PROBLEM SET C

PROBLEM 11-1C

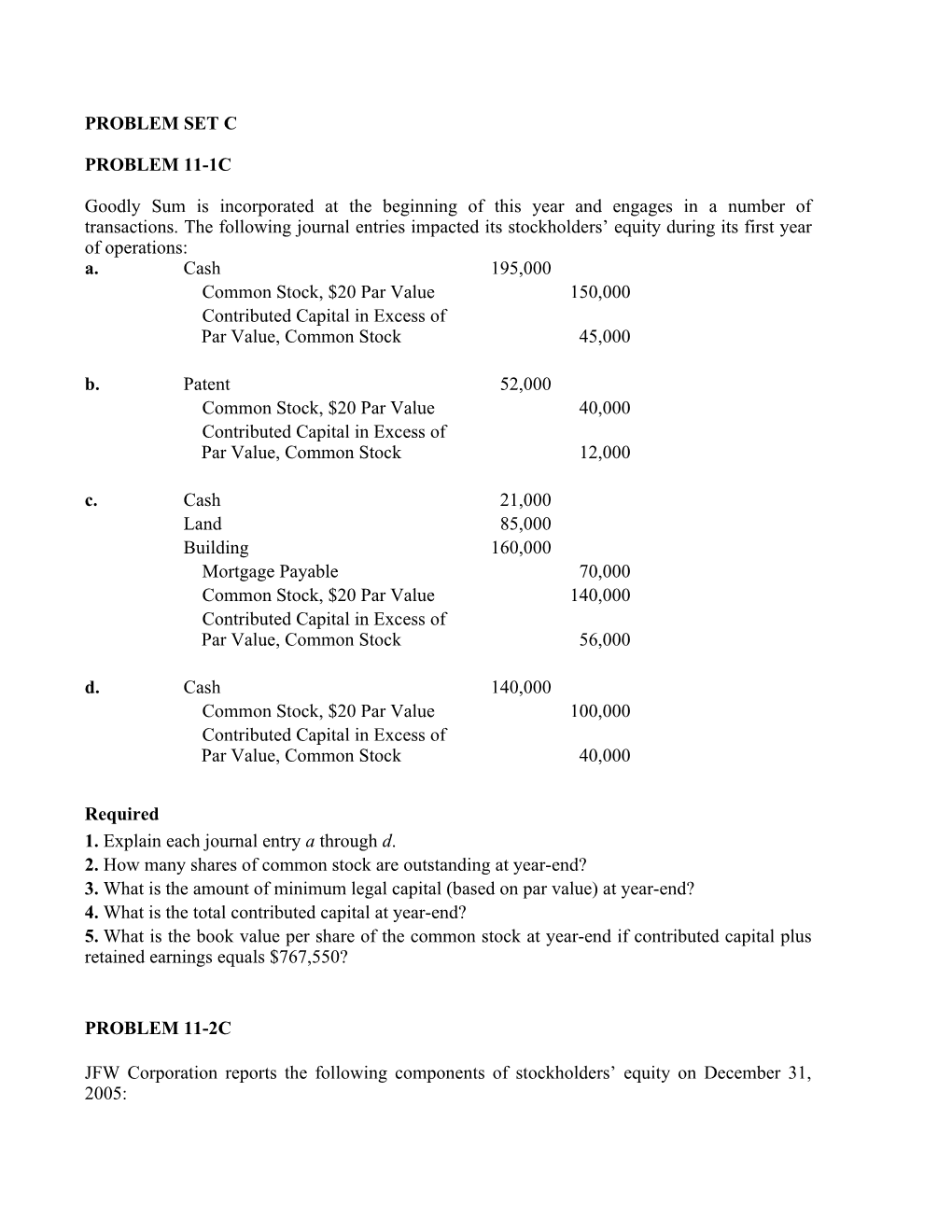

Goodly Sum is incorporated at the beginning of this year and engages in a number of transactions. The following journal entries impacted its stockholders’ equity during its first year of operations: a. Cash 195,000 Common Stock, $20 Par Value 150,000 Contributed Capital in Excess of Par Value, Common Stock 45,000 b. Patent 52,000 Common Stock, $20 Par Value 40,000 Contributed Capital in Excess of Par Value, Common Stock 12,000 c. Cash 21,000 Land 85,000 Building 160,000 Mortgage Payable 70,000 Common Stock, $20 Par Value 140,000 Contributed Capital in Excess of Par Value, Common Stock 56,000 d. Cash 140,000 Common Stock, $20 Par Value 100,000 Contributed Capital in Excess of Par Value, Common Stock 40,000

Required 1. Explain each journal entry a through d. 2. How many shares of common stock are outstanding at year-end? 3. What is the amount of minimum legal capital (based on par value) at year-end? 4. What is the total contributed capital at year-end? 5. What is the book value per share of the common stock at year-end if contributed capital plus retained earnings equals $767,550?

