ACCT 351, Fall 2012, Sections 3, 4, 5 Tax Preparation Assignment (Due Date for Monday Section: Dec 10) (Due Date for TR sections: Dec 11)

This is an individual assignment. The entire tax return has to be completed on an individual basis without the help of tax software. You may not share your work with other students. Failing to follow these instructions may result in referring you to the Office for Academic Integrity.

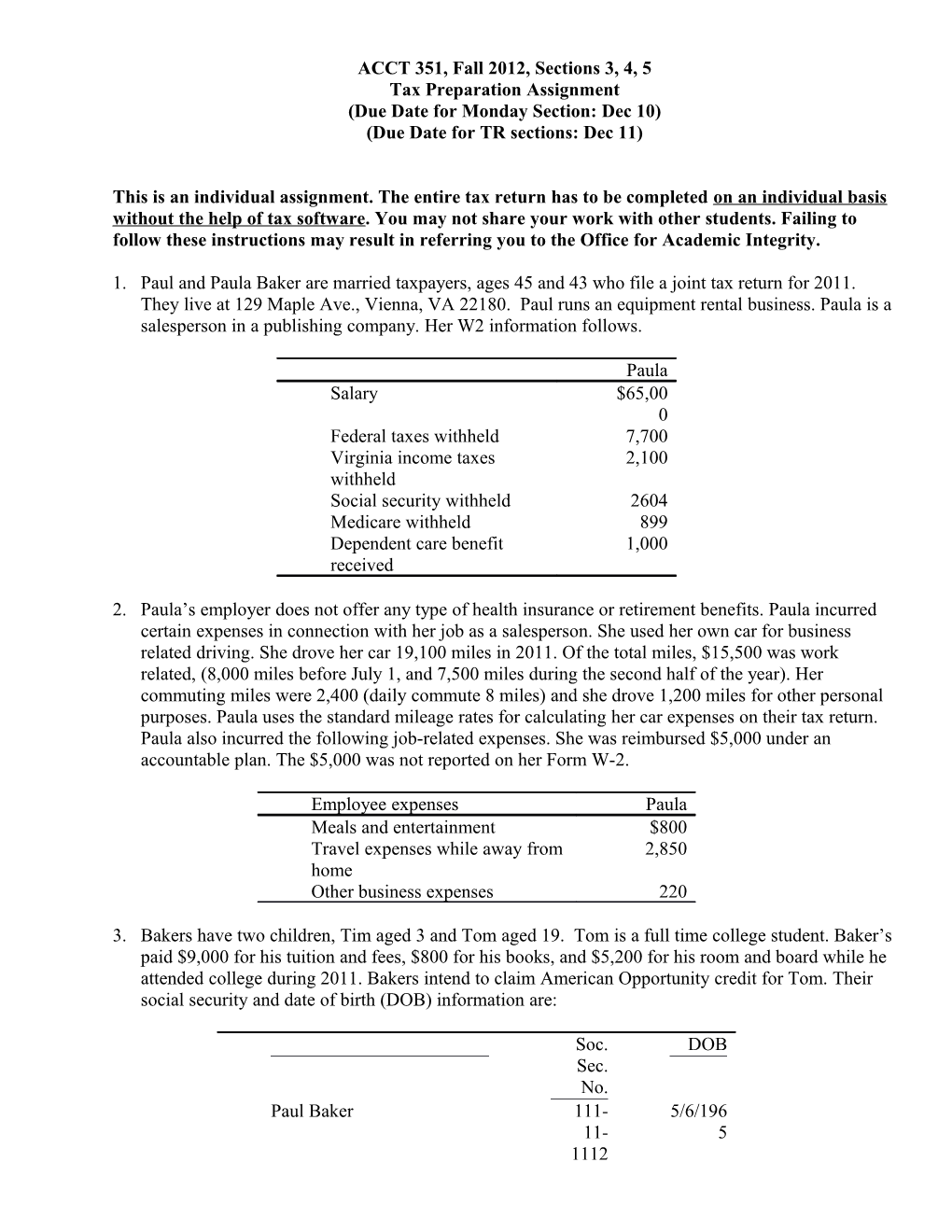

1. Paul and Paula Baker are married taxpayers, ages 45 and 43 who file a joint tax return for 2011. They live at 129 Maple Ave., Vienna, VA 22180. Paul runs an equipment rental business. Paula is a salesperson in a publishing company. Her W2 information follows.

