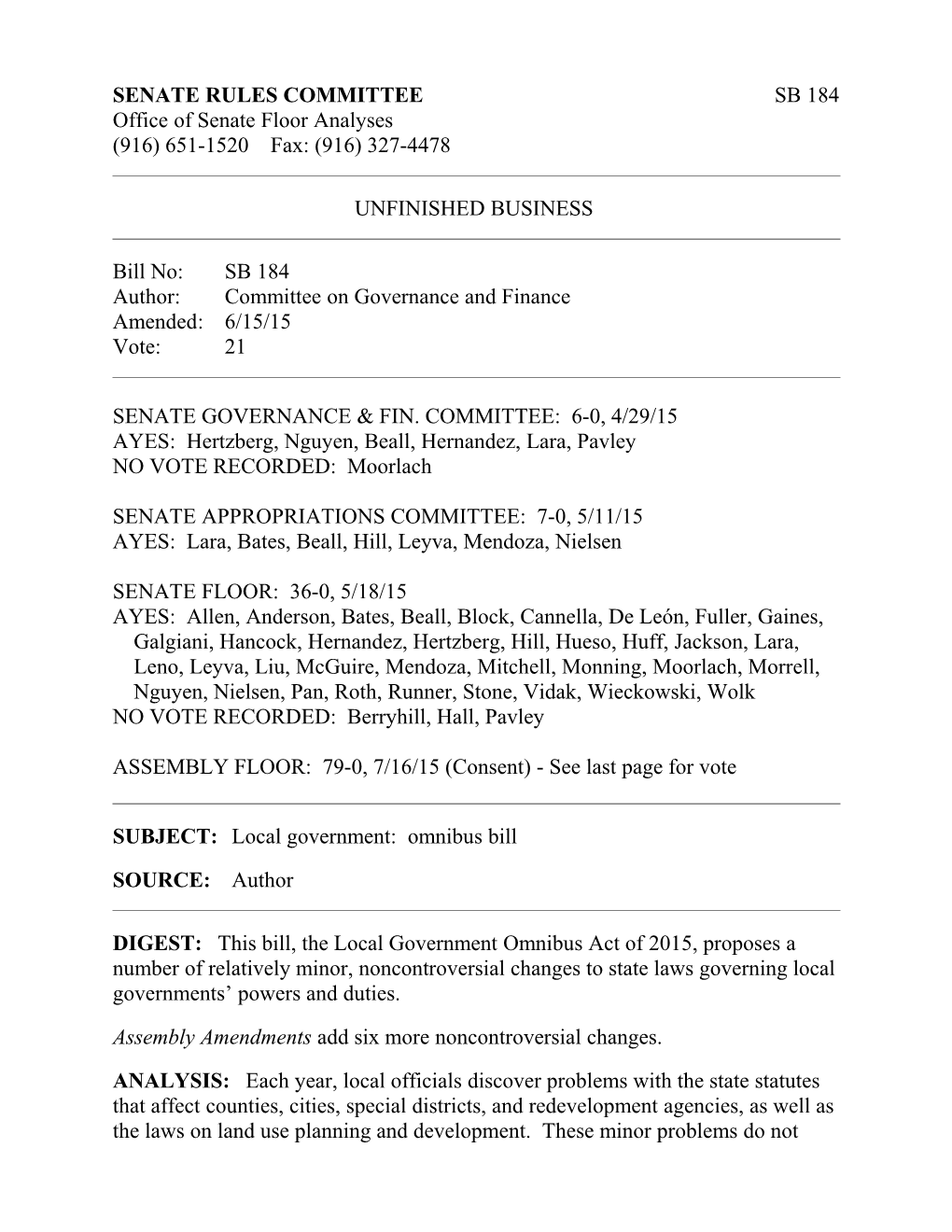

SENATE RULES COMMITTEE SB 184 Office of Senate Floor Analyses (916) 651-1520 Fax: (916) 327-4478

UNFINISHED BUSINESS

Bill No: SB 184 Author: Committee on Governance and Finance Amended: 6/15/15 Vote: 21