PROBLEM 11-2C

JFW Corporation reports the following components of stockholders’ equity on December 31, 2005: Common stock — $10 par value, 50,000 shares authorized, 30,000 shares issued and outstanding $300,000 Contributed capital in excess of par value, common stock 140,000 Retained earnings 330,000 Total stockholders’ equity $770,000

In year 2006, the following transactions affect its stockholders’ equity accounts: Jan. 2 Purchased 2,500 shares of its own stock at $16 per share. Jan. 9 Directors declared a $5.00 per share cash dividend payable on Feb. 15 to the Feb. 5 stockholders of record. Feb.15 Paid the dividend declared on January 9. July 16 Sold 1,000 of the treasury shares at $20 per share. Aug.12 Sold 1,500 of the treasury shares at $12 per share. Sept.4 Directors declared a $5.00 per share cash dividend payable on October 18 to the September 25 stockholders of record. Oct.18 Paid the dividend declared on September 4. Dec.31 Closed the $128,000 credit balance (from net income) in the Income Summary account to Retained Earnings.

Required 1. Prepare journal entries to record the transactions and closings for 2006. 2. Prepare a statement of retained earnings for the year ended December 31, 2006. 3. Prepare the stockholders’ equity section of the company’s balance sheet as of December 31, 2006.

PROBLEM 11-3C

At March 30, the end of Wizwhiskey Company’s first quarter, the following stockholders’ equity accounts appear: Common stock, $10 par value $150,000 Contributed capital in excess of par value, common stock 75,000 Retained earnings 420,000

In the second quarter, the following entries related to its equity accounts are recorded:

April 2 Retained Earnings 90,000 Common Dividend Payable 90,000 April 25 Common Dividend Payable 90,000 Cash 90,000 April 30 Retained Earnings 42,000 Common Stock Dividend Distributable 30,000 Contributed Capital in Excess of Par Value, Common Stock 12,000 May 5 Common Stock Dividend Distributable 30,000 Common Stock, $10 Par Value 30,000 June 1 Memo — Change the title of the common stock account to reflect the new par value of $5. June 30 Income Summary 101,000 Retained Earnings 101,000

Required 1. Explain each journal entry. 2. Complete the following table showing the balances of the company’s equity accounts at each indicated date: April 2 April 25 April 30 May 5 June 1 June 30 Common stock $_____ $_____ $_____ $_____ $_____ $_____ Common stock dividend distributable ______Contributed capital in excess of par ______Retained earnings ______Combined balances of equity accounts $_____ $_____ $_____ $_____ $_____ $_____

PROBLEM 11-4C

The equity sections from Melanie’s Mamas 2005 and 2006 balance sheets follow: Stockholders’ Equity (December 31, 2005) Common stock — $4 par value, 100,000 shares authorized, 40,000 shares issued and outstanding $160,000 Contributed capital in excess of par value, common stock 120,000 Total contributed capital $280,000 Retained earnings 320,000 Total stockholders’ equity $600,000

Stockholders’ Equity (December 31, 2006) Common stock — $4 par value, 100,000 shares authorized, 47,400 shares issued, 3,000 in the treasury $189,600 Contributed capital in excess of par value, common stock 179,200 Total contributed capital $368,800 Retained earnings ($30,000 restricted) 400,000 $768,800 Less cost of treasury stock (30,000) Total stockholders’ equity $738,800 The following transactions and events affect its equity accounts during year 2006: Jan. 5 Declared a $0.40 per share cash dividend, date of record January 10. Mar.20 Purchased treasury stock. Apr. 5 Declared a $0.40 per share cash dividend, date of record April 10. July 5 Declared a $0.40 per share cash dividend, date of record July 10. July31 Declared a 10% stock dividend when the stock’s market value is $14 per share. Aug.14 Issued stock dividend. Oct. 5 Declared a $0.40 per share cash dividend, date of record October 10. Required 1. How many common shares are outstanding on each cash dividend date? 2. What is the dollar amount for each of the four cash dividends? 3. What is the amount of the capitalization of retained earnings for the stock dividend? 4. What is the per share cost of the treasury stock purchased? 5. How much net income did the company earn during year 2006?

PROBLEM 11-5C

Selected account balances from the adjusted trial balance for the Dough not Bakery Corporation as of December 31, 2005, follow: Debit Credit a. Interest earned $ 17,000 b. Depreciation expense — Equipment $ 28,000 c. Gain on sale of equipment 15,750 d. Accounts payable 38,000 e. Other operating expenses 184,900 f. Accumulated depreciation — Equipment 52,200 g. Gain from insurance settlement 44,000 h. Cumulative effect of change in accounting principle (pretax) 36,000 i. Accumulated depreciation — Buildings 133,300 j. Loss from operating a discontinued segment (pretax) 17,500 k. Loss on retirement of debt (pretax) 18,000 l. Net sales 872,000 m.Depreciation expense — Buildings 41,000 n. Correction of understatement of prior year’s sales (pretax) 14,000 o. Gain on sale of discontinued segment’s assets (pretax) 22,000 p. Gain from settlement of lawsuit 3,000 q. Income taxes expense ? r. Cost of goods sold 324,000 Required Answer each of the following questions by providing supporting computations: 1. Assuming the company’s income tax rate is 35% for all items, identify the tax effects and after-tax measures of the items labeled pretax. 2. What is the amount of the company’s income from continuing operations before income taxes? What is the amount of the company’s income taxes expense? What is the amount of the company’s income from continuing operations after income taxes? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of income (loss) before both any extraordinary items and any cumulative effect of changes in accounting principle? 5. What is the amount of net income for the year?