Paula Salary $65,00 0 Federal taxes withheld 7,700 Virginia income taxes 2,100 withheld Social security withheld 2604 Medicare withheld 899 Dependent care benefit 1,000 received

2. Paula’s employer does not offer any type of health insurance or retirement benefits. Paula incurred certain expenses in connection with her job as a salesperson. She used her own car for business related driving. She drove her car 19,100 miles in 2011. Of the total miles, $15,500 was work related, (8,000 miles before July 1, and 7,500 miles during the second half of the year). Her commuting miles were 2,400 (daily commute 8 miles) and she drove 1,200 miles for other personal purposes. Paula uses the standard mileage rates for calculating her car expenses on their tax return. Paula also incurred the following job-related expenses. She was reimbursed $5,000 under an accountable plan. The $5,000 was not reported on her Form W-2.

Employee expenses Paula Meals and entertainment $800 Travel expenses while away from 2,850 home Other business expenses 220

3. Bakers have two children, Tim aged 3 and Tom aged 19. Tom is a full time college student. Baker’s paid $9,000 for his tuition and fees, $800 for his books, and $5,200 for his room and board while he attended college during 2011. Bakers intend to claim American Opportunity credit for Tom. Their social security and date of birth (DOB) information are:

Soc. DOB Sec. No. Paul Baker 111- 5/6/196 11- 5 1112 Paula Baker 222- 12/9/19 22- 67 3333 Tim 222- 5/5/20 22- 08 2222 Tom 333- 12/8/19 33- 92 3333 4. Partial list of Baker family’s tax related information:

Items Am ount Other medical expenses, doctors, medicine, dentists, etc. 10,2 00 Charitable donations, cash 1,50 0 Home mortgage interest 9,95 0 Interest on car loan 1,98 0 Interest on credit cards 670 Real estate taxes paid for their personal residence 4,48 0 Virginia car taxes paid in 2011 660 Tax preparation fees paid in 2010 460 Refund of state income taxes for 2010 (the family had itemized in 567 2010*) * Assume their itemized deductions in 2010 was greater than their standard deduction by $6,200.

5. Baker’s paid $7,500 to KinderCare LLC for child care. The company’s EIN (employer identification number) is: 54-2899600; and its address is: 1000 Main St., Fairfax, VA 22030.

6. Baker’s own two rental properties. Rental condo #1 (part of a multi-family residential building) is located on 1700 University Dr., Fairfax, VA 22030, and was purchased on July 1, 2005 for $500,000 (Land $100,000, building, $400,000). This property was purchased as an investment property and has been rented since its purchase. For 2011, the rental income and expenses are as follows:

Rent received $1 1, 90 0 Mortgage interest paid $1 4, 50 0 Property taxes paid $6 ,7 50 Condo fees $3 ,2 00 Management fees $2 ,4 00 Depreciation $1 4, 54 4 Bakers did not make personal use of this condo and had no suspended rental losses on this property from prior years. Rental condo # 2 (multifamily residential condo located on 1600 International Drive, McLean, VA 22102) purchased on July 1, 2011 for $280,000 (Land $70,000, building, $210,000). This property was purchased as an investment property and has been rented since its purchase. Bakers rented the property on July 10 and it remained rental for the rest of 2011 (property was owned for 183 days and rented for 174 days in 2011). For 2011, the rental income and expenses are as follows:

Rent received $1 3, 00 0 Mortgage interest paid $4 ,9 00 Property taxes paid $1 ,7 00 Condo fees $9 00 Depreciation $3 ,5 01

Backers did not make personal use of this condo. They are active participants in the rental of both properties.

