders’ Liability

Corporate Veil

A “veil” exists between shareholders and the corporation’s creditors. Shareholders generally have no personal liability for the debts or obligations of the corporation. They are allowed to hide behind the “corporate veil.”

Hint: Think of the corporate veil as a wall that protects shareholders from attack by corporate creditors and others.

Piercing the Corporate Veil

The corporate veil can be penetrated or “pierced”:

1. to prevent fraud or injustice 2. if a shareholder personally guarantees a corporate loan

Prevent Fraud or Injustice

______Corporate Organizational Structure 3 Example: John intends to sell time-share interests in nonexistent property to retired couples. He forms a corporation as part of his scam and immediately transfers all money received by the corporation into his personal bank account. A victim of his scam sues John’s corporation, as well as John personally, to recover his losses. The court would allow the personal lawsuit in the “interests of justice,” to prevent John’s fraudulent conduct.

1 Hint: A court will uphold a corporation if it looks and acts the part. In other words, a corporation must observe corporate formalities (e.g., meeting requirements), corporate moneys must be kept separate from personal accounts, and the corporation must have money to pay its debts and obligations. 2 Personal Guarantee by Shareholder It is not uncommon for shareholders to personally guarantee debts of the corporation, particularly at the beginning of a corporation’s existence or if the corporation is experiencing financial problems (creditors do not want to lend money to a business in financial trouble).

Directors: Corporate Policy Makers

Directors make policy decisions for the corporation, as opposed to the daily management decisions made by corporate officers.

Election of Directors

Corporate directors are elected by shareholders at annual shareholders’ meetings. In this way, directors are accountable to the corporate owners for their policy decisions and can be removed by a vote of 10 percent of the shareholders.

Directors’ Duties

Management Responsibilities The management responsibilities of directors include

making corporate policy declaring corporate dividends electing and removing officers of the corporation initiating extraordinary corporate matters

______Corporate Organizational Structure 4 Fiduciary Duties. Directors are in a position of trust with corporate shareholders. Shareholders trust that directors will properly manage their investments in the corporation. Thus, directors are considered fiduciaries of the shareholders and are required to act in good faith, act with due care, and be loyal to the corporation and its business interests.

Directors’ Liability

Note: Directors are not guarantors of the success of the corporation’s business. As long as they make reasonable informed decisions, the business judgment rule protects directors from personal liability.

Ultra Vires Acts

A director who exceeds the authority granted by the corporation will be personally liable for the losses the corporation suffers due to ultra vires acts.

Breach of Fiduciary Duties

A corporate director who is negligent in his or her duties or is not loyal to the corporation (has a conflict of interest, usurps a corporate opportunity, or is guilty of insider trading) may be liable to the corporate for its losses due to the director’s wrongful conduct.

Example: Mark, a director of Zony, Inc., informs the corporation’s board that he has found an office building with an ideal location. He does not, however, inform the board that he owns the office building and the rent is twice what other tenants pay. This creates a conflict of interest for Mark. While Mark may rent the building to the corporation, he has a duty to inform the board of his ownership interest, as well as his intent to charge higher than the market rate for the office space.

Officers: Corporate Managers

Officers implement corporate policy and manage the daily business affairs of the corporation.

Note: The corporation’s board makes the general policies, while the officers implement the policies.

Example: The board of directors of Disnex, Inc., votes to produce children’s animated movies. The officers are responsible for creating the movies (hiring writers, producers, animators, etc.).

______Corporate Organizational Structure 5 Appointment and Removal of Officers

Corporations are typically run by the following corporate officers:

president vice-president secretary treasurer

The board of directors of a corporation is responsible for appointing, supervising, and removing corporate officers.

Officers’ Duties

President oversees general management Vice-President has variable management duties Secretary keeps records of corporation Treasurer is responsible for financial affairs of the corporation

Agency

Officers are agents of the corporation, with the authority to act on behalf of the corporation.

Express Authority

Corporate officers are granted express authority to perform their responsibilities in the corporate articles of incorporation, bylaws, or by direction of the board of directors.

Implied Authority

An officer has implied authority to act for the corporation in matters associated with the officer’s position (e.g., the treasurer has implied authority to sign corporate checks).

Apparent Authority

A corporation that gives the public the impression that an officer may act on its behalf will be bound by the officer’s exercise of apparent authority. (E.g., a corporate vice president appears, to the general public, to have expansive authority to act in almost any capacity on behalf of the corporation. Therefore, corporations should designate their vice presidents as vice president of marketing, vice president of sales, etc.)

______Corporate Organizational Structure 6 Purpose: Apparent authority protects the public from the unauthorized acts of corporate officers by holding the corporation responsible for the acts of its officers (since the corporation created the appearance of authority).

Fiduciary Duties

Officers are fiduciaries of the corporation because they manage the operations of the corporation and thus the investments of its shareholders. Therefore, the same duties of care and loyalty imposed on directors are also imposed on corporate managers.

Note: Courts generally will not hold officers liable for their actions unless they are guilty of gross negligence in the management of corporate affairs.

Answers to Study Questions in Review

1. Identify the structure of a corporation by answering the following questions:

a. Who owns a corporation?

