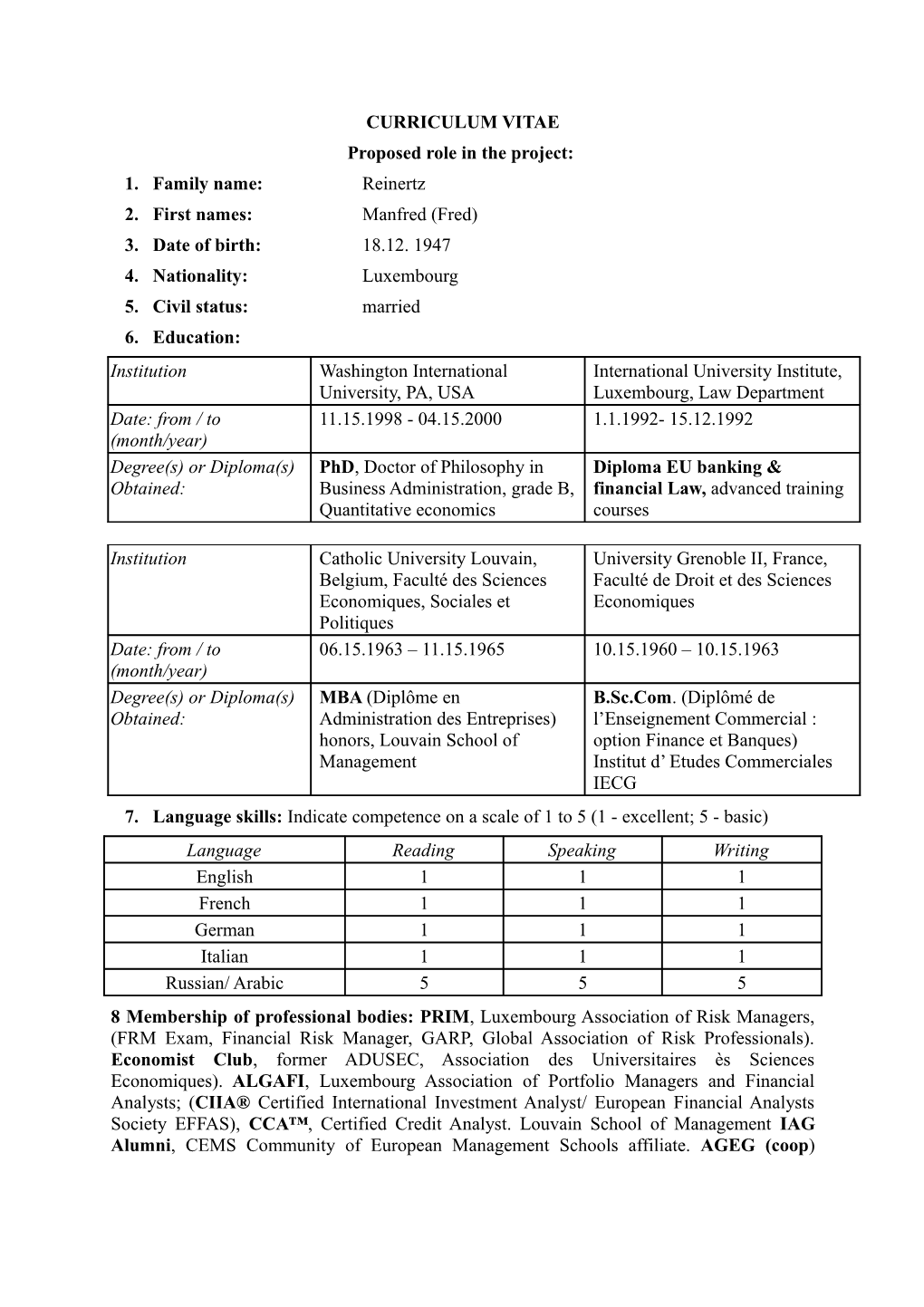

CURRICULUM VITAE Proposed role in the project: 1. Family name: Reinertz 2. First names: Manfred (Fred) 3. Date of birth: 18.12. 1947 4. Nationality: Luxembourg 5. Civil status: married 6. Education: Institution Washington International International University Institute, University, PA, USA Luxembourg, Law Department Date: from / to 11.15.1998 - 04.15.2000 1.1.1992- 15.12.1992 (month/year) Degree(s) or Diploma(s) PhD, Doctor of Philosophy in Diploma EU banking & Obtained: Business Administration, grade B, financial Law, advanced training Quantitative economics courses

Institution Catholic University Louvain, University Grenoble II, France, Belgium, Faculté des Sciences Faculté de Droit et des Sciences Economiques, Sociales et Economiques Politiques Date: from / to 06.15.1963 – 11.15.1965 10.15.1960 – 10.15.1963 (month/year) Degree(s) or Diploma(s) MBA (Diplôme en B.Sc.Com. (Diplômé de Obtained: Administration des Entreprises) l’Enseignement Commercial : honors, Louvain School of option Finance et Banques) Management Institut d’ Etudes Commerciales IECG 7. Language skills: Indicate competence on a scale of 1 to 5 (1 - excellent; 5 - basic) Language Reading Speaking Writing English 1 1 1 French 1 1 1 German 1 1 1 Italian 1 1 1 Russian/ Arabic 5 5 5 8 Membership of professional bodies: PRIM, Luxembourg Association of Risk Managers, (FRM Exam, Financial Risk Manager, GARP, Global Association of Risk Professionals). Economist Club, former ADUSEC, Association des Universitaires ès Sciences Economiques). ALGAFI, Luxembourg Association of Portfolio Managers and Financial Analysts; (CIIA® Certified International Investment Analyst/ European Financial Analysts Society EFFAS), CCA™, Certified Credit Analyst. Louvain School of Management IAG Alumni, CEMS Community of European Management Schools affiliate. AGEG (coop) German Association of Development Consultants ; IBFL, International Bankers Forum Luxembourg. 9 Other skills: Computer literate http://www.reinertz.lu/-, kudos in PCM (project cycle management), LFA (logical framework approach) and ZOPP (zeroing in on people and processes) objective-oriented project planning methodology/approach planning, management and evaluation of projects and programs. Member of EFEX Clearing House, the EC’s European Financial Expertise Network for TA (Technical Assistance) programs in the Asian ASEM countries; Individual expert EU EuropeAid Office - finance/economic development. Ministry of Commerce, Trade & Industry, Luxembourg, License No 87373 as “Conseil Economique” and “Chartered Accountant”. Investment Fund license Authorization No 61-P- 003, the Securities Commission of the Bahamas. http://www.regencyfund.com/thefund1.html. 10. Present position: project based, free lance Consultant/ Expert/Team Leader (over 10 years) and Associated Professor. 11. Years within the firm: Over 30 year’s professional experience, Consultant/ Expert since 1997. Lecturing since 1980. 12. Key qualifications: Senior Expert in , Central Bank issues and commercial banking (corporate and investment banking) with Team Leader / Consultant experience in various International Aid projects, namely policy development, institutional capacity building, and executive training: Capital and Financial Market Development, Central Bank policy and commercial bank restructuring/development, Credit and Monetary Council organizational support, banking administrative and finance operations. Although specializing in Financial sector consultancy in the areas of Regulatory and Supervisory tasks and banking reform, Dr Reinertz is a qualified investment and corporate banker, with professional experience gained in the Pacific Rim, New York and London for more then 20 years. His kudos encompasses Risk Management (including Credit Risk, Operational and Market Risk Management) Bank Supervision and Bank Staff Training. Familiar with the Bank for International Settlements, Basel: the Basel Committee on Banking Supervision recommendations, Basel II implementation, all working papers and