7. Paul Baker’s business is operated as a sole proprietorship. The business is names, Northern Virginia Rental Experts, and its facilities are located at 19240 Lee Highway, Fairfax, VA. The main activity of the business is rental of construction and agricultural equipment and machinery. He also sells some small agricultural tools equipment. Paul uses Hybrid Method (accrual for inventory, inventory reported at cost, and cash basis for all other expenses) to report his taxable income in this business. In collections from customers totaled $320,000. Expenses were as follows:

Amo unt Beginning inventory of merchandize $11, 400 Purchases 50,0 00 Ending inventory of merchandize 14,8 00 Returns and allowances 2,40 0 Wages paid to employees (other than Paul who works in the business) 37,8 00 Social security, Medicare and other payroll related taxes 2,96 0 Facility rent 55,8 70 Supplies 2,72 0 Car and truck expenses used solely for business (assume fully depreciated) 4,23 4 Office expenses 5,11 2 Utilities 2,44 0 Interest expense (on loans used for regular business activity) 5,75 0 Insurance, business liability 12,0 00 Legal and professional services 5,08 0 Heath care premiums to cover himself and his family 3,40 0 Depreciation 32,4 50 Advertising 19,7 40 Repairs 17,2 30

Since Paul is not covered by any employer retirement account, he contributed $5,000 to a traditional IRA account in December of 2011. During 2011, Paul made four equal payments of $1,100 for quarterly estimated taxes to cover for federal income taxes resulting from his business activity. He also made four quarterly estimated tax payments of $600 to cover his VA income tax liability. He made these payments on the 15th of April 2011, June 2011, Sept. 2011 and January 2012. Paul uses cash method of accounting, except for calculating cost of goods sold. Inventory is valued at cost and there was no change in inventory valuation during the year.

Bakers had the following personal casualties in 2011

FMV FMV Date Date of Adjusted before after Insurance Item purchased incident basis incident incident proceeds Type Damage to family 04/18/201 Personal 05/12/1992 23,500 14,050 1,560 1,500 house roof* 1 Personal Auto* 04/18/201 Personal 08/20/2008 28,300 22,300 4,800 14,500 1 *The roof and the automobile were damaged as a result of a major hurricane (single event)

8. On October 1, 2011, Paul’s business warehouse was damaged by fire. The warehouse was purchased on 5/20/2001 for $370,000 and had an adjusted basis at the date of fire of $280,000. Assume that fair market value of the warehouse before fire was $350,000 and immediately after the fire its value was appraised to be $320,000. He received $25,300 from insurance company. and spent $28,000 repairing the warehouse. Depreciation claimed on the warehouse up to the date of fire was $17,435

9. Bakers also sold the following stocks in 2011: Cost or Item Date Acquired Date Sold other basis Sale Price 250 shares of IBM 05/12/2007 04/18/2011 $23,000 $26600 50 share of Google 08/20/2008 06/09/2011 19,400 14,500 100 share of GE 12/10/2010 4/9/2011 8,400 9,500

Bakers also have a short-term capital loss carry forward from 2010 of $1,900.

10. They also received $2,800 dividends from PEPCO Utilities of which $2600 was qualified dividend. Required:

Prepare the 2011 tax return for the Baker family. You need to download all the relevant forms from IRS site (you can also search for the forms in Google using the form number or worksheet name). Prepare a draft return and make any necessary corrections in your draft version. After completing the draft version, type your final results. Organize your tax return in proper order and attach your original hand-written draft and turn in your assignment by the due date. WRITE YOUR NAME and G NUMBER ON TOP RIGHT SIDE of Form 1040 or on the cover page, if any.

GUIDE TO TAX RETURN PREPARATION:

Use 2011 tax forms and prepare the return for 2011. The forms you need are: Forms 1040, 2441, 4684, 8582, 8863, Child Tax Credit Worksheet. (IRS Publication 972, pages 4 and 5). Qualified Dividends and Capital Gains Worksheet IRA deduction worksheet. Schedules, A, B, C, D, E, SE Instructions for completing these forms can be found in individual instruction booklets found for each form on www.irs.gov, or in IRS publication 17.