SENATE GOVERNANCE & FIN. COMMITTEE: 6-0, 4/29/15 AYES: Hertzberg, Nguyen, Beall, Hernandez, Lara, Pavley NO VOTE RECORDED: Moorlach

SENATE APPROPRIATIONS COMMITTEE: 7-0, 5/11/15 AYES: Lara, Bates, Beall, Hill, Leyva, Mendoza, Nielsen

SENATE FLOOR: 36-0, 5/18/15 AYES: Allen, Anderson, Bates, Beall, Block, Cannella, De León, Fuller, Gaines, Galgiani, Hancock, Hernandez, Hertzberg, Hill, Hueso, Huff, Jackson, Lara, Leno, Leyva, Liu, McGuire, Mendoza, Mitchell, Monning, Moorlach, Morrell, Nguyen, Nielsen, Pan, Roth, Runner, Stone, Vidak, Wieckowski, Wolk NO VOTE RECORDED: Berryhill, Hall, Pavley

ASSEMBLY FLOOR: 79-0, 7/16/15 (Consent) - See last page for vote

SUBJECT: Local government: omnibus bill

SOURCE: Author

DIGEST: This bill, the Local Government Omnibus Act of 2015, proposes a number of relatively minor, noncontroversial changes to state laws governing local governments’ powers and duties.

Assembly Amendments add six more noncontroversial changes.

ANALYSIS: Each year, local officials discover problems with the state statutes that affect counties, cities, special districts, and redevelopment agencies, as well as the laws on land use planning and development. These minor problems do not SB 184 Page 2 warrant separate (and expensive) bills. According to the Legislative Analyst, in 2001-02 the cost of producing a bill was $17,890.

Legislators respond by combining several of these minor topics into an annual “omnibus bill.” In 2014, for example, the Senate Governance and Finance Committee’s omnibus bill was SB 1462 (Chapter 201, Statutes of 2014) which contained 10 proposals to change state law, avoiding more than $160,000 in legislative costs (Chapter 201, Statutes of 2014). Although this practice may violate a strict interpretation of the single-subject and germaneness rules as presented in Californians for an Open Primary v. McPherson (2006) 38 Cal.4th 735, nevertheless it is an expeditious and relatively inexpensive way to respond to multiple requests.

This bill, the Local Government Omnibus Act of 2015, proposes the following changes to the state laws affecting local agencies’ powers and duties:

1) County recorders. County recorders accept and officially record legal documents, notices, or papers. Among the papers that they record are "instruments," which are written papers signed by the persons who are transferring real property. The County Recorders Association of California is proposing several amendments to clarify statutes governing county recorders’ activities and conform state law to current document recording practices:

a) Gender-neutral language. Some statutes that govern county recorders have not been amended for many decades and use the masculine pronouns "he" and "him" to refer to a county recorder.

This bill replaces outdated references to "he" and "him" with gender- neutral terms.

b) Internal revenue stamps. State law allows a county recorder to make marginal notations on records to indicate whether “internal revenue stamps” were affixed to specified documents (Government Code §27203).

This bill deletes the references to “internal revenue stamps” and substitutes language that allows a recorder to make marginal notations as part of the recording process.

c) Separate index of married women’s property. Section 14 of Article XI of California’s 1849 Constitution established a wife’s right to own property separately from her husband and decreed that, “Laws shall also be passed providing for the registration of the wife's separate property.” Section 5 of SB 184 Page 3 Chapter 103 of the Statutes of 1850, included language authoring a complete inventory of a wife’s separate property to be filed in a county recorder’s office as notice that “all property belonging to her, including the inventory, shall be exempt from seizure or execution for the debts of her husband.” State law still requires county auditors to keep an index of the separate property of married women (Government Code §27251).

This bill repeals this antiquated requirement. d) Electronic indexing. State law allows a county recorder to keep a “general grantor-grantee index” of specified recorded documents relating to real property transfers (Government Code §27257).