publications on Supervisory and Regulatory issues. A past member of the Board of Directors of ALFI, the Association of the Luxembourg Fund Industry and a member of the Executive Board of Directors of ABBL, the Luxembourg Bankers Association. He was a full-time member in the Legal- and Regulatory Commissions of both instrumentalities. ABBL designated member in the Financial Sector Supervisory ad hoc working group on the transposition of the EC CRD (2006/48/CE and 2006/49/CE) directives with the CSSF, the Commission de Surveillance du Secteur Financier (Banking and Capital Market Regulator in Luxembourg). ALFI designated member of the industry workgroup at the CSSF sub-committee on the transposition of the EC Prospectus directive (2003/71/EC), the different subsequent UCITS directives (2001/108/EC…) and the recent MiFID (2004/39/EC) directive. Member of the Sub-committee on capital markets regulations in the Luxembourg Stock Exchange with emphasis on corporate governance setting up the conduct code for listed companies in compliance with the EC directives (2006/6/EC….). Member in the Board of Directors of AGDL, the Luxembourg Bankers’ Deposit Guarantee Association (a self Regulatory instrumentality), the transposition of EC Deposit Guarantee Scheme (94/19/EC) and Investor Compensation Directive (97/9/EC). Familiar with all prevailing EU Financial sector regulations, the EC’s Financial Services Action Plan (FSAP) and other initiatives: IFRS, anti-money laundering, and market abuse regulations ((2003/6/EC….), the SEPA, the single European payment area regulations. The CEBS issued FINREP and COREP standards. The IOSCO and CESR rules in capital market issues. Member of the CESR‘s ad hoc Market Participants Consultative Panel : Report on evaluation of equivalence of supervisory powers in the EU under the Market Abuse Directive and the Prospectus Directive The EC’s new plans for more financial integration: UCITs IV as well as their implementation in banking, financial services and stock exchanges. Proven comprehensive grasp of the legal and regulatory framework that is governing EC financial market activities. Proven intercultural and team competence with acumen for creative solutions. 13. Specific Countries experience: Country Date: from (month/year) to (month/year) East 03.2007-10.2007; Key Expert: Finance Expert, EC Framework Contract London, No.2006/132783. Improve efficiency and effectiveness of LED Local Economic Eastern Development support mechanisms in the Eastern Cape Province/South Africa and to Cape strengthen the ECDC Eastern Cape Development Corporation as the leading Province, enterprise development organization, facilitating business development services and South Africa finance partnership with national South African Government agencies. Lecturing / training / workshops in Project Cycle Management, Due Diligence, project evaluation criteria and decision making process, feasibility studies and cost benefits analysis. Orlando, Fl, 10.2006-06.2007; Board member and Senior Investment Consultant, JUSA Invest / USA and Jupiter USA Inc. Orlando, Fl., USA. Venture Capital and Private Equity Financial “Investment House”, with subsidiaries in Germany and Luxembourg. Customize Center Project Planning, Due Diligence and Finance Structuring with Investment Banking Luxembour partners for project funding in the US. Funding Solutions through mezzanine g finance to achieve full project finance. Structured projects finance either as “private placements” 2nd lien/mortgage backed and/or “private equity partnerships” formula in combination with own capital and long term banking debt. Damascus, 01.2006-05.2006; TL, Senior Expert in Banking sector Reform, MEDA contract: Syria Central Bank of Syria/ancillary Ministry of Finance. Banking sector support Program II: provide expertise and advice on banking sector reform to the Central Bank of Syria and the Credit and Monetary Council; ancillary the Ministry of Finance, provide global advice to the commercial banks on modernization of procedures, systems and services: emphasis credit