PROBLEM 11-6C

On January 1, 2003, Nancy and the Pennsters rock band purchases recording equipment costing $700,000 with an expected salvage value of $50,000 at the end of its four-year useful life. Depreciation is allocated to 2003, 2004, and 2005 with the double-declining-balance method. Early in 2006, the company decides to change to the straight-line method to produce more useful financial statements and to be consistent with other firms in the music business. Required 1. Do generally accepted accounting principles allow Nancy and the Pennstersto change depreciation methods in 2006? 2. Prepare a table to show the amount of depreciation expense allocated to 2003 through 2005 using the double-declining-balance method. 3. Prepare a table to show the amount of depreciation expense that would have been allocated to 2003 through 2005 using the straight-line method. 4. The cumulative effect on prior year income statements is to decrease depreciation expense by $125,000 and increase pretax income by $125,000. The company’s income tax rate is 30%. What are the pretax and after-tax cumulative effects of the accounting change? 5. How should the cumulative effect of the change in accounting principle be reported? Does the cumulative effect increase or decrease net income? 6. How much depreciation expense is reported on the company’s income statement for 2006? Anaylsis Component 7. Assume that Nancy and the Pennsters mistakenly treats the change in depreciation methods as a change in accounting estimate. Using the answers from parts 2, 3, and 4, describe the effect of this error on the 2006 financial statements.

PROBLEM 11-7C

The income statements for MacroHard, Inc., as reported when they were initially published in 2003, 2004, and 2005 follow: 2003 2004 2005 Net sales $450,000 $620,000 $535,000 Operating expenses 275,000 415,000 395,000 Income from continuing operations $175,000 $205,000 $140,000 Gain on discontinued segment 55,000 — — ______Income before extraordinary items $230,000 $205,000 $140,000 Extraordinary gain (loss) — (88,000) 20,000 ______Net income $230,000 $117,000 $160,000 The company also experienced changes in the number of outstanding shares from the following events: Outstanding shares on December 31, 2002 50,000 2003 Treasury stock purchase on April 1 -5,000 Issuance of new shares on June 30 +10,000 8% stock dividend on October 1 +4,400 Outstanding shares on December 31, 2003 59,400 2004 Issuance of new shares on July 1 +12,000 Treasury stock purchase on November 1 -3,000 Outstanding shares on December 31, 2004 68,400 2005 Issuance of new shares on August 1 +8,000 Treasury stock purchase on September 1 -4,000 2-for-1 stock split on October 1 +72,400 Outstanding shares on December 31, 2005 144,800 Required 1. Compute the weighted average of the common shares outstanding for year 2003. 2. Compute the EPS component amounts to report with the year 2003 income statement for income from continuing operations, loss on discontinued segment, and net income. 3. Compute the weighted average of the common shares outstanding for year 2004. 4. Compute the EPS component amounts to report with the year 2004 income statement for income from continuing operations, the extraordinary loss, and net income. 5. Compute the weighted average of the common shares outstanding for year 2005. 6. Compute the EPS component amounts to report with the year 2005 income statement for income from continuing operations, the extraordinary gain, and net income. Analysis Component 7. Explain how you would use the EPS data from part (6) to predict EPS for 2006.

PROBLEM 11-8C Karcriso Corporation’s common stock is currently selling on a stock exchange at $54 per share, and its current balance sheet shows the following stockholders’ equity section: Preferred stock, 7% cumulative $___ par value, 500 shares authorized, issued, and outstanding $ 20,000 Common stock, $___ par value, 6,000 shares authorized, issued, and outstanding 48,000 Retained earnings 116,000 Total stockholders’ equity $184,000

Required 1. What is the current market value (price) of this corporation’s common stock? 2. What are the par values of the corporation’s preferred stock and its common stock? 3. If no dividends are in arrears, what are the book values per share of the preferred stock and the common stock? 4. If two years’ preferred dividends are in arrears, what are the book values per share of the preferred stock and the common stock? 5. If two years’ preferred dividends are in arrears and the preferred stock is callable at $50 per share, what are the book values per share of the preferred stock and the common stock? 6. If two years’ preferred dividends are in arrears and the board of directors declares dividends of $8,000, what total amount will be paid to the preferred and to the common shareholders? What is the amount of dividends per share for the common stock? Analysis Component 7. What are some factors that can contribute to a difference between the book value of common stock and its market value (price)?