This bill allows a county recorder to combine the general grantor-grantee index in computerized or electronic format and requires that the names of the grantors must be distinguished from the names of the grantees by an easily recognizable mark or symbol. e) Name of person requesting recordation. State law specifies the procedures that a county recorder must follow to record an instrument that is authorized by law to be recorded and deposited in the recorder's office. Among those procedures is a requirement that the recorder must endorse upon the document the “name of the person at whose request it is recorded” (Government Code §27320). A more recently enacted statute specifies that the name of a person requesting recording must be shown in the left hand margin of a document (Government Code §27361.6, enacted by AB 689, Tucker, 1992).

This bill deletes the outdated requirement that a recorder must include a requestor’s name in the endorsement upon the document. f) Returning recorded documents. Read narrowly, state law could be interpreted as requiring a county recorder to use the mail to return a recorded document to the person who submitted it for recording (Government Code §27321).

This bill clarifies that a county recorder may immediately return a document that has been recorded to the party who submitted the document. g) Tax statement declaration. State law requires that a deed or instrument executed to convey fee title to real property must, before a recorder accepts SB 184 Page 4 it for recording, note across the bottom of the first page the name and address to which future tax statements may be mailed (Government Code §27321.5).

This bill deletes language specifying that the information must appear “across the bottom” of the page, allowing the tax statement declaration to appear at the top of the page.

2) Subdivision Map Act – Payments for setting final monuments. The Subdivision Map Act controls how counties and cities approve the conversion of large landholdings into separate parcels. The Act requires that an engineer or surveyor making a survey for a final map or parcel map must set sufficient durable monuments so that another engineer or surveyor may readily retrace the survey (Government Code §66495). A city or county may require a subdivider to provide a deposit to ensure the payment of various fees and services related to a final map or parcel map, including payment of the cost of setting the final monuments. The Act requires that if an engineer or surveyor’s costs of setting final monuments are to be paid from the deposit held by the city or county, the payment must be made by the city or county’s “legislative body” (Government Code §66497). As a result, an item approving the release of funds from a subdivider’s deposit must be placed on the legislative body’s agenda for approval. The California Land Surveyors Association notes that the requirement that a local legislative body must act before an engineer or surveyor can receive payments from a subdivider’s deposit can result in substantial delays and unnecessary costs.

This bill allows a local legislative body to designate a public officer or employee who is qualified to prepare or approve parcel maps or final maps to release or reduce the amount of a deposit to pay an engineer or surveyor for setting final monuments, subject to specified conditions and rules.

3) Subdivision performance securities. Counties and cities commonly impose conditions when they approve proposed subdivisions, often requiring the subdividers to install public works such as street lights, curbs, and sewers. Sometimes subdividers must provide assurances that the work will be completed, including performance bonds, deposits, credit instruments, liens, or other property interests. Until 2006, counties and cities followed their own procedures in deciding when to release these securities. At the request of builders, the Legislature adopted uniform procedures and time limits by which counties and cities must either release the securities provided for subdivision conditions or tell the subdividers about the incomplete performance or SB 184 Page 5 unsatisfactory work (Government Code §66499.7, enacted by AB 1460, Umberg, Chapter 411, Statutes of 2005). Wary that these new requirements might not work, city officials asked the Legislature to impose a January 1, 2011 sunset clause. In 2010, the Legislature extended the statute’s sunset date by five years, until January 1, 2016. Since the 2005 Umberg bill, there are no reported problems with the statutory procedures for releasing subdivision performance securities, nor have counties and cities filed any claims for state- mandated local costs. The California Building Industry Association wants legislators to make the statute permanent.

This bill repeals the sunset date in the statute governing the timeframe and procedures for releasing subdivision performance securities, thereby allowing the statute to remain in effect indefinitely.

