This quiz is due on Tuesday, June 13th

Name: ______

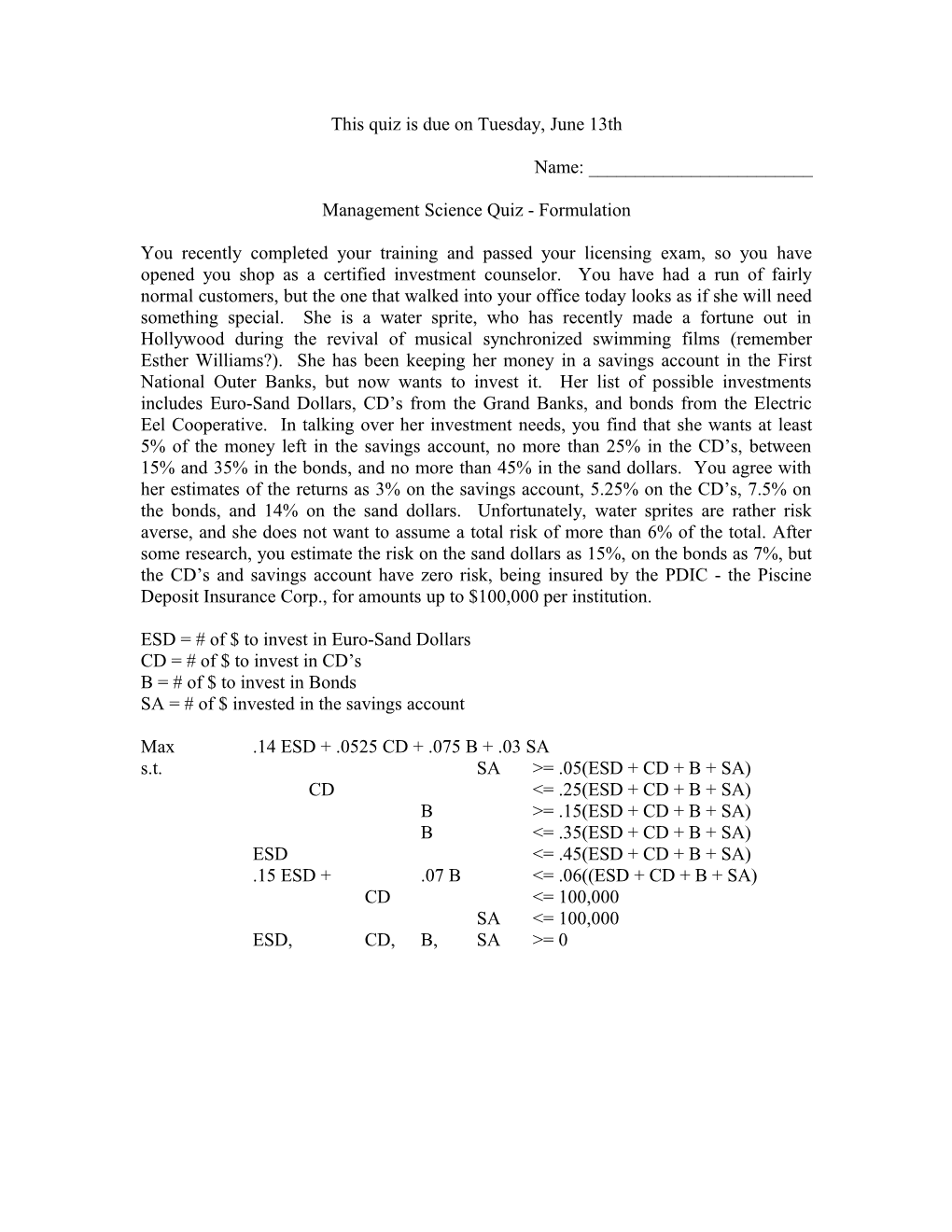

Management Science Quiz - Formulation

You recently completed your training and passed your licensing exam, so you have opened you shop as a certified investment counselor. You have had a run of fairly normal customers, but the one that walked into your office today looks as if she will need something special. She is a water sprite, who has recently made a fortune out in Hollywood during the revival of musical synchronized swimming films (remember Esther Williams?). She has been keeping her money in a savings account in the First National Outer Banks, but now wants to invest it. Her list of possible investments includes Euro-Sand Dollars, CD’s from the Grand Banks, and bonds from the Electric Eel Cooperative. In talking over her investment needs, you find that she wants at least 5% of the money left in the savings account, no more than 25% in the CD’s, between 15% and 35% in the bonds, and no more than 45% in the sand dollars. You agree with her estimates of the returns as 3% on the savings account, 5.25% on the CD’s, 7.5% on the bonds, and 14% on the sand dollars. Unfortunately, water sprites are rather risk averse, and she does not want to assume a total risk of more than 6% of the total. After some research, you estimate the risk on the sand dollars as 15%, on the bonds as 7%, but the CD’s and savings account have zero risk, being insured by the PDIC - the Piscine Deposit Insurance Corp., for amounts up to $100,000 per institution.

ESD = # of $ to invest in Euro-Sand Dollars CD = # of $ to invest in CD’s B = # of $ to invest in Bonds SA = # of $ invested in the savings account

Max .14 ESD + .0525 CD + .075 B + .03 SA s.t. SA >= .05(ESD + CD + B + SA) CD <= .25(ESD + CD + B + SA) B >= .15(ESD + CD + B + SA) B <= .35(ESD + CD + B + SA) ESD <= .45(ESD + CD + B + SA) .15 ESD + .07 B <= .06((ESD + CD + B + SA) CD <= 100,000 SA <= 100,000 ESD, CD, B, SA >= 0