What follows are my suggestions on the steps required to prepare this return. It is possible that I have overlooked certain steps, but this is as close as I could get. I leave you to read IRS instructions and find additional steps, if necessary.

1. Complete the top section and Dependent section of Form 1040. Bakers choose Yes in response to the Presidential Election Campaign question. 2. Enter Paula’s gross wage on line 7. 3. Complete Schedule B for dividend income. Carry relevant amounts to lines 9a and 9b of Form 1040. 4. Complete Schedules C. Carry net profit to line 12 of 1040. 5. Complete Schedule SE. Enter the resulting figures on pages 1 and 2 of Form 1040, lines 27 and 56. 6. Complete Schedule D both pages. No need to complete Form 8949 for this exercise. Carry the result, to line 13 of Form 1040. 7. Partially complete page 1 of Form 4684 using information for personal casualty and theft. Stop when it prompts you to enter AGI. 8. Complete page 2 of the Form 4684 for fire damage to the warehouse. Carry any losses on line 38a to line 14 of Form 1040. 9. Complete Form 1040, page 1 (lines 7, 9, 10, 12, 13, 14) using available information. 10. Complete page 1 of Schedule E to line 22. 11. Complete Form 8582. Amounts in part II, III, IV of this form should be shown in positive even if indicating a loss. To complete Form 8582, you need to calculate Modified Adjusted Gross Income or MAGI. To calculate MAGI, add up amounts in lines 7 through 21 of Form 1040 (except line 17 which is not known at this time). Subtract self-employed health insurance. The resulting amount is MAGI. Complete Form 8582 using MAGI and any loss or income from rental properties 1 and 2. Total losses allowed on line 16 should be carried over to Schedule E, line 22. Do not complete any worksheets for Form 8582. 12. Return to Schedule E and complete the rest of this form. Carry the amount on line 26 of Schedule E to line 17 of Form 1040. 13. Complete IRA deduction worksheet. 14. Complete page 1 of 1040. 15. Complete page 1 of from 4684 and carry the resulting amount from line 18 to Schedule A line 20. 16. Complete Form 2106. Carry over the amount from line 10 of this form to line 21 of Schedule A. 17. Complete Schedule A using other relevant information. Be careful to include the first three installments of estimated VA tax payments on line 5a. 18. Complete Form 6521 (optional for this exercise). 19. Go to page 2 of Form 1040 and complete lines 38 through 43. Calculate tax using tax tables in your book or the tax Schedules shown in the front cover of your book for 2011. Enter the resulting tax figure on line 44 and 46. Since Bakers have some qualified dividend, be careful about calculation of their taxes. You need to fill in Qualified Dividends and Capital Gains Worksheet at this stage. However, if you can calculate the tax using textbook procedures, you may skip preparation of the Worksheet. 20. Form 2441. Complete page 2 and then page 1 of Form 2441. Enter the resulting credit on line 48. (To find earned income for lines 4 and 18 of this form, simply use tentative profit from line 29 of Schedule C. (Caution: Do not follow IRS Form instructions for this step.) 21. Complete Form 8863 and carry the resulting nonrefundable and refundable credits to lines 49 and 66 of Form 1040. 22. Complete Child Tax Credit Worksheet to calculate the credit and enter the resulting credit on line 51 of Form 1040. 23. Complete Form 1040 lines 54, 55, 61, 62 (estimated tax payments), 63 and the remainder of page 2.

Assemble your tax return in the following order (DO NOT INCLUDE instruction pages that accompany some forms). 1040 (page 1, page 2) A B C (both pages) D (both pages) E (page 1 only) SE (page 1 only) 2441 4684 (both pages) 8863 (both pages) 8582 (page 1 only) Child tax credit worksheet Qualified Dividends and Capital Gains Worksheet Ignore any other worksheets that IRS publications may instruct you to prepare. IRA deduction worksheet.