4) Clerks. Several statutes governing a local government’s powers to acquire, construct, maintain and operate sanitary sewer systems assign specified duties to the local government’s clerk (Article 4 (commencing with Section 5470) of Chapter 6 of Division 5 of the Health and Safety Code). Similarly, several statutes that govern improvement districts assign specified duties to a local government’s clerk (Part 7 (commencing with Section 36600) of Division 18 of the Streets and Highways Code and Part 8 (commencing with Section 36700) of Division 18 of the Streets and Highways Code). The California Association of Clerks and Elections Officials notes that some of these statutory definitions and uses of the term “clerk” are ambiguous and could be misinterpreted to refer to a county clerk, a court clerk, or even a county registrar of voters.

This bill clarifies that the term “clerk,” as used in several statutes governing local governments’ sanitary sewer functions and business improvement districts, means the clerk of the local agency’s legislative body.

5) County Auditors and Sanitation and Sewage Systems. Cities, counties, special districts, and authorized public corporations can collect fees for the sanitation and sewage services and facilities they provide (Health & Safety Code §5471). If a local government wants to collect these fees as part of its general taxes, or if it plans to place a lien on a parcel of land to collect these charges, the Health and Safety Code requires officials to give written notice to affected property owners and file a copy of this notice with “the auditor.” The Code defines “auditor” as “the financial officer of the [local government] entity” (Id. at §§5473 and 5474 et seq., 5740). The California State Association of Counties SB 184 Page 6 notes that the word “auditor” in this context is confusing, as these code sections only relate to duties and powers of county auditors.

This bill adds the word “county” before the word “auditor” in the three relevant sections of the Health and Safety Code.

6) Small counties and job order contracting. Current law allows counties to award annual contracts for “repair, remodeling, or other repetitive work” (Public Contract Code §20128.5). These contracts are commonly referred to as job order contracts. Article 3.6 (commencing with Section 20150) of Chapter 1 of Part 3 of Division 2 of the Public Contract Code contains contracting requirements that apply only to counties with fewer than 500,000 residents. Because Article 3.6 declares that its provisions prevail over other statutes (Public Contract Code §20150.1), some county officials worry that this creates ambiguity about whether smaller counties can use the job order contracting authority that is established elsewhere in state law. In 2007, the Legislature passed a bill to eliminate a similar ambiguity over whether state law allows smaller counties to participate in the Public Construction Cost Accounting Act (SB 206, Cox, Chapter 26, Statutes of 2007). County officials want the Legislature to similarly clarify smaller counties’ authority to use job order contracts.

This bill clarifies that counties with fewer than 500,000 residents may award contracts pursuant to the provisions of a specified statute governing counties’ job order contracts.

7) Public utility districts cross-reference correction. The California Public Contract Code specifies rules that public utility districts must follow when letting contracts for certain types of work (Public Contract Code §20200 et seq.). The Tahoe City Public Utility District notes that a Public Contract Code provision contains an erroneous cross-reference to the Public Utility Code statutes that govern public utility districts.

This bill corrects the cross-reference.

8) California Uniform Public Construction Cost Accounting Act updates. The Public Contract Code spells out the procedures that local officials follow when they build public works projects, including limits on the contracts' values. When counties, cities, special districts, school districts, and community college districts voluntarily adopt the standards and procedures of the Uniform Public Construction Cost Accounting Act (UPCCAA), they can use higher limits for SB 184 Page 7 their contracts (Public Contract Code §22000, enacted by AB 1666, Cortese, Chapter 1054, Statutes of 1983). About 770 local agencies participate. The UPCCAA created the Uniform Public Construction Cost Accounting Commission (Commission), which is responsible for administering the UPCCAA. The Commission consists of 14 members: 13 are appointed by the State Controller and one is a designated member of the Contractors State License Board. Seven members represent the public sector (counties, cities, school districts, and special districts). Six members represent the private sector (public works contractors and unions). At its December 17, 2014 meeting, the Commission voted unanimously to approve several proposed amendments to the UPCCAA to clarify some provisions and improve the Act’s functionality: a) School representatives. The UPCCAA requires that two Commission members must represent school districts, one with an average daily attendance over 25,000 and one with an average daily attendance under 25,000 (Public Contract Code §22010).