risk, loan portfolio management, corporate governance requirements program management together with PMU and PD. EuropeAid/12648/C/SV/SY Vientiane/ 12,2005-01.2006; TL, category 1 expert, financial and banking issues, PCM, PDR Lao Multiple framework contract EU. Final External evaluation of EC Project LAO/B7- 3010/IB/97/0210 Euro-TAL Bank Training Project, Lao PDR, EuropeAid/119860/C/SV7multi; Evaluation of the experienced project implementation. Bratislava / 05.2005-11.2006; Team coordinator, Senior International Expert: Risk assessment Slovakia banks and capital market, PHARE contract: National Bank of Slovakia & Financial Country Date: from (month/year) to (month/year) Market Authority. Support to the implementation of the Basel II Risk-based- supervision for the Central Bank, EuropeAid/ 119754/D/SV/SK, to achieve credit institutions, capital market and insurance supervision in transparency and stability. Prepare training courses and seminars for risk management for the on-site and off- site Supervisory Inspection teams of the Regulators. Develop proposals for regulations and technical provisions for the new Basel II frame-work, implementation rules regarding risk enhanced supervision for banks and capital market participants. Twinning exercise between the Capital Market Authority and the Luxembourg CSSF Commission de Surveillance du Secteur Financier on Basel II implementation. Prague/ 02.2005-11.2005; TL banking supervision team; Senior International Expert Czech technological and training component, PHARE contract: Czech National Bank. Republic Strengthening the Czech Banking sector-Application of Basel II, the Czech banks and the Central Bank (Regulator), EuropeAid/ 116971/D/SV/CZ, reinforce the banking sector and to improve credit risk and risk management, by training, Contribute to write rules & instructions in the manuals for the Central banking Supervisory Authority especially with emphasis how to perform banking supervision under new Basel II conditions. Review of credit risk models, score cards (scoring techniques) and rating. The Basel II approaches: StA; IRB, AMA, a credit risk and market risk methodology for Czech banks in the SME sector etc… setting up a Twinning partnership between the Czech Central Bank & Capital market Regulator) and the Luxembourg CSSF, organized a twinning exercise in Supervisory assessment of Basel II requirements Moscow/ 02.2004-12.2004; TL Financial sector corporate governance, TACIS contract: Russia Federal Service for Financial Markets. TACIS Corporate Governance Facility, Russian Federation, EuropeAid/114006/C/SV/RU, improve coherence of regulatory frame-work for bank and capital market participants, improvement of financial sector administrative capacity. As TL wrote paper regarding proposals to improve the general regulatory framework of the financial sector supervision in the Russian Federation, and an assessment paper on corporate governance issues in the Russian capital market. Cairo / 10.2003-02.2004; TL, Class 1 international Expert, Financial Regulations and Egypt Monetary Policy, MEDA contract: Bank of Egypt / Capital Markets Authority / Insurance Supervisory Authority. Modernization of the Egyptian Financial sector AMS/451-Lot 10 Contract No 2003/73868 FISC Financial: global reform of the Egyptian financial sector, banks, capital markets and insurance industry, components: Banking Supervision and Regulations, Implementation of banks operational restructuring, etc as TL I did write the TOR components regarding the Central bank on Policy Advice, Monetary Policy, Regulation and Supervision of the banking sector, also the Corporate Governance issues for the Capital Market Authority, as well as the component regarding the implementation of bank restructuring: operational audit, operational restructuring, credit work out, as well as the FISC rationale paper; New 06.2002-07.2003; TL, Senior Advisor & External Consultant, for KPMG York /USA Luxembourg, JP Morgan Chase Asset Management Company. Assessment Study of implications of the EU new UCITS III directive