Shareholders and stockholders own a corporation.

b. Who determines the policy for a corporation?

The board of directors is the policy-making body for the corporation.

c. Who manages the daily business of the corporation?

The officers manage the business of the corporation.

2. What does a shareholder of a corporation actually own?

Shareholders do not own the assets of the corporation (buildings, cars, etc.). Rather, a

shareholder “owns” the rights to receive distributions of corporate profits, elect or

remove directors, vote on extraordinary corporate matters, and receive a proportionate

share of corporate assets, if any, in a dissolution.

3. Are shareholders automatically entitled to receive dividends if the corporation earns profits?

______Corporate Organizational Structure 7 No. Shareholders are not automatically entitled to receive a distribution of the

corporation’s profits, known as corporate dividends. Shareholders only receive a share

of the corporate profits if either (1) the board of directors declares a corporate dividend

or (2) the corporation is dissolved and liquidated and there are still assets (money or

corporate property) to distribute to the shareholders.

4. Under what circumstances are shareholders entitled to vote on the business matters of a

corporation?

If an action by the board of directors will materially affect the ownership interests of the

shareholders, the shareholders have the right to vote on the issues. Such actions include

but are not limited to amendment of the articles of incorporation, mergers, sale of

corporate assets not in the ordinary course of business, and corporate dissolution.

5. What is a quorum?

A quorum is the minimum number of shares issued by the corporation (represented by

shareholders) that must be present at the meeting in order for matters to be submitted to

the shareholders for a valid binding vote.

6. What is the purpose of granting preemptive rights to shareholders?

Preemptive rights allow shareholders to maintain their proportionate share of stock

ownership of a corporation when the corporation issues new stock.

7. Are directors of a corporation required to be shareholders of the corporation?

No. Directors may be shareholders or they may be outsiders. Many corporations retain

directors who bring expertise to the board of directors and who are compensated for

their service as a director but do not own shares in the corporation.

8. Why is it advisable for a board of directors to consist of an odd number of directors?

______Corporate Organizational Structure 8 It is advisable for a board to have an odd number to avoid deadlocks on voting.

9. Is a director a fiduciary of a corporation?

Yes

10. Does a director’s obligation to use due care with regard to corporate matters make him or her

a guarantor of the corporation’s business?

No. While a director is obligated to use due care when acting for the corporation, he or

she cannot guarantee that every decision made by the board will profit the corporation.

11. What should a director do if he or she has a conflict of interest with the corporation?

A director does not violate his or her duty of loyalty to the corporation merely because

the director may gain a personal benefit from the corporation’s business. A director who

has a conflict of interest should disclose the conflict to the board or the shareholders.

12. What is an ultra vires act?

When directors exceed the authority granted to them by the corporation, their actions are

ultra vires acts.

13. What is insider trading?

Insider trading occurs when an insider of a corporation, such as a director or officer,

buys or sells stock based on information that is not generally available to the public (e.g.,

that the corporation intends to file for bankruptcy).

14. Are officers agents of their corporations?

Yes. Officers are agents of a corporation. Everything an officer does is binding on the

corporation; it is as though the corporation itself acted.

Answers to Case Studies in Review

______Corporate Organizational Structure 9 1. Sam and Ted convinced their doctor friend, Shauna, to invest in their new production

company by telling her that it would be able to generate revenues of more than $250,000.00

annually. In fact, the first year, the company’s revenues exceeded $250,000.00. However,

Sam and Ted, the directors of the corporation, decided to reinvest all of the company’s

profits into new projects. Shauna is very upset and contacts your law firm to represent her in

demanding the corporation declare a substantial dividend. Your advising attorney asks you to

look into this to determine Shauna’s rights. What are Shauna’s rights? Can she force the

corporation to declare a dividend?

No. Directors do not have to declare dividends and distribute the corporate profits to the

shareholders. It is fairly common for new corporations to reinvest their profits into the

business.

2. Jeremy is a director of Toys ’N Tots, a national toy manufacturer. An employee of the

corporation submits a proposal to the board of directors suggesting that the company

manufacture interactive dolls. The marketing director of the company recommends against

the proposal on the basis that the public is not interested in buying interactive toys. The board

votes against manufacturing the doll. Six months later, Playskul starts distributing an

interactive doll, very similar to the one proposed to Toys ’N Tots’ board of directors.

Playskul earns over $10 million dollars in profits the first year the doll is on the market. The

shareholders of Toys ’N Tots are furious that its board passed up on the doll. Can the

shareholders sue the directors for their decision?

No. The courts presume that directors will use their best business judgment in making

decisions for the corporation. Most jurisdictions statutorily protect directors who have

acted reasonably. In this case, the board relied on the statement of the marketing

______Corporate Organizational Structure 10 director that the public would not buy an interactive doll. While the director may have

been wrong, it was reasonable for the board to rely on his opinion.

Project Application

Your firm represents Toys ’N Tots against a lawsuit brought by its shareholders for the profits lost by the company in failing to manufacture an interactive doll. Prepare a research memorandum to your supervising attorney explaining your response to Case Study 2, supra. In preparing your memo, research your state’s statute addressing the duties of corporate directors.

______Corporate Organizational Structure 11