This bill repeals the language specifying average daily attendance thresholds, thereby allowing the Commission’s two school representatives to come from districts of any size. b) Controller’s appointments. The UPCCAA specifies that the members of the commission hold office for terms of three years, and until their successors are appointed (Public Contract Code §22014).

This bill clarifies that the State Controller may reappoint members for subsequent three year terms. This bill also increases, from 90 days to 120 days, the period of time within which the Controller must appoint a replacement to fill a vacancy on the Commission. c) Travel reimbursements. Commission members cannot receive compensation for serving on the Commission, but must be reimbursed for travel and other expenses necessarily incurred in the performance of their duties (Public Contract Code §22015).

This bill specifies that the reimbursement rates must conform to the Controller’s travel guideline rates. d) Updates to Office of Management and Budget (OMB) circular. The UPCCAA requires the Commission, as part of its deliberations and review, to take into consideration relevant provisions of OMB Circular A-76, SB 184 Page 8 which relates to the performance of commercial activities (Public Contract Code §22017).

This bill clarifies that the Commission’s consideration should include any periodical revisions of that OMB circular. e) Informal bid solicitation procedures. The UPCCAA requires participating local agencies to adopt an informal bidding ordinance that, among other things, specifies the manner in which notices inviting informal bids are to be sent to a list of qualified contractors, construction trade journals, or both (Public Contract Code §22034).

This bill clarifies the informal bid solicitation procedures and allows notices inviting informal bids to be mailed, faxed, or emailed to the appropriate contractors list or trade journals. f) Adoption of plans, specifications, and working details. The UPCCAA requires a participating agency’s governing body to adopt plans, specifications, and working details for public projects that exceed a specified value.

This bill allows the plans, specifications, and working details to be prepared by a designated representative of the governing body, which will accommodate the Division of the State Architect’s role in the plan approval process for school districts. g) Commission findings after compliance review. The UPCCAA requires the Commission to prepare written findings after it reviews an agency’s compliance with the Act’s provision (Public Contract Code §22044). The proposed amendments require that the written finding must be presented to the agency within 30 days of the Commission’s review. The UPCCAA requires a local agency to present the Commission’s findings to its governing board and requires the board to hold a hearing within 30 days of receiving the findings. The proposed amendments require that the board must be presented with the findings within 30 days and allows the board to hold a hearing within 60 days of receiving the findings.

For Commission findings relating to non-accounting practices, this bill requires the agency’s board to notify the Commission in writing, within 60 days of receipt of written notice of the findings, of the public agency’s efforts to comply. SB 184 Page 9

9) Summarily vacating public service easements. As a condition of property development, cities and counties may require developers to dedicate public service easements that provide a legal basis for utilities and other public facilities to occupy land within the development. In some cases, these public service easements are never used for the purposes for which they were originally intended. State law specifies the manner in which cities and counties can summarily vacate public service easements that are no longer needed (Streets and Highways Code §8330 et seq., enacted by SB 1540, Rains, Chapter 1050, Statutes of 1980). The California Land Surveyors notes that the procedures for summarily vacating public service easements, which require a local legislative body to adopt a “resolution of vacation” at a public hearing, can be unnecessarily time consuming and costly.

As an alternative, this bill allows a local legislative body to delegate the authority to vacate a public service easement to a designated public officer or employee who is otherwise qualified to prepare easements or approve parcel maps or final maps. The designated officer or employee can vacate an easement by recording a document that contains the same information that must be stated in a “resolution of vacation,” including a certification that all entities having any right, title, or interest on the public service easement being vacated have been notified of this action.

10) California Water District contracting authority. All 135 California Water Districts are governed by the provisions of the California Water District Law (Water Code §34000 et seq., enacted by SB 1123, Donnelly, 1951). The Law requires that contracts necessary to carry out a California Water District’s powers and purposes must be executed by a district’s president and secretary (Water Code §35406). Statutes governing several other types of special districts allow the districts’ boards to delegate the power to sign contracts to district officers and employees. For example, the Municipal Water District Law of 1911 allows a district’s board to “delegate and redelegate to officers of the district the power to bind the district by contract” (Water Code §71309, enacted by SB 15, Backstrand, 1963). Officials of the Irvine Ranch Water District, which is governed by the California Water District Law, note that a strict interpretation of the Law’s requirement that a district’s president and secretary must sign each contract would create unnecessary administrative burdens.