on Collective investment undertakings, CIU’s. Regulatory issues with FRS reporting, IAS implications versus US GAAP issues. General compliance wit EC rules and regulations in matters of Country Date: from (month/year) to (month/year) corporate governance issues. Ljubljana / 07.2001 07.2002; TL, financial sector reform: banks, capital market, and insurance Slovenia Supervision, PHARE contract: National Bank of Slovenia/Ministry of Finance. Feasibility study for integration of financial regulation and supervision No SKOFIC1Bis-Phare-SL-PAO-CFCU/ECOND as TL author of a comparative Study on Regulatory and Supervisory frame-work in the EU and world, elaborated and wrote proposals to unify the Financial sector segregated Regulators in Slovenia, A pro and cons study etc Lithuania, 1998-1999; TL, Senior Consultant EU accession Member States TA, Luxembourg Latvia, Ministry of Finance direct TA. IFRS and the compulsory Prudential reporting to Hungary Bank Regulatory Institutions, the EU’s CAD II requirements and the impact for accession Countries, gap analysis for forthcoming EU accession, the “acquis communautaire” transposition in their domestic Regulatory frame. Brussels/ 06.1999-07.1999; Assigned project Evaluator, EC Commission DG XII Science, Belgium Research & Development. 5th Framework Program: Improving the Human Research Potential and the Socio-Economic Knowledge base (1998-2002) Evaluation of academic research projects in global economics: assessment of banking and finance related research requests on their eligibility for EC funding. Tunisia, 1998-2000; Chef de Mission (TL) in TA Emerging markets Economies, ATTF Algeria Agence pour le Transfert des Technologies Financières. Lux Gov. Agency. EU banks’ CAD I and II, “ALM, assets & liabilities management”, “Financial analysis, contingent liabilities & risk management”, effective Market risks management, Taking & Managing Trading/Balance sheet Risks seminars, Treasury management issues. 14. Professional Experience Record: Dates Since 1989-ongoing Location Luxembourg Company ATTF, Luxembourg Government Financial Technology Transfer Agency and IFBL, Luxembourg Bankers’ Association Banking Academy. VET Lifelong Learning Center CEP-L, funded by the EU’s Social Fund Position Associated Professor, Chargé de Cours, Senior Lecturer VET Descripti Assets & liabilities management, risk management and contingent liabilities analysis, on Risks and Hedging techniques, Capacity building to understand Market dynamics, Corporate Governance concerns, international seminars in the involved specific target countries. IFRS/IAS accounting principles , anti-money laundering, terrorist finance and restrictive financial measures rules Investment Funds related matters: Accounting, NAV calculation, reporting, compliance issues, organizational set-up etc

Dates 1/12/1989-15/03/1997 Location Tokyo, London, Luxembourg Company The Nomura Securities Company Ltd, Tokyo Position General Manager, Luxembourg banking unit Descripti Upgrading representative office to a banking unit: Manager, Mutual Fund Dept.1994, on Senior Manager Business Planning & Fund Advisory Dept.1995, General Manager 1996 Investment banking

Dates 01/06/1984-15/11/1989 Location Paris, London, Luxembourg Company Banque Indosuez-Credit Agricole, Paris Position Counselor, 1989 Fondé de Pouvoirs Principal Descripti Financial Services Dept., financial engineering, collective investment schemes on onshore and offshore jurisdictions, capital markets issues, structured finance: Private banking.

Dates 01/03/1972-30/11/1989 Location Singapore, Luxembourg Company DEXIA Banque Internationale à Luxembourg, Singapore Position Fondé de Pouvoirs / Reg. Rep. Officer ASEAN /Hong-Kong/Pacific Rim Descripti 10 years Corporate banking Dept, then 7 years as Regional Rep. Officer in Singapore on for the Pacific Rim: Corporate banking/Private Banking/Project finance and ancillary Export finance 14. Other relevant information PhD thesis: Essay on proper ALM (assets and liabilities) management approach for banks. Major: Quantitative economics.