Replicating statutory language that governs municipal water districts, this bill grants California Water Districts’ governing boards the authority to delegate to SB 184 Page 10 district officers and employees the power to sign contracts on the district’s behalf.

11) Paso Robles Basin Water District. Current law authorizes, under the California Water District Law, the governing board structure and powers of the Paso Robles Basin Water District in San Luis Obispo County (AB 2453, Achadjian, Chapter 350, Statutes of 2014). State law specifies that the District’s board must be comprised of nine directors. Stakeholders note that statutory language enacted by last year’s bill erroneously allows the District’s board to adopt emergency regulations, which become effective immediately upon adoption, by the vote of only four or more board members.

This bill corrects this error by requiring that a supermajority vote of seven members of the Paso Robles Basin Water District Board is required to adopt an emergency ordinance.

Comments

This bill compiles noncontroversial changes to state laws affecting local agencies and land use into a single bill. Sending a bill through the legislative process costs around $18,000. By avoiding separate bills, this bill avoids more than $180,000 in legislative costs. Although the practice may violate a strict interpretation of the single-subject and germaneness rules, the Senate Governance and Finance Committee insists on a very public review of each item. More than 100 public officials, trade groups, lobbyists, and legislative staffers see each proposal before it goes into the Committee’s bill. Should any item attract opposition, the Committee will delete it. In this transparent process, there is no hidden agenda. If it’s not consensus, it’s not omnibus.

FISCAL EFFECT: Appropriation: No Fiscal Com.: Yes Local: Yes

According to the Assembly Appropriations Committee:

Potential minor reimbursable mandate costs related to provisions eliminating the sunset on releasing subdivision performance securities. No mandate claims have been filed in the 10 years that these provisions have been in statute, so it is unlikely that local agencies would submit a reimbursement claim in the future.

The remaining provisions of this bill are expected to have negligible fiscal impact.

SUPPORT: (Verified 7/29/15) SB 184 Page 11 Air Conditioning Sheet Metal Association Air-Conditioning & Refrigeration Contractors Association California Building Industry Association California Land Surveyors Association California Legislative Conference of the Plumbing, Heating and Piping Industry Construction Industry Force Account Council County Recorders Association of California Irvine Ranch Water District Finishing Contractors Association of Southern California National Electrical Contractors Association United Contractors

OPPOSITION: (Verified 7/29/15)

None received

ASSEMBLY FLOOR: 79-0, 7/16/15 AYES: Achadjian, Alejo, Travis Allen, Baker, Bigelow, Bloom, Bonilla, Bonta, Brough, Brown, Burke, Calderon, Campos, Chang, Chau, Chávez, Chiu, Chu, Cooley, Cooper, Dababneh, Dahle, Daly, Dodd, Eggman, Frazier, Beth Gaines, Gallagher, Cristina Garcia, Eduardo Garcia, Gatto, Gipson, Gomez, Gonzalez, Gray, Grove, Hadley, Harper, Roger Hernández, Holden, Irwin, Jones, Jones- Sawyer, Kim, Lackey, Levine, Linder, Lopez, Low, Maienschein, Mathis, Mayes, McCarty, Medina, Melendez, Mullin, Nazarian, Obernolte, O'Donnell, Olsen, Patterson, Perea, Quirk, Rendon, Ridley-Thomas, Rodriguez, Salas, Santiago, Steinorth, Mark Stone, Thurmond, Ting, Wagner, Waldron, Weber, Wilk, Williams, Wood, Atkins NO VOTE RECORDED: Gordon

Prepared by: Brian Weinberger / GOV. & F. / (916) 651-4119 8/13/15 13:02